Professional Skincare Market Size 2025-2029

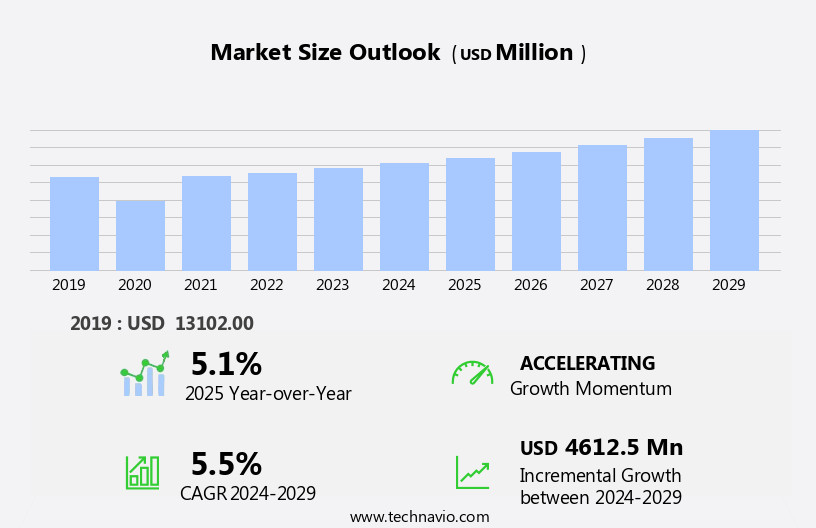

The professional skincare market size is forecast to increase by USD 4.61 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the continuous product innovation and product line extension strategies adopted by key players. This trend towards premiumization is resonating well with consumers, particularly those seeking advanced skincare solutions. Simultaneously, there is a rising demand for organic skincare products, reflecting a growing awareness and concern for health and wellness. However, the market faces challenges, including increasing competition from low-priced consumer category products. Companies must navigate this competitive landscape by offering differentiated value propositions and effective marketing strategies to capture market share.

- To capitalize on opportunities, players can focus on expanding their product offerings, catering to diverse consumer segments, and leveraging digital channels for customer engagement. Additionally, partnerships and collaborations with influencers, dermatologists, and industry experts can help build trust and credibility in the market. Overall, the market presents a dynamic and promising landscape for businesses, offering opportunities for growth and innovation.

What will be the Size of the Professional Skincare Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer trends and innovative product offerings. Facial cleansers and anti-aging products remain staples, with ongoing product development focusing on active ingredients such as vitamin C and salicylic acid. Combination skin products cater to diverse skin types, while organic and clinically-trialed ingredients gain popularity for their ethical sourcing and effectiveness. Consumer preferences shift towards personalized skincare solutions, with e-commerce platforms enabling easy access to customized regimens. Skincare subscription boxes offer ongoing product discovery, while skincare technology advances, including skin imaging and analysis, enhance the customer experience. Sensitive skin products and lip balms cater to specific concerns, with brands emphasizing gentle formulations and natural ingredients.

Skin brightening products and acne treatments target various skin concerns, while marketing strategies leverage social media influence to reach wider audiences. Hyaluronic acid, a key active ingredient, maintains its prominence due to its ability to retain moisture and improve skin elasticity. Oily skin products and eye creams cater to specific needs, with ongoing research and development ensuring continuous innovation. Brand awareness and customer loyalty are crucial in this dynamic market, with retail distribution channels expanding to meet evolving consumer demands. Skincare technology, skincare routine, and skin concerns remain key focal points, as the market continues to unfold and adapt to the ever-evolving needs of consumers.

How is this Professional Skincare Industry segmented?

The professional skincare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Face skincare products

- Body skincare products

- Distribution Channel

- Offline

- Online

- Type

- Anti-aging

- Anti-dehydration

- Sun protection

- Anti-pigmentation

- Method

- Conventional

- Organic or natural

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

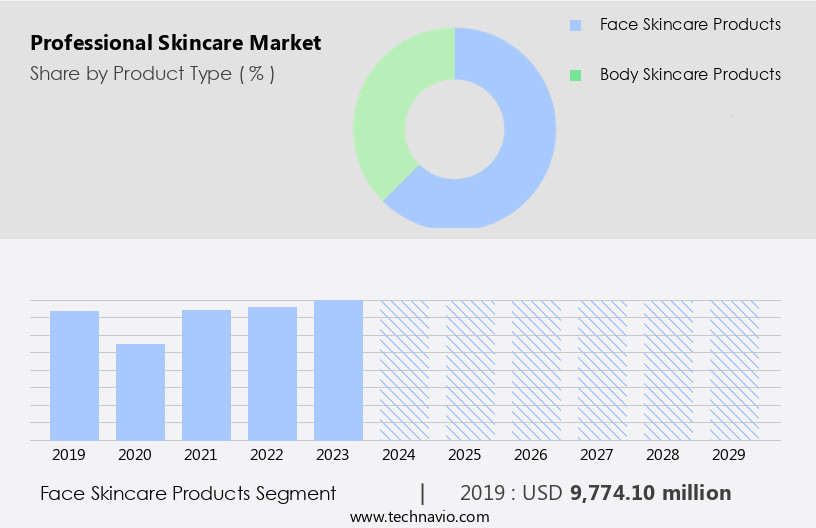

By Product Type Insights

The face skincare products segment is estimated to witness significant growth during the forecast period.

The market for face care products is experiencing significant growth, driven by increasing consumer awareness and the aging population's demand for anti-aging solutions. Anti-aging products, including those targeting wrinkles, dark spots, dark circles, hyperpigmentation, and uneven skin tones, account for a substantial market share. In response, manufacturers are innovating with ingredients such as UV absorbers and developing multifunctional and natural products. The cosmetics industry's expansion significantly influences the face skincare product segment. Influencer marketing and clinical trials contribute to brand awareness and consumer trust. Product innovation continues to be a key trend, with the introduction of combination skin products, vitamin C serums, salicylic acid treatments, and eye creams.

Natural ingredients, such as hyaluronic acid and glycolic acid, are increasingly popular for their effectiveness and ethical sourcing. E-commerce platforms and personalized skincare offerings provide convenience and customization, while skincare subscription boxes and skin imaging technology cater to diverse skin types and concerns. Brands focus on retail distribution and price points to expand their reach, while maintaining brand awareness and customer loyalty. Active ingredients, such as retinol and niacinamide, are essential components of many professional skincare regimens. Social media influence and skin analysis tools further enhance the skincare experience for consumers. Sensitive skin products and lip balms cater to specific skin concerns, ensuring a comprehensive skincare routine for various individuals.

The Face skincare products segment was valued at USD 9.77 billion in 2019 and showed a gradual increase during the forecast period.

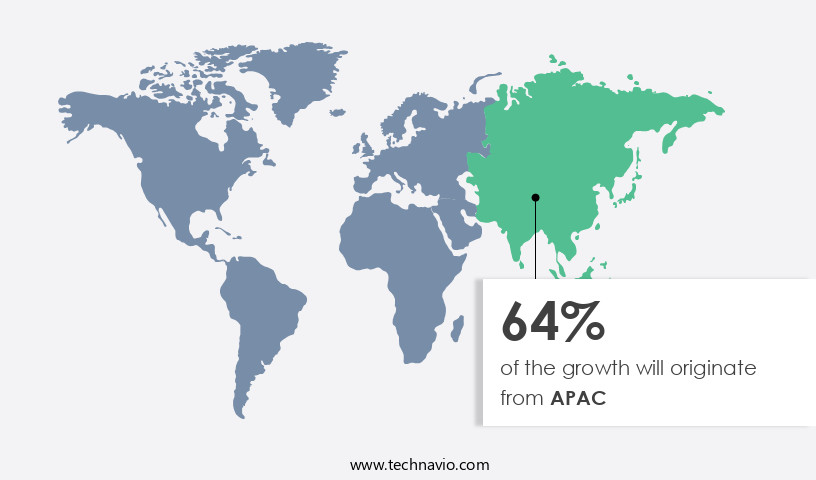

Regional Analysis

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is the largest contributor to the global market, driven by consistent product offerings from established brands, constant innovation, and effective marketing strategies. Major countries in APAC, including China, Japan, South Korea, Australia, and India, account for a significant market share due to the high demand for quality skincare products. Domestic players in APAC are gaining traction, capturing a substantial share of retail value sales among the top beauty and personal care manufacturers, particularly in developing nations like India and China. Product innovation is a key trend, with an emphasis on anti-aging products, facial cleansers, and combination skin solutions.

Consumer preferences lean towards natural ingredients, such as vitamin C and salicylic acid, and ethical sourcing. Clinical trials and skin analysis are increasingly utilized to ensure product efficacy. Skincare subscription boxes and personalized skincare are also gaining popularity. E-commerce platforms have become essential for skincare brands to reach consumers directly. Skincare technology, including skin imaging and skincare routines, is advancing to address various skin concerns, such as dry, oily, sensitive, and acne-prone skin. Active ingredients, such as glycolic acid and hyaluronic acid, are in high demand. Brands are focusing on brand awareness and customer loyalty through various marketing efforts. Eye creams and lip balms are also essential skincare products.

Skin concerns, such as skin brightening and skin type analysis, are influencing product development. Social media influence is shaping consumer trends and purchasing decisions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Professional Skincare Industry?

- Product innovation and line extensions, which include the introduction of premium offerings, are the primary factors fueling market growth through the process of product premiumization.

- The market is experiencing significant growth due to increasing customer demand for effective skincare solutions. Companies are responding to this demand by investing in research and development, introducing innovative products, and expanding their product lines. Active ingredients such as glycolic acid continue to gain popularity for their ability to address multiple skin concerns. Skincare subscription boxes offer personalized skincare regimens, while skin imaging technology and skin analysis tools enable more accurate assessment of skin type and concerns. Skincare brands are focusing on increasing brand awareness and customer engagement through various marketing strategies.

- The growing purchasing power and disposable income of consumers are also contributing to the market's growth. Overall, the market is expected to continue its growth trajectory in the coming years, as customers seek out high-quality, effective skincare solutions.

What are the market trends shaping the Professional Skincare Industry?

- Organic skincare products are experiencing heightened demand, reflecting a notable market trend. This growing preference for natural and organic skincare solutions underscores the importance of sustainability and health-conscious consumer choices.

- The market has witnessed a significant shift towards natural and organic skincare products due to growing concerns about the potential negative effects of synthetic ingredients. These concerns include skin irritation, allergies, nerve damage, and dark marks. As a result, skincare product manufacturers are increasingly focusing on organic offerings, which are made from natural and organic ingredients such as plant extracts, natural oils, and other botanicals. Some popular natural ingredients used in organic skincare products include sunflower oil, jojoba oil, aloe vera, turmeric, and olive oil. This trend not only addresses consumer health concerns but also helps companies differentiate themselves in a competitive market.

- Furthermore, social media influence and customer loyalty have become crucial factors in the skincare industry, with many consumers turning to organic and natural products based on recommendations from influencers and positive reviews from other customers. Skincare technology, such as hyaluronic acid, is also gaining popularity for its ability to improve skin hydration and elasticity. Overall, the organic skincare market is expected to continue growing as consumers become more educated about skin health and the benefits of natural ingredients.

What challenges does the Professional Skincare Industry face during its growth?

- The growth of the industry is significantly impacted by the similar benefits derived from low-priced consumer category products, presenting a formidable challenge.

- The market growth is driven by several factors, including product innovation and influencer marketing. Anti-aging products and combination skin solutions continue to dominate the market. Vitamin C and salicylic acid are popular ingredients in these products, known for their efficacy in addressing various skin concerns. Organic ingredients are increasingly preferred by consumers due to growing awareness about health and wellness. Clinical trials are conducted to ensure the safety and efficacy of professional skincare products. Dry skin products are another segment experiencing significant demand. Despite these trends, the adoption of professional skincare products remains limited in some regions, particularly in developing countries.

- Consumers often rely on traditional remedies and homemade solutions due to their affordability and availability. Common homemade remedies include milk, cheese, baking soda, oatmeal, tomato pulp, sandalwood powder, almond, and honey. In conclusion, the market is witnessing continuous growth, fueled by product innovation, influencer marketing, and consumer demand for effective skincare solutions. However, the market's reach remains limited in certain regions due to consumer preferences for traditional remedies and affordability concerns.

Exclusive Customer Landscape

The professional skincare market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the professional skincare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, professional skincare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allergan Aesthetics - The company specializes in advanced skincare solutions, encompassing a range of brands including Botox Cosmetic, Skinvive, and Kybella. Our offerings cater to diverse skincare needs, leveraging innovative technologies and scientific research. Botox Cosmetic targets dynamic wrinkles through neuromodulators, while Skinvive focuses on restorative treatments using peptides and antioxidants. Kybella addresses submental fullness through deoxycholic acid injections. By merging science and beauty, we deliver effective, high-quality skincare solutions for a more radiant and youthful appearance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allergan Aesthetics

- Bausch Health Companies Inc.

- Beiersdorf AG

- Chanel Ltd.

- Coty Inc.

- Eminence Organic Skin Care

- Episciences Inc.

- Fountain Of Youth Skincare

- Groupe Clarins

- Guinot SAS

- Lancer Skincare LLC

- LOccitane Groupe SA

- LOreal SA

- Natura and Co Holding SA

- Obagi Cosmeceuticals LLC

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Professional Skincare Market

- In March 2024, Estée Lauder Companies introduced a new line of professional skincare products, 'Estée Lauder Professional Revitalizing Supreme+', focusing on anti-aging and skin restoration. This launch marked a strategic expansion to their existing skincare portfolio (Estée Lauder Companies Press Release, 2024).

- In July 2024, L'Oréal and Procter & Gamble announced a partnership to co-create a new active cosmetics brand, combining L'Oréal's expertise in skincare and Procter & Gamble's knowledge in consumer goods (Reuters, 2024).

- In October 2024, Unilever completed the acquisition of Dermalogica, a leading professional skincare brand, strengthening Unilever's presence in the premium skincare market (Bloomberg, 2024).

- In February 2025, the European Commission approved the use of gene therapy for cosmetic applications, paving the way for significant technological advancements in professional skincare products (European Commission Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant activity and trends, with a focus on addressing skin pigmentation and enhancing skin tone through the use of antioxidant properties and anti-inflammatory ingredients. Brands are leveraging the influence of brand ambassadors to promote product safety and build consumer trust. Sustainability initiatives are gaining momentum, with a growing emphasis on ingredient efficacy, supply chain transparency, and environmental impact. Consumer reviews and online platforms are driving product discovery and decision-making, while the skin microbiome and cellular regeneration are emerging areas of interest.

- Uv protection and skin hydration remain key concerns, with a growing demand for sebum control and collagen production. Clinical studies and product ratings provide valuable insights into product effectiveness, while quality control and manufacturing processes ensure consistency and safety. Customer service and packaging materials also play crucial roles in enhancing the overall consumer experience.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Professional Skincare Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 4612.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, Germany, India, South Korea, France, UK, Canada, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Professional Skincare Market Research and Growth Report?

- CAGR of the Professional Skincare industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the professional skincare market growth of industry companies

We can help! Our analysts can customize this professional skincare market research report to meet your requirements.