Ready Mix Concrete Batching Plant Market Size 2025-2029

The ready mix concrete batching plant market size is forecast to increase by USD 152 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is witnessing significant growth, driven primarily by the increasing demand for mobile concrete batching plants. This trend is attributed to the flexibility and efficiency these plants offer in meeting the diverse construction needs of various industries. Furthermore, technological advancements in the batching process are enhancing productivity and reducing wastage, making ready mix concrete a preferred choice for construction projects. However, the market faces challenges due to the environmental concerns arising from the existence of ready mix concrete batching plants.

- The increasing pollution levels resulting from the production and transportation of ready mix concrete are becoming a significant concern for regulatory bodies and environmental activists. Companies in the market must address these challenges by implementing sustainable production methods and adhering to stringent environmental regulations to maintain their market position and ensure long-term growth.

What will be the Size of the Ready Mix Concrete Batching Plant Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-changing dynamics of infrastructure development and construction projects across various sectors. Supply chain management plays a crucial role in ensuring the seamless integration of cement silos, water tanks, aggregate bins, and other essential components into the batching process. The ongoing unfolding of market activities reveals a focus on enhancing delivery efficiency, inventory management, and quality control through advanced control systems, PLC controls, and concrete testing. Fiber reinforced concrete and high-performance concrete are gaining popularity due to their superior lifecycle cost and compressive strength. Moreover, the market is witnessing a shift towards energy efficiency, with batching plants incorporating renewable energy sources and optimizing operational costs.

Environmental impact is also a significant concern, leading to innovations in wastewater treatment and dust suppression systems. In the realm of commercial and industrial construction, concrete pumps, material handling equipment, and transit mixers are essential components of the batching plant. The batching process involves precise mix proportioning, and the use of self-consolidating concrete ensures optimal safety and efficiency. The evolving nature of the market necessitates a continuous focus on improving production capacity, reducing operational costs, and ensuring regulatory compliance. The market's dynamic landscape calls for a proactive approach to raw material sourcing, ensuring a steady supply of high-quality raw materials.

In conclusion, the market is a continuously evolving landscape, with a focus on enhancing efficiency, reducing costs, and addressing environmental concerns. The integration of advanced technologies and a proactive approach to market trends are essential for success in this competitive industry.

How is this Ready Mix Concrete Batching Plant Industry segmented?

The ready mix concrete batching plant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential construction

- Non-residential construction

- APAC

- Middle East and Africa

- Europe

- South America

- North America

- Type

- Dry batch concrete plant

- Wet batch concrete plant

- Product Type

- Crushed stone

- River gravel

- Slag

- Application

- Infrastructure

- Mining

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The residential construction segment is estimated to witness significant growth during the forecast period.

Ready mix concrete, a key component in infrastructure development and construction projects, is manufactured at a batching plant and transported to construction sites with precise proportions of cement, aggregate, water, and admixtures. This type of concrete offers benefits such as consistent quality, durability, and time efficiency, making it increasingly popular in both residential and commercial construction. The residential sector, driven by urbanization, population growth, and rising disposable income, has seen significant expansion, leading to increased demand for ready mix concrete. Industrial construction also relies on this concrete for its high-performance qualities and energy efficiency. Efficient supply chain management and inventory control are crucial for maintaining production capacity and minimizing operational costs.

Quality control measures, including concrete testing and mix proportioning, ensure the desired compressive strength and durability. Delivery efficiency is essential for keeping construction projects on schedule. Environmental impact is a growing concern, with wastewater treatment and dust suppression systems becoming standard. Fiber reinforced concrete, self-consolidating concrete, and other advanced concrete technologies are also gaining popularity. The batching process, including control systems, weighing systems, and plc controls, ensures precise mix design and production. Transit mixers and concrete pumps facilitate efficient material handling and transportation. Safety regulations and regulations regarding raw material sourcing further shape the market. Precast concrete and slurry pumps are also used in the production process.

Overall, the ready mix concrete market is dynamic, with trends including increasing production capacity, mixing efficiency, and sustainability.

The Residential construction segment was valued at USD 289.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

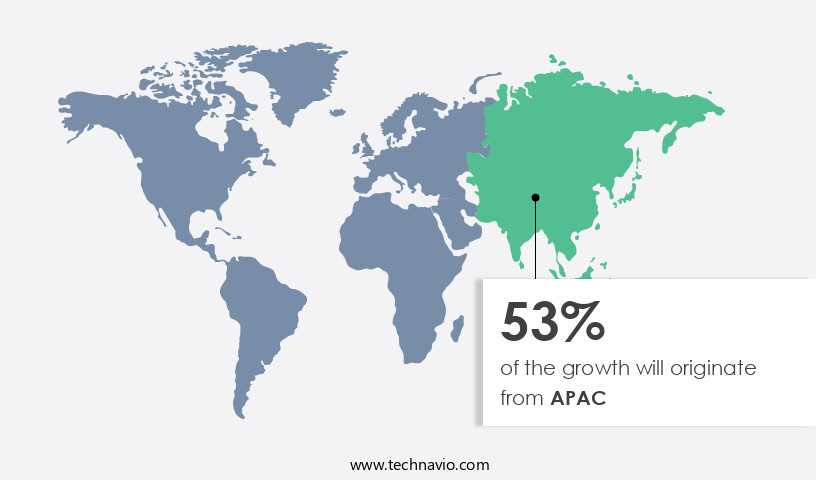

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, driven by substantial investments in construction projects from both the public and private sectors in countries like India and China. The increasing demand for commercial and industrial buildings, coupled with the ongoing infrastructural development, is fueling market expansion in the region. Furthermore, the growing population and urbanization in APAC have heightened the need for smart and sustainable infrastructure solutions. In response, companies are focusing on developing advanced batching plants to enhance delivery efficiency, quality control, and energy efficiency. The integration of technology in the form of control systems, weighing systems, and concrete mix design software is becoming increasingly important for operational cost savings and improved production capacity.

Additionally, the use of high-performance concrete, fiber reinforced concrete, and self-consolidating concrete is gaining popularity due to their superior compressive strength and durability. Environmental concerns are also driving the market, with a focus on wastewater treatment, dust suppression, and raw material sourcing from sustainable sources. The market's evolution is further characterized by the increasing adoption of safety regulations, PLC controls, and the integration of concrete pumps and truck mixers into the batching process. Overall, the market's growth is underpinned by the demand for efficient and sustainable concrete production solutions to meet the region's infrastructure and construction needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and essential sector in the construction industry. This market encompasses the production and distribution of concrete mixtures, tailored to specific project requirements. Ready mix concrete batching plants utilize advanced technologies, such as computerized control systems and automated batching equipment, ensuring consistent product quality. These plants offer numerous benefits, including reduced construction time, improved work site safety, and enhanced concrete durability. Key players in this market focus on innovation, sustainability, and cost-effectiveness. Products and services include concrete mixing, transportation, and delivery. Market trends include the increasing adoption of mobile and precast concrete plants, growing demand for green concrete, and the integration of artificial intelligence and IoT technologies. The market is poised for continued growth, driven by infrastructure development, urbanization, and the expanding construction sector.

What are the key market drivers leading to the rise in the adoption of Ready Mix Concrete Batching Plant Industry?

- The primary factor fueling market growth is the rising demand for ready-mix mobile concrete batching plants. These plants offer convenience and efficiency, making them increasingly preferred in construction projects over traditional stationary batching plants. As a result, the market for these plants is experiencing significant expansion.

- A ready mix mobile concrete batching plant is an essential equipment solution for commercial construction projects, offering portability and cost-effectiveness. This compact, trailer-mounted system includes all necessary procedures for producing ready mix concrete on-site. Its user-friendly interface ensures easy operation, even in challenging environments. The twin-shaft mandatory mixer, a key component, delivers high capacity, superior mixing quality, extensive mixing direction, and uniform, rapid concrete production. Moreover, these plants prioritize energy efficiency through advanced control systems, optimizing power consumption and reducing operational costs.

- Material handling is streamlined with concrete pumps and weighing systems, ensuring precise measurements and minimizing waste. Environmental impact is mitigated with wastewater treatment systems, making these plants a responsible choice for modern construction projects. Overall, the investment in a ready mix mobile concrete batching plant offers a significant return, ensuring productivity, efficiency, and sustainability for commercial construction endeavors.

What are the market trends shaping the Ready Mix Concrete Batching Plant Industry?

- The batching process is undergoing significant technological advancements, which is a prevailing market trend. Two lines: 1. The batching process is currently undergoing technological advancements. 2. This trend is a prominent market development.

- The market has experienced significant growth due to the integration of advanced technologies in the construction industry. These technologies have led to the development of automated and digitized batching processes, which are crucial for the successful completion of construction projects. The use of sensors, controllers, and software in batching operations ensures precise measurement of raw materials and enhances the overall quality of the concrete mix. This includes self-consolidating concrete, which requires precise control during the batching process. Additionally, safety regulations mandate the use of dust suppression systems and safety features such as PLC controls.

- Slurry pumps and truck mixers are also essential components of these plants, contributing to their production capacity. The market's growth is driven by the increasing demand for reinforced concrete structures and the need for efficient and high-quality concrete production.

What challenges does the Ready Mix Concrete Batching Plant Industry face during its growth?

- The expansion of ready-mix concrete batching plants poses a significant challenge to the industry's growth due to the resulting increase in pollution.

- Ready mix concrete batching plants play a crucial role in the construction industry, yet they contribute to air pollution through particulate matter emissions. The primary sources of these emissions are the truck loading point and cement silos, where the absence of effective filter systems can lead to significant dust release. This issue is a major concern as it hinders compliance with environmental regulations, potentially leading to plant closures.

- The resulting pollution can negatively impact market growth during the forecast period. It is essential for concrete producers to prioritize the implementation of central dust collectors and other emission control technologies to mitigate these environmental challenges and ensure industry sustainability.

Exclusive Customer Landscape

The ready mix concrete batching plant market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ready mix concrete batching plant market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ready mix concrete batching plant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akona Engineering Pvt. Ltd. - The company specializes in providing advanced ready-mix concrete batching solutions, including the AH series fully automatic plants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akona Engineering Pvt. Ltd.

- Ammann Group

- Apollo Inffratech Pvt. Ltd.

- Astec Industries Inc.

- CEMEX SAB de CV

- ELKON

- Haomei Machinery Equipment Co. Ltd.

- Holcim Ltd.

- Jayem Manufacturing Co.

- Jaypee India Ltd.

- Laxmi En Fab Pvt. Ltd.

- MACONS Equipments Pvt. Ltd.

- MEKA

- ODISA CONCRETE EQUIPMENT

- Oshkosh Corp.

- Powerol Energy Systems

- SCHWING GmbH

- Stephens MFG. Co.

- The Vince Hagan Co.

- Vicat

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ready Mix Concrete Batching Plant Market

- In January 2024, Fujian Shouhong Cement Co., Ltd. Announced the launch of its new generation Ready Mix Concrete (RMC) batching plant in China, featuring advanced automation and smart production technologies, increasing the company's production capacity by 50% (Fujian Shouhong Cement Co., Ltd. Press release).

- In March 2024, LafargeHolcim and Schindler Group entered into a strategic partnership to develop and implement digital solutions for RMC plants, aiming to enhance operational efficiency and reduce carbon emissions (LafargeHolcim press release).

- In May 2024, Cemex S.A.B. De C.V. completed the acquisition of a 60% stake in South America's largest RMC producer, Cementos Argos S.A., expanding its footprint in the region and strengthening its market position (Bloomberg).

- In January 2025, the European Union approved new regulations on the sustainability of RMC, requiring increased use of recycled aggregates and reduced carbon emissions, effective from 2027 (European Commission press release).

Research Analyst Overview

- The market is characterized by a focus on material optimization and adherence to industry standards. Companies are integrating lifecycle analysis and sustainability initiatives to reduce environmental impact. Mobile applications and smart sensors enable real-time monitoring and process optimization, while concrete pumping technology ensures efficient delivery. Regulatory compliance is paramount, with big data and IoT integration facilitating emission reduction and safety enhancement. Energy management and cost reduction are key priorities, with machine learning and data analytics driving productivity improvement. Renewable energy and water management are essential for long-term sustainability, while supply chain optimization and remote monitoring streamline operations.

- Quality assurance remains a top concern, with artificial intelligence and cloud computing enabling advanced data analytics and automation systems. Overall, the market is undergoing significant transformation, driven by technological advancements and a growing focus on sustainability and efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ready Mix Concrete Batching Plant Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 152 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

India, Japan, China, US, Saudi Arabia, UAE, Brazil, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ready Mix Concrete Batching Plant Market Research and Growth Report?

- CAGR of the Ready Mix Concrete Batching Plant industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, Europe, South America, and North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ready mix concrete batching plant market growth of industry companies

We can help! Our analysts can customize this ready mix concrete batching plant market research report to meet your requirements.