Print On Demand Market Size 2025-2029

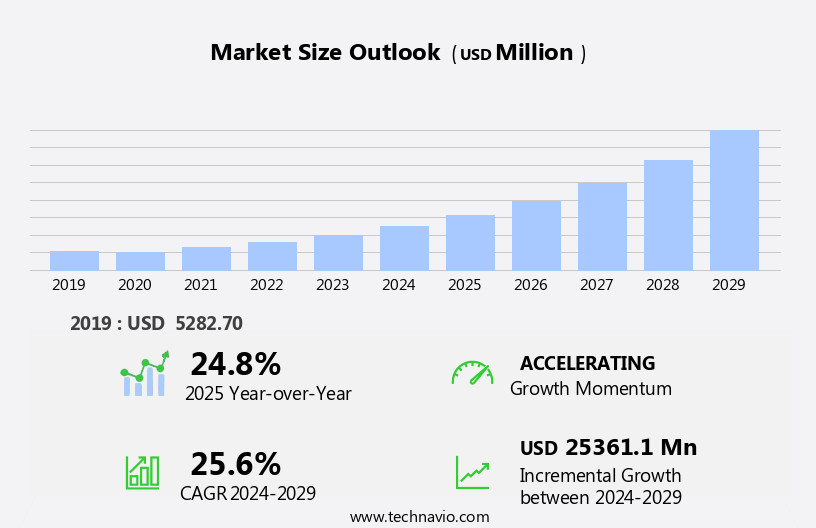

The print on demand market size is forecast to increase by USD 25.36 billion, at a CAGR of 25.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of customized merchandise as a branding tool. Businesses are leveraging print on demand services to create unique, personalized products, particularly in the apparel sector, where custom T-shirts are leading the charge. This trend is further fueled by the seamless integration of print on demand services with e-commerce platforms, enabling businesses to reach a wider customer base and streamline their operations. However, the market is not without challenges. The dynamic pricing of raw materials poses a significant obstacle for businesses, as fluctuations in the cost of essential inputs can significantly impact profitability.

- Moreover, ensuring consistent quality across various orders and maintaining a steady supply chain are ongoing challenges that require careful attention and strategic planning. To capitalize on the opportunities presented by this market and navigate these challenges effectively, companies must stay agile, invest in advanced technology, and build strong relationships with their suppliers.

What will be the Size of the Print On Demand Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by shifting consumer preferences and advancements in technology. This dynamic industry caters to various sectors, including home decor, personalized products, and custom apparel. The ongoing unfolding of market activities is characterized by continuous improvements in printing quality and customer service. Production costs and lead times are subject to change as new technologies emerge, such as digital and sublimation printing. Customer lifetime value and environmental impact are increasingly important considerations for businesses in this market. Ethical sourcing and sustainable practices are gaining traction, as are marketing and advertising strategies that leverage email marketing and social media.

Heat transfer printing and phone case production remain popular applications, with a focus on color accuracy and customer satisfaction. On-demand printing enables businesses to offer a wide range of products, from canvas prints to white-label items, without holding inventory. E-commerce integration and order management systems streamline operations, while graphic design services and product photography help businesses create compelling offerings. Fulfillment services and inventory management systems ensure timely delivery, enhancing customer experience. Pricing strategies continue to evolve, with businesses leveraging pay-per-click (PPC) advertising and returns and exchanges policies to optimize revenue. Print resolution and file formats are crucial factors in maintaining high-quality output, while color profiles and shipping and logistics are essential components of a successful business model.

The print-on-demand landscape is constantly evolving, with new trends and applications emerging as consumer demands and technological advancements shape the industry.

How is this Print On Demand Industry segmented?

The print on demand industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Software

- Service

- Product

- Apparel

- Home decor

- Drinkware

- Others

- Channel

- D2C

- Marketplace

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Platform Insights

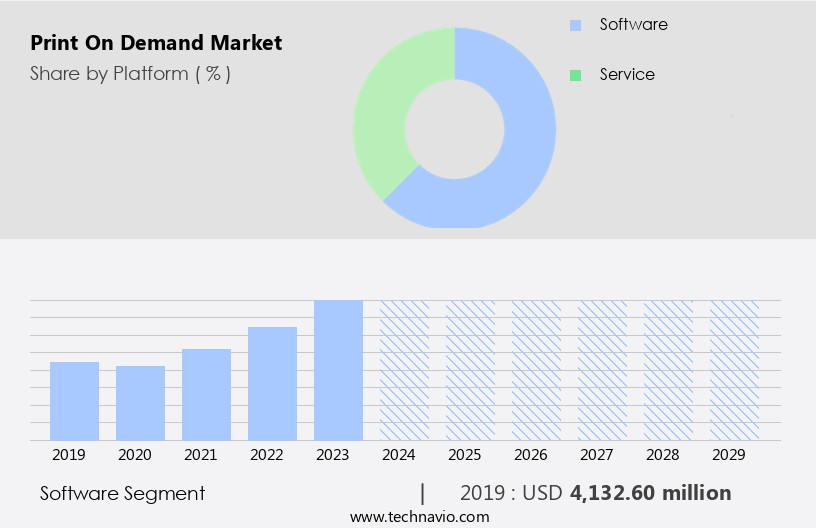

The software segment is estimated to witness significant growth during the forecast period.

Print on demand software, including platforms like Printful, Spocket, and Gooten, offers businesses access to essential printing tools via a cloud network or on-premises setup. The globalization trend and expanding reach of IT, BFSI, and retail sectors necessitate a centralized system for managing print operations. The cloud facilitates access to extensive data sets, thereby reducing capital expenditure (CAPEX) for businesses. Print quality and customer service are crucial factors driving the adoption of print on demand solutions. Production costs and lead times are significantly reduced through digital printing technologies, such as sublimation and direct-to-garment printing. Canvas prints, home decor, and personalized products are popular offerings in this market.

E-commerce integration, white-label products, and order management systems enable seamless selling of print products online. Ethical sourcing and environmental impact are growing concerns, with many print-on-demand platforms focusing on sustainable practices and certifications. Customer reviews and product design are essential components of a successful print on demand business. Pricing strategies, marketing and advertising, and inventory management are also crucial elements that require careful consideration. Returns and exchanges, print resolution, color accuracy, and fulfillment services are essential aspects of the print on demand value proposition. Heat transfer printing, phone cases, and email marketing are popular applications for this technology.

Incorporating graphic design services and social media marketing into the print on demand process can enhance customer satisfaction and boost sales. Print-ready files, color profiles, and shipping and logistics are essential considerations for businesses to ensure a smooth and efficient production process. Customer lifetime value and profit margins are critical metrics for businesses to monitor and optimize. Understanding the evolving market trends and staying informed about the latest advancements in print technology can help businesses stay competitive in the print on demand industry.

The Software segment was valued at USD 4.13 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing substantial growth, fueled by advancements in digital printing technology and the rising demand for personalized products. Notably, North America is a significant contributor to this expansion due to its robust e-commerce infrastructure and consumer preference for customized items. In May 2023, major players in the North American print on demand industry made strategic moves to strengthen their service offerings and operational efficiency. SATO Holdings, a leading industry player, acquired Stafford Press to expand its on-demand tag and label solutions for various industries across the United States. Quality is a top priority in this market, ensuring customer satisfaction.

Production costs and lead times are critical factors that influence profitability. Pay-per-click advertising is a popular marketing strategy to reach potential customers. Canvas prints and home decor are popular product categories, with various fabric types and file formats catering to diverse customer preferences. Ethical sourcing and sustainable practices are essential as consumers increasingly demand transparency. Digital and sublimation printing are popular techniques, with artwork creation and graphic design services available for customization. Returns and exchanges are managed efficiently, with print resolution and color accuracy ensuring high-quality products. White-label solutions enable businesses to brand their products, while e-commerce integration streamlines sales processes.

Product design and personalization are key differentiators, with direct-to-garment printing and screen printing catering to various customer needs. Social media marketing and email campaigns are effective marketing strategies, with pricing strategies and inventory management ensuring optimal profitability. Fulfillment services ensure timely delivery, and shipping and logistics are crucial for customer satisfaction. Customer lifetime value and environmental impact are essential considerations, with marketing and advertising efforts focusing on these aspects. Heat transfer printing and phone cases are popular product offerings, with color accuracy and print resolution ensuring high-quality production. Overall, the market is a dynamic and evolving industry, with continuous innovation and customer-centric approaches driving its growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Print On Demand Industry?

- The increasing prevalence of customized T-shirts serves as a significant market driver, functioning as an effective branding tool.

- The market is experiencing significant growth as businesses recognize the value of customized merchandise for branding purposes. This trend is particularly prevalent among startups seeking to increase their visibility and attract customers. Ethical sourcing of materials is a crucial consideration for companies, ensuring that digital printing and sublimation techniques are used to create high-quality artwork. Returns and exchanges are streamlined through e-commerce integration, ensuring customer satisfaction. Print resolution is a critical factor, with white-label products allowing businesses to maintain their brand identity.

- Graphic design services are often utilized to create unique and eye-catching designs. Customer reviews play a significant role in the decision-making process, and product design is a continuous process to meet evolving consumer demands. Overall, the market offers a flexible and cost-effective solution for businesses looking to make a lasting impression.

What are the market trends shaping the Print On Demand Industry?

- The integration of print-on-demand services with e-commerce platforms is a significant market trend. This fusion enables businesses to produce and sell customized products online without holding inventory, offering increased efficiency and flexibility.

- Print on demand (POD) services have gained significant traction in the business world, particularly in conjunction with e-commerce platforms. The integration of these services allows businesses to offer customized products without the burden of maintaining large inventories. This trend is fueled by the increasing preference for personalized items and the convenience of online shopping. Advanced APIs and plugins enable seamless connectivity between POD services and popular e-commerce platforms like Shopify, WooCommerce, and BigCommerce. Direct-to-garment printing is a popular POD technique, ensuring color accuracy and immersive designs on various items, including apparel, home decor, and personalized products.

- Fulfillment services further streamline the process by handling order management, inventory management, and shipping. Social media marketing plays a crucial role in promoting these customized offerings, making it easier for businesses to reach a broader audience. POD platforms provide businesses with the flexibility to work with print-ready files, ensuring high-quality prints and efficient production. By minimizing the need for inventory and reducing financial risks, businesses can focus on providing a harmonious and engaging shopping experience for their customers.

What challenges does the Print On Demand Industry face during its growth?

- Dynamic pricing of raw materials poses a significant challenge to industry growth, requiring close monitoring and strategic adaptation to maintain profitability and competitiveness within the market.

- In the realm of on-demand printing, the use of raw materials such as paper, substrates, and inks is essential. The paper industry experiences cost pressure due to escalating prices of raw materials, particularly wood pulp, which significantly impacts paper prices. Digital printing ink production involves the utilization of additives, binders, solvents, and pigments. The cost of pigments, a crucial ingredient in ink formulation for color efficiency, significantly influences ink pricing. Moreover, customer satisfaction is a critical factor in the on-demand printing market. Companies employ various strategies, including heat transfer printing for producing customized phone cases, to cater to diverse customer preferences.

- Shipping and logistics play a pivotal role in customer satisfaction, with efficient and timely delivery being a key differentiator. Marketing and advertising are integral to the growth of the on-demand printing industry. Email marketing campaigns and pricing strategies are popular tactics to attract and retain customers. Environmental impact is an emerging concern, with companies focusing on sustainable practices and eco-friendly materials to minimize their carbon footprint. In conclusion, the on-demand printing market is dynamic, with various factors influencing its growth and development. Raw material costs, customer satisfaction, marketing strategies, and environmental considerations are some of the key drivers shaping the industry.

Exclusive Customer Landscape

The print on demand market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the print on demand market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, print on demand market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amplifier Fulfillment - The company specializes in on-demand apparel printing solutions, utilizing advanced technology to produce high-quality, custom designs for clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amplifier Fulfillment

- Apliiq

- Breakout Commerce Inc.

- CustomCat

- Gelato ASA

- Graham Holdings Co.

- imINDY LLC

- JetPrint Fulfillment

- Printed Mint LLC

- Printful Inc.

- Printify Inc.

- Printsome SL

- Printy6 Inc.

- Prodigi Group Ltd.

- Qikink

- Redbubble Ltd.

- Spreadshirt Print On Demand GmbH

- Walgreens Boots Alliance Inc.

- Zazzle Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Print On Demand Market

- In February 2024, global e-commerce giant Amazon announced the expansion of its Print on Demand (POD) services to Europe, allowing European sellers to produce and ship custom products directly to customers without holding inventory (Amazon Press Release, 2024). This strategic move aimed to cater to the growing demand for personalized and customized products in the European market.

- In May 2024, print technology company EFI (Electronics For Imaging) unveiled its new Pro 30r UV inkjet roll-to-roll printer, which significantly increased the capacity and productivity of its POD offerings (EFI Press Release, 2024). This technological advancement enabled faster turnaround times and larger production volumes for POD businesses, enhancing their competitiveness in the market.

- In March 2025, print and marketing services provider Vistaprint partnered with leading e-commerce platform Shopify to offer POD services directly within Shopify's platform (Shopify Press Release, 2025). This collaboration allowed small businesses using Shopify to easily create and sell custom products, further expanding the reach of POD services to a broader audience.

- In June 2025, print technology company HP Inc. acquired SAi (Sign & Imaging America), a leading provider of software solutions for the sign making, vehicle graphics, and textile industries (HP Inc. Press Release, 2025). This strategic acquisition aimed to strengthen HP's POD offerings by integrating SAi's software solutions into its print technology, providing more advanced design and production capabilities for POD businesses.

Research Analyst Overview

- The print-on-demand market is experiencing significant growth, driven by advanced technologies and shifting consumer preferences. Key trends include data analytics for production efficiency, customizable products through vinyl cutting and dye sublimation, and affiliate marketing to expand customer base. Product personalization, content marketing, and brand awareness are essential strategies for businesses seeking to engage customers and differentiate themselves. Influencer marketing and design templates further enhance customization and reach. Competitor analysis, order tracking, and API integrations streamline operations, while print-on-demand software and business intelligence tools support business growth.

- Large format printing, laser cutting, mockup generators, digital embroidery, and 3D printing expand the range of offerings. Customer acquisition and engagement remain critical, with print-on-demand marketplaces and industrial printing solutions catering to diverse industries. Overall, the print-on-demand industry continues to evolve, offering numerous opportunities for businesses to thrive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Print On Demand Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.6% |

|

Market growth 2025-2029 |

USD 25361.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.8 |

|

Key countries |

US, Canada, China, UK, Japan, India, Germany, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Print On Demand Market Research and Growth Report?

- CAGR of the Print On Demand industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the print on demand market growth of industry companies

We can help! Our analysts can customize this print on demand market research report to meet your requirements.