Public Warehousing Market Size 2025-2029

The public warehousing market size is forecast to increase by USD 62.6 billion at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of Small and Medium-sized Enterprises (SMEs) seeking cost-effective and flexible storage solutions. These businesses are turning to public warehousing to manage their inventory and logistics, leading to increased demand for third-party logistics services. Another key trend in the market is the rise of automation and the implementation of smart warehousing solutions, which enhance operational efficiency and reduce labor costs. However, the market faces challenges, including the shortage of skilled labor, which can impact the ability of warehouses to meet the growing demand for their services.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on investing in technology and training programs to attract and retain skilled labor. Additionally, partnerships and collaborations with technology providers and educational institutions can help address the labor shortage and stay competitive in the market. Overall, the market offers significant growth potential for companies able to adapt to changing market dynamics and provide innovative solutions to meet the evolving needs of their customers.

What will be the Size of the Public Warehousing Market during the forecast period?

- The market continues to evolve, driven by the growing demand for efficient and flexible logistics solutions. With the rise of e-commerce and direct-to-consumer (D2C) sales, there is a heightened focus on warehouse network optimization, delivery speed, and order accuracy. Contract logistics providers are increasingly leveraging technology to enhance their offerings, including barcode scanning, route optimization, predictive analytics, and warehouse optimization. Sustainability is also a key trend, with initiatives such as zero-waste, sustainable packaging, and renewable energy gaining traction. Space utilization and labor shortages are ongoing challenges, leading to innovations like warehouse safety standards, access control systems, and automation solutions such as conveyor systems and sorting systems.

- Supply chain disruptions and the need for on-time delivery have heightened the importance of inventory turnover, reverse logistics, and returns management. Additionally, regulatory compliance, particularly in areas of safety and environmental regulations, remains a critical consideration. The market is also witnessing the digital transformation of logistics, with the adoption of advanced technologies like surveillance systems, access control systems, and fleet management tools. Overall, the market is a dynamic and innovative space, with a focus on enhancing customer service, reducing lead times, and improving operational efficiency.

How is this Public Warehousing Industry segmented?

The public warehousing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- General

- Specialized

- Application

- Manufacturing

- Consumer goods

- Retail

- Healthcare

- Others

- Service

- Inventory management

- Order fulfilment

- Transportation

- Others

- Area

- Small (less than 100000 sq ft)

- Medium (100000 - 500000 sq ft)

- Large (more than 500000 sq ft)

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South America

- APAC

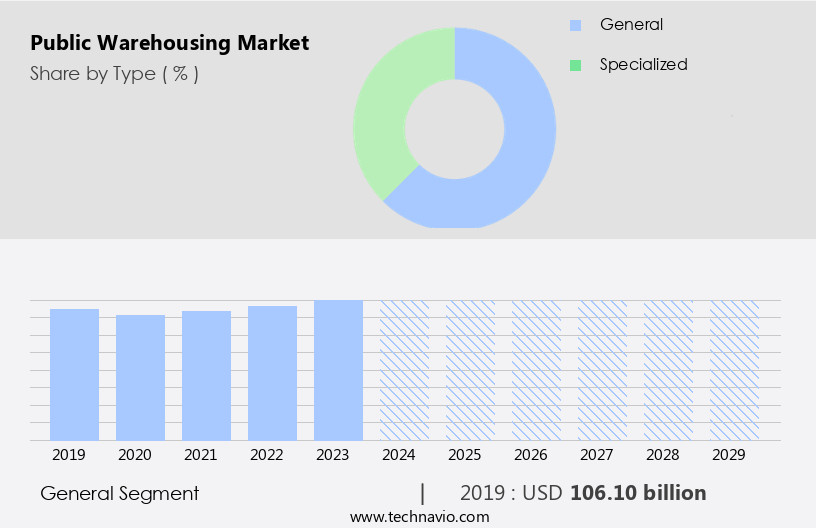

By Type Insights

The general segment is estimated to witness significant growth during the forecast period. Public warehousing is an essential component of supply chain management, enabling businesses to store and manage their inventory efficiently. The industry caters to various sectors, including apparel, manufacturing, automotive, and consumer staples, among others. General warehouses, which make up the largest segment, do not require special handling equipment or temperature control. Instead, they store a range of goods, from raw materials to finished products and spare parts. Just-in-Time (JIT) manufacturing relies heavily on public warehousing for inventory management and order fulfillment. Supply chain visibility and demand forecasting are crucial in this context, allowing businesses to optimize their inventory levels and reduce carrying costs.

Pick and pack services further streamline the process, ensuring accurate order fulfillment and timely shipping and receiving. Advancements in technology are transforming the public warehousing landscape. Artificial Intelligence (AI) and Machine Learning (ML) are being used for labor optimization, inventory management, and demand forecasting. Warehouse automation, including robotics and conveyor systems, enhance productivity and reduce human error. Climate-controlled warehousing, temperature-controlled warehousing, and cold storage cater to industries with temperature-sensitive goods. Business continuity and disaster recovery are essential considerations in today's volatile business environment. Cloud-based Warehouse Management Systems (WMS) and access control systems ensure data security and real-time tracking.

Fire suppression and other safety measures ensure business resilience in the face of unforeseen circumstances. Value-added services, such as kitting, labeling, and packaging, add value to the warehousing process. Energy efficiency and green logistics are becoming increasingly important, with businesses seeking to minimize their carbon footprint. Inventory optimization and distribution center location are key factors in minimizing transportation costs and ensuring timely delivery. In summary, public warehousing plays a vital role in supply chain management, enabling businesses to manage their inventory efficiently, optimize their supply chain, and adapt to changing market conditions. The industry is undergoing significant technological advancements, with a focus on automation, data analytics, and sustainability.

Get a glance at the market report of share of various segments Request Free Sample

The General segment was valued at USD 106.10 billion in 2019 and showed a gradual increase during the forecast period.

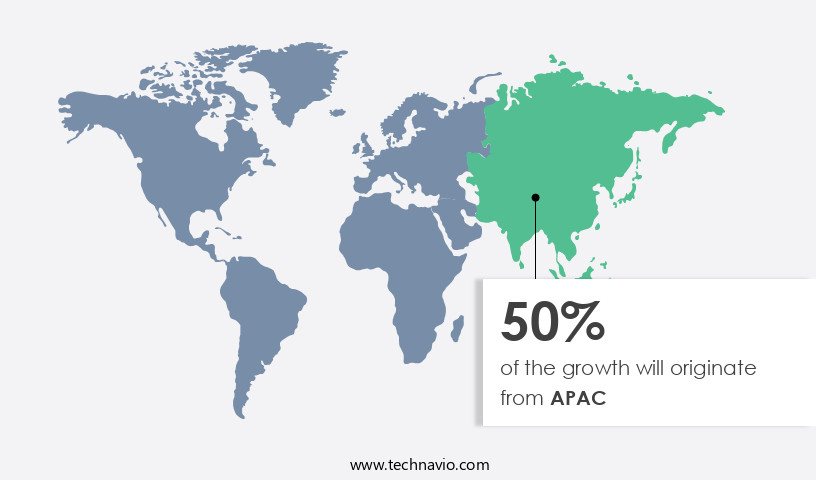

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the region's economic expansion and increasing industrialization. The rise of e-commerce and consumer demand for faster delivery services have heightened the importance of efficient warehousing and distribution solutions. Public warehousing plays a vital role in achieving last-mile delivery efficiency and supporting supply chain management. Ongoing infrastructure development projects, such as logistics parks and transportation networks, contribute to the growth of the warehousing sector in APAC. Just-in-Time (JIT) manufacturing and lean manufacturing practices require reliable and efficient warehousing solutions for inventory management and order fulfillment. Advancements in technology, including artificial intelligence (AI), machine learning (ML), data analytics, and warehouse automation, are transforming the warehousing industry.

These technologies enable supply chain visibility, demand forecasting, labor optimization, and real-time tracking. Climate-controlled warehousing, such as cold storage and temperature-controlled facilities, cater to specific industries and their unique inventory requirements. Moreover, businesses are focusing on supply chain resilience and business continuity by implementing disaster recovery plans and cloud-based warehouse management systems (WMS). Energy efficiency, green logistics, and carbon footprint reduction are also essential considerations for modern warehousing operations. Access control, pallet storage, and value-added services, such as pick and pack, are essential features of public warehousing solutions. Fire suppression systems and other safety measures ensure the protection of inventory and facilities. In summary, the market in APAC is expected to grow substantially due to the region's economic growth, increasing trade activities, and the evolving demands of modern business operations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Public Warehousing Industry?

- A growing number of SMEs is the key driver of the market. Public warehousing plays a significant role in catering to the storage needs of Small and Medium Enterprises (SMEs) due to their resource constraints. With the growing number of SMEs globally, representing approximately 90% of businesses and over half of the employment worldwide, the demand for public warehousing is expected to increase. SMEs often require handling services such as contract storage, packing, and transportation to efficiently manage their inventory and expand their distribution networks. They offers solutions for general merchandise, sensitive items, and even refrigerated warehousing. Moreover, the integration of automation and robotics, data analytics tools, cloud computing, and warehouse management systems in public warehousing enhances operational efficiency.

- Security concerns are addressed through advanced technologies and practices. Sustainability is a priority, with the implementation of sustainable practices, reduction of carbon footprint, and energy-efficient lighting. E-commerce platforms have also fueled the demand for on-demand storage solutions and short-term storage options. Public warehousing services offer third-party logistics solutions, enabling businesses to focus on their core competencies while ensuring efficient inventory management. Contract warehousing and multi-client warehousing are popular options, providing cost savings and flexibility. The integration of artificial intelligence, automation, and robotics in public warehousing further streamlines operations and enhances productivity. Despite these advantages, labor shortages and energy consumption remain challenges.

What are the market trends shaping the Public Warehousing Industry?

- The rise in automation and implementation of smart warehousing solutions is the upcoming market trend. Public warehousing is a crucial component of the logistics industry, offering solutions for businesses requiring flexible and efficient storage solutions. Two primary types of public warehousing are Bonded and Private. Bonded warehousing allows for the storage of goods without paying customs duties until they are ready to be released into the market. Private warehousing, on the other hand, is used by businesses for their exclusive use. They provide various handling services, including contract storage, packing, and transportation. Efficient inventory management is a significant advantage of public warehousing, allowing businesses to expand their distribution networks and accommodate omnichannel retailing.

- Security concerns are addressed through advanced technologies and strict protocols. smart warehousing, featuring automation and robotics, is increasingly popular. Automated systems for receiving, identifying, sorting, organizing, and pulling goods for transportation increase productivity, efficiency, and accuracy. Sensitive items require specialized handling, with refrigerated warehousing a common solution. Forecasting and on-demand storage solutions cater to urban customers and short-term storage needs. Sustainability practices, such as energy-efficient lighting and waste reduction, are essential for reducing a warehouse's carbon footprint. E-commerce platforms drive the demand for warehousing solutions, with third-party logistics providers offering multi-client warehousing and dedicated warehousing options. Warehouse management systems and data analytics tools, including cloud computing, automation, artificial intelligence, and robotics, optimize warehouse operations.

What challenges does the Public Warehousing Industry face during its growth?

- Shortage of skilled labor is a key challenge affecting the industry's growth. The market encompasses various types of warehousing solutions, including bonded and private warehousing, contract storage, and multi-client warehousing. These services cater to the handling of general merchandise and offer handling, packing, and transportation services. Efficient inventory management is a crucial aspect of public warehousing, ensuring the smooth flow of goods and reducing the need for on-demand storage solutions. Third-party logistics providers play a significant role in the market, offering warehousing services that expand distribution networks and support omnichannel retailing. Security concerns are addressed through advanced technologies such as automation, robotics, and warehouse management systems that incorporate data analytics tools and cloud computing.

- Sensitive items require specialized handling, and refrigerated warehousing solutions cater to this need. The e-commerce sector's growth has significantly impacted the market, with e-commerce platforms requiring dedicated warehousing and short-term storage options. Sustainability practices are increasingly important, with companies focusing on reducing their carbon footprint and implementing energy-efficient lighting and waste-reduction strategies. The labor shortage In the warehousing industry is a significant challenge, necessitating the adoption of automation and robotics to improve productivity. The market is dynamic, with ongoing advancements in technology and evolving consumer demands shaping its growth. The market's success hinges on its ability to adapt to these changes and provide innovative solutions to meet the needs of urban customers and e-commerce businesses.

Exclusive Customer Landscape

The public warehousing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the public warehousing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, public warehousing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agility Public Warehousing Co. K.S.C.P - The company offers public warehousing solution through logistics parks and industrial real estate complexes for storage, distribution, and supply chain management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agility Public Warehousing Co. K.S.C.P

- CEVA Logistics SA

- Deutsche Bahn AG

- DHL International GmbH

- FedEx Corp.

- Fullers Logistics Ltd.

- GEODIS

- Globe Express Services logistics and Shipping Co.

- Kenco Group Inc.

- Kuehne Nagel Management AG

- NFI Industries Inc.

- Penske Corp.

- PiVAL International

- Ryder System Inc.

- Saddle Creek Logistics Services

- The China Fox Group Pty Ltd.

- United Parcel Service Inc.

- Warehouse Services Inc.

- Wincanton Plc

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Public warehousing has emerged as a critical component of modern supply chain management, enabling businesses to efficiently store and manage their inventory while ensuring timely delivery to customers. This sector is characterized by various trends and technologies shaping its evolution. Just-in-Time (JIT) inventory management is a prevalent practice in public warehousing, allowing businesses to maintain low inventory levels and minimize holding costs. Supply chain visibility, facilitated by advanced technologies, plays a pivotal role in JIT success. This transparency enables real-time monitoring of inventory levels, demand patterns, and order status, ensuring a seamless flow of goods from the warehouse to the end consumer.

Another essential aspect of public warehousing is demand forecasting. By analyzing historical data and market trends, warehouses can anticipate future demand and optimize their inventory levels accordingly. This proactive approach reduces the risk of stockouts or overstocking, ensuring an efficient and cost-effective supply chain. Automation and technology are revolutionizing public warehousing, with applications ranging from pick and pack processes to climate-controlled environments. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being used to optimize labor and improve operational efficiency. These technologies enable real-time data analysis, automate repetitive tasks, and enhance overall productivity. Value-added services, such as kitting, labeling, and packaging, are also gaining popularity in public warehousing.

These services help businesses save time and resources by outsourcing non-core functions to specialized warehouses. This not only improves their focus on their core competencies but also enhances their overall supply chain agility. Energy efficiency and sustainability are becoming essential considerations in public warehousing. Temperature-controlled warehouses, for instance, are adopting energy-efficient technologies to minimize their carbon footprint. Warehouse automation and optimization strategies further contribute to energy savings and reduced environmental impact. Business continuity and disaster recovery are crucial aspects of public warehousing. Warehouses employ various measures, such as redundant systems, backup power supplies, and cloud-based Warehouse Management Systems (WMS), to ensure uninterrupted operations and minimize downtime in the event of disruptions.

Security and access control are essential components of public warehousing, with advanced technologies being used to safeguard inventory and maintain supply chain integrity. Pallet storage systems and temperature-controlled environments are designed with full access control mechanisms to prevent unauthorized access and ensure product safety. Public warehousing is also evolving to accommodate the growing importance of real-time tracking and data analytics. Cloud-based WMS and other advanced technologies enable businesses to monitor their inventory levels, order status, and shipment information in real-time, providing them with valuable insights to optimize their supply chain operations.

From JIT inventory management and demand forecasting to automation, sustainability, and real-time data analytics, these developments are transforming the way businesses manage their inventory and supply chains. By staying abreast of these trends and embracing innovative technologies, public warehouses can help businesses optimize their operations, reduce costs, and improve overall supply chain resilience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 62.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, China, Canada, India, Germany, Japan, UK, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Public Warehousing Market Research and Growth Report?

- CAGR of the Public Warehousing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the public warehousing market growth and forecasting

We can help! Our analysts can customize this public warehousing market research report to meet your requirements.