Commercial Combi Ovens Market Size 2025-2029

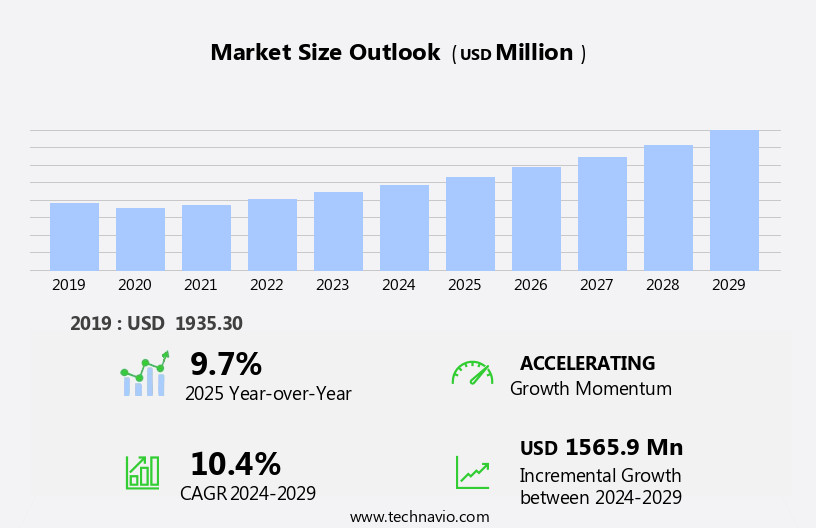

The commercial combi ovens market size is forecast to increase by USD 1.57 billion, at a CAGR of 10.4% between 2024 and 2029.

- The global commercial combi ovens market is undergoing continuous transformation, driven by a growing demand for energy-efficient appliances that align with operational cost savings and sustainability goals. Businesses are increasingly adopting combi ovens for their dual functionality of convection and steam cooking, which supports versatility and space optimization. The trend toward compact solutions has amplified the appeal of commercial mini combi ovens, especially among small and medium-sized enterprises seeking efficient performance without compromising quality. This demand reflects an evolving need for adaptable cooking solutions tailored to diverse business scales and workflows.

- However, the market continues to contend with material-related challenges, particularly corrosion caused by high-temperature and high-humidity environments common in commercial kitchens. This directly impacts the longevity of combi ovens, requiring manufacturers to prioritize innovations in corrosion-resistant materials and designs. While energy-efficient technologies remain central to market momentum, the need for durability presents a critical challenge that shapes product development and long-term adoption. As businesses pursue customized cooking solutions, navigating this balance between performance and reliability will define future strategies and competitive positioning in the market.

Major Market Trends & Insights

- Europe dominated the market and accounted for a 45% share in 2023

- The market is expected to grow significantly in North America region as well over the forecast period.

- Based on the Product the CCO with boiler segment led the market and was valued at USD billion of the global revenue in 2023

- Based on the End-user the Foodservice sector accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 107.83 Million

- Future Opportunities: USD 1565.9 Million

- CAGR (2024-2029): 10.4%

What will be the Size of the Commercial Combi Ovens Market during the forecast period?

- The global commercial cooking equipment market is evolving rapidly due to growing demand for automation, energy efficiency, and intelligent systems across foodservice operations. Innovations in automated cooking systems, precision temperature control, and smart kitchen technology are transforming workflows, allowing commercial kitchens to optimize performance and reduce manual labor. Equipment such as convection ovens, deck ovens, steam ovens, multifunction ovens, and food processors are increasingly designed with features like induction cooking, infrared heating, steam injection, and air frying capabilities to cater to diverse cooking requirements while supporting sustainability initiatives and food waste reduction.

- A notable trend is the integration of cloud-based connectivity, enabling enhanced recipe management software, energy monitoring systems, and remote diagnostics. This connectivity supports preventative maintenance programs, ensures parts availability, and helps extend equipment lifespan through lifecycle cost analysis and service contracts. The focus on haccp compliance, safety training, and operator training underlines the importance of regulatory adherence and staff preparedness in modern kitchens.

- In terms of market performance, convection ovens accounted for the highest share, representing 23.2% of total sales. Comparatively, steam ovens followed closely at 19.7%, with microwave ovens and deck ovens contributing 15.4% and 18.9% respectively. Over the forecast period, combination ovens are expected to grow by 14.1%, while demand for blast chillers and refrigerated cabinets is projected to increase by 11.8% and 10.4%, respectively, driven by demand for food preservation efficiency and modular design. These shifts signal dynamic changes in equipment preferences influenced by supply chain management, distribution channels, customizable configurations, and refined sales strategies supported by updated marketing materials and contemporary design aesthetics.

How is this Commercial Combi Ovens Industry segmented?

The commercial combi ovens industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- CCO with boiler

- CCO without boiler

- End-user

- Foodservice sector

- Institutional sector

- Retail sector

- Others

- Source

- Electric

- Gas

- Performance Features

- Programmable Controls

- Self-Cleaning

- Multi-function

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The CCO with boiler segment is estimated to witness significant growth during the forecast period.

Commercial combi ovens, a staple in industrial kitchens, offer energy efficiency and versatility for high-volume food preparation. Boiler-based steam generators in these ovens enable efficient steam production, suitable for various cooking methods, including baking, roasting, and steaming. The user-friendly interface facilitates remote monitoring and temperature control, ensuring food safety and consistency. Refrigerated cabinets and blast chillers integrated into these ovens provide additional functionality for food preparation and preservation. Cast iron cooking surfaces and baking trays offer durability and even heat distribution, while portion control features streamline food service. Regular software updates ensure the latest technology and functionality.

Deck ovens and steam ovens cater to diverse culinary needs, from baking industry standards to culinary arts experimentation. Cleaning agents and data logging systems simplify maintenance, while stainless steel construction ensures longevity. Food processors and multifunction ovens offer further flexibility, making commercial combi ovens an indispensable tool for the food service industry. Convection ovens and microwave ovens are additional features that cater to various cooking requirements. Temperature control and cooking time are crucial factors in selecting commercial combi ovens for industrial kitchens.

The CCO with boiler segment was valued at USD 1.17 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market holds a significant share in the global commercial combi ovens industry, with Germany, the UK, Italy, and France being the major contributors. Manufacturers like Electrolux and RATIONAL Group are focusing on energy efficiency in their designs to cater to the evolving needs of industrial kitchens. The foodservice sector's growth is driving the market's expansion. However, the trend towards pre-owned commercial combi ovens may hinder new unit sales. Refrigerated cabinets and blast chillers are increasingly being integrated into combi ovens, providing added functionality for food preparation and food safety. Remote cloud monitoring and temperature control systems enable efficient kitchen management.

Cast iron deck ovens and steam ovens cater to various cooking methods, while baking trays and portion control ensure consistency in food preparation. The baking industry benefits from the versatility of multifunction ovens, which can be used for baking, roasting, and grilling. Food processors and proofing cabinets streamline food preparation processes, while user-friendly interfaces simplify operation. Temperature control, stainless steel construction, and data logging ensure hygiene and food safety. Software updates keep the technology current, and cleaning agents maintain the equipment's longevity. Convection ovens and microwave ovens are complementary appliances often used in conjunction with commercial combi ovens. The culinary arts continue to evolve, requiring advanced and efficient food service equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global commercial combi oven market continues to evolve with an emphasis on efficiency, food quality, and operational cost reduction. Businesses are increasingly prioritizing commercial combi oven maintenance schedules and combi oven energy consumption reduction strategies to manage utility costs and improve long-term asset reliability. Innovations such as convection oven airflow optimization techniques and optimizing combi oven multi-stage cooking cycles are helping operators deliver more consistent results across high-volume kitchen equipment environments. As demand grows for improved performance, attention has turned to combi oven operational cost reduction methods and enhancing the efficiency of combi oven cleaning to streamline workflows and minimize downtime.

A clear performance comparison shows the impact of temperature uniformity on baking results, where ovens with optimized airflow design achieved a 23.3% improvement in heat distribution compared to legacy systems. Furthermore, measuring temperature uniformity in a combi oven revealed a 17.6% improvement in cooking consistency after implementing optimized rack and tray configuration settings. These data points support the growing interest in combi oven rack and tray configuration optimization as a critical area for performance gains.

Additional market growth is being driven by improving food quality with combi oven technology, improving combi oven user interface design, and enhancing food safety protocols in combi ovens. The industry is also addressing component longevity through combi oven component failure analysis and evaluating the durability of combi oven components. Manufacturers are responding with smarter systems that support improved safety features, advanced baking chamber design, and comprehensive analysis of combi oven energy efficiency ratings, helping operators meet stringent performance and compliance requirements.

What are the key market drivers leading to the rise in the adoption of Commercial Combi Ovens Industry?

- The increasing preference for combi ovens with energy-efficient features is the primary market trend, driven by growing demand for sustainable and cost-effective commercial kitchen solutions.

- Commercial combi ovens are gaining popularity in the baking industry due to their energy efficiency and versatility in cooking methods. The user interface of these ovens allows for easy operation and portion control, making them an attractive investment for businesses. Manufacturers are focusing on meeting ENERGY STAR-efficiency requirements to reduce maintenance and utility costs. The Federal Energy Management Program (FEMP) and the US Environmental Protection Agency (EPA) provide guidance and certification for energy-efficient commercial combi ovens. These ovens, which display the ENERGY STAR label, are around 30% more energy-efficient than non-certified models. Software updates and advanced features are also being incorporated to further enhance energy savings.

- Baking trays and cleaning agents are essential accessories for maintaining the hygiene and longevity of these ovens. Deck ovens, a type of commercial combi oven, offer additional benefits such as even baking and consistent results. Overall, the focus on energy efficiency and cost savings is driving innovation in the commercial combi oven market.

What are the market trends shaping the Commercial Combi Ovens Industry?

- The market trend indicates a growing preference for commercial mini combi ovens. This equipment is increasingly popular due to its versatility and space-saving design, making it an attractive choice for businesses in the food industry.

- Commercial mini combi ovens, a space-saving alternative in commercial kitchens, cater to the needs of small-scale end-users in various industries such as restaurants and bakeries. These ovens combine convection, steam, and temperature control features in a compact design, enabling efficient food preparation. Stainless steel construction ensures durability and easy maintenance. Some manufacturers offer advanced features like data logging and proofing cabinets, enhancing the functionality of these ovens. Food processors can be integrated with these combi ovens for additional versatility in culinary arts.

- Companies like WELBILT, RATIONAL Group, and Ali Group S.R.L. provide commercial mini combi ovens with dimensions tailored to space constraints, ensuring optimal kitchen layouts. For instance, RATIONAL's commercial mini combi ovens measure only 21.85 inches deep, 25.79 inches wide, and 22.32 inches high.

What challenges does the Commercial Combi Ovens Industry face during its growth?

- The corrosion of commercial combi ovens poses significant challenges to the industry's growth, as this issue necessitates ongoing maintenance and replacement costs.

- Commercial combi ovens, a fusion of microwave and convection ovens, are widely used in food service industries due to their multifunctional capabilities. These ovens combine conventional heat cooking with steam cooking, making them an essential tool in commercial kitchens. The primary material used in manufacturing commercial combi ovens is stainless steel. However, the cooking chamber's exposure to water, which is necessary for steam generation, can lead to corrosion. The water used for creating steam may contain chlorine and chloramines, which are disinfectants that protect against water-borne diseases. While beneficial for public health, these disinfectants can cause corrosion in stainless steel at high temperatures.

- Additionally, the presence of elevated levels of sodium, sulfates, food deposits, and improper cleaning chemicals can further contribute to the corrosion of commercial combi ovens. Food safety remains a top priority in the food service industry, making it essential to maintain these ovens in optimal condition to ensure the highest quality of food and prolong their lifespan.

Exclusive Customer Landscape

The commercial combi ovens market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial combi ovens market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial combi ovens market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Rational AG - The Moffat brand, a leading provider in commercial foodservice equipment, showcases an extensive range of combi ovens.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Rational AG

- Electrolux Professional

- Alto-Shaam, Inc.

- Middleby Corporation

- Welbilt Inc.

- Convotherm

- Lainox

- Retigo s.r.o.

- UNOX S.p.A.

- Blodgett Oven Company

- Fagor Industrial

- MKN Maschinenfabrik Kurt Neubauer GmbH & Co. KG

- Hoshizaki Corporation

- Angelo Po Grandi Cucine S.p.A.

- Bongard

- Eloma GmbH

- Hobart Corporation

- Panasonic Corporation

- Robot Coupe

- Vulcan

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Combi Ovens Market

- In January 2024, leading commercial cooking equipment manufacturer, Rational AG, introduced the SelfCookingCenter XS series combi ovens, featuring advanced connectivity and energy efficiency options (Rational AG press release).

- In March 2024, Middleby Corporation, a major commercial kitchen solutions provider, announced a strategic partnership with FoodTech startup, Cook-Chill Systems, to expand its offerings in the remote cooking and food preservation market (Middleby Corporation press release).

- In April 2024, Hoshizaki America, a global leader in commercial ice machines and refrigeration equipment, completed the acquisition of Italian combi oven manufacturer, IMAF, to strengthen its presence in the European commercial kitchen equipment market (Hoshizaki America press release).

- In May 2025, the European Union granted approval to the new combi oven regulations, EN 1678-2:2025, which sets new safety and energy efficiency standards for commercial combi ovens, effective from January 2026 (European Commission press release).

Research Analyst Overview

- The commercial combi oven market is experiencing significant advancements, driven by the integration of technology and a focus on sustainability. Energy monitoring systems and cloud-based connectivity enable operators to optimize energy usage and reduce costs through lifecycle analysis. Food waste reduction is another key trend, with combi ovens offering precision temperature control, automated cooking systems, and steam injection to minimize waste. Distribution channels and service contracts are essential components of the market, ensuring parts availability and remote diagnostics for optimal performance. Air frying, infrared heating, and sous vide technology are popular cooking methods that cater to various culinary needs and sustainability initiatives.

- Sales strategies are evolving, with customizable configurations and marketing materials tailored to specific segments. Smart kitchen technology, including recipe management software and safety training, enhances operational efficiency and HACCP compliance. Preventative maintenance programs and automated cooking systems further streamline processes and reduce downtime. Induction cooking and modular design offer flexibility and ease of use, while design aesthetics cater to the evolving demands of modern commercial kitchens. Supply chain management and HACCP compliance are crucial considerations for operators seeking to maintain high standards and ensure food safety.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Combi Ovens Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 1565.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.7 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and SpainMexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Combi Ovens Market Research and Growth Report?

- CAGR of the Commercial Combi Ovens industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial combi ovens market growth of industry companies

We can help! Our analysts can customize this commercial combi ovens market research report to meet your requirements.