Power Tools Market Size 2025-2029

The power tools market size is forecast to increase by USD 17.09 billion at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increase in global construction and infrastructure development activities. This trend is particularly notable in the adoption of portable power tools, which offer increased efficiency and productivity on worksites. A key trend shaping the market is the integration of smart technologies into power tools, enabling advanced features such as remote monitoring, diagnostics, and energy management. However, the market faces challenges from the volatility in prices of raw materials used in power tool production, including steel, copper, and batteries.

- This price instability can impact both manufacturers and consumers, necessitating strategic supply chain management and pricing strategies. Companies seeking to capitalize on market opportunities should focus on innovation, particularly in the areas of battery technology and smart tool integration, while also addressing the challenges of raw material price volatility through strategic sourcing and supply chain optimization. Air compressors and various power tool accessories further expand the market's scope, addressing the evolving needs of professionals and DIY enthusiasts alike.

What will be the Size of the Power Tools Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market exhibits dynamic trends, with noise reduction and ergonomic grip gaining significant attention from businesses. LED worklights enhance visibility during use, while spare parts availability ensures uninterrupted operations. Recyclable materials and tool-free adjustments contribute to sustainability and efficiency. Trigger lock and blade depth adjustment provide user convenience, and dust extraction systems minimize mess. Carrying cases offer portability, while kickback protection ensures safety. Air flow rate and repair services are crucial for maintaining tool performance. Product lifecycle management and maintenance intervals optimize tool usage.

- Vibration dampening and variable speed control reduce operator fatigue. Clutch settings and energy efficiency enhance productivity. Router bit diameter, air pressure, and impact rate impact tool performance. Grinding wheel size and laser guidance facilitate precise work. Charger compatibility and blade guard ensure tool compatibility and safety. Cutting capacity and planer cutting depth enable larger projects.

How is this Power Tools Industry segmented?

The power tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Residential

- Technology

- Electric

- Pneumatic

- Others

- Product

- Drills

- Saws

- Grinders

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

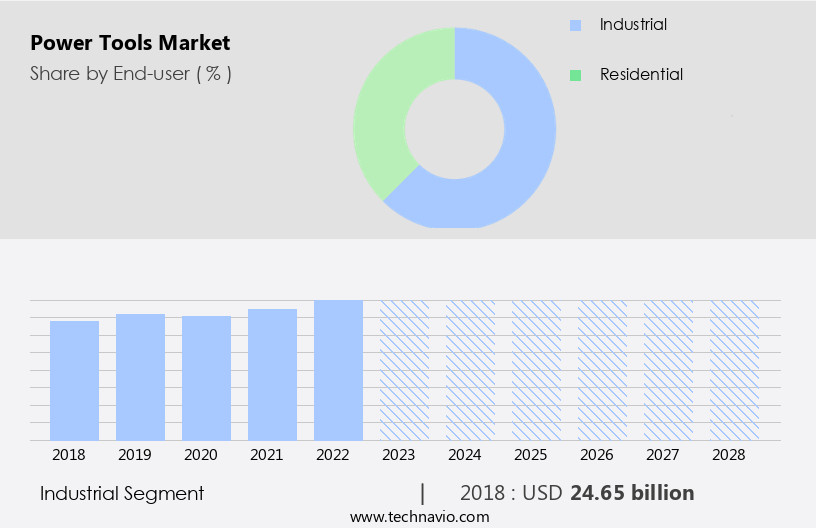

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period. Power tools, including cordless drills, nail guns, and table saws, play a crucial role in enhancing productivity and efficiency in various industries. The market caters to diverse end-users, with a significant portion being consumed in the industrial sector. Factors such as increasing manufacturing output, technological advancements, and the growing demand for precision and speed drive the market's expansion. Lightweight designs, longer run times, and safety features are essential considerations for industrial power tools. Brushless motors and lithium-ion batteries have revolutionized the cordless power tools segment, offering increased power output and longer run times. Smart tools, such as tool tracking systems and data analysis, are increasingly being adopted for improved productivity and cost savings.

In the industrial sector, power tools are essential for heavy-duty applications in automotive repair, residential building, and commercial construction. Tools like power wrenches, miter saws, circular saws, and reciprocating saws are indispensable for professional trades and DIY projects. Safety features, such as hearing protection and dust collection systems, are essential for ensuring a safe and healthy work environment. Brand reputation, price point, and tool kits are critical factors influencing the purchasing decisions of industrial buyers. Manufacturers continually innovate to meet evolving industry demands, offering a wide range of power tools to cater to various applications. Air compressors, power screwdrivers, power shears, and impact drivers are some examples of tools that have found extensive use in industrial settings.

The Industrial segment was valued at USD 24.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth worldwide, particularly in the APAC region. The region's rapid urbanization and infrastructure development have led to an increase in construction activities, making power tools indispensable for tasks such as drilling, cutting, and fastening. The industrial sector in APAC, including manufacturing and fabrication, is experiencing substantial growth, driving the demand for power tools. Governments in the region are attracting investments in industries like semiconductors, aviation, and more, further fueling the market's expansion. Lightweight design, long run time, and safety features are key trends shaping the market. Brushless motors and lithium-ion batteries have become increasingly popular due to their high power output and efficiency. The automotive sector and wind energy industry are leading the charge in the adoption of cordless power equipment, particularly battery-powered fastening tools and lithium-ion batteries.

Cordless drills, nail guns, impact drivers, and power screwdrivers are among the most sought-after tools for DIY projects and professional trades. Table saws, miter saws, circular saws, reciprocating saws, and band saws are essential for residential building and commercial construction projects. Power staplers, power wrenches, and tool kits cater to heavy-duty applications in automotive repair and industrial manufacturing. Data analysis and tool tracking systems have become crucial for optimizing productivity and efficiency in power tool usage. Smart tools with advanced features, such as hearing protection and dust collection systems, are gaining popularity in the market. Brand reputation and price point are significant factors influencing consumer preferences in the market.

Cordless drills, nail guns, and power screwdrivers are popular among home improvement enthusiasts, while professional trades prefer heavy-duty tools for their demanding applications. Air compressors are a staple in the market, providing compressed air for various pneumatic tools. The market for power tools is diverse, catering to various industries, from residential building to commercial construction, automotive repair, and industrial manufacturing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Power Tools market drivers leading to the rise in the adoption of Industry?

- The increase in global construction and infrastructure development activities serves as the primary catalyst for market growth. Power tools play a crucial role in the construction industry, enhancing labor efficiency and productivity. The market is driven by the increasing demand for infrastructure development in emerging economies, including Brazil, Russia, India, China, South Africa, and the Gulf Cooperation Council countries. China and India, as the world's most populous and fastest-growing economies, significantly contribute to market growth. Brushless motors and lithium-ion batteries are becoming increasingly popular due to their energy efficiency and longer runtime.

- Miter saws, jigsaw puzzles, power screwdrivers, and other power tools are essential for various blade types and power output requirements. The market is expected to grow as construction activities expand in these regions, leading to increased demand for power tools.

What are the Power Tools market trends shaping the Industry?

- Smart technologies are increasingly being integrated into portable power tools, representing a significant market trend. These advanced tools offer enhanced functionality and efficiency. The market is witnessing significant advancements with the integration of web and digital connectivity. Leading power tools brands are incorporating smart technologies into their product offerings to cater to the demands of heavy-duty applications. For instance, Bluetooth-enabled power tools allow users to monitor tool status and ensure safety. DEWALT, a renowned power tools brand under Stanley Black and Decker Inc., offers Bluetooth-enabled batteries that can be connected to a smartphone via an application. This feature enables tool owners to receive alerts if the tool goes out of Bluetooth range and disables the battery to prevent unauthorized usage. Power tools with bit types such as power wrenches, reciprocating saws, band saws, power shears, and impact drivers are increasingly popular in automotive repair and industrial applications.

- Safety glasses are a necessary accessory to ensure user safety while operating these tools. The market's growth is driven by the increasing demand for efficient and powerful tools for various industries.

How does Power Tools market face challenges during its growth?

- The volatility in the prices of raw materials used in the production of power tools poses a significant challenge to the industry's growth trajectory. This market instability, driven by fluctuations in the cost of essential components, can hinder the industry's ability to maintain consistent production and profitability. Power tools are essential for both home improvement projects and commercial construction. In the home improvement sector, these tools are popular among DIY enthusiasts, while professional trades rely on them for their livelihood. The market is witnessing innovation with the introduction of smart tools that offer enhanced functionality and improved safety features. Industrial manufacturing also utilizes power tools extensively for production processes. The production of power tools involves the use of raw materials such as steel, copper, rubber, plastic, and rare earth magnets for motors. Fluctuations in the prices of these commodities can significantly impact power tool manufacturers, potentially reducing profit margins or sales due to increased tool prices.

- Hearing protection and dust collection systems are essential safety features for power tools, further increasing production costs. In the competitive landscape, companies are focusing on brand reputation and product differentiation to maintain a competitive edge. Air compressors and circular saws are popular power tools with significant demand. As market dynamics continue to evolve, manufacturers must adapt to changing consumer preferences and market conditions to ensure long-term success.

Exclusive Customer Landscape

The power tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apex Tool Group LLC - The company specializes in providing a comprehensive range of power tools, including drills, saws, grinders, and more, under the brands Weller, Cleco, Xcelite, Erem, and Apex.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apex Tool Group LLC

- Atlas Copco AB

- C. and E. Fein GmbH

- Chervon Holdings Ltd.

- Emerson Electric Co.

- Evolution Power Tools Ltd

- Group Silverline Ltd.

- Hilti AG

- Illinois Tool Works Inc.

- JPW Industries Inc.

- Koki Holdings Co. Ltd.

- Makita Power Tools India Pvt. Ltd.

- Nemo Power Tools Ltd.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Snap On Inc.

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

- Vicky Power Tools

- IDEAL POWER TOOLS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Power Tools Market

- In February 2024, Bosch Power Tools introduced the world's first cordless angle grinder with a modular battery system, allowing users to choose the battery capacity based on their specific requirements (Bosch Press Release, 2024). This innovative product launch marks a significant technological advancement in the market, enhancing both efficiency and flexibility.

- In July 2024, Stanley Black & Decker and Techtronic Industries Co. Ltd. announced a strategic partnership to expand their cordless power tool offerings through the collaboration of Stanley's DeWalt and Techtronic's Milwaukee Tool brands (Stanley Black & Decker Press Release, 2024). This partnership represents a major strategic move to strengthen their market position and cater to the growing demand for cordless power tools.

- In March 2025, Makita Corporation announced the acquisition of Reliance Electric Company, a leading manufacturer of industrial motors and generators, to expand its product portfolio and enter the industrial motor market (Makita Corporation Press Release, 2025). This strategic move marks a significant geographic expansion and diversification for Makita, broadening its reach beyond the market.

- In May 2025, the European Union passed new regulations on the energy performance of power tools, setting minimum efficiency standards for various tool categories (European Commission Press Release, 2025). This regulatory approval marks a key policy change aimed at reducing energy consumption and promoting sustainability within the market.

Research Analyst Overview

The market continues to evolve, with new innovations and applications emerging across various sectors. Cordless drills and nail guns have gained popularity in DIY projects and residential building due to their lightweight design and increased run time offered by brushless motors and lithium-ion batteries. In heavy-duty applications, power wrenches and impact drivers are essential tools for professional trades and industrial manufacturing. Tool kits, including safety glasses, are crucial for automotive repair and home improvement projects. Reciprocating saws, band saws, power shears, and miter saws cater to diverse cutting needs, while power screwdrivers and jigsaw puzzles offer versatility for various tasks.

Safety features, such as hearing protection and dust collection systems, are increasingly integrated into power tools to ensure user safety and productivity. Brand reputation and price point remain significant factors in market dynamics, with smart tools and tool tracking systems adding value through data analysis and improved efficiency. Power output and blade types vary among table saws, circular saws, and other saws, catering to the unique demands of commercial construction and industrial manufacturing.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Power Tools Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 17.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, China, Germany, India, UK, Japan, France, Canada, Italy, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power Tools Market Research and Growth Report?

- CAGR of the Power Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power tools market growth of industry companies

We can help! Our analysts can customize this power tools market research report to meet your requirements.