Process Automation and Instrumentation Market Size 2024-2028

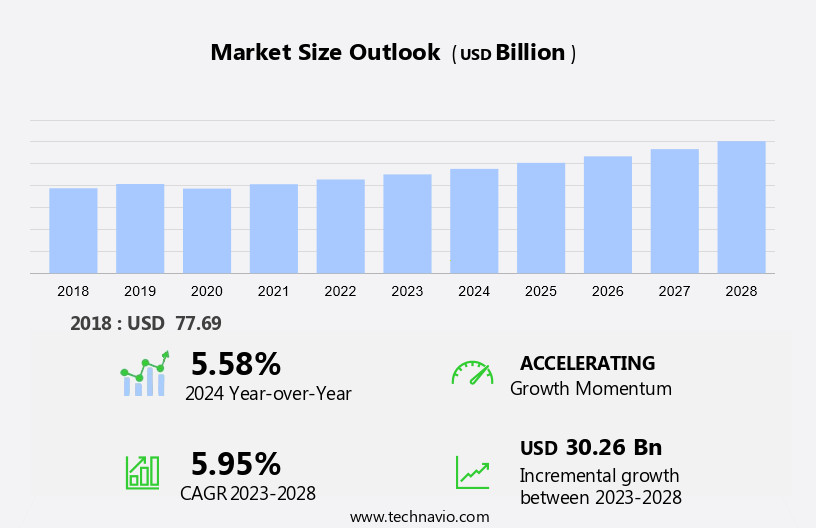

The process automation and instrumentation market size is forecast to increase by USD 30.26 billion, at a CAGR of 5.95% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for manufacturing simplification through automation. Companies are recognizing the benefits of streamlined operations and cost savings, leading to increased investment in automation technologies. Another key trend is the shift from on-premises to cloud-based systems, enabling real-time data access and remote monitoring, which is becoming increasingly essential in today's business environment. However, this market is not without challenges. Cybersecurity threats pose a significant risk to the adoption of automation and instrumentation systems, with potential vulnerabilities in cloud-based systems and the increasing use of IoT devices.

- Companies must prioritize robust security measures to mitigate these risks and protect their data and operations. To capitalize on market opportunities and navigate challenges effectively, organizations should focus on implementing advanced security protocols, investing in automation technologies, and embracing cloud-based solutions.

What will be the Size of the Process Automation and Instrumentation Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for enhanced process control, product quality, and operational efficiency across various sectors. Digital twins, process analyzers, and validation techniques are increasingly being integrated into systems to optimize processes and ensure data integrity. Energy efficiency and performance monitoring are key focus areas, with smart manufacturing and data acquisition systems playing crucial roles. Control strategies such as PID control and SCADA systems are being augmented with advanced process control and machine learning algorithms to improve predictive analytics and real-time monitoring. Remote diagnostics and wireless communication enable cost reduction and efficient field services.

Process safety remains a top priority, with emergency shutdown systems and safety instrumented systems ensuring process reliability and compliance. Industrial IoT and cloud computing facilitate remote monitoring and data visualization, enabling process improvement and operational efficiency. Temperature sensors, ph meters, conductivity meters, pressure transmitters, and flow meters are essential components of process control systems, providing critical data for process optimization and quality control. Calibration services ensure accuracy and reliability of these sensors, while artificial intelligence and big data analytics enhance process understanding and optimization. Overall, the market is characterized by continuous innovation and integration of advanced technologies to address evolving market dynamics and customer requirements.

How is this Process Automation and Instrumentation Industry segmented?

The process automation and instrumentation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas

- Chemical

- Food and beverages

- Energy and power

- Others

- Type

- Process automation

- Process instrumentation

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

The oil and gas segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable growth, particularly in the oil and gas sector. Factors driving this expansion include the increasing energy demand, ongoing exploration efforts, and industry-wide emphasis on operational efficiency and safety. Government initiatives also play a significant role. For instance, the US Department of Energy invests in advanced process automation technologies to enhance the sustainability and productivity of oil and gas operations. Similarly, Saudi Arabia's Vision 2030 plan aims to promote automation and digitization within the oil and gas industry while diversifying the economy. Predictive analytics and process control solutions, such as control valves and PLC controllers, are integral to optimizing product quality and reducing costs.

Data visualization tools facilitate real-time monitoring and process optimization, while cloud computing enables remote access and collaboration. Emergency shutdown systems ensure process safety, and industrial IoT, flow meters, and remote monitoring systems enhance operational efficiency. Control algorithms, DCS systems, and SCADA systems facilitate process improvement and safety instrumented systems. Advanced process control strategies, maintenance services, and industrial automation solutions optimize performance and energy efficiency. Analytical instruments, including temperature sensors, pressure transmitters, and conductivity meters, provide valuable data for process validation and calibration services. Artificial intelligence and machine learning enable process analyzers to identify trends and anomalies, while digital twins offer immersive, harmonious simulations for process optimization.

Wireless communication technologies, such as industrial ethernet and fieldbus communication, facilitate seamless integration and data acquisition. Instrumentation engineering expertise is essential for implementing these solutions effectively. Energy efficiency, performance monitoring, quality control, and smart manufacturing are key concerns for the industry. Data integrity is crucial for maintaining regulatory compliance and ensuring accurate decision-making. Overall, the market is evolving to meet the demands of modern industry, with a focus on enhancing operational efficiency, improving safety, and reducing costs.

The Oil and gas segment was valued at USD 20.33 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is projected to expand during the forecast period due to the region's ongoing industrial development and the pursuit of enhanced industry efficiency. However, the market's growth has been influenced by the presence of cost-effective industries, which may have financial constraints. Additionally, the availability of a large workforce at relatively low costs has been another factor hindering the adoption of process automation and instrumentation solutions in APAC. Despite these challenges, there is a growing awareness of the benefits of automation, including process optimization, product quality improvement, and cost reduction. Cloud computing and Industrial IoT technologies are increasingly being adopted for remote monitoring, diagnostics, and control.

Advanced process control strategies, such as PID control and digital twins, are gaining traction to enhance operational efficiency and improve process safety. Data visualization and big data analytics are essential tools for real-time performance monitoring and process improvement. Furthermore, the integration of automation systems with wireless communication technologies and safety instrumented systems is a significant trend in the market. Calibration services, machine learning, and artificial intelligence are also being employed to ensure data integrity and improve overall system performance. Instrumentation engineering plays a crucial role in the design, installation, and maintenance of process automation and instrumentation systems. The market also encompasses various components, including control valves, PLC controllers, conductivity meters, level sensors, temperature sensors, ph meters, pressure transmitters, flow meters, and process analyzers.

DCS systems, SCADA systems, and analytical instruments are integral to the market, with industrial ethernet and fieldbus communication facilitating seamless connectivity and data acquisition. Process validation, energy efficiency, and smart manufacturing are essential aspects of the market, with a focus on continuous process improvement and safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Process Automation and Instrumentation Industry?

- The significant simplification of manufacturing processes achieved through automation serves as the primary market catalyst.

- Process automation and instrumentation have become essential components of modern manufacturing, particularly in industries with complex product development methods and stringent quality requirements. Predictive analytics, a key aspect of process automation, enables real-time monitoring and analysis of production data to optimize processes, reduce costs, and enhance product quality. Control systems, such as programmable logic controllers (PLCs) and control valves, play a crucial role in process automation. These systems facilitate process optimization by maintaining consistent process parameters and ensuring efficient production. Data visualization tools provide operators with real-time insights into the manufacturing process, enabling them to identify and address issues promptly.

- Advancements in technology, including industrial IoT, cloud computing, and remote diagnostics, have further enhanced process automation capabilities. For instance, IoT sensors enable real-time monitoring of critical process parameters, while cloud computing facilitates remote access to data and analytics tools. Remote diagnostics enable predictive maintenance, reducing downtime and maintenance costs. Moreover, automation has led to cost reduction by eliminating routine work, improving work safety, and reducing lead times. Conductivity meters and other advanced sensors provide real-time process data, enabling manufacturers to maintain optimal process conditions and prevent product defects. Emergency shutdown systems ensure process safety and minimize potential damage to equipment and the environment.

- In conclusion, process automation and instrumentation have become essential for manufacturing industries seeking to improve productivity, reduce costs, and enhance product quality. Predictive analytics, process control systems, data visualization, and advanced sensors are key technologies driving the adoption of process automation and instrumentation.

What are the market trends shaping the Process Automation and Instrumentation Industry?

- The transition from on-premises to cloud-based systems is an emerging market trend. It is essential for organizations to consider adopting cloud solutions to remain competitive and efficient in today's business landscape.

- The market: Shifting Towards Cloud-Based Solutions for Enhanced Flexibility and Functionality Industrial operators are increasingly recognizing the value of service-based technology architecture in process automation and instrumentation. This trend is driving a shift from cloud-first to cloud-only models, compelling companies to invest more in public cloud services. Cloud-based systems offer several advantages, including high security, disaster recovery, and cost savings. However, small and medium-sized enterprises (SMEs) in process and discrete industries face budget constraints, making the initial investment for automation control systems like MES and DCS a challenge. Flow meters, level sensors, and other process instrumentation devices are crucial components of automation systems.

- Control strategies, such as PID control, and DCS systems, facilitate real-time monitoring and optimization of industrial processes. Wireless communication and big data analytics enable remote monitoring and predictive maintenance, further enhancing operational efficiency. Control algorithms and field services ensure seamless integration and maintenance of these systems. In the ever-evolving industrial landscape, staying updated with the latest automation technologies is essential. Cloud-based automation systems provide a cost-effective and efficient solution for SMEs, enabling them to compete effectively with larger enterprises. By embracing these technologies, organizations can optimize their processes, improve safety, and enhance overall productivity.

What challenges does the Process Automation and Instrumentation Industry face during its growth?

- Cybersecurity threats pose a significant challenge to the growth of various industries by jeopardizing data security and confidentiality, leading to potential financial losses, reputational damage, and legal consequences.

- Process automation and instrumentation are transforming traditional industries by integrating advanced technologies such as digital twins, process analyzers, and data acquisition systems. These solutions enhance process validation, energy efficiency, performance monitoring, and quality control in manufacturing processes. Digital twins create immersive, harmonious simulations of physical processes, enabling real-time analysis and predictive maintenance. Process analyzers, including temperature sensors and pH meters, provide accurate data for process optimization and compliance. Calibration services ensure data integrity and maintain the accuracy of these instruments. Smart manufacturing, powered by artificial intelligence, streamlines operations and improves overall productivity. However, these technologies introduce new challenges, particularly in the area of cybersecurity.

- Hackers can exploit vulnerabilities in industrial control systems, leading to operational downtime, manipulation of product development procedures, and theft of sensitive information. To mitigate these risks, organizations must prioritize data security and implement robust cybersecurity measures. By doing so, they can reap the benefits of automation and instrumentation while minimizing potential threats.

Exclusive Customer Landscape

The process automation and instrumentation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the process automation and instrumentation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, process automation and instrumentation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing process automation offerings, encompassing Control systems, Control Room Solutions, and Measurement Products. These solutions streamline operations for various industries, enhancing efficiency and accuracy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Delta Electronics Inc.

- Emerson Electric Co.

- Endress Hauser Group Services AG

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- Metso Outotec Corp.

- Mitsubishi Electric Corp.

- OMRON Corp.

- Pepperl and Fuchs SE

- Rockwell Automation Inc.

- Schlumberger Ltd.

- Schneider Electric SE

- Siemens AG

- Teledyne Technologies Inc.

- Titan Co. Ltd.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Process Automation And Instrumentation Market

- In January 2024, ABB, a leading technology provider, announced the launch of its new digital process automation solution, ABB Ability⢠Process Automation 800XA, designed to optimize manufacturing processes and improve efficiency for various industries (ABB Press Release, 2024). In March 2024, Honeywell International and Microsoft Corporation announced a strategic partnership to integrate Honeywell's process automation solutions with Microsoft Azure to enhance industrial digital transformation (Microsoft News Center, 2024).

- In April 2024, Emerson Electric Company completed the acquisition of Aventics, a leading global manufacturer of industrial valves and pneumatic components, expanding its automation solutions portfolio (Emerson Press Release, 2024). In May 2025, Schneider Electric, a major player in energy management and automation, received approval from the European Commission for its acquisition of AVEVA Group plc, a global leader in industrial software, to strengthen its digital transformation offering (European Commission Press Release, 2025).

Research Analyst Overview

- The markets witness dynamic growth, driven by the increasing demand for efficient and reliable industrial processes. Process historians and modelers facilitate data analysis, while calibration standards ensure instrument accuracy. Pressure regulators, level controllers, flow controllers, and temperature controllers maintain optimal process conditions. Preventive maintenance and validation services prolong equipment life, reducing downtime. Human-machine interfaces and alarm management improve operator efficiency. Remote access and cybersecurity solutions enhance system security. Process simulation software and edge computing enable predictive maintenance, optimizing performance. Industrial communication protocols facilitate seamless data exchange between devices. Data analytics software and batch control systems provide real-time insights for continuous improvement.

- Calibration standards, diagnostic tools, and regulatory compliance services ensure industrial instrumentation solutions meet quality and safety requirements. Spare parts management, report generation, and asset management software optimize inventory and maintenance operations. Fault detection and corrective maintenance minimize production losses. Continuous control systems and distributed control systems enable real-time process adjustments. Wireless sensor networks and programmable logic controllers provide real-time data and automation capabilities. Industrial networks and industrial security safeguard against cyber threats. Cloud-based automation solutions offer flexible and cost-effective alternatives to traditional systems. Process automation solutions and valve positioners streamline operations and improve overall process efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Process Automation and Instrumentation Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.95% |

|

Market growth 2024-2028 |

USD 30.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, Canada, China, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Process Automation and Instrumentation Market Research and Growth Report?

- CAGR of the Process Automation and Instrumentation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the process automation and instrumentation market growth of industry companies

We can help! Our analysts can customize this process automation and instrumentation market research report to meet your requirements.