Rapid Plasma Reagin Test Market Size 2024-2028

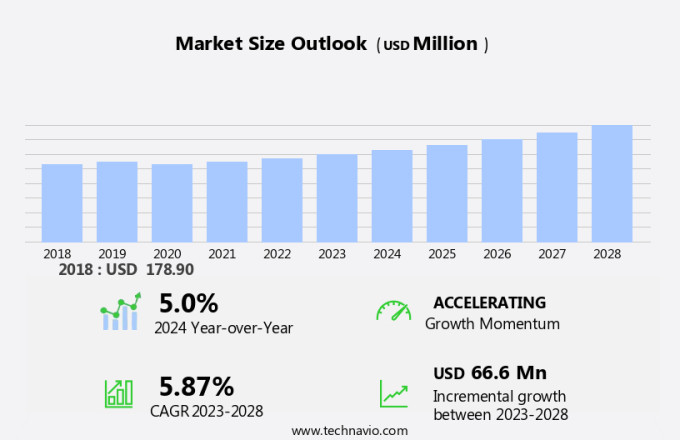

The rapid plasma reagin test market size is forecast to increase by USD 66.6 million, at a CAGR of 5.87% between 2023 and 2028. The market is experiencing significant growth due to the rising incidence of syphilis and the implementation of automated RPR systems in laboratories. These systems enhance productivity, reduce labor overhead, and ensure consistent testing results, thereby improving the overall quality of syphilis diagnosis. Automation also helps in minimizing human error and increasing the efficiency of laboratory operations. The implementation of automated RPR systems is a key trend in the market, as it enables laboratories to handle a larger volume of tests while maintaining accuracy and precision. Ensuring quality control for syphilis testing is crucial to prevent false positive or negative results, which can lead to misdiagnosis and incorrect treatment. The use of automated RPR systems plays a vital role in maintaining the highest standards of quality and consistency in syphilis testing.

Market Analysis

The Rapid Plasma Reagin (RPR) test market is witnessing significant growth due to the increasing demand for accurate and efficient diagnostic solutions. RPR testing is a crucial aspect of syphilis diagnosis, particularly in high-risk populations such as pregnant women and individuals with Lyme disease, pneumonia, or other conditions that may require this test. RPR testing involves the detection of proteins in the blood, specifically, the cardiolipin antibodies, which are indicative of a syphilis infection. The use of RPR testing kits and automated RPR systems in laboratories and specialty clinics has revolutionized the diagnostic process, offering numerous benefits.

Moreover, one of the primary advantages of RPR testing is its ability to enhance productivity and efficiency. Automated RPR systems have streamlined the testing process, reducing the need for extensive labor overhead and minimizing the potential for human error. These systems can process multiple samples simultaneously, providing quick and accurate results. Moreover, the implementation of RPR testing in various healthcare settings, including hospitals and diagnostics laboratories, has led to improved diagnostic quality and consistency. RPR testing plays a critical role in the early detection and treatment of syphilis, which is essential for preventing complications, such as neurological damage and cardiovascular issues.

Further, cerebrospinal fluid (CSF) RPR testing is another area of growth in the RPR testing market. This type of testing is crucial for diagnosing neurosyphilis, a severe form of the disease that can cause neurological damage. The ability to quickly and accurately diagnose neurosyphilis using RPR testing can significantly improve patient outcomes and reduce the need for invasive and costly diagnostic procedures. In conclusion, the RPR testing market is experiencing steady growth due to its importance in the diagnosis of syphilis and other conditions. The use of RPR testing kits and automated RPR systems in laboratories and specialty clinics has led to increased productivity, improved diagnostic quality, and enhanced patient outcomes. The continued advancements in RPR testing technology will further strengthen its position in the diagnostic landscape, ensuring accurate and efficient detection of syphilis and related conditions.

Market Segmentation

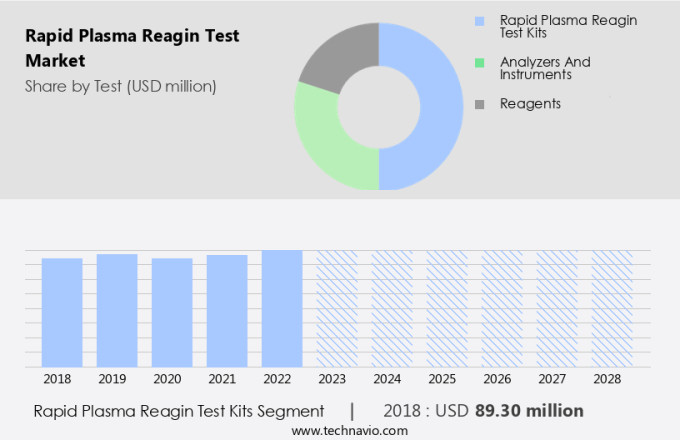

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Test

- Rapid plasma reagin test kits

- Analyzers and instruments

- Reagents

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Test Insights

The rapid plasma reagin test kits segment is estimated to witness significant growth during the forecast period. The RPR test market's RPR test kits segment holds a substantial share in the global market and is projected to maintain this trend during the forecast period. RPR test kits are utilized in diagnostic laboratories and hospitals for detecting reagin antibodies in human serum via a slide test method. Reagins are a type of antibodies produced by the human body in response to the stimulation of an infection, specifically syphilis. The causative agent of syphilis, Treponema pallidum, induces damage to the liver and heart, leading to the release of tissue fragments that trigger the production of these antibodies. With the increasing prevalence of syphilis and the availability of these kits, the demand for RPR tests is anticipated to grow. RPR tests are essential for diagnosing various conditions, including Lyme disease, pneumonia, and malaria, as they can detect a range of reagin antibodies. These tests play a crucial role in the early detection and treatment of these diseases, improving patient outcomes and reducing healthcare costs.

Get a glance at the market share of various segments Request Free Sample

The rapid plasma reagin test kits segment accounted for USD 89.30 million in 2018 and showed a gradual increase during the forecast period.

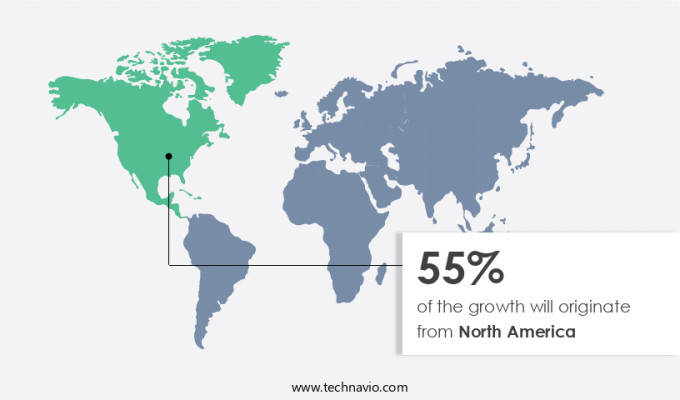

Regional Insights

North America is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the Rapid Plasma Reagin (RPR) test market holds a substantial share of the global industry. The United States and Canada are the primary contributors to this regional market growth. The presence of numerous companies providing RPR test kits, analyzers, and related instruments and reagents in the US is a significant driving factor. Moreover, the substantial healthcare expenditure in the US and Canada, coupled with well-established healthcare infrastructure, significantly boosts the regional market expansion. The North American healthcare sector is among the leading globally, making it an attractive market for RPR test providers. With the increasing prevalence of infectious diseases, the demand for rapid and accurate diagnostic tests, such as RPR, is on the rise in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing incidence of syphilis is the key driver of the market. Syphilis, an infection caused by the bacterium Treponema pallidum subspecies pallidum, is a significant public health concern in the United States despite the availability of affordable screening tests and effective antibiotic treatments. Untreated syphilis can result in severe damage to various organs, including the central and peripheral nervous systems, liver, bones, joints, and cardiovascular system. In extreme cases, it can lead to changes in gait, neuropathy, dementia, and even death. Moreover, primary syphilis infection increases the risk of acquiring and transmitting human immunodeficiency virus (HIV). Syphilis can also lead to adverse pregnancy outcomes, such as stillbirth, neonatal death, low birth weight infants, and syphilis-infected infants.

Moreover, to address this issue, companies like MedAccess and SD Biosensor are developing point-of-care diagnostic tests for syphilis using proteins found in the blood. These tests offer quick and accurate results, making it easier for healthcare professionals to diagnose and treat syphilis in its early stages. By implementing these tests, healthcare providers can reduce the risk of complications and prevent the transmission of syphilis and HIV. In conclusion, syphilis remains a significant public health concern in the United States, particularly among pregnant women. The development and implementation of point-of-care diagnostic tests using proteins in the blood can help healthcare providers diagnose and treat syphilis earlier, reducing the risk of complications and preventing the transmission of the disease and HIV.

Market Trends

Automated RPR systems is the upcoming trend in the market. The global RPR test market is experiencing growth due to the rising incidence of syphilis and the requirement for automation in RPR testing. companies in this industry are capitalizing on trends such as automated RPR systems. These systems streamline the processing, analysis, reporting, and archival of RPR screening and titer results. Advanced technology is driving the automation of RPR tests, expanding the market's potential.

Additionally, automated RPR systems can execute various sample processing stages, including dilutions, dispenses, and incubations. Laboratories benefit significantly from these systems through increased productivity, improved quality, and consistency in testing results. Labor overhead is reduced, allowing for more efficient use of resources and enhanced accuracy in diagnosis. As the demand for efficient and reliable RPR testing continues to grow, the market for automated RPR systems is poised for significant expansion.

Market Challenge

Ensuring quality control for syphilis testing is a key challenge affecting the market growth. In the realm of laboratory diagnostics, the importance of maintaining the accuracy and reliability of Rapid Plasma Reagin (RPR) tests for sexually transmitted infections (STIs) cannot be overstated. These tests play a crucial role in identifying and treating conditions such as syphilis, which can lead to neonatal death and bone deformities if left untreated. Quality control (QC) is a vital process employed by diagnostic centers to ensure the validity and dependability of each RPR test run. Internal QC procedures ensure that tests are carried out in accordance with the companies' recommendations.

However, this encompasses the implementation of written standard operating procedures (SOPs) detailing equipment maintenance and testing procedures in the laboratory setting. External quality assurance (EQA) serves to maintain the precision of testing performed by laboratory technicians and clinical providers. EQA programs provide samples to laboratories for periodic testing and evaluation, enabling continuous improvement and ensuring the accuracy of RPR test results.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbott Laboratories - The company offers rapid plasma reagin tests such as Impact RPR test, which is for the detection of non-treponemal rapid plasma reagin antibodies in human serum or plasma to assist in the diagnosis of syphilis. The test is read by eye so there is no need for a microscope.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anamol Laboratories Pvt. Ltd.

- ARKRAY Inc.

- Arlington Scientific Inc.

- Atlas Medical GmbH

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Cardinal Health Inc.

- F. Hoffmann La Roche Ltd.

- Innovatek Medical Inc.

- Lorne Laboratories Ltd.

- Mediclone Biotech

- Newmarket Biomedical Ltd.

- Novacyt SA

- Sclavo Diagnostics International S.r.l.

- Sekisui Chemical Co. Ltd.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Rapid Plasma Reagin (RPR) test is a crucial diagnostic tool used for detecting Syphilis, a sexually transmitted infection. This point-of-care diagnostic test is essential for various healthcare settings, including specialty clinics, diagnostics laboratories, and hospitals. RPR testing kits and instruments employ proteins derived from the Veneral Disease Research Laboratory (VDRL) rabbit or human serum to detect the presence of antibodies in the blood. RPR testing strategies are critical for early detection and treatment of Syphilis, especially in high-risk populations such as pregnant women. The interferometer type RPR systems offer increased productivity, quality, and consistency in testing results. Automated RPR systems have gained popularity due to their ability to reduce labor overhead and improve testing efficiency.

In summary, RPR testing is not limited to blood samples; cerebrospinal fluid samples can also be used for diagnosing neurosyphilis. The test is also used for various other conditions, such as Lyme disease, pneumonia, malaria, systemic lupus erythematosus, tuberculosis, autoimmune disorders, excessive bleeding, fainting, hematoma, and infection. Monoclonal antibodies test and immunofluorescence test are alternative methods used for Syphilis diagnosis. Antibiotics are the primary treatment for Syphilis, and timely diagnosis through RPR testing plays a significant role in preventing complications such as neonatal death, bone deformities, and other health issues.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.87% |

|

Market growth 2024-2028 |

USD 66.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.0 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 55% |

|

Key countries |

US, France, China, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Anamol Laboratories Pvt. Ltd., ARKRAY Inc., Arlington Scientific Inc., Atlas Medical GmbH, Becton Dickinson and Co., Bio Rad Laboratories Inc., Cardinal Health Inc., F. Hoffmann La Roche Ltd., Innovatek Medical Inc., Lorne Laboratories Ltd., Mediclone Biotech, Newmarket Biomedical Ltd., Novacyt SA, Sclavo Diagnostics International S.r.l., Sekisui Chemical Co. Ltd., and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch