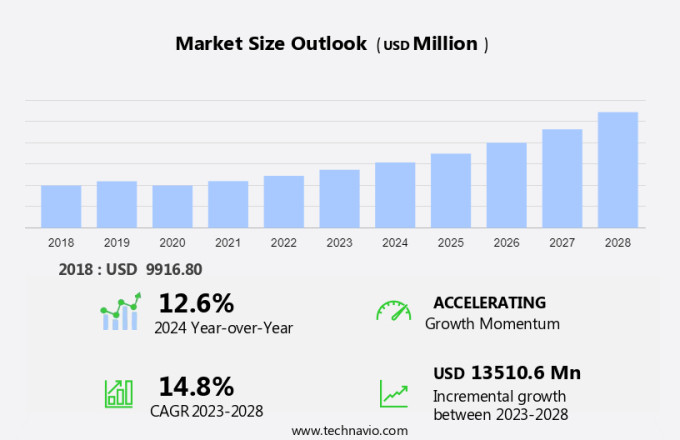

Pure Play Software Testing Services Market Size and Trends

The pure play software testing services market size is forecast to increase by USD 13.51 billion at a CAGR of 14.8% between 2023 and 2028. The market is witnessing significant growth due to several key trends and challenges. One of the primary drivers is the increasing demand for expert testing partners to ensure application quality and stability in the face of continuous operations and shorter time-to-market. Additionally, the proliferation of big data and IoT-enabled technology is leading to an increased need for specialized testing partners to ensure application downtime is minimized and testing productivity is maximized. Furthermore, the rise in cybersecurity concerns necessitates the adoption of advanced testing methodologies to mitigate risks and ensure data security. Strategic testing partnerships throughout the software development lifecycle are becoming essential for cost savings and maintaining a competitive edge in the market.

Market Overview

In today's fast-paced digital world, software systems play a pivotal role in powering businesses and delivering exceptional user experiences. Evaluating software products for quality and stability is a critical aspect of the software development lifecycle (SDLC). A pure-play software testing services provider brings impartial focus, competence, and unique insights to the table, ensuring that software meet customer expectations and deliver continuous operations. The Importance of Software Testing: Software testing is an essential process that helps identify defects, vulnerabilities, and performance issues in software systems. It plays a crucial role in enhancing software quality and ensuring customer satisfaction. User expectations are high, and application downtime can lead to significant financial and reputational damage. A pure-play software testing partner brings specialized expertise and concentrated knowledge to the table, enabling organizations to address these challenges effectively. Pure-play software testing services providers employ various testing techniques and tools to ensure software quality. These techniques include functional testing, regression testing, performance testing, security testing, and usability testing.

Furthermore, the use of advanced testing tools and processes helps streamline testing productivity, reduce time-to-market, and minimize cost savings. Forming strategic testing partnerships with a pure-play software testing services provider offers numerous benefits. These partners bring a global vision and impartial focus to the table, enabling organizations to maintain a strategic advantage in the market. They help ensure that software systems are of the highest quality and stability, allowing businesses to meet their strategic objectives. A pure-play software testing services provider helps ensure continuous operations by identifying and addressing potential issues before they impact users. This proactive approach to testing helps improve customer satisfaction and reduces the risk of application downtime. It also enables organizations to deliver software updates and new features more quickly, keeping up with the ever-evolving market demands. In conclusion, pure-play software testing services are an essential component of the software development lifecycle. They help organizations ensure software quality, meet customer expectations, and maintain a strategic advantage in the market. By partnering with a pure-play software testing expert, businesses can benefit from concentrated knowledge, unique insights, and advanced testing techniques and tools, ultimately leading to improved software quality, increased testing productivity, and reduced cost savings. IT services organizations that prioritize software testing as a strategic initiative can reap significant rewards in terms of customer satisfaction, continuous operations, and market competitiveness.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- BFSI

- IT

- Telecom

- Retail

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By End-user Insights

The BFSI segment is estimated to witness significant growth during the forecast period. In the Banking, Financial Services, and Insurance (BFSI) sector, the shift towards digital marketing through mobile channels is gaining momentum. This trend is expected to persist in the coming years, driven by the increasing use of smartphones and smart devices for financial transactions.

Get a glance at the market share of various segment Download the PDF Sample

The BFSI segment was the largest segment and was valued at USD 2.63 billion in 2018. Banks have been investing significantly in IT solutions and are quick to adopt emerging technologies like analytics, cloud computing, and virtualization. To meet the demands of this digital transformation, BFSI firms require expert Pure Play Software Testing Services. These services offer tailored expertise and guidance, enabling seamless multichannel interactions such as Internet banking, mobile banking, kiosks, and ATMs. Pure-play distributors provide scale and efficiency, making them a popular choice over Big Integrators (SIs). The hybrid method, which combines both in-house and outsourced testing, offers the best of both worlds. As the BFSI sector continues to digitize, the need for reliable software testing services will only grow.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In North America, enterprises are leading the charge in adopting Software as a Service, Mobile, Analytics, and Cloud (SMAC) technologies. The Bring-Your-Own-Access (BYOA) policy is gaining popularity among employers, fueling the need for testing services, particularly in mobile application testing and mobile DevOps. The banking, IT, and telecom sectors are the major consumers of testing services in this region. In the telecom industry, the development and maintenance of advanced CRM systems necessitate a well-managed test environment.

Furthermore, the growing consumerization of data services and location-based applications in telecom is driving the software testing market's expansion. Computer-based products, including software applications and websites, require rigorous testing to ensure high-quality results in the Internet age. companies offering testing services can leverage cutting-edge technologies such as process coordination engines, controlled crowd testing, human-to-human workflows, and analysis capability to cater to the demands of these industries. A multi-platform staging area is essential to support the testing needs of these sectors effectively.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Increased use of industry-specific testing service offerings is notably driving market growth. Offline simulations play a crucial role in ensuring the accuracy and reliability of network software in various industries, particularly in sectors with high consumer interaction such as telecommunications. In this domain, location-based services have become increasingly popular, enabling users to identify nearby establishments and manage daily activities. Before deployment, these applications undergo rigorous testing to enhance their precision and eliminate errors.

Furthermore, testing companies specialize in specific verticals to provide domain expertise and added value to clients. For instance, in the telecom sector, testers execute a series of testing processes throughout the development cycle to optimize network software for location-based services, ensuring seamless user experiences at airports, hospitals, and other key locations. Thus, such factors are driving the growth of the market during the forecast period.

Major Market Trends

Proliferation of big data- and IoT-enabled technology testing is the key trend in the market. In today's data-driven business landscape, enterprises require expert testing partners to ensure the accuracy and correctness of big data. The increasing volume of data from various sources necessitates continuous testing to maintain quality and stability during continuous operations.

Furthermore, big data testing is a complex process, with companies facing challenges in testing large amounts of structured and unstructured data in real-time. The need for testing productivity and cost savings in agile environments is crucial for businesses to gain a competitive edge and reduce time-to-market. Strategic testing partnerships throughout the software development lifecycle with specialized testing partners can help businesses overcome these challenges and ensure the reliability and effectiveness of their big data applications. Thus, such trends will shape the growth of the market during the forecast period.

Significant Market Challenge

Rise in cybersecurity concerns is the major challenge that affects the growth of the market. In today's global market, evaluating software products through comprehensive testing services is of paramount importance for ensuring software quality and customer satisfaction. With the increasing complexity of software systems and the adoption of cloud-based services, testing techniques have become more intricate. companies must maintain an impartial focus on testing to meet customer expectations and adhere to the latest IT security guidelines.

Furthermore, as cloud infrastructure becomes more prevalent for Software as a Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS), testing these environments thoroughly is crucial to mitigate security risks. Testing providers should employ various testing methods and rigorously assess security features such as multi-factor authentication and data encryption to prevent potential breaches. By providing competent testing services, companies can instill confidence in their clients and contribute to the overall vision of delivering high-quality software systems. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

a1qa software testing co. - The company offers pure play software testing services such as cross browser compatibility testing, cross platform compatibility testing.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- a1qa software testing co.

- Acial

- Astegic Inc.

- Cigniti Technologies Ltd.

- Expleo Group SAS

- Fraunhofer Institute for Experimental Software Engineering IESE

- imbus AG

- Methods and Technology of Systems and Processes SL

- Nomura Research Institute

- QualiTest Group

- QualiTlabs LLC

- Quality Area Ltd.

- Real Time Technology Solutions Inc.

- ScienceSoft USA Corp.

- tapQA

- Tesnet Group

- TestingXperts

- Trigent Software Inc.

- ZenQ

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Pure-play software testing refers to specialized organizations that provide impartial focus on evaluating software products throughout the software development lifecycle. These expert testing partners bring competence, unique insights, and concentrated knowledge to ensure software quality and customer satisfaction. By providing a global vision, pure-play testing services enable continuous operations and productivity gains, reducing application downtime and time-to-market. Pure-play software testing services employ various testing techniques, including manual and automated testing, vulnerability scans, and user acceptance testing. They offer tailored expertise for industries such as healthcare and banking, providing guidance and skill in functional testing services, delegated assessment abilities, and suitability testing.

Furthermore, pure-play software testing companies leverage tools and processes to create a multi-platform staging area, process coordination engines, and human-to-human workflows for analysis capability and offline simulations. Their expertise and domain knowledge enable scheme interaction, high-quality results, and cutting-edge technologies like controlled crowd testing. In contrast to generalist organizations in the IT services industry, pure-play software testing providers focus solely on testing, providing cost savings, strategic testing partnerships, and a hybrid method that combines the best of manual and automated testing. Their scale and existing networks enable them to offer integrated testing services, making them indispensable partners for businesses seeking quality and stability in their computer-based products and internet applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.8% |

|

Market growth 2024-2028 |

USD 13.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.6 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 32% |

|

Key countries |

US, India, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

a1qa software testing co., Acial, Astegic Inc., Cigniti Technologies Ltd., Expleo Group SAS, Fraunhofer Institute for Experimental Software Engineering IESE, imbus AG, Methods and Technology of Systems and Processes SL, Nomura Research Institute, QualiTest Group, QualiTlabs LLC, Quality Area Ltd., Real Time Technology Solutions Inc., ScienceSoft USA Corp., tapQA, Tesnet Group, TestingXperts, Trigent Software Inc., and ZenQ |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch