Liquefied Natural Gas (LNG) Market Size 2025-2029

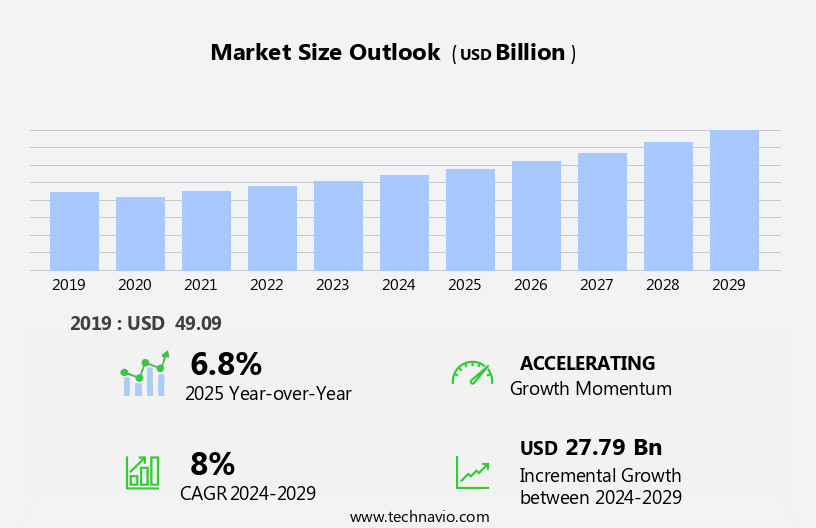

The liquefied natural gas (LNG) market size is forecast to increase by USD 27.79 billion, at a CAGR of 8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the surge in LNG production and the increasing demand for LNG bunkering. The production increase is due to the expansion of LNG infrastructure in key producing regions, enabling greater access to natural gas resources and facilitating the liquefaction process. Simultaneously, the demand for LNG bunkering is rising as more shipping companies adopt LNG as a cleaner alternative fuel for their vessels, in response to stricter environmental regulations. However, the LNG market faces challenges, including the fluctuations in global oil and gas prices. These price volatilities can impact the profitability of LNG projects, as the price of LNG is closely linked to the price of oil.

- Additionally, the infrastructure required for LNG production, transportation, and regasification is capital-intensive and complex, posing challenges for companies looking to enter the market. Furthermore, safety concerns and the need for specialized expertise to handle LNG can create operational challenges for companies. To capitalize on market opportunities and navigate these challenges effectively, companies must remain agile, invest in innovative technologies, and collaborate with industry partners to optimize their operations and mitigate risks.

What will be the Size of the Liquefied Natural Gas (LNG) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by shifting consumer demands, technological advancements, and regulatory changes. LNG metering and insulation technologies are crucial components in ensuring accurate measurement and efficient storage of this cryogenic fuel. LNG derivatives and contracts provide flexibility in managing price risks and securing supply. Industrial applications of LNG span various sectors, including power generation, heavy-duty vehicles, and processing industries. LNG valves, membranes, and pumps are essential components in LNG infrastructure, enabling the safe and efficient handling of this fuel. Carbon capture and utilization are emerging applications, offering potential environmental benefits. LNG pricing remains volatile due to market dynamics, supply and demand imbalances, and geopolitical factors.

Transportation, from production sites to end-users, involves complex logistics, including LNG tankers, pipelines, and terminals. Regulations and safety standards are continually evolving to address emerging challenges and ensure the safe and sustainable use of LNG. LNG vaporization and shipping technologies are essential for converting LNG back into its gaseous state for use as a fuel. LNG bunkering and supply chain optimization are crucial for the growing use of LNG as a marine fuel. LNG utilization in residential applications and export markets is expanding, driven by innovation and evolving consumer preferences. LNG production processes, such as gas-to-liquids (GTL), are advancing to improve efficiency and reduce emissions.

LNG hydrogen and fuel cells are emerging applications, offering potential benefits in decarbonizing energy systems. The LNG market's continuous dynamism underscores the importance of staying informed about the latest trends and developments.

How is this Liquefied Natural Gas (LNG) Industry segmented?

The liquefied natural gas (lng) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Power

- Industry

- Others

- Application

- Off-grid power plants

- Transportation

- Industrial and manufacturing

- Marine fuel

- Others

- Geography

- North America

- US

- Canada

- Europe

- Norway

- Russia

- The Netherlands

- Middle East and Africa

- Qatar

- UAE

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

.

By End-user Insights

The power segment is estimated to witness significant growth during the forecast period.

Liquefied Natural Gas (LNG) is a critical component of the global energy landscape, with increasing demand driven by various factors. The shift towards cleaner fuels for power generation and industrial applications is a significant trend, as LNG emits fewer greenhouse gases compared to coal and oil. LNG cryogenics technology enables the liquefaction, storage, and transportation of natural gas in its liquid form, making it a versatile fuel for various sectors. LNG infrastructure, including regasification terminals and pipelines, is essential for importing and distributing LNG to consumers. Safety standards are stringently enforced to ensure the safe handling and transportation of LNG.

LNG sensors and metering systems enable accurate measurement and monitoring of LNG quantities. LNG is gaining traction as a marine fuel due to its lower emissions compared to traditional marine fuels. LNG hydrogen blending is an emerging trend, offering potential carbon capture and utilization benefits. LNG derivatives, such as ethane and propane, are used in industrial applications, while LNG contracts and pricing mechanisms provide market stability. LNG production involves the extraction and processing of natural gas into its liquid form. LNG transportation, including tankers and pipelines, ensures the delivery of LNG to consumers. LNG vaporization and regasification enable the conversion of LNG back into its gaseous state for use in power generation, industrial applications, and residential use.

LNG regulations aim to ensure safety and environmental sustainability. LNG utilization in heavy-duty vehicles and power generation is increasing, while LNG fuel cells offer potential for zero-emission transportation. LNG boil-off, or the loss of LNG during storage and transportation, is a challenge being addressed through technological innovations. LNG demand is expected to grow due to its versatility and environmental benefits. LNG market volatility is influenced by various factors, including supply and demand dynamics, geopolitical tensions, and technological advancements. LNG pipelines and gas-to-liquids (GTL) technology are alternative methods for transporting and producing LNG, respectively. Innovations in LNG technology, such as membranes, valves, pumps, and insulation, are driving efficiency and reducing costs.

LNG bunkering and supply chain optimization are essential for ensuring the smooth delivery of LNG to consumers. The environmental impact of LNG production and use is a critical consideration, with efforts being made to reduce emissions and improve sustainability.

The Power segment was valued at USD 17.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The LNG market in North America is driven by the increased consumption in countries such as the US, Canada, and Mexico. In the US, the shift from coal to natural gas in the power sector has significantly boosted its demand. Moreover, the competitive pricing of natural gas for industrial applications further fuels its usage. Mexico, which heavily relies on natural gas for primary energy consumption, is another major consumer in the region. The US shale revolution has revolutionized the oil and gas industry, making it the largest producer of natural gas globally during the forecast period.

LNG infrastructure, including regasification terminals and storage facilities, plays a crucial role in the market. Advanced technologies such as LNG cryogenics, sensors, and insulation ensure efficient production, transportation, and utilization of LNG. LNG is increasingly being used as a marine fuel, and safety standards are stringently enforced to ensure safe operations. The LNG market is also witnessing innovation in various areas, such as LNG hydrogen blending, carbon capture, and utilization. LNG derivatives and contracts are essential components of the market, providing price stability and risk management solutions. LNG is finding applications in industrial processes, power generation, and heavy-duty vehicles, among others.

The LNG supply chain involves various players, including producers, processors, transporters, and distributors. LNG pricing is influenced by various factors, including market volatility and transportation costs. LNG transportation is carried out through pipelines, LNG carriers, and bunkering vessels. The environmental impact of LNG is a significant concern, and regulations are being implemented to minimize its carbon footprint. Biomethane and GTL are emerging as alternative sources of LNG. The market is expected to continue its growth trajectory, driven by increasing demand, technological advancements, and regulatory support.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Liquefied Natural Gas (LNG) Industry?

- The significant rise in Liquified Natural Gas (LNG) production serves as the primary catalyst for market growth.

- The global LNG market is experiencing significant growth due to the increasing supply of unconventional natural gas resources, such as coalbed methane, shale gas, and tight gas. According to the US Energy Information Administration (EIA), the US has been a major contributor to this trend since 2008, with shale gas production increasing from 68% to 71% between 2018 and 2019. By 2023, the US is expected to continue leading in shale gas production, with the Marcellus and Utica shale plays being the top producers, followed by the Permian Basin. The International Energy Agency (IEA) predicts that the US will account for 49% of global natural gas output growth by 2023.

- LNG infrastructure, including cryogenics, regasification, storage, and distribution, has been expanding to meet the demand for this cleaner-burning fossil fuel. LNG is increasingly being used as a marine fuel and for hydrogen production. Safety standards are a critical consideration in the LNG industry, with sensors and advanced technologies playing a crucial role in ensuring safe operations. LNG emissions are a focus of ongoing research and development, as the industry seeks to reduce its carbon footprint and meet sustainability goals. LNG import and export have become essential components of the global energy market, with LNG tankers transporting the fuel across the world.

- Despite the challenges of LNG cryogenics and the need for specialized infrastructure, the benefits of LNG as a cleaner-burning fuel and a reliable energy source are driving its adoption in various industries.

What are the market trends shaping the Liquefied Natural Gas (LNG) Industry?

- The demand for liquefied natural gas (LNG) bunkering is experiencing significant growth, representing a noteworthy market trend in the maritime industry. This increasing need for LNG as a cleaner fuel source is driving innovation and expansion in the LNG bunkering sector.

- Liquefied Natural Gas (LNG) is gaining momentum as a sustainable marine fuel, driving the development of LNG bunkering facilities to reduce emissions from shipping activities. According to the International Energy Agency (IEA), heavy fuel oil (HFO) accounted for 79% of marine fuel mix in 2023, making it the most widely used marine fuel. However, the increasing focus on environmental sustainability and the need to reduce sulfur emissions have led to the exploration of cleaner alternatives, such as LNG. LNG utilization in industrial applications is also on the rise, with the demand for insulation, valves, pumps, and membranes driving the market growth.

- LNG metering, a crucial aspect of LNG infrastructure, ensures accurate measurement and delivery of LNG, contributing to the market's expansion. The LNG market dynamics are influenced by various factors, including LNG pricing, transportation, production, and carbon capture. The development of advanced LNG technologies, such as membrane separation and cryogenic distillation, is expected to further boost the market growth. LNG derivatives, such as LNG options and futures contracts, offer price risk management solutions, providing stability to the LNG market. The integration of LNG into the power sector and its use as a feedstock in the chemical industry are also expanding the market's scope.

- In conclusion, the LNG market is witnessing significant growth due to its increasing use as a marine fuel and in various industrial applications. The market's expansion is driven by factors such as technological advancements, pricing dynamics, and the need for environmental sustainability.

What challenges does the Liquefied Natural Gas (LNG) Industry face during its growth?

- The volatility of global oil and gas prices poses a significant challenge to the industry's growth trajectory.

- The LNG market is a significant component of the global energy sector, encompassing various aspects such as LNG vaporization, processing, shipping, power generation, and regulations. LNG vaporization converts natural gas into liquid form for transportation and storage. LNG shipping involves transporting this liquid via specialized vessels to various destinations. LNG heavy-duty vehicles utilize this fuel for transportation, contributing to the reduction of greenhouse gas emissions. LNG hedging is a risk management strategy used by market participants to protect against price volatility. LNG power generation is a cleaner alternative to traditional coal-fired power plants, making it an attractive option for energy producers and consumers.

- LNG processing involves extracting LNG from natural gas through a series of cooling processes. Regulations play a crucial role in the LNG market, with various international and national bodies setting standards for safety, environmental impact, and trade. LNG biomethane, derived from renewable sources, is gaining popularity due to its lower carbon footprint and potential to reduce greenhouse gas emissions. LNG terminals are essential infrastructure for the LNG market, facilitating the loading and unloading of LNG vessels and the transfer of LNG to pipelines or trucks. LNG spot prices reflect the current market conditions and can be volatile due to various factors, including supply and demand imbalances, geopolitical events, and weather conditions.

- The LNG market's dynamics are influenced by various factors, including production costs, transportation costs, government policies, and technological advancements. Companies in the LNG value chain face challenges such as high capital costs, operational risks, and regulatory compliance. Despite these challenges, the LNG market continues to grow, driven by increasing demand for cleaner energy sources and the need to diversify energy supplies.

Exclusive Customer Landscape

The liquefied natural gas (LNG) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the liquefied natural gas (LNG) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, liquefied natural gas (lng) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bechtel Corp. - The company specializes in delivering comprehensive liquefied natural gas (LNG) solutions, encompassing engineering, procurement, and construction (EPC) services, alongside advanced hydrocarbon technology for LNG liquefaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bechtel Corp.

- BP Plc

- Cheniere Energy Inc.

- Chevron Corp.

- China Petrochemical Corp.

- Eni SpA

- Equinor ASA

- Exxon Mobil Corp.

- Fluor Corp.

- Freeport LNG Development LP

- Gasum Oy

- INPEX Corp.

- PAO NOVATEK

- PetroChina Co. Ltd.

- Qatargas Operating Co. Ltd.

- SEFE Energy Ltd.

- Sempra

- Shell plc

- TechnipFMC plc

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Liquefied Natural Gas (LNG) Market

- In February 2023, Qatar Petroleum and ExxonMobil announced a significant expansion of their global LNG partnership. The two companies signed an agreement to increase their joint venture's production capacity from 7.5 million tons per annum (mtpa) to 11 mtpa at the Goldboro LNG project in Nova Scotia, Canada (ExxonMobil press release, 2023). This strategic collaboration represents a substantial investment in LNG production and underscores the growing demand for cleaner energy sources.

- In March 2024, Royal Dutch Shell received a crucial regulatory approval from the U.S. Federal Energy Regulatory Commission (FERC) for its proposed LNG export terminal in Texas, known as the Annova LNG Terminal. This approval marks a significant milestone in the project's development and paves the way for the first U.S. LNG export terminal to be owned and operated by an African company (Shell press release, 2024). The terminal, with an initial capacity of 5 mtpa, is expected to contribute significantly to the global LNG market.

- In May 2024, TotalEnergies and Adani Green Energy Limited signed a memorandum of understanding (MoU) to jointly develop a green hydrogen and LNG project in India. This collaboration represents a significant step towards decarbonizing the energy sector, as it combines renewable energy and LNG to produce green hydrogen (TotalEnergies press release, 2024). The project is expected to have a production capacity of 1 GW for green hydrogen and 5 mtpa for LNG.

Research Analyst Overview

- The LNG market continues to evolve, shaped by various trends and dynamics. Innovation trends, such as advanced LNG storage solutions and transportation optimization, are enhancing the competitiveness of this fuel in the energy sector. Risk management remains a critical concern for LNG market participants, with risk assessment and pricing strategies playing essential roles in mitigating uncertainties. Demand projections for LNG remain strong, driven by increasing adoption in maritime transportation through LNG-fueled vessels. Environmental regulations and sustainability initiatives are shaping the future trends in the LNG industry, with a growing emphasis on reducing emissions and improving fuel efficiency.

- LNG market integration and economic impact are significant factors influencing the market's growth. The development of infrastructure, including bunkering infrastructure and LNG-related investments, is crucial for expanding the reach of this cleaner fuel. Geopolitical factors and safety regulations also play a role in shaping the market outlook. Technology advancements continue to drive innovation in the LNG sector, with price forecasting and financial instruments offering new opportunities for risk management. Industry partnerships and collaboration are essential for addressing the challenges of LNG transportation and storage. Overall, the LNG market is poised for continued growth, with various trends and factors shaping its future trajectory.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Liquefied Natural Gas (LNG) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 27.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Qatar, Russia, China, Norway, Saudi Arabia, Canada, Japan, UAE, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Liquefied Natural Gas (LNG) Market Research and Growth Report?

- CAGR of the Liquefied Natural Gas (LNG) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, Europe, APAC, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the liquefied natural gas (lng) market growth of industry companies

We can help! Our analysts can customize this liquefied natural gas (lng) market research report to meet your requirements.