Spirit-Based RTD Mixes Market Size 2024-2028

The spirit-based RTD mixes market size is forecast to increase by USD 980.1 million at a CAGR of 5.32% between 2023 and 2028. The spirit-based ready-to-drink (RTD) mixes market is experiencing significant growth due to several key factors. One trend driving this market is the convenience factor, as consumers lead increasingly busy lifestyles and seek out convenient options for enjoying their favorite spirits. Another trend is the incorporation of functional and health-enhancing ingredients into spirit-based RTDs, making them more appealing to health-conscious consumers. Additionally, the rise of DIY and home mixology culture has led to increased competition for spirit-based RTDs from non-alcoholic beverages. Innovations such as shot glasses with built-in spirit measures and plastic balls infused with flavors are also contributing to the growth of this market.

What will the size of the market be during the forecast period?

The spirit-based ready-to-drink (RTD) mixes market in the United States has been experiencing steady growth, driven by consumers' increasing preference for convenience and premiumization in their alcoholic beverage choices. This sector caters to a wide range of spirit types, including rum, whiskey, vodka, and bourbon, among others. Fresh and premium ingredients are a key focus in the market. Manufacturers are increasingly using natural flavors and high-quality ingredients to cater to the evolving tastes of consumers. Single serving, sealed containers have gained popularity due to their convenience and portability, making it easier for consumers to enjoy their favorite cocktails anytime, anywhere. Packages for spirit-based RTD mixes come in various forms, such as shot glasses, plastic balls, and other innovative designs, to enhance the overall drinking experience. The use of chemical compounds like triammonium citrate, dioctyl sodium, sodium dioctylsulfosuccinate, alcohol ethoxylate, and benzene sulfonates, among others, is common in the production of spirit-based RTD mixes. These compounds help stabilize the drink, improve its texture, and enhance its flavor.

Further, the market is witnessing significant innovation, with new product launches and product extensions. For instance, there has been a growing trend towards the development of cocktail-in-a-can formats, which offer the convenience of a can and the taste of a well-crafted cocktail. Additionally, the market is seeing an increase in the number of offerings from craft distilleries, which cater to consumers seeking authentic and unique spirit-based beverages. In conclusion, the market in the US is a dynamic and growing industry, driven by consumers' demand for convenience, premiumization, and innovation. Manufacturers are responding to this trend by offering high-quality, natural ingredients, convenient packaging, and a wide range of spirit types and flavors. The use of chemical compounds is common in the production process to ensure stability, texture, and flavor enhancement. The market is expected to continue growing, as consumers' preferences for convenient, premium, and unique alcoholic beverage options continue to evolve.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Dark spirit-based RTD mixes

- Light spirit-based RTD mixes

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Product Insights

The dark spirit-based RTD mixes segment is estimated to witness significant growth during the forecast period. Dark spirits, including dark rum, have gained significant popularity among consumers due to their rich, complex flavors. This trend has resulted in a growing demand for ready-to-drink (RTD) mixes that feature these spirits. Old Fashioned and other classic cocktails made with dark spirits, such as dark rum, continue to be popular choices. Premiumization is a key trend in the beverage industry, leading to an increased preference for high-quality RTD mixes made with premium dark spirits, like Bacardi Dark Rum.

Further, specialist retailers and on-trade establishments, such as bars and restaurants, are major contributors to the demand for these RTD mixes. Convenience stores also stock a variety of RTD mixes to cater to consumers' increasing demand for premium and convenient drinking options. The market for spirit-based RTD mixes is expected to grow steadily, reflecting the ongoing trend towards premium spirits and the popularity of classic cocktails.

Get a glance at the market share of various segments Request Free Sample

The dark spirit-based RTD mixes segment accounted for USD 1.43 billion in 2018 and showed a gradual increase during the forecast period.

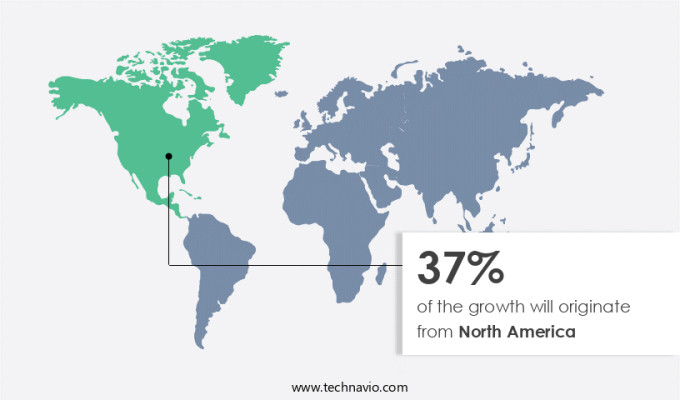

Regional Insights

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market for dark spirit-based Ready-to-Drink (RTD) mixes continues to gain traction among consumers in urban areas, particularly among the young population. These convenient beverage options cater to the busy lifestyles of individuals who seek authentic and superior-tasting cocktails without the hassle of mixing ingredients. The preference for dark spirit-based RTDs is driven by a diverse range of flavors and innovations that cater to various consumer preferences. Health-conscious consumers are increasingly opting for lower-calorie and lower-alcohol RTD options, aligning with the trend towards healthier lifestyle choices. Moreover, continuous innovation in flavors, packaging, and formulations keeps the market dynamic and appealing to consumers.

Further, limited-edition and seasonal releases create excitement and drive sales, as seen with the recent collaboration between Brown Forman Corp. And The Coca-Cola Co. To launch a new RTD cocktail, Jack Daniel's & Coca-Cola, in June 2023. Despite the appeal of RTD mixes, concerns regarding potential health risks, such as liver damage, dental disorders, diabetes, and infertility, may deter some consumers. However, the market is expected to continue growing, as consumers prioritize convenience and superior taste over potential health risks. In conclusion, the market for dark spirit-based RTD mixes is a dynamic and growing industry that caters to the diverse preferences and lifestyles of consumers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The incorporation of functional and health-enhancing ingredients into spirit-based RTD is notably driving market growth. The Market encompasses a wide range of ready-to-drink (RTD) beverages, including Alcopops, Cobbler, Cocktails, and Bai Antioxidant Beverages. These beverages incorporate various spirits such as rum, vodka, whiskey, gin, and others. Dark rum, specifically Bacardi Dark rum, is a popular choice for many RTD mixes.

Moreover, the market caters to diverse channels, including On-Trade establishments, Specialist Retailers, Convenience Stores, and various retail formats like Supermarkets, Hypermarkets, and Retail Stores, as well as Online Stores. Dark spirit-based RTDs are gaining traction in urban areas due to their convenience and appeal to a young population. However, concerns regarding the use of chemical compounds like triammonium citrate, dioctyl sodium, sodium dioctylsulfosuccinate, alcohol ethoxylate, and benzene sulfonates in the production process may deter some consumers. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

The rise of DIY and home mixology culture is the key trend in the market. The Market encompasses a diverse range of beverages, including Alcopops, Cobbler, Cocktails, and Bai Antioxidant Beverages. These beverages often incorporate dark spirits such as rum, particularly Bacardi Dark rum, with various chemical compounds like triammonium citrate, dioctyl sodium, sodium dioctylsulfosuccinate, alcohol ethoxylate, and benzene sulfonates. These additives enhance the taste and texture of the beverages.

Moreover, craft distilleries have gained popularity in urban areas, catering to a young population's preference for unique and premium spirit-based RTDs. On-Trade and Specialist Retailers, as well as Convenience Stores, Supermarkets, Hypermarkets, Retail Stores, and Online Stores, stock a wide variety of these beverages in Cans and Bottles. However, the consumption of spirit-based RTDs can lead to health concerns such as liver damage, dental disorders, diabetes, and infertility. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Competition from non-alcoholic beverages is the major challenge that affects the growth of the market. The Market encompasses a wide range of beverages, including Alcopops, Cobbler, Cocktails, and Bai Antioxidant Beverages. These beverages often feature spirits such as rum, vodka, whiskey, gin, and others. Dark rum, like Bacardi Dark rum, is a popular choice for RTD mixes. The market caters to various channels, including On-Trade establishments and Specialist Retailers, as well as Convenience Stores and Supermarkets/Hypermarkets.

Moreover, chemical compounds such as triammonium citrate, dioctyl sodium, sodium dioctylsulfosuccinate, alcohol ethoxylate, and benzene sulfonates are used in the production of these RTDs. The market for these beverages is particularly strong in urban areas with a young population. However, concerns regarding liver damage, dental disorders, diabetes, and infertility associated with excessive alcohol consumption may impact market growth. Liquors like rum, vodka, whiskey, and gin are often used to create popular cocktails such as Mojitos, Martini, Manhattan, Cosmopolitan, and Old Fashioned. Hence, the above factors will impede the growth of the market during the forecast period.

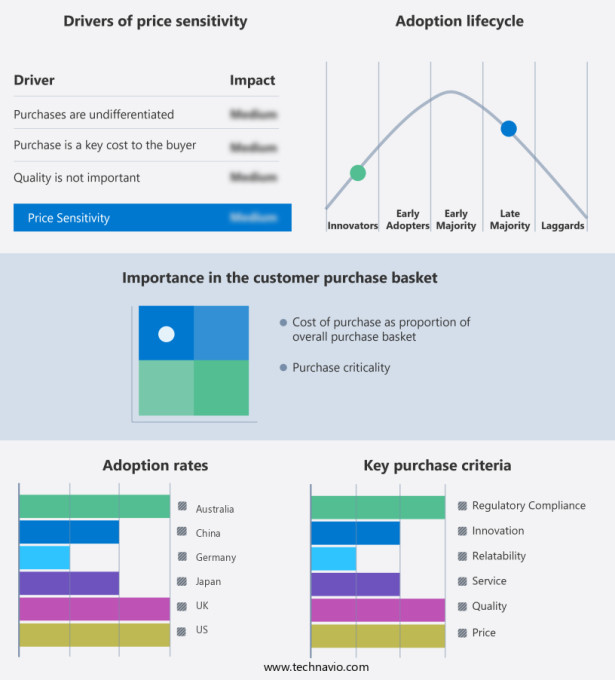

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anheuser Busch InBev SA NV: The company offers Spirit-based RTD Mixes such as Tiki Rum Punch, Cutwater Spirits and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Group Holdings Ltd.

- Bacardi Ltd.

- Suntory Global Spirits Inc.

- Brown Forman Corp.

- Campari Group

- Constellation Brands Inc.

- Cutwater Spirits LLC

- Diageo Plc

- Euphoric Beverages Pvt Ltd.

- Flavorman

- HEINKEN Beverages

- Molson Coors Beverage Co.

- PepsiCo Inc.

- Pernod Ricard SA

- Radico Khaitan Ltd.

- T.Hasegawa USA Inc.

- The Coca Cola Co.

- The Mark Anthony Group of Companies

- Zing Zang, LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The spirit-based Ready-to-Drink (RTD) mixes market is witnessing significant growth due to the increasing preference for convenience and the trend of enjoying cocktails at home. These RTDs come in various flavors such as mojitos, martinis, manhattans, cosmopolitans, old fashioned, and more, made with dark spirits like rum and whiskey, or clear spirits like vodka and gin. The market caters to diverse consumer segments, including urban areas with a young population, on-trade establishments, specialist retailers, and convenience stores. Chemical compounds like triammonium citrate, dioctyl sodium, sodium dioctylsulfosuccinate, alcohol ethoxylate, and benzene sulfonates are used in the production of spirit-based RTDs.

However, health concerns, such as liver damage, dental disorders, diabetes, and infertility, are driving the demand for non-alcoholic beverages in the market. The convenience factor and busy lifestyles of consumers are fueling the growth of the spirit-based RTDs market. The use of fresh and premium ingredients, single serving sealed containers, and packages catering to different consumer preferences further boosts market growth. Aluminum cans and plastic bottles are the most common packaging materials used in the market, but there is a growing trend towards eco-friendly and sustainable packaging solutions. Inflation and rising alcohol prices are some of the challenges facing the spirit-based RTDs market. However, the market is expected to continue growing as consumers seek convenient and premium drinking experiences at home.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.32% |

|

Market growth 2024-2028 |

USD 980.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.14 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, Japan, Germany, UK, China, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anheuser Busch InBev SA NV, Asahi Group Holdings Ltd., Bacardi Ltd., Suntory Global Spirits Inc., Brown Forman Corp., Campari Group, Constellation Brands Inc., Cutwater Spirits LLC, Diageo Plc, Euphoric Beverages Pvt Ltd., Flavorman, HEINKEN Beverages, Molson Coors Beverage Co., PepsiCo Inc., Pernod Ricard SA, Radico Khaitan Ltd., T.Hasegawa USA Inc., The Coca Cola Co., The Mark Anthony Group of Companies, and Zing Zang, LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch