Railway Wiring Harness Market Size 2024-2028

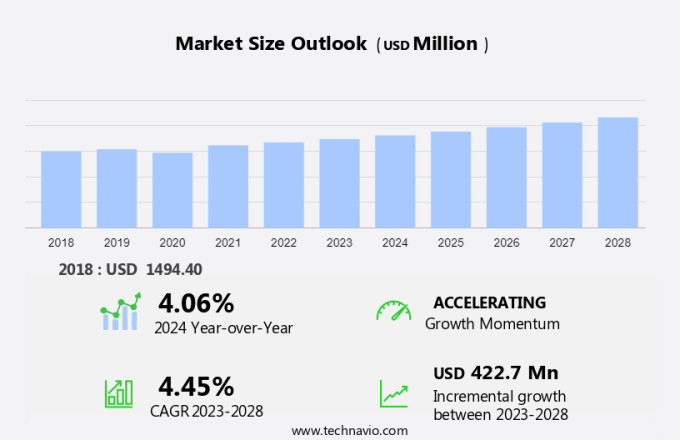

The railway wiring harness market size is forecast to increase by USD 422.7 million at a CAGR of 4.45% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for efficient and reliable transportation systems. The integration of advanced technologies such as Communications-Based Train Control and European Train Control System in railway systems is driving market growth.

However, the high cost of installation of railway wiring harnesses remains a major challenge for market growth. To mitigate this challenge, manufacturers are focusing on developing cost-effective solutions using lightweight materials and modular designs. Additionally, the increasing electrification of railways and the growing trend towards automation and digitization in railway systems are providing new opportunities for market growth. Overall, the market is expected to witness steady growth in the coming years due to these factors.

What will the Size of the Railway Wiring Harness Market be during the Forecast Period?

Wiring harnesses play a crucial role in the railway infrastructure by ensuring the seamless transmission of electric power to various electrical and mechanical systems in trains and railway networks. The rapid advancements in technology have led to increased electrification in the railway sector, making wiring harnesses an essential component for electric trains and even some diesel locomotives. The effectiveness, reliability, and energy efficiency of railway systems are significant factors driving the growth of the wiring harness market. The railway network's electrical systems and mechanical systems require intricate wiring arrangements to ensure smooth operation, particularly in heavy-haul sectors and long-distance journeys.

Further, signaling telecommunication systems, automatic signaling, light rail, metros, tube rail projects, and Deutsche bahn are some of the areas where wiring harnesses are extensively used. The railway budget, travel time, road traffic, and road congestion in urban areas have led to increased investment in railway infrastructure, further boosting the demand for wiring harnesses. The wiring harness market is particularly active in the Gulf countries due to their extensive railway networks and focus on energy efficiency. The transportation sector's growing emphasis on sustainability and reducing travel time has also contributed to the market's growth. The track length of railway networks continues to expand, necessitating the installation of extensive wiring systems to support the growing demand for railway transportation.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- HVAC

- Lighting

- Engine

- Brake

- Others

- Type

- High speed/bullet train

- Light train

- Metro/monorail

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

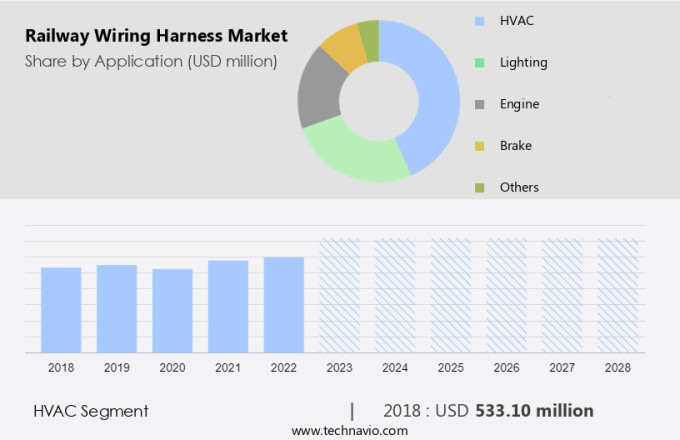

The HVAC segment is estimated to witness significant growth during the forecast period. In the railways sector, railway wiring harnesses play a vital role in ensuring the efficient operation of various railway systems, including infotainment harnesses for passenger comfort and automatic signaling for train control. Railways in urban areas, such as metros, tube rail projects, and light rail, face unique challenges due to high temperatures and corrosion from environmental changes. Railways in Gulf countries, where temperatures can exceed 50 degrees Celsius, require strong electrical wiring systems to withstand extreme weather conditions. Infotainment harnesses provide data transmission for passenger information systems, while automatic signaling and train control systems rely on reliable electrical connections.

Rail networks in rail and transit systems face challenges from road traffic and congestion, leading to increased travel time. To address these issues, rail manufacturers are investing in automated rail systems, including driverless trains and safety systems like positive train control. However, high temperatures and weather conditions, such as water leakages and corrosion of wires and terminals, pose significant challenges to railway wiring harnesses. Environmental changes, sensor system faults, and system safety are critical concerns for railway infrastructure. Deutsche Bahn and other rail networks are addressing these challenges by implementing advanced railway wiring harnesses that can withstand harsh weather conditions and ensure reliable data transmission. Lanner rail computers and other advanced technologies are being integrated into railway wiring harnesses to improve train performance and passenger comfort.

Get a glance at the market share of various segments Request Free Sample

The HVAC segment accounted for USD 533.10 million in 2018 and showed a gradual increase during the forecast period.

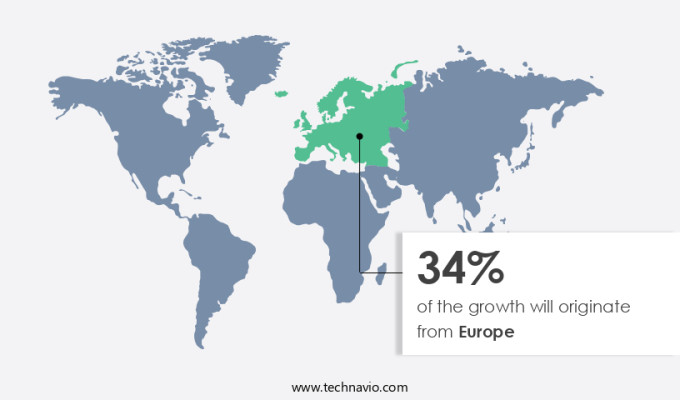

Regional Insights

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the increasing demand for automation and infotainment systems in the railways sector. High temperatures and environmental changes pose challenges to the railway wiring harnesses, necessitating the use of advanced materials and technologies. Infotainment harnesses are becoming essential for rail and transit systems in urban areas to reduce travel time and mitigate road traffic congestion. Automatic signaling systems, including light rail and tube rail projects, require strong electrical wiring systems for data transmission and train control. Rail networks in Gulf countries are investing heavily in automated rail systems, including metros and tube trains, to cater to the growing demand for public transportation.

Furthermore, corrosion of wires and terminals due to weather conditions and water leakages is a major concern for railway budgets. Safety systems, such as positive train control, rely on sensor technology and depend on reliable wiring harnesses for proper functioning. Rail manufacturers are focusing on developing advanced railway wiring harnesses that can withstand harsh weather conditions and prevent system faults. Lanner, Deutsche Bahn, and other rail network operators are integrating rail computers and advanced technologies to improve train control and ensure efficient energy usage.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Railway Wiring Harness Market Driver

The growing demand for efficient and reliable transportation systems is the key driver of the market. The market is experiencing significant growth due to the increasing demand for efficient and dependable transportation systems in the rail industry. Urbanization and population expansion are key drivers of this demand, as urban areas require effective transportation solutions to link various parts of the city. Railways are a preferred choice for sustainable and efficient public transport, reducing traffic congestion and offering real-time information on travel speed, arrival time, and transfer information. To ensure seamless operation, reliable wire harness systems are essential. These systems consist of electrical cables and wiring harnesses that facilitate signal transmission between electrical devices, locomotive engines, and communication systems.

The rail industry demands wire harnesses capable of withstanding harsh conditions, including shock transfer, vibration, and exposure to sharp and rough edges. Key features of these systems include auditability, scalability, and real-time monitoring for optimal railway project management. The economic growth and expansion of rail infrastructure and rail connectivity contribute to the increasing ridership, leading to fluctuating prices for electrical wiring and high loads. Durability and malfunction prevention are crucial to minimize delays and ensure the smooth transmission of power and data through transmission cables and jumper cables. Plastic electrical wiring is a popular choice due to its flexibility, resistance to vibration, and insulation properties.

Railway Wiring Harness Market Trends

The integration of advanced technologies in railway systems is the upcoming trend in the market. The railway industry's integration of advanced technologies, including the Internet of Things and artificial intelligence has significantly transformed the global market. This technological advancement has led to improved railway system efficiency, safety, and overall performance. Real-time information, such as travel speed and arrival time, is now readily available to passengers through organized communication systems. The rail industry's urban rail systems benefit from signal transmission through electrical cables, ensuring the smooth operation of electrical devices and locomotive engines. Railway projects, economic growth, and public transport's increasing importance have led to the development of railway infrastructure and rail connectivity.

The market caters to the demand for high-performance electrical wiring, capable of withstanding high loads and offering durability against shock transfer, vibration, and the rough edges often encountered in trains. Real-time monitoring and auditability are essential for maintaining the reliability and scalability of railway systems. The use of AI and IoT in railway systems enables predictive maintenance, allowing operators to address potential malfunctions before they cause delays or transmission cable failures. This proactive approach ensures a seamless passenger experience while minimizing economic losses.

Railway Wiring Harness Market Challenge

The high cost of installation of railway wiring harness is a key challenge affecting the market growth. In the rail industry, the implementation of wire harnesses for urban rail and high-speed trains is essential for real-time information transfer and efficient operation. These organized systems of electrical cables ensure signal transmission between various electrical devices, including locomotive engines and communication systems. However, the installation and maintenance of wire harnesses come with significant challenges due to their high costs. Factors contributing to these expenses include the complex installation process, which necessitates skilled labor, specialized equipment, and safety measures to handle heavy machinery, tools, and rough or sharp edges. Additionally, the durability of wire harnesses is crucial to withstand shock transfer and vibration during train operation.

Economic growth and increasing ridership in the rail sector necessitate scalability and auditability in railway projects. Fluctuating prices for materials like plastic electrical wiring and high loads also impact the cost. Malfunctions and delays due to transmission cable or jumper cable issues can result in significant economic losses. Therefore, it is imperative to invest in high-quality wire harnesses that offer durability and reliability, minimizing the risk of malfunctions and ensuring on-time arrival and travel speed for passengers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Apar Industries Ltd.: The company offers a railway wiring harness which is used for railway coaches covered with fire retardant accessories.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALLIED ELECTRONICS CORP.

- AQ Group AB

- ECI Inc.

- Furukawa Electric Co. Ltd.

- HELUKABEL Romania Srl

- Hitachi Ltd.

- HUBER SUHNER AG

- International Business Machines Corp.

- KEI Industries Ltd.

- Komax Holding AG

- Leoni AG

- LS Corp.

- NAC Corp. Ltd.

- NKT AS

- Prysmian Spa

- Rockford Components Ltd.

- Samvardhana Motherson International Ltd.

- Siechem Technologies Pvt. Ltd.

- TE Connectivity Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wiring harnesses play a crucial role in the railway infrastructure by transmitting electric power to various components of the railway network. With the rapid advancements in technology, the railway sector is witnessing the electrification of trains, replacing diesel locomotives with electric trains. The transportation sector, including mining and heavy-haul sectors, is increasingly relying on railway systems for long-distance journeys, especially in urban centers where traffic congestion is a major issue. Railway wiring harnesses are essential for the effective and reliable functioning of both electrical and mechanical systems. These harnesses are used in various segments, including power supplies, rail signals, and vehicles, such as braking systems, immobilizers, and high-speed trains.

Further, energy efficiency is a significant consideration in the railway sector, and wiring harnesses contribute to this by minimizing power loss and ensuring optimal performance. The terminal segment also benefits from wiring harnesses, which facilitate the smooth transfer of power and data between trains and the terminal. Humidity and other environmental factors pose challenges to the reliability of wiring harnesses in the railway sector. To address these challenges, the use of advanced technologies like artificial intelligence and machine learning is gaining popularity in the development of railway wiring harnesses. Despite the initial high entry barrier, the benefits of wiring harnesses in terms of passenger safety, urban transportation, and budget allocation make them a worthwhile investment for the railway fleet.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.45% |

|

Market growth 2024-2028 |

USD 422.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.06 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALLIED ELECTRONICS CORP., Apar Industries Ltd., AQ Group AB, ECI Inc., Furukawa Electric Co. Ltd., HELUKABEL Romania Srl, Hitachi Ltd., HUBER SUHNER AG, International Business Machines Corp., KEI Industries Ltd., Komax Holding AG, Leoni AG, LS Corp., NAC Corp. Ltd., NKT AS, Prysmian Spa, Rockford Components Ltd., Samvardhana Motherson International Ltd., Siechem Technologies Pvt. Ltd., and TE Connectivity Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch