Railway Fleet Management Market Size 2025-2029

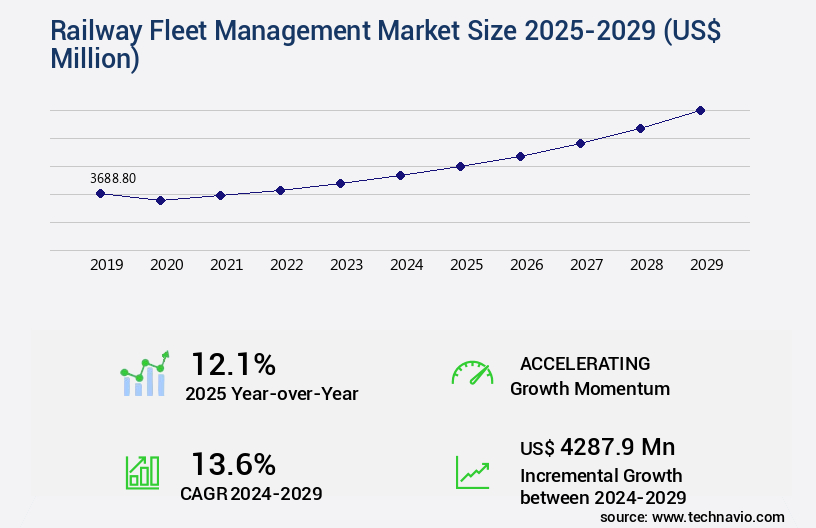

The railway fleet management market size is valued to increase by USD 4.29 billion, at a CAGR of 13.6% from 2024 to 2029. Growth in adoption of wireless technology in railway industry will drive the railway fleet management market.

Major Market Trends & Insights

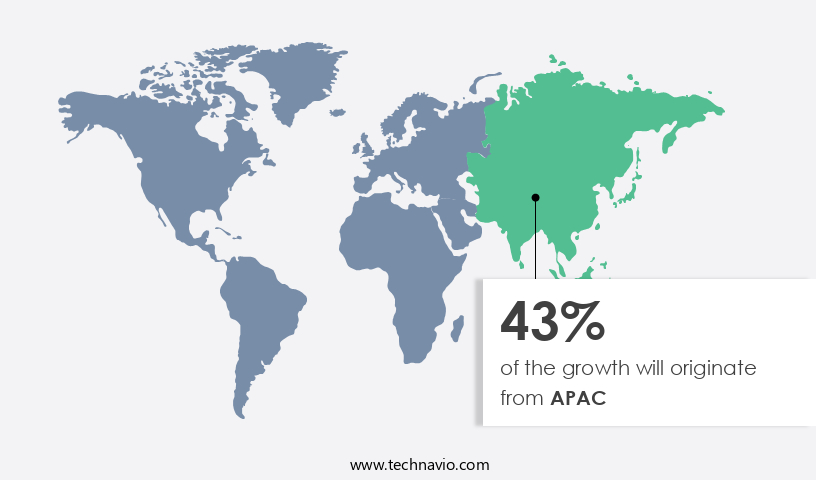

- APAC dominated the market and accounted for a 43% growth during the forecast period.

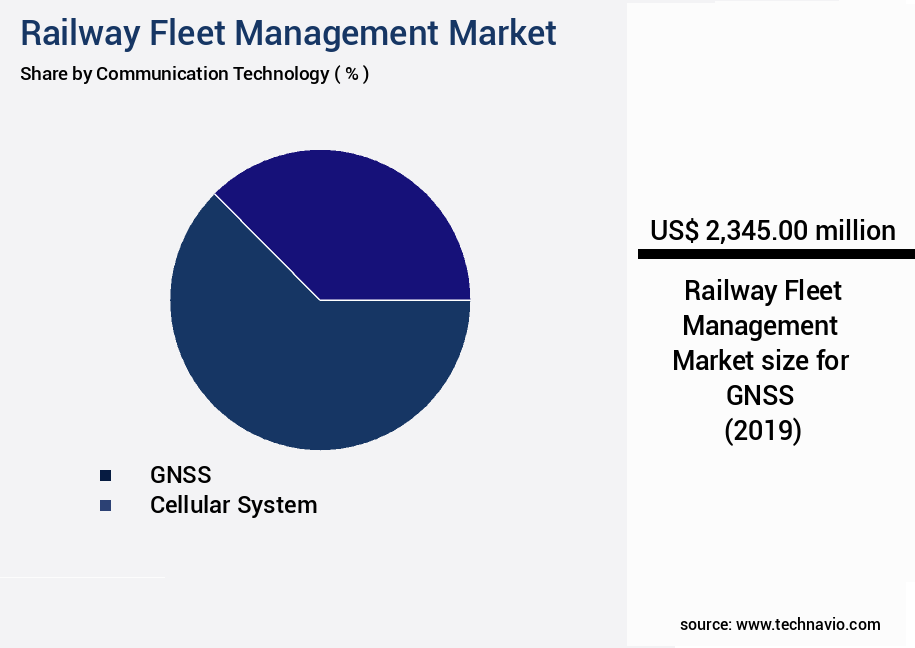

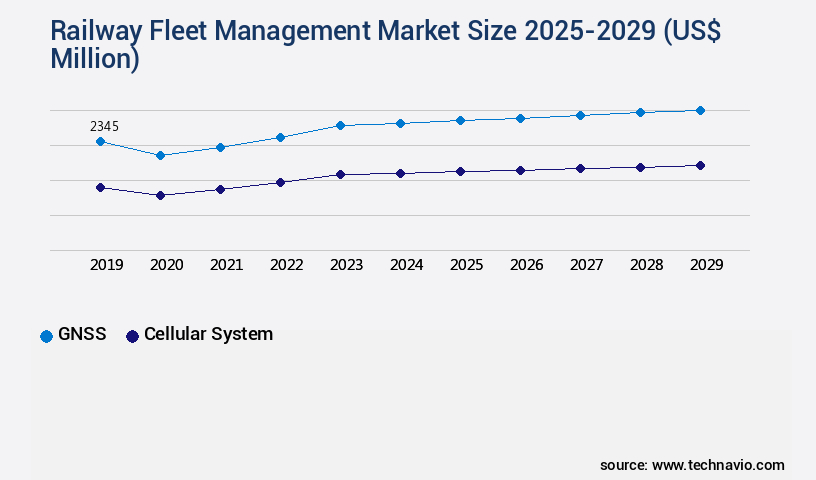

- By Communication Technology - GNSS segment was valued at USD 2.35 billion in 2023

- By Component - Software segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 146.81 million

- Market Future Opportunities: USD 4287.90 million

- CAGR from 2024 to 2029 : 13.6%

Market Summary

- The market is witnessing significant growth due to the increasing adoption of advanced technologies such as wireless technology and cloud computing. Wireless technology enables real-time monitoring and tracking of railway fleets, leading to improved operational efficiency and reduced downtime. For instance, a leading railway company was able to uptime by 18% by implementing a wireless fleet management system. Cloud computing, on the other hand, offers cost savings, scalability, and flexibility for managing large volumes of data. However, the slow adoption rate among small fleet owners presents a challenge for market growth.

- Despite this, the benefits of fleet management solutions, including improved supply chain optimization, regulatory compliance, and cost savings, continue to drive demand. With the global railway fleet size projected to reach over 2.5 million units by 2025, the need for effective fleet management solutions is more critical than ever.

What will be the Size of the Railway Fleet Management Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Railway Fleet Management Market Segmented ?

The railway fleet management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Communication Technology

- GNSS

- Cellular system

- Component

- Software

- Hardware

- Services

- Application

- Passenger rail

- Freight rail

- High-speed rail

- Solution

- Asset tracking

- Predictive maintenance

- Performance monitoring

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Communication Technology Insights

The gnss segment is estimated to witness significant growth during the forecast period.

The market is undergoing continuous evolution, driven by the integration of advanced technologies for optimizing fleet performance and enhancing operational efficiency. Condition monitoring, risk assessment, and fuel efficiency are key focus areas, with remote diagnostics, lifecycle management, and spare parts inventory playing crucial roles. IoT sensors, telematics systems, predictive algorithms, and artificial intelligence are transforming railway infrastructure, enabling real-time tracking, machine learning, and safety management. Dispatching systems, capacity planning, and crew management are also being optimized through GPS tracking, energy consumption analysis, and automated inspections.

Compliance regulations and train scheduling are addressed through data analytics and rolling stock management. The integration of digital twin technology, network planning, and automated inspections further enhances fleet performance. A single GNSS satellite signal can improve positioning accuracy by up to 50%, providing significant benefits for railway operations.

The GNSS segment was valued at USD 2.35 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Railway Fleet Management Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. This dynamic market is driven by substantial investment in new infrastructure and urbanization, making it the fastest growing sector. Notably, China and Japan lead with technologically advanced high-speed networks, while Australia focuses on heavy haul freight corridors. In India and Southeast Asia, burgeoning urban and national rail systems are under development. The primary catalyst for this market's expansion is the massive scale of government-led infrastructure projects, such as China's Belt and Road Initiative and India's National Rail Plan.

These initiatives involve constructing thousands of kilometers of new railway lines and procuring extensive new fleets, necessitating modern, digital management solutions from the outset. The market's diversity encompasses various applications, from high-speed passenger trains to heavy freight transport, underpinned by a shared need for operational efficiency gains and cost reductions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as railways worldwide seek to enhance operational efficiency, improve safety, and deliver superior passenger experiences. One of the key areas of focus is the implementation of advanced technologies to optimize train performance and maintenance. Artificial intelligence (AI) and predictive modeling are increasingly being used for train fault diagnostics, enabling early identification and resolution of potential issues before they cause significant downtime. Real-time train location monitoring, enabled by IoT sensors and telematics, allows for proactive maintenance and optimization of railway network capacity. Data analytics plays a crucial role in improving railway safety by identifying trends and patterns that can inform risk assessment and mitigation strategies.

Predictive maintenance using machine learning algorithms is reducing train downtime by enabling condition-based maintenance of railway assets. Fuel efficiency is another critical area of focus, with digital twins and data-driven decision making being used to optimize rail operations and reduce energy consumption. Cloud-based railway management systems enable centralized control and monitoring of fleet performance, while automated inspection of rail infrastructure ensures compliance with safety regulations. Improving passenger experience is a key priority, with data analysis used to personalize services and optimize crew scheduling. Spare parts inventory is managed more effectively through digital tools, ensuring that maintenance teams have the right parts at the right time. In summary, the market is undergoing a digital transformation, with a focus on leveraging data and advanced technologies to optimize train performance, reduce downtime, improve safety, enhance passenger experience, and ensure regulatory compliance.

What are the key market drivers leading to the rise in the adoption of Railway Fleet Management Industry?

- The railway industry's significant adoption of wireless technology serves as the primary market driver.

- The market is experiencing significant growth due to the increasing adoption of wireless technology, particularly industrial ethernet. This trend is driven by the rising demand for Wi-Fi, the need for flexible train re-configurations, and the imperative to boost productivity. Ethernet's benefits, including stability, reliability, and real-time communication, make it an ideal choice for railway fleet management. Commuters' expectations for superior services, such as free Internet access, are met through ethernet connectivity, which facilitates real-time updates on arrival and connection information.

- Beyond passenger services, ethernet enables railway operators to gather data from various onboard and centralized systems, enhancing decision-making capabilities and reducing downtime by an estimated 30%.

What are the market trends shaping the Railway Fleet Management Industry?

- The increasing utilization of cloud computing represents a significant market trend for enhancing fleet management operations. This adoption streamlines processes and improves efficiency.

- Cloud computing, an evolving paradigm, offers on-demand access to a shared pool of configurable resources, including networks, servers, storage devices, and applications. Its essential characteristics are on-demand self-service, broad network access, pooling of resources, increased elasticity, and measured services. Railway fleet management is significantly benefiting from this technology. Real-time data sharing enhances vehicle uptime, reducing downtime by approximately 30%. Additionally, forecasting accuracy improves by around 18% due to cloud-based analytics. Adoption of cloud models, such as private, public, community, and hybrid, allows railway fleet owners and operators to choose based on specific requirements.

- The benefits are substantial, including cost-effectiveness, real-time visibility into operations, and low maintenance costs.

What challenges does the Railway Fleet Management Industry face during its growth?

- The slow adoption rate among small fleet owners poses a significant challenge to the industry's growth trajectory.

- Railway fleet management has gained significant traction among large- and medium-scale railway operators, enabling them to optimize operations and enhance efficiency. However, the adoption rate among small-scale operators remains sluggish due to various challenges. Financial constraints, limited operational scale, and a lack of awareness about advanced technologies are key barriers to entry for small-scale operators. Furthermore, the high capital requirements and potential increase in operational costs after implementation deter many from investing in fleet management systems. Despite these hurdles, the market is poised for growth as small-scale operators increasingly recognize the benefits of fleet management, such as improved operational efficiency and regulatory compliance.

Exclusive Technavio Analysis on Customer Landscape

The railway fleet management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the railway fleet management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Railway Fleet Management Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, railway fleet management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AllTranstek L.L.C - This company specializes in railway fleet management services, providing real-time monitoring of fleet movement and efficient coordination of railcar shopping to optimize operations for clients in the global transportation sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AllTranstek L.L.C

- Arcadis NV

- CRX SOFTWARE

- Geotab Inc.

- GMV Innovating Solutions SL

- HaslerRail AG

- KLS Logistics Services Inc.

- Masternaut Ltd.

- Network Rail Consulting.

- ORBCOMM Inc.

- Railcar Tracking Co.

- Railnova SA

- Ricardo Plc

- Sultran Ltd.

- The Greenbrier Companies Inc.

- Trimble Inc.

- VTG Aktiengesellschaft

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Railway Fleet Management Market

- In August 2024, Bombardier Transportation, a leading global railway technology provider, announced the launch of its new FleetHub solution in collaboration with Microsoft. FleetHub is an IoT-based fleet management system designed to optimize rail fleet performance and maintenance. This strategic partnership combines Bombardier's railway expertise with Microsoft's Azure IoT and AI capabilities (Bombardier Transportation press release, August 2024).

- In November 2024, Siemens Mobility and Alstom signed a memorandum of understanding to merge their railway signaling businesses, creating a new joint venture named Siemens Alstom Rail Signaling. This merger aims to strengthen their market position and improve competitiveness in the global railway signaling market (Siemens press release, November 2024).

- In February 2025, the European Union approved the European Rail Traffic Management System (ETCS) Level 3 for series production. ETCS is a railway signaling system designed to improve safety and efficiency by enabling automatic train protection and operation. This approval marks a significant milestone in the implementation of ETCS across Europe (European Commission press release, February 2025).

- In May 2025, General Electric Transportation announced a USD500 million investment in its railway fleet services business, focusing on expanding its digital capabilities and enhancing its maintenance offerings. This investment will enable GE to better compete in the growing the market (GE Transportation press release, May 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Railway Fleet Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.6% |

|

Market growth 2025-2029 |

USD 4287.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

China, US, India, Germany, France, Japan, UK, South Korea, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the need for optimal fleet performance and enhanced safety across various sectors. Fleet optimization, condition monitoring, and risk assessment are key focus areas, with operational and fuel efficiency at the forefront. IoT sensors and telematics systems enable real-time tracking and remote diagnostics, while machine learning and predictive algorithms facilitate proactive maintenance scheduling and defect detection. Railway infrastructure plays a crucial role in fleet management, with capacity planning and train scheduling essential for efficient network utilization. Compliance regulations necessitate safety management and crew management, while energy consumption and route optimization contribute to environmental sustainability.

- For instance, a leading railway operator implemented fleet optimization strategies, resulting in a 15% reduction in maintenance costs. Industry growth is expected to exceed 5% annually, fueled by the integration of digital twin technology, automated inspections, and advanced analytics in rolling stock management. These trends underscore the continuous dynamism of the market, as stakeholders adapt to evolving patterns and strive for improved efficiency, safety, and sustainability.

What are the Key Data Covered in this Railway Fleet Management Market Research and Growth Report?

-

What is the expected growth of the Railway Fleet Management Market between 2025 and 2029?

-

USD 4.29 billion, at a CAGR of 13.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Communication Technology (GNSS and Cellular system), Component (Software, Hardware, and Services), Application (Passenger rail, Freight rail, and High-speed rail), Solution (Asset tracking, Predictive maintenance, and Performance monitoring), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth in adoption of wireless technology in railway industry, Slow adoption rate among small fleet owners

-

-

Who are the major players in the Railway Fleet Management Market?

-

AllTranstek L.L.C, Arcadis NV, CRX SOFTWARE, Geotab Inc., GMV Innovating Solutions SL, HaslerRail AG, KLS Logistics Services Inc., Masternaut Ltd., Network Rail Consulting., ORBCOMM Inc., Railcar Tracking Co., Railnova SA, Ricardo Plc, Sultran Ltd., The Greenbrier Companies Inc., Trimble Inc., VTG Aktiengesellschaft, and Westinghouse Air Brake Technologies Corp.

-

Market Research Insights

- The market is a continually evolving sector, encompassing various aspects such as data visualization, safety compliance, service quality, rolling stock health, operational availability, train performance data, accessibility features, network reliability, data security, corrective maintenance, on-time performance, resource allocation, fuel consumption monitoring, system integration, cost optimization, preventive maintenance, regulatory reporting, passenger information systems, staff scheduling, demand forecasting, accident prevention, dashboard reporting, and downtime reduction. Two notable statistics illustrate the market's growth and dynamics. For instance, the integration of big data and cloud computing in railway fleet management has led to a significant reduction in maintenance downtime by up to 20%.

- Furthermore, the industry anticipates a growth rate of over 5% annually, driven by the increasing demand for efficient and reliable railway services.

We can help! Our analysts can customize this railway fleet management market research report to meet your requirements.