Preclinical Isolated Organ Perfusion System Market Size 2025-2029

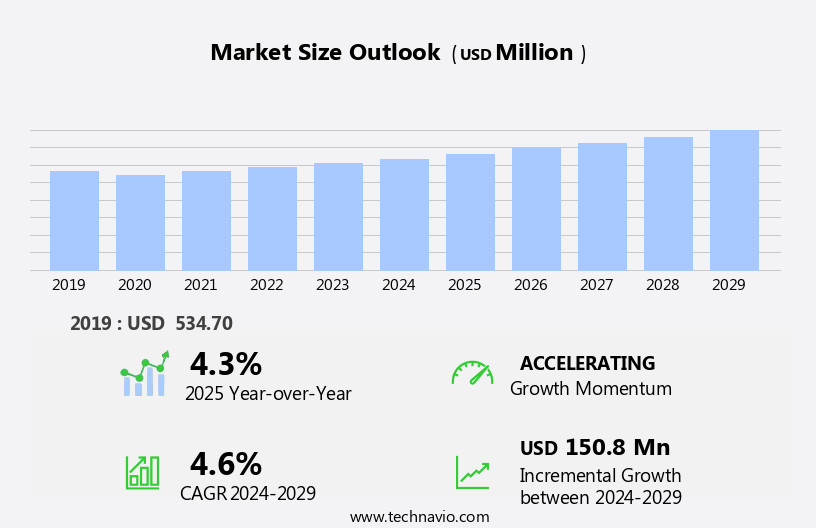

The preclinical isolated organ perfusion system market size is forecast to increase by USD 150.8 million at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases and the rise in preclinical research and testing on various diseases. Isolated organ perfusion systems, which include central venous catheters and heart-lung machines, play a crucial role In the research and testing process for infectious diseases and population health management, play a crucial role in the advancement of medical research by enabling the preservation and function of organs outside the body for extended periods. This allows for more comprehensive testing and evaluation of potential treatments and therapies. However, the high cost of these systems remains a significant challenge for market growth. Despite this obstacle, opportunities exist for companies to capitalize on the market's potential by offering cost-effective solutions or partnering with research institutions to provide access to their technology.

- As the demand for innovative medical treatments and therapies continues to grow, the market is expected to remain a vital component of the research and development landscape. Companies seeking to succeed in this market must navigate the cost challenge while continuing to innovate and provide value to their customers.

What will be the Size of the Preclinical Isolated Organ Perfusion System Market during the forecast period?

- The market is characterized by continuous evolution and dynamic market activities. This system plays a pivotal role in advancing various sectors, including biotechnology, pharmaceuticals, and academia. The system's applications span from data acquisition and analysis in preclinical studies to organ preservation and transplantation in Regenerative Medicine. Biocompatibility testing and toxicity assessment are integral parts of the perfusion process, ensuring the safety and efficacy of perfusion media and biocompatible materials. The system's ability to maintain precise temperature control and flow rate facilitates pharmacokinetic studies, tissue culture, and organ perfusion. Moreover, the perfusion system's role in organ transplantation and regenerative medicine is increasingly significant, enabling researchers to explore new frontiers in personalized medicine and tissue engineering.

- Perfusion circuits and solutions facilitate drug screening and organ preservation, while perfusion pumps ensure nutrient supply and waste removal. Regulatory approval and animal welfare are crucial considerations in the market, driving the development of alternative methods and in vitro models. The integration of precision medicine, 3D printing, and Artificial Organs further expands the system's potential applications, fueling ongoing research and development in the biomedical engineering field.

How is this Preclinical Isolated Organ Perfusion System Industry segmented?

The preclinical isolated organ perfusion system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial laboratories and CROs

- Academic and government research institutes

- Hospitals and clinical research centers

- Private research foundations

- Type

- Isolated heart perfusion systems

- Isolated abdominal organ perfusion systems

- Isolated lung perfusion systems

- Isolated liver perfusion systems

- Isolated kidney perfusion systems

- Isolated brain perfusion systems

- Multi-organ perfusion systems

- Others

- Application

- Drug discovery and development

- Toxicology studies Organ transplantation research

- Disease modeling Basic physiological research

- Technology

- Normothermic perfusion systems

- Hypothermic perfusion systems

- Subnormothermic perfusion systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

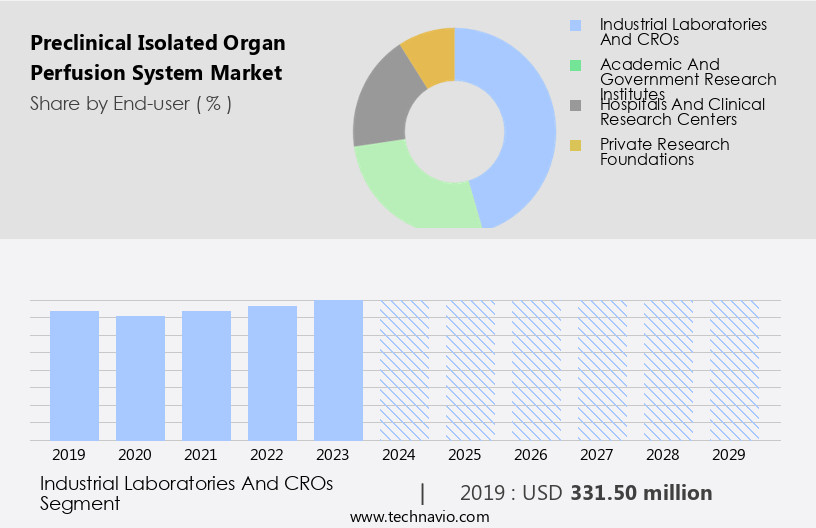

By End-user Insights

The industrial laboratories and cros segment is estimated to witness significant growth during the forecast period.

Preclinical studies play a crucial role in drug discovery and development, with industrial laboratories, including pharmaceutical and biotechnology companies and Contract Research Organizations (CROs), being the primary players in this domain. These organizations invest significantly in research and development, utilizing advanced technologies such as pressure monitoring, data analysis, biocompatibility testing, and pharmacokinetic studies for drug screening and organ perfusion. Tissue culture and Cell Culture techniques are employed for disease modeling and precision medicine, while biocompatible materials and temperature control ensure the success of organ transplantation and regenerative medicine. Perfusion circuits and perfusion solutions facilitate organ preservation and nutrient supply during isolated organ perfusion.

The biotechnology industry's focus on tissue engineering and 3D printing has led to the development of bioartificial organs and organoid culture, further advancing research in this field. Regulatory approval, animal welfare, and toxicity testing are essential considerations in this process. Clinical trials, flow rate control, data acquisition, and perfusion pumps are instrumental in bringing new drugs to market. The growing investment in research and development, increasing outsourcing activities to CROs, and the potential of alternative methods in drug discovery are expected to drive the growth of this market.

The Industrial laboratories and CROs segment was valued at USD 331.50 million in 2019 and showed a gradual increase during the forecast period.

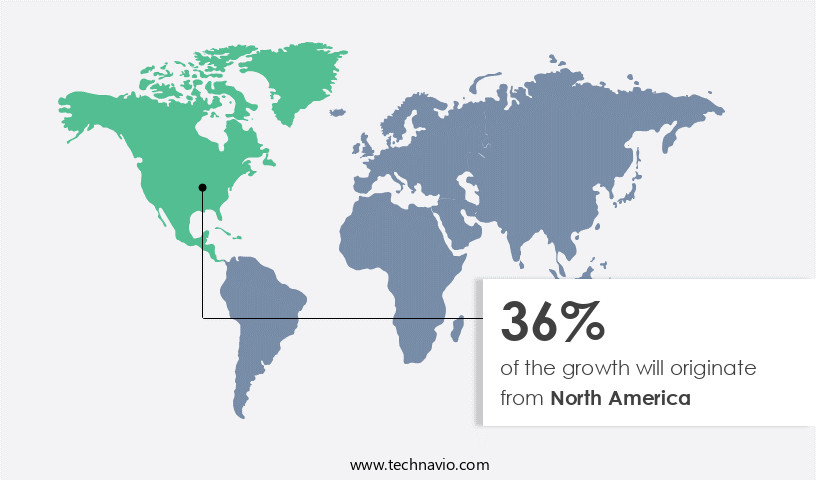

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth due to several key factors. Advanced technologies and products, such as perfusion systems and pumps, are increasingly being adopted for preclinical research in the region. This trend is driven by the presence of established pharmaceutical companies and research institutes, as well as the growing focus on personalized medicine and regenerative medicine. Technological innovations in areas like pressure monitoring, data analysis, and temperature control are enhancing the capabilities of these systems, making them valuable tools for pharmacokinetic studies, biocompatibility testing, and organ preservation. Furthermore, the biotechnology industry's investment in tissue engineering and tissue culture is fueling the demand for perfusion solutions.

Regulatory approval for the use of bioartificial organs and alternative methods in research is also contributing to the market's expansion. Despite animal welfare concerns, the market is expected to continue growing, with academic research and biomedical engineering playing a crucial role in driving advancements in organ perfusion, drug screening, and nutrient supply. Additionally, the integration of 3D printing and organoid culture in the development of artificial organs is a promising trend, offering potential solutions for waste removal and disease modeling in precision medicine.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Preclinical Isolated Organ Perfusion System Industry?

- The rising incidence of chronic diseases serves as the primary catalyst for market growth.

- Isolated organ perfusion systems play a crucial role in preclinical research by enabling the study of drug delivery to specific organs and investigating their physiological responses to therapeutic interventions. The rising prevalence of chronic conditions, such as cancer, cardiovascular diseases, and respiratory diseases, necessitates the development of innovative therapeutics for these diseases. According to the Centers for Disease Control and Prevention (CDC), approximately 62% of adult Americans have at least one chronic disease, and cardiovascular diseases account for one death every 36 seconds in the US. With the increasing burden of chronic diseases, there is a growing demand for advanced research techniques to develop effective treatments.

- In vitro models, including organoid culture, 3D printing of artificial organs, and perfusion systems using perfusion pumps, are gaining popularity as alternative methods for disease modeling and drug development. These techniques offer several advantages, such as precise control over experimental conditions, efficient waste removal, and the ability to study organ-specific drug responses. Moreover, these methods align with the principles of precision medicine, which aims to provide tailored treatments based on individual patient characteristics. In conclusion, the need for effective therapeutics for chronic diseases and the advancements in in vitro research techniques, such as isolated organ perfusion systems, are driving the growth of this market.

- These techniques offer several advantages, including precise control over experimental conditions, efficient waste removal, and the ability to study organ-specific drug responses, making them valuable tools for drug development and disease modeling.

What are the market trends shaping the Preclinical Isolated Organ Perfusion System Industry?

- Preclinical research and testing are experiencing significant growth in the scientific community, particularly in the field of various diseases. This upward trend reflects the increasing importance of discovering new treatments and therapies at the early stages of development.

- Preclinical Isolated Organ Perfusion Systems have gained significant attention in the biotechnology industry due to their role in advancing pharmaceutical research and development. The increasing prevalence of various diseases, such as cardiovascular diseases, metabolic disorders, and cancer, has fueled the need for novel and effective therapeutics. Consequently, there has been a surge in preclinical and clinical research activities across pharmaceutical companies and Contract Research Organizations (CROs). The emergence of advanced omics-based technologies, including genomics, proteomics, and metabolomics, has further accelerated the development of promising therapeutic candidates. These technologies enable a deeper understanding of biological processes and facilitate personalized medicine approaches.

- Preclinical Isolated Organ Perfusion Systems play a crucial role in biocompatibility testing, pressure monitoring, data analysis, tissue culture, and pharmacokinetic studies. Flow rate control is another essential feature of these systems, ensuring the consistent and accurate delivery of nutrients and drugs to the organs. The growing investment from public and private funding organizations in drug development and research projects worldwide has led to the launch of numerous new drug candidates and biosimilars. This trend is expected to continue, further boosting the demand for Preclinical Isolated Organ Perfusion Systems in the biotechnology industry. In conclusion, the growing need for effective therapeutics and the increasing investment in pharmaceutical research and development have fueled the growth of the Preclinical Isolated Organ Perfusion Systems market.

- These systems' ability to facilitate advanced research techniques, such as tissue engineering and personalized medicine, makes them indispensable tools for the biotechnology industry.

What challenges does the Preclinical Isolated Organ Perfusion System Industry face during its growth?

- The high cost of isolated organ perfusion systems poses a significant challenge to the growth of the industry. Isolated organ perfusion systems, which are essential for preserving and reviving organs prior to transplantation, come with a hefty price tag. This financial barrier hinders the expansion and accessibility of organ transplantation services, thereby limiting industry growth.

- Isolated organ perfusion systems have gained significant attention in preclinical research due to the increasing demand for in-depth organ studies. These systems enable researchers to maintain organ functions outside the body, facilitating extensive research in organ transplantation and regenerative medicine. However, the high cost of these systems poses a significant challenge to market growth. The cost varies depending on the organ type, brand, and quality, ranging from USD30,000 to USD35,000. The price can also fluctuate based on domestic or international market rates.

- More complex organs, such as lungs, may require additional equipment, further increasing the cost. Despite the expense, the benefits of using isolated organ perfusion systems, including precise temperature control, biocompatible materials, and advanced perfusion circuits and solutions, make them indispensable tools for drug screening and organ preservation in the fields of biomedical research and pharmaceuticals.

Exclusive Customer Landscape

The preclinical isolated organ perfusion system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the preclinical isolated organ perfusion system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, preclinical isolated organ perfusion system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADInstruments Pty Ltd. - The company provides advanced preclinical solutions, including the Isolated Perfused Rodent Liver System. This system features specialized glassware designed for perfusing an isolated rodent liver, preserving its hepatic function. By maintaining optimal conditions, researchers can explore the liver's complex biology and evaluate potential therapeutics. This cutting-edge technology enables more precise and efficient research, contributing to scientific advancements in various fields.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADInstruments Pty Ltd.

- ALA Scientific Instruments Inc.

- Bridge to Life Ltd.

- emka TECHNOLOGIES

- Hugo Sachs Elektronik GmbH

- MDE GmbH

- OrganOx Ltd.

- TransMedics Inc.

- World Precision Instruments

- XVIVO Perfusion AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Preclinical Isolated Organ Perfusion System Market

- In February 2024, Maquet Holding B.V., a leading provider of medical technology and services, announced the launch of their new preclinical isolated organ perfusion system, the Maquet Perfusion System MPS 1. This advanced system enables the preservation and reconditioning of organs outside the body, paving the way for potential transplant applications and research purposes (Maquet Holding B.V. Press release, 2024).

- In October 2025, Terumo Corporation, a global healthcare solutions company, entered into a strategic partnership with the University of Pittsburgh Medical Center (UPMC) to develop and commercialize a novel isolated organ perfusion system. This collaboration aims to improve organ preservation techniques and expand the application of this technology in clinical settings (Terumo Corporation press release, 2025).

- In March 2024, TransMedics Group, Inc. Raised USD50 million in a Series D financing round, led by New Enterprise Associates (NEA). This investment will support the company's continued growth and the commercialization of their Organ Care System, a portable preclinical isolated organ perfusion platform (TransMedics Group, Inc. Press release, 2024).

- In August 2025, the European Medicines Agency (EMA) granted a positive opinion for the marketing authorization of the Organ Care System by TransMedics Group, Inc. This approval marks a significant milestone for the company, enabling them to commercialize their preclinical isolated organ perfusion system in Europe (European Medicines Agency press release, 2025).

Research Analyst Overview

The market encompasses the development, innovation, and application of technologies used to maintain organ viability and assess perfusion outcomes during research. Heart, brain, kidney, liver, and lung perfusion are key areas of focus, each presenting unique perfusion challenges. Perfusion quality, safety, and duration are critical factors influencing perfusion development and innovation. Perfusion hardware, software, and consulting services play essential roles in perfusion research, while perfusion parameters, monitoring, and analysis are crucial for assessing perfusion efficacy and organ function. Perfusion trends include organ-specific perfusion models, protocols, and kits, as well as advances in perfusion biomarkers and training programs.

Perfusion opportunities lie in improving perfusion safety, efficiency, and efficacy, making it an exciting and dynamic field for business readers in the life sciences industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Preclinical Isolated Organ Perfusion System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 150.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Germany, Canada, China, Japan, UK, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Preclinical Isolated Organ Perfusion System Market Research and Growth Report?

- CAGR of the Preclinical Isolated Organ Perfusion System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the preclinical isolated organ perfusion system market growth of industry companies

We can help! Our analysts can customize this preclinical isolated organ perfusion system market research report to meet your requirements.