Rail Logistics Market Size 2024-2028

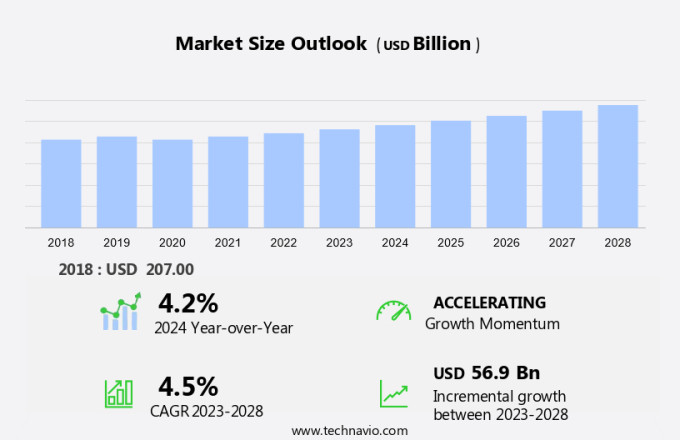

The rail logistics market size is forecast to increase by USD 56.9 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for efficient and eco-friendly goods carriage. The use of wheeled vehicles on fixed routes offers numerous advantages, including reduced fuel consumption and lower carbon emissions compared to truckload transport. Market trends include the increasing adoption of cloud technology for optimizing rail intermodal operations and enhancing safety. However, challenges persist, such as weather turbulences disrupting schedules and the risks associated with public-private partnerships (PPPs) in rail infrastructure development. Despite these challenges, the rail logistics sector continues to evolve, offering opportunities for stakeholders to innovate and improve the efficiency and sustainability of freight transportation.

Furthermore, the use of hybrid trains, which consume less energy than traditional trains, is another trend in the market. Additionally, cross-border freight transport is becoming easier and more cost-effective with the advancements in rail logistics. However, stakeholders must be aware of the risks associated with Public-Private Partnerships (PPPs) in rail logistics projects. Overall, the market is an essential component of the global logistics industry, providing a sustainable and efficient alternative to road transport.

What will be the Size of the Market During the Forecast Period?

Rail logistics plays a vital role in the transportation of goods, especially in the context of cross-border trade activities and trade contracts. This sector encompasses the use of wheeled vehicles on tracks to move cargo from one place to another, ensuring a secure and efficient transport system. Safety is a top priority in rail logistics, with weather turbulences and other unforeseen circumstances posing potential challenges. To mitigate these risks, rail logistics relies on fixed routes and schedules to minimize disruptions. Rail intermodal, a critical component of rail logistics, enables the seamless transfer of cargo between different modes of transport, such as trucks and trains.

Additionally, mining activities, in particular, benefit from rail logistics due to the large volumes of raw materials transported over long distances. Infrastructure development plays a pivotal role in the growth of the rail logistics market. Advanced technologies, such as IoT (Internet of Things), AI (Artificial Intelligence), and autonomous train development, are revolutionizing the industry, enabling real-time monitoring, predictive maintenance, and optimized scheduling. Autonomous train development is another area of focus in rail logistics, with the potential to revolutionize the industry by reducing human error and increasing operational efficiency. Mining activities, in particular, can greatly benefit from the use of autonomous trains due to their heavy cargo requirements and remote locations.

In addition, infrastructure development is crucial to the growth of the market. Governments and private organizations are investing in the expansion and modernization of transportation infrastructure to accommodate the increasing demand for secure and reliable transportation solutions. E-commerce and last-mile rail transportation are emerging areas of interest in rail logistics. As e-commerce continues to grow, the need for efficient and cost-effective last-mile transportation solutions becomes increasingly important. Rail logistics offers a viable alternative to traditional truckload transport, providing a more sustainable and cost-effective solution for the final leg of the delivery journey. In conclusion, rail logistics plays a crucial role in the transportation of goods, offering a secure, efficient, and sustainable alternative to traditional truckload transport. With the adoption of advanced technologies and infrastructure development, the market is poised for continued growth and innovation.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Intermodals

- Tank wagons

- Freight cars

- Geography

- Europe

- Germany

- UK

- APAC

- China

- India

- North America

- US

- Middle East and Africa

- South America

- Europe

By Type Insights

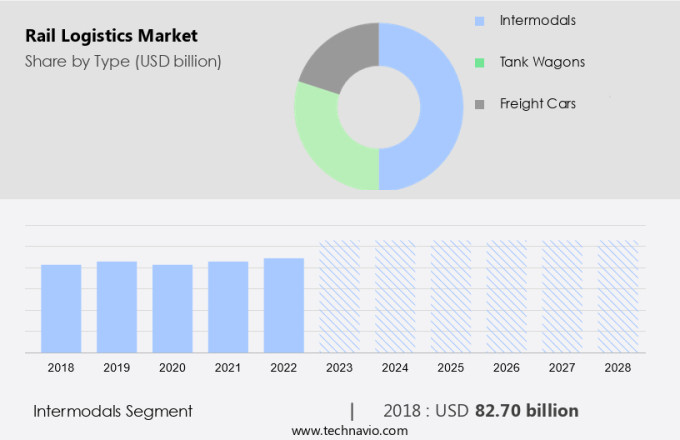

The intermodals segment is estimated to witness significant growth during the forecast period. Intermodal transportation, which involves the use of multiple freight modes to move goods from origin to destination, is gaining popularity among shippers due to its flexibility and efficiency. This mode of transport is particularly beneficial for those sending multiple less-than-truckload (LTL) shipments to the same location. The growth of intermodal transportation is driven by several factors, including the increasing adoption of containerization, the expansion of domestic intermodal networks, globalization, and the rise in international trade. Intermodal rail logistics is particularly popular among shippers sending multiple less-than-truckload (LTL) consignments to the same location. The flexibility of this transportation mode makes it an attractive choice for shipping bulky and semi-bulky commodities, such as fertilizers and building materials.

Furthermore, intermodal transportation offers environmental benefits by reducing harmful emissions and energy consumption compared to traditional trucking. Railway infrastructure plays a crucial role in intermodal transportation, as it provides a secure and reliable transport system for intermodal containers. To ensure the security of the cargo, on-board cameras and other security measures are often employed. Additionally, the use of hybrid trains, which combine electric and diesel power, further reduces energy consumption and harmful emissions. Intermodal transportation also offers safety benefits, as it reduces the number of road traffic injuries associated with traditional trucking. As cross-border freight transport continues to grow, intermodal transportation is expected to play an increasingly important role in the logistics market.

Get a glance at the market share of various segments Request Free Sample

The intermodals segment accounted for USD 82.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the European market, passenger transportation dominates the railway network, with investments continuing in response to increasing environmental concerns and the need for sustainable transportation. France, Germany, and the UK led European railway spending in 2020, accounting for approximately 75% of the European Union's railway industry expenditures. Rail freight transportation accounts for approximately 20% of the total freight transportation in Europe, with Germany, Poland, and the UK being the major contributors. Advanced technologies, such as IoT, AI, and intermodal rail networks, are transforming the European rail logistics sector. E-commerce growth and the need for last-mile rail transportation are also driving innovation in the market.

Moreover, temperature-controlled transportation and hazardous material handling are other areas of focus for rail logistics providers. Infrastructure development remains a critical factor in the market's growth, with governments and private entities investing in modernizing and expanding rail networks. The US market is also experiencing significant growth, driven by similar factors. The increasing focus on sustainable transportation and infrastructure development, as well as the adoption of advanced technologies such as IoT, AI, and intermodal rail networks, are key trends shaping the market. E-commerce growth and the need for efficient last-mile transportation solutions are also driving demand for rail logistics services. Furthermore, the sector accounts for a significant portion of the country's freight transportation, with major contributors including the United States, Canada, and Mexico.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased demand for rail logistics due to rising trade is the key driver of the market. Rail logistics plays a significant role in global trade, offering advantages over road and air transportation. Rail freight is more fuel-efficient than road transport, with fuel efficiency ranging from 150 to 520 ton-miles per gallon, compared to 70 to 140 ton-miles per gallon for road freight. This efficiency contributes to reduced greenhouse gas emissions and lower operational costs for businesses. Intermodal transportation, which combines multiple modes of transport, is gaining popularity due to its flexibility and cost-effectiveness. Rail transportation is essential for various industries, including manufacturing, agriculture, and online retail. This not only benefits businesses by reducing operational costs but also contributes to the economy by reducing traffic congestion and promoting e-commerce.

In addition, IT and telecommunications also play a vital role in optimizing rail operations, enabling real-time tracking and monitoring of freight. The economic benefits of rail transportation extend beyond individual companies. Rail logistics facilitates the delivery of goods and services to customers, contributing to the growth of industries and economies. The United States, in particular, can leverage its extensive rail network to improve trade efficiency, reduce traffic congestion on highways, and enhance its global competitiveness.

Market Trends

Increasing use of cloud technology in rail logistics is the upcoming trend in the market. Rail logistics is an essential aspect of transporting goods using wheeled vehicles on tracks with fixed routes and schedules. Cloud computing plays a significant role in enhancing rail logistics by providing fuel-efficient, real-time services through the Internet. ICT, including logistics and warehouse management, can transmit data effortlessly, ensuring optimal rail intermodal operations.

Furthermore, the integration of intelligent systems with material handling equipment will witness substantial growth in the coming years. Effective Supply Chain Management is crucial for the seamless functioning of rail logistics operations. However, it's crucial to prioritize safety measures, such as implementing strong cybersecurity systems, to mitigate potential weather turbulences and cyberattacks when availing cloud services. By doing so, rail logistics providers can offer reliable, fuel-efficient, and on-demand services to meet the evolving needs of the truckload transport industry.

Market Challenge

Stakeholders risk in PPPs is a key challenge affecting the market growth. Partnerships between public and private sectors (PPPs) offer optimal solutions for executing rail logistics projects with financing components. In the context of the US market, PPPs in railways present several advantages. The availability of a proficient workforce in the private sector ensures project execution efficiency. Furthermore, private sector management of construction or operation typically surpasses that of the railway sector. PPPs also provide incentives for service enhancement and market development. Before extending financing, potential investors meticulously evaluate potential risks. Two primary concerns include the railway sector's governance and the railway company's corporate governance. By addressing these risks, PPPs facilitate successful rail logistics projects in sectors such as Mining and Metals, Energy, and Chemicals.

Furthermore, effective long-distance and short-distance transportation, as well as supply chain management, are crucial components of these projects. Conventional rail, high-speed rail, light rail, and metro rail systems can all benefit from PPPs. By fostering collaboration between the public and private sectors, PPPs contribute to the growth and development of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Brookfield Business Partners LP - The company offers solutions for rail logistics with 135,000 communication towers that form the infrastructure backbone and are strategically located for pan-India 4G coverage.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BLR Logistiks I Ltd.

- Canadian National Railway Co.

- DB Cargo AG

- Deutsche Bahn AG

- FedEx Corp.

- Gebruder Weiss

- GeoMetrix Rail Logistics Inc.

- INTERPORT GLOBAL LOGISTICS Pvt. Ltd.

- Japan Freight Railway Co.

- JSC RUSSIAN RAILWAYS LOGISTICS

- Kuehne Nagel Management AG

- Nippon Express Holdings Inc.

- Rail Cargo Group

- RSI Logistics Inc.

- SBB Cargo International AG

- Tschudi Group

- Union Pacific Corp.

- United Parcel Service Inc.

- VTG Aktiengesellschaft

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the transportation of goods via wheeled vehicles on fixed routes and schedules. This mode of freight transportation is gaining popularity due to its fuel-efficiency, ability to bypass highway congestion, and reduction of harmful emissions. Rail intermodal, a type of rail freight that uses intermodal containers, is a significant contributor to this market. Safety is a top priority in rail logistics, with advanced technologies such as on-board cameras and autonomous train development being employed to ensure secure transport systems. Weather turbulences and infrastructure development are key challenges in the market. Intermodal transportation, which involves the transfer of freight between different modes of transport, is a growing trend in the market.

Furthermore, this includes the use of cross-border railway for trade activities and transport contracts. The transportation infrastructure, including railway infrastructure, terminals and depots, IT and telecommunications, and track and signaling, plays a crucial role in the efficient operation of rail logistics. Manufacturing, agriculture, mining and metals, energy, chemicals, and e-commerce are some of the major industries that rely on rail logistics for long-distance and short-distance transportation. Temperature-controlled transportation, hazardous material handling, last-mile rail transportation, and sustainable transportation are emerging areas in the market. Advanced technologies such as IoT, artificial intelligence, and hybrid trains are being adopted to enhance the efficiency and productivity of rail logistics. The market is expected to grow significantly in the coming years due to the increasing demand for secure and sustainable transportation solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 56.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BLR Logistiks I Ltd., Brookfield Business Partners LP, Canadian National Railway Co., DB Cargo AG, Deutsche Bahn AG, FedEx Corp., Gebruder Weiss, GeoMetrix Rail Logistics Inc., INTERPORT GLOBAL LOGISTICS Pvt. Ltd., Japan Freight Railway Co., JSC RUSSIAN RAILWAYS LOGISTICS, Kuehne Nagel Management AG, Nippon Express Holdings Inc., Rail Cargo Group, RSI Logistics Inc., SBB Cargo International AG, Tschudi Group, Union Pacific Corp., United Parcel Service Inc., and VTG Aktiengesellschaft |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch