Hexagonal Boron Nitride Market Size 2024-2028

The hexagonal boron nitride market size is forecast to increase by USD 308.3 million at a CAGR of 5.5% between 2023 and 2028.

- The market is experiencing significant growth due to the abundance of boron and the commercialization of boron nitride nanotubes. Boron is one of the most abundant elements In the Earth's crust, making it an attractive resource for various industries. The emergence of boron nitride nanotubes, a promising material with unique properties, is driving the demand for HBN.

- However, the high cost of producing HBN remains a challenge for market growth. Despite this, the potential applications of HBN in various industries, including consumer electronics, energy, and healthcare, are expected to fuel market expansion. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders and businesses operating in the HBN industry.

What will be the Size of the Hexagonal Boron Nitride Market During the Forecast Period?

- The market is experiencing significant growth due to its versatile properties and applications in various industrial sectors. With the recent trend of increasing oil prices, there is a heightened focus on improving efficiency and reducing costs in industrial lubricants. HBN's unique properties, including excellent lubrication, corrosion resistance, and thermal management solutions, make it an attractive alternative to traditional lubricants In the transportation sector, particularly in engine oil segments.

- Moreover, the lifting of restrictions in aerospace and electronics industries is driving the demand for HBN in coatings and electrical insulation applications. HBN's high electrical insulation properties make it an ideal material for high-voltage applications In the electronics industry, while its excellent thermal conductivity and low coefficient of thermal expansion make it a popular choice for thermal management solutions In the aerospace industry.

- In summary, the Hexagonal Boron Nitride market is poised for growth due to its applications in industrial lubricants, coatings, electrical insulation, and thermal management solutions across various industries, including transportation, aerospace, and electronics. Its unique properties offer cost savings, efficiency improvements, and performance enhancements, making it a valuable addition to the industrial landscape.

How is this Hexagonal Boron Nitride Industry segmented and which is the largest segment?

The HBN industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Coatings and mold release agents

- Electrical insulation

- Lubricants

- Refractory

- Others

- End-user

- Automotive

- Electronics

- Aerospace

- Metallurgy

- Others

- Type

- Tubes

- Rods

- Powder

- Gaskets

- Plates and Sheets

- Others

- Geography

- APAC

- China

- India

- South Korea

- North America

- US

- South America

- Europe

- Germany

- Middle East and Africa

- APAC

By Application Insights

The coatings and mold release agents segment is estimated to witness significant growth during the forecast period. Hexagonal boron nitride (HBN) is a versatile material utilized in various industries due to its exceptional thermal and mechanical properties. HBN coatings, specifically, are applied to metals, graphite, ceramics, and organic materials, withstanding temperatures up to 1,500°C. These coatings are integral to the automotive, aerospace, and defense sectors, as well as high-temperature applications in foundry die-casting, aluminum manufacturing, and glass production. HBN coatings offer superior abrasion resistance, toughness, and durability on surfaces such as aluminum, steel, zinc, magnesium, and alloys. The coatings and mold release agents segment represents the largest consumer of boron nitride. In addition, HBN is employed In the electrical insulation segment for its low dielectric constant and insulation properties, as well as In thermal management applications due to its low thermal expansion.

The personal care sector utilizes boron nitride in skincare products for its chemical stability and biocompatibility. Boron nitride nanotubes and nanosheets are gaining popularity in electronic applications, including consumer electronics like radios, cellular phones, and thermal interface materials. Boron nitride is also used in lubricants and greases, automobile production, and 3D printed components.

Get a glance at the share of various segments. Request Free Sample

The coatings and mold release agents segment was valued at USD 210.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

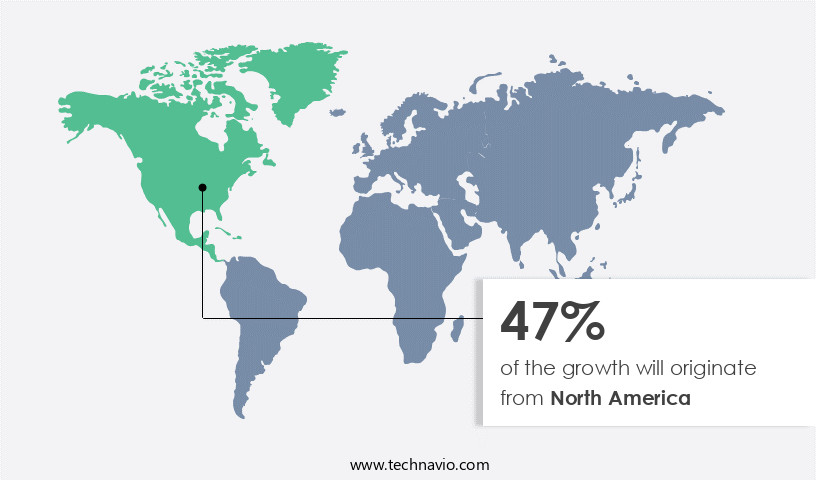

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Hexagonal Boron Nitride (HBN) is a significant player in various industries, with APAC being the largest market in 2023. The region's growth is driven by expanding applications in coatings, lubricants, mold release agents, and electrical insulation. China is the leading consumer due to surging demand in lubricants, coatings, and electrical insulation sectors. Japan, South Korea, and India are other significant contributors to the HBN market in APAC. Industrial sectors, including aerospace, electronics, and automotive, utilize HBN for its exceptional properties, such as corrosion resistance, low dielectric constant, and thermal management capabilities. In the automotive sector, HBN is used in engine oil and automobile production, while In the electronics industry, it is employed in consumer electronics, such as radios and cellular phones, and thermal interface materials.

The chemical stability and lubricating properties of HBN make it suitable for use in various industries, including plastics, elastomers, composite components, spacecrafts, and aircrafts. HBN is also used in luxury vehicles and dental, skincare, and plastic. The electrical insulation segment benefits from HBN's low thermal expansion and high insulation properties. Boron nitride nanotubes and nanosheets are advanced forms of HBN, used in 3D printed components and thermal management solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hexagonal Boron Nitride (HBN) Industry?

Abundance of boron minerals is the key driver of the market.

- Hexagonal Boron Nitride (HBN) is a crystalline form of boron nitride with a hexagonal lattice structure. The production of HBN relies on boron and nitrogen as its primary raw materials, which are sourced from approximately 200 naturally occurring boron minerals. Major producers of these minerals include Turkey and the US, accounting for a significant share of the global boron market with sales of around USD2.6 billion in 2022, according to the Turkey Energy and Natural Resources ministry. The Americas and China are the leading consumers of boron minerals, with applications spanning various industries. In the industrial sector, HBN is used for electrical insulation and lubricants, contributing to the transportation industry's engine oil segment and automotive activities.

- The aerospace and electronics industries utilize HBN for its excellent corrosion resistance, thermal management applications, and lubricating properties in mechanical systems, metal processing, plastics, elastomers, composite components, and spacecrafts. Additionally, HBN finds applications In the personal care sector, particularly in skincare products, and In the dental industry for its biocompatibility. The electrical insulation segment uses HBN in 2D HBN for electronic applications, such as consumer electronics like radios, cellular phones, and thermal interface materials. Furthermore, HBN is used In the production of silicon nitride, aluminum nitride, synthetic graphite, cosmetics, dental care products, and electric vehicles. In summary, the demand for boron minerals and their derived products, including HBN, is driven by the diverse applications in various industries, including transportation, aerospace, electronics, and personal care.

What are the market trends shaping the Hexagonal Boron Nitride (HBN) Industry?

Commercialization of boron nitride nanotubes is the upcoming market trend.

- Boron nitride, specifically In the form of hexagonal boron nitride (HBN) and boron nitride nanotubes, offers unique properties including high thermal conductivity, electrical insulation, and chemical stability. These attributes make boron nitride an attractive alternative to traditional materials in various industrial sectors. In the automotive industry, boron nitride nanotubes are being explored for use in engine oil and industrial lubricants due to their superior lubricating properties and friction reduction. The transportation sector, including automobile production, is expected to be a significant market for boron nitride as lifting restrictions on oil prices continue to drive demand for fuel efficiency and durability.

- Beyond transportation, the electrical insulation segment is another major market for boron nitride. Its low dielectric constant and insulation properties make it suitable for use in electrical applications, particularly In the consumer electronics industry for components such as radios, cellular phones, and thermal interface materials in electric vehicles. Boron nitride's low thermal expansion and chemical stability also make it a desirable material for use in coatings and mechanical systems in metal processing, plastics, elastomers, and composite components. Furthermore, boron nitride's unique properties make it an ideal material for aerospace applications, including thermal management in spacecrafts and aircrafts, as well as corrosion resistance in luxury vehicles.

What challenges does the Hexagonal Boron Nitride (HBN) Industry face during its growth?

High cost of hexagonal boron nitride is a key challenge affecting the industry growth.

- Hexagonal Boron Nitride (HBN) is a versatile material with applications spanning various industries, including oil prices, industrial sectors, and transportation. In the industrial sector, HBN is used as an additive in industrial lubricants for its excellent lubricating properties, friction reduction, and corrosion resistance. However, the higher cost of HBN, particularly for high-purity grades, is a significant barrier to its widespread adoption. The price of standard-grade HBN ranges from USD55 to USD130/kg, while premium-grade HBN for specialized applications, such as skincare products and the personal care sector, can cost between USD350 and USD800/kg. This high cost makes HBN less competitive compared to alternatives like graphite, molybdenum disulfide, and tungsten disulfide, limiting its growth In these markets.

- In the transportation sector, HBN is used in engine oil segments for automotive activities, where lifting restrictions and stringent regulations require high-performance lubricants. HBN's excellent thermal management properties make it an ideal choice for thermal management applications In the electronics industry, including consumer electronics like radios, cellular phones, and electronic appliances. Furthermore, HBN's chemical stability, low dielectric constant, and insulation properties make it a popular choice for electrical insulation applications, particularly In the aerospace and electronics segments. HBN's unique properties also make it suitable for various other applications, such as thermal interface materials, coatings, mechanical systems, metal processing, plastics, elastomers, composite components, spacecrafts, and aircraft.

Exclusive Customer Landscape

The hexagonal boron nitride market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the HBN market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hexagonal boron nitride (hbn) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- American Elements

- BORTEK Boron Technologies and Mechatronic Inc.

- Compagnie de Saint Gobain

- Denka Co. Ltd.

- Henze Boron Nitride Products AG

- Hoganas AB

- JFE Holdings Inc.

- Kennametal Inc.

- KYOCERA Corp.

- Liaoning PengDa technology Co. Ltd.

- Momentive Performance Materials Inc.

- PJSC Zaporozhsky Abrasivny Combinat

- Resonac Holdings Corp.

- Shin Etsu Chemical Co. Ltd.

- Supervac Industries LLP

- UK Abrasives Inc.

- Yingkou Liaobin Fine Chemical Co. Ltd.

- Zibo Xinfukang Specialty Materials Co. Ltd.

- ZYP Coatings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hexagonal Boron Nitride (HBN), a crystalline form of boron nitride, is a versatile material that offers unique properties, making it a valuable addition to various industries. HBN's hexagonal lattice structure, similar to graphene, provides it with exceptional thermal conductivity, electrical insulation, and mechanical strength. These properties make HBN an attractive alternative to traditional materials in numerous applications. The global market for Hexagonal Boron Nitride is driven by its wide range of applications in various sectors. In the industrial sector, HBN is used as a thermal management material due to its excellent thermal conductivity. It is also utilized in lubrication applications due to its low friction and high chemical stability.

Moreover, HBN's electrical insulation properties make it an essential component In the electronics industry. It is used in various electronic applications, including thermal interface materials and coatings, to enhance the performance of electronic devices. The aerospace industry also utilizes HBN for its high thermal conductivity and excellent mechanical properties in various components, such as thermal management systems and coatings. The chemical industry is another significant market for HBN. It is used as a reinforcing agent in composite materials due to its high strength and low thermal expansion. Additionally, HBN's biocompatibility makes it suitable for use in dental and skincare products.

The automotive industry is another potential market for HBN. Its use in lubrication applications can enhance engine performance and reduce wear and tear. Furthermore, HBN's low thermal expansion and high chemical stability make it an attractive material for use in high-performance luxury vehicles. The growth of the electric vehicle market is also expected to drive the demand for HBN. Its thermal management properties make it an ideal material for thermal interface materials in electric vehicles. Additionally, HBN's low dielectric constant and high electrical insulation properties make it suitable for use in electronic components in electric vehicles. The market for HBN is expected to grow significantly due to its versatility and unique properties.

The material's ability to enhance the performance of various components in different industries makes it an attractive alternative to traditional materials. Furthermore, ongoing research and development efforts are expected to uncover new applications for HBN, further expanding its market potential. In conclusion, Hexagonal Boron Nitride is a versatile material with unique properties that make it an attractive alternative to traditional materials in various industries. Its use In thermal management, lubrication, electrical insulation, and composite materials makes it a valuable component in numerous applications. The global market for HBN is expected to grow significantly due to its wide range of applications and ongoing research and development efforts.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2024-2028 |

USD 308.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.12 |

|

Key countries |

US, China, Germany, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hexagonal Boron Nitride Market Research and Growth Report?

- CAGR of the Hexagonal Boron Nitride (HBN) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, South America, Europe, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hexagonal boron nitride (hbn) market growth of industry companies

We can help! Our analysts can customize this hexagonal boron nitride market research report to meet your requirements.