Precision Ball Screws Market Size 2025-2029

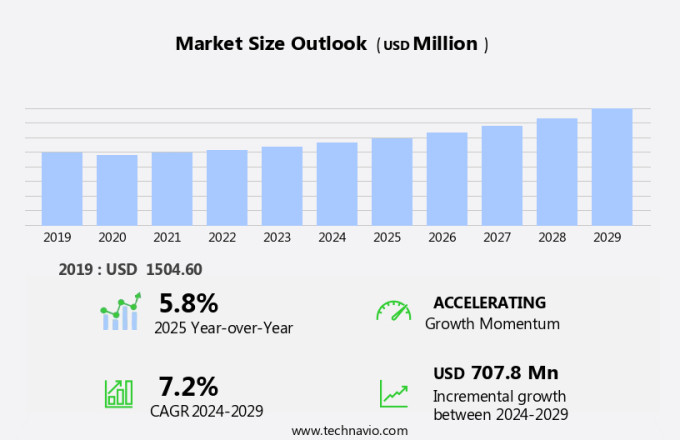

The precision ball screws market size is forecast to increase by USD 707.8 million, at a CAGR of 7.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increased automation in manufacturing industries. This trend is driven by the need for high precision and productivity in various applications. Another growth factor is the adoption of advanced coatings and materials for ball screws, which enhances their durability and performance.

- However, competition from alternative motion systems, such as belt drives and linear motors, poses a challenge to the market's growth. To stay competitive, manufacturers are focusing on improving the efficiency and accuracy of their ball screws through technological advancements and innovation. Additionally, the use of sustainable materials and energy-efficient designs is gaining importance in the market. Overall, the market is expected to grow steadily, driven by these key trends and challenges.

What will be the Precision Ball Screws Market Size During the Forecast Period?

- Precision ball screws have gained significant traction in various industries due to their ability to provide high positional accuracy and less friction. These screws are essential components in automated machinery, robotics systems, CNC machinery, and motion control systems. The demand for precision ball screws is driven by the need for productivity and consistency in sectors such as medical diagnostics, aviation, semiconductor manufacturing, electronics, and aerospace. Raw materials play a crucial role in the production of precision ball screws.

- Alloy steel, carbon steel, stainless steel, and advanced chemicals are commonly used to manufacture these screws due to their material strength and ability to withstand high loads. In the medical diagnostics industry, for instance, precision ball screws made of stainless steel are preferred due to their resistance to corrosion and sterilization. The aviation sector relies on precision ball screws for the manufacturing of telecom equipment and displays.

- These components require high positional accuracy to ensure optimal functionality and performance. Similarly, in the automotive industry, precision ball screws are used in robotic arms and linear motion applications to enhance productivity and reduce emissions. Precision ball screws are also integral to the operation of surgical robots and dental milling machines. In surgical robots, these screws ensure less friction and high positional accuracy, enabling precise movements during complex procedures. In dental milling machines, precision ball screws provide the consistency required to produce high-quality dental restorations. Recirculating ball bearings are often used in conjunction with precision ball screws to improve their performance and efficiency. The use of these bearings reduces friction and wear, ensuring the longevity and reliability of the precision ball screws.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Ground

- Rolled

- End-user

- Automotive

- Aerospace and defense

- Healthcare

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

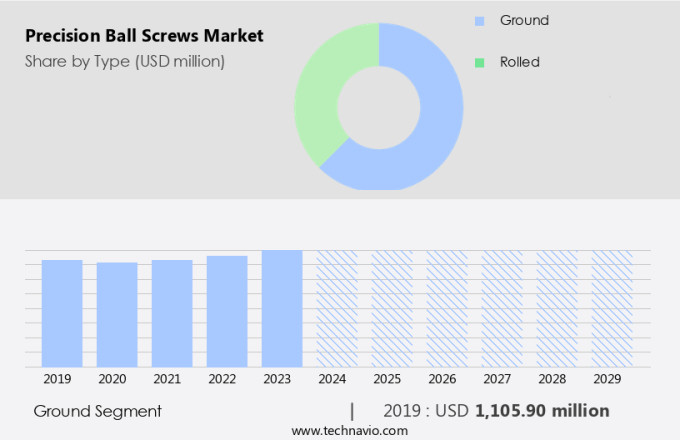

- The ground segment is estimated to witness significant growth during the forecast period.

Ground precision ball screws represent a significant segment in The market, recognized for their meticulous manufacturing process and application in high-precision industries. These ball screws undergo a rigorous grinding process, ensuring superior accuracy and seamless operation. The high degree of precision offered by ground ball screws makes them indispensable in applications where exact movement and control are essential, such as CNC machines and aerospace industries. In CNC machines, ground ball screws provide precise and consistent movements, enabling repeatable results. In the aerospace sector, they are utilized in various applications, including flight control systems and critical components, where reliability and precision are non-negotiable.

Precision components play a vital role in industrial automation integration, manufacturing optimization, and motion control technology, enhancing the overall performance of industrial automation solutions in high-precision manufacturing environments.

Get a glance at the market report of share of various segments Request Free Sample

The ground segment was valued at USD 1.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is experiencing significant growth in the market, driven by the increasing demand for electric vehicles (EVs), robotics, and industrial machinery. The region's rapid adoption of advanced technologies such as smart manufacturing and Industry 4.0 initiatives is further fueling market expansion. In China, the number of new EV registrations reached 8.1 million in 2023, representing a 35% increase from the previous year. This rise in EV adoption is a major driver for the regional market, as precision ball screws are essential components for various EV systems, including battery assembly and motor control. Additionally, the market is gaining traction in sectors such as medical robotics, biomedical engineering, microelectronics, data centers, and satellite technology due to their low friction and high-precision capabilities. The integration of machine learning, artificial intelligence, and other advanced technologies is further increasing the demand for these components in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Precision Ball Screws Market?

Increased automation in manufacturing is the key driver of the market.

- The market is experiencing significant growth due to the increasing adoption of automated systems and Industry 4.0 in manufacturing processes. This trend is driven by the need for high-precision components to enhance manufacturing efficiency and reduce production costs. China, as the world's largest manufacturing hub, is leading this transformation. The Chinese government's initiatives, such as Made in China 2025, aim to modernize manufacturing and promote high-tech industries. This modernization effort includes the integration of advanced automation technologies, which heavily rely on precision ball screws for accurate and reliable motion control. Beyond manufacturing, precision ball screws find extensive applications in various sectors such as medical robotics, biomedical engineering, microelectronics, data centers, and aerospace manufacturing.

- In medical robotics and biomedical engineering, these components are crucial for the development of high-performance surgical instruments and dental implants. In the microelectronics industry, precision ball screws are used in semiconductor fabrication for the production of advanced materials and components. In the data center sector, precision ball screws are employed in the design and manufacturing of networking equipment, ensuring product consistency and reliability. In the aerospace industry, these components are used in aircraft components and satellite technology, where low friction and high-performance motion are essential. Moreover, precision ball screws are used in automated assembly systems, linear motion systems, and industrial automation solutions, enabling manufacturing optimization and advanced manufacturing processes.

- The rising demand for industrial automation trends, such as machine learning, artificial intelligence, and robotics, is also fueling the growth of the market. These technologies rely heavily on high-precision components to function effectively, making precision ball screws an indispensable part of the industrial automation landscape. In conclusion, the market is poised for growth due to the increasing adoption of automation and Industry 4.0 in manufacturing processes, as well as the expanding applications in various sectors such as medical robotics, biomedical engineering, microelectronics, data centers, and aerospace manufacturing. The market's growth is further driven by the rising demand for industrial automation trends, such as machine learning, artificial intelligence, and robotics, which require high-precision components for optimal performance.

What are the market trends shaping the Precision Ball Screws Market?

The adoption of advanced coatings and materials is the upcoming trend in the market.

- The market is experiencing a notable shift towards the utilization of advanced materials and coatings to enhance the durability and performance of these components. Manufacturers are prioritizing the development of ball screws with protective coatings, such as Teflon and ceramic, to minimize friction and wear in challenging environments. Teflon coatings, for example, provide exceptional lubricity and resistance to corrosion, making them suitable for applications requiring smooth and dependable motion. Beyond coatings, high-strength materials like steel alloys are being employed to manufacture ball screws for industries such as medical robotics, biomedical engineering, microelectronics, data centers, and aerospace manufacturing. These materials contribute to the production of high-performance automation systems, linear motion systems, and advanced manufacturing processes.

- In the medical field, ball screws are utilized in robotic surgery, surgical instruments, and dental implants, necessitating the need for low-friction and high-precision components. In the semiconductor fabrication sector, precision ball screws are essential for manufacturing high-performance automation systems and motion control technology. In the aerospace industry, they are used in aircraft components, satellite technology, and aviation equipment, where reliability and durability are paramount. The adoption of advanced materials and coatings in precision ball screws is driven by the increasing demand for industrial automation, machine learning, artificial intelligence, and nanotechnology. The integration of precision engineering, mechatronics engineering, and industrial automation software into manufacturing processes further fuels the growth of the market.

What challenges does Precision Ball Screws Market face during the growth?

Competition from alternative motion systems is a key challenge affecting the market growth.

- The market experiences competition from alternative motion systems, such as linear motors, belt drives, and hydraulic actuators. These technologies offer advantages that can make them more suitable for specific applications, posing a challenge to the widespread adoption of precision ball screws. For instance, linear motors provide higher speeds and acceleration compared to ball screws and offer direct drive capabilities, eliminating the need for mechanical components like gears and belts. This results in reduced maintenance requirements, making linear motors attractive for high-speed and high-precision applications, such as semiconductor manufacturing and advanced robotics in the fields of medical robotics, biomedical engineering, microelectronics, data centers, and aerospace manufacturing.

- Additionally, the reliability and durability of precision ball screws are crucial factors in industries like machine tools, biotechnology, and manufacturing technology, where product consistency and high-performance automation are essential. However, the rising prices of steel, oil, and gas may impact the cost-effectiveness of precision ball screws, potentially influencing market growth. Despite these challenges, the market continues to evolve, driven by industrial automation trends, advanced manufacturing processes, and the increasing demand for high-precision components in various industries. Motion control technology, precision engineering services, and industrial equipment suppliers play a significant role in addressing the market's needs for innovation, efficiency, and reliability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bauer Gear Motor - The company offers precision ball screws which are used to provide the precise linear motion required in lathes, milling machines, and other CNC machines.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barnes Industries Inc.

- Bosch Rexroth AG

- HepcoMotion Ltd.

- Isotech Inc.

- Joyce Dayton Corp.

- JTEKT Corp.

- MISUMI India Pvt Ltd.

- MTAR Technologies Ltd.

- NACHI FUJIKOSHI Corp.

- Nippon Bearing Co. Ltd.

- NSK Ltd.

- Pacific Bearing Co. Inc.

- Parker Hannifin Corp.

- Schaeffler AG

- The Timken Co.

- THK Co. Ltd.

- Thomson Industries Inc.

- Zenda Linear Motion

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Precision ball screws have become an indispensable component in various technology-intensive industries, enabling high-performance automation and manufacturing processes. These screws offer unparalleled accuracy, reliability, and durability, making them a preferred choice for applications in sectors such as medical robotics, biomedical engineering, microelectronics, data centers, and more. The demand for precision ball screws is fueled by the increasing need for product consistency and high-performance automation across industries. In sectors like medical robotics and biomedical engineering, these screws play a crucial role in ensuring the reliability and durability of surgical instruments and dental equipment. In the microelectronics industry, they are essential for semiconductor fabrication and the production of advanced materials.

Moreover, precision ball screws are also gaining popularity in the manufacturing of data centers, telecommunications infrastructure, and networking equipment. The low-friction properties of these screws contribute to the efficient operation of automated assembly systems and industrial robotics solutions, enabling manufacturing optimization and reducing downtime. In the aerospace industry, precision ball screws are used extensively in aircraft components and aviation equipment due to their high-performance motion capabilities and reliability. In addition, they are also employed in the manufacturing of industrial machinery, machine tools, and linear actuator systems, contributing to manufacturing efficiency and automated production lines.

Further, the use of precision ball screws extends to industries such as nanotechnology, biotechnology, and oil and gas, where high-precision components are required. In the oil and gas sector, these screws are used in drilling equipment and hydraulic systems to ensure precise control and efficient operation. The adoption of precision ball screws is further driven by industrial automation trends, including the integration of artificial intelligence, machine learning, and robotics. These technologies rely on high-precision components to function effectively, making precision ball screws an essential component in the development and deployment of advanced manufacturing processes. In conclusion, precision ball screws have become an integral part of technology-intensive industries, enabling high-performance automation, manufacturing optimization, and product consistency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market Growth 2025-2029 |

USD 707.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

China, US, Japan, South Korea, India, Germany, UK, Italy, France, and Taiwan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.