Rubber Bonded Abrasive Market Size 2024-2028

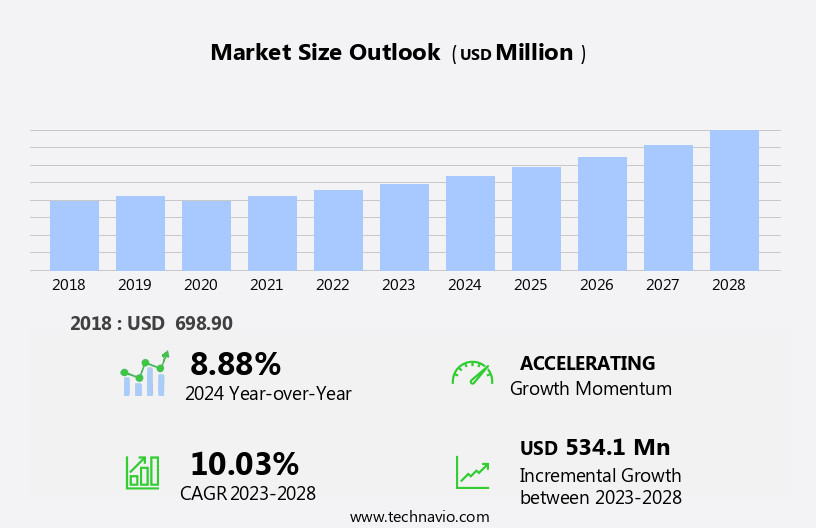

The rubber bonded abrasive market size is forecast to increase by USD 534.1 million at a CAGR of 10.03% between 2023 and 2028.

- The Rubber Bonded Abrasives market experiences significant growth, driven by the increasing demand from heavy industries and high-speed applications. This trend is attributed to the superior performance and durability of rubber bonded abrasives in heavy-duty applications, such as metalworking, mining, and construction. However, market expansion encounters challenges. Regulatory hurdles impact adoption due to stringent environmental regulations governing the use of certain abrasive materials. Additionally, machine parameter constraints, including power requirements and abrasive grain size compatibility, necessitate careful consideration in the selection and application of rubber bonded abrasives.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory developments and invest in research and development to address machine parameter constraints. By doing so, they can offer innovative solutions that cater to the evolving needs of industries and end-users.

What will be the Size of the Rubber Bonded Abrasive Market during the forecast period?

- The market experiences continuous growth driven by the increasing demand for high-precision components in various industries. Geometric accuracy and dimensional accuracy are crucial factors in high-speed grinding applications, where abrasive lubrication and coolant play essential roles in ensuring tool life and surface quality. Abrasive wear resistance, corrosion resistance, and bond strength are key considerations for manufacturers seeking to enhance surface integrity and improve bond porosity. Robotic grinding and automated grinding processes, coupled with advances in abrasive recycling and disposal methods, contribute to increased efficiency and sustainability.

- Surface roughness, impact resistance, and heat resistance are also critical factors in abrasive selection for CNC grinding, lapping, honing, and polishing applications. Grain density, distribution, and cutting edge retention are essential for maintaining optimal abrasive performance in abrasive machining processes, including waterjet cutting and blasting. Safety remains a top priority, with ongoing efforts to improve abrasive safety and minimize environmental impact.

How is this Rubber Bonded Abrasive Industry segmented?

The rubber bonded abrasive industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Synthetic rubber

- Natural rubber

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Material Insights

The synthetic rubber segment is estimated to witness significant growth during the forecast period.

Synthetic rubber bonded abrasives, utilizing thermoplastic polymers like styrene-isoprene block copolymers (SIS), neoprene, and styrene butadiene rubber (SBR), account for the largest share of abrasive grain production. These materials consist of 80-90% abrasive grains. The binder for synthetic rubber adhesive employs copolymers and mechanical mixtures. The primary application of rubber-bonded abrasives lies in grinding wheels for carbides and ceramics. The manufacturing process involves selecting the appropriate abrasive grain, sieving it, and kneading it into synthetic rubber. A vulcanizing agent, such as sulfur, is incorporated, followed by rolling the mixture between steel calendar rolls to create a sheet of the desired thickness.

Abrasive optimization, coated abrasives, abrasive cloth, and various abrasive technologies, including resin, vitrified, ceramic, and metal bond, contribute to the market's evolution. Abrasive grains, such as aluminum oxide and silicon carbide, are integral to surface finishing processes. Abrasive efficiency, durability, and performance are crucial factors driving market growth. Abrasive tools, including abrasive paper, belts, rolls, discs, flaps, brushes, and pastes, cater to diverse applications within the manufacturing industry. Zirconia alumina and other advanced abrasive materials further expand the market's scope.

The Synthetic rubber segment was valued at USD 605.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 71% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth due to the revival of key manufacturing industries following the COVID-19 pandemic. Manufacturers in the area are transitioning from mercury-based production to membrane technology. The metal and steel industries are the primary drivers of this market, as rubber bonded abrasives are extensively used in manufacturing and assembly lines, finishing processes, tool production, and maintenance and repair applications. These abrasives offer advantages such as improved efficiency, durability, and versatility. Aluminum oxide and silicon carbide are commonly used abrasive grains, while abrasive technology includes resin, vitrified, ceramic, and metal bonds.

Coated abrasives, abrasive cloth, abrasive paper, abrasive stones, abrasive belts, abrasive rolls, abrasive discs, and abrasive brushes are various forms of rubber bonded abrasives. Abrasive optimization and abrasive selection are crucial for maximizing abrasive life and performance. The manufacturing industry relies heavily on these abrasives for material removal and surface finishing processes. Zirconia alumina and other advanced abrasive materials are also gaining popularity for their superior properties. Overall, the market in APAC is poised for continued growth, driven by the evolving needs of the manufacturing sector.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Rubber Bonded Abrasive market drivers leading to the rise in the adoption of Industry?

- The significant demand for rubber bonded abrasives in heavy industries serves as the primary market driver.

- Rubber bonded abrasives are essential components in heavy industry applications, offering unique benefits for various processes. These abrasives provide flexibility for use in foundries where fixed points are necessary, as well as for precise cutting and grinding of intricate industrial tool details. In the steel industry, they are extensively employed to remove scale or imperfections from steel slab surfaces. The versatility of rubber bonded abrasives makes them indispensable for heavy industries, as they offer high resistance to temperature and cater to various grinding, grooving, cutting, polishing, regulating, and flute grinding requirements.

What are the Rubber Bonded Abrasive market trends shaping the Industry?

- High-speed applications are experiencing rising demand, representing a significant market trend. This increasing need for high-performance solutions is a key development in various industries.

- Rubber bonded abrasives offer flexibility and enhanced performance in various industries, including transportation, electrical and electronic equipment manufacturing, and medical equipment production. These abrasives, which utilize resin bond technology, provide significant benefits in high-speed applications. The improved adhesive bonds, formed by the combination of rubber bonded abrasives and bond lines, enable faster and more reliable manufacturing processes. Additionally, rubber bonded abrasives contribute to cost savings by reducing surface requirements, initial investment, labor costs, and maintenance expenses. The versatility of these abrasives in diverse industrial applications results in accelerated performance and timely responses.

- Abrasive selection, grit size, and optimization are essential factors in ensuring the effective use of coated abrasives, abrasive powders, and abrasive cloth in various industries. Abrasive technology continues to evolve, offering advancements in vitrified bond and other bonding methods to cater to the evolving needs of the manufacturing sector.

How does Rubber Bonded Abrasive market faces challenges face during its growth?

- The growth of the industry is significantly impacted by the constraints imposed on machine parameters, which represents a major challenge that necessitates continuous innovation and optimization.

- In the realm of industrial surface finishing, the selection of appropriate abrasives is crucial for efficient and effective grinding operations. Among various abrasive types, rubber bonded abrasives have gained significant attention due to their versatility and adaptability to diverse applications. These abrasives, which come in the form of papers and stones, are characterized by their ceramic bond and ability to maintain abrasive grain integrity, ensuring high abrasive efficiency and durability. Rubber bonded abrasives are particularly suitable for applications requiring low to medium grinding pressures, such as automotive body repair, metal fabrication, and glass processing. Their unique feature lies in their ability to conform to the contours of the workpiece, making them an ideal choice for finishing complex shapes and irregular surfaces.

- The rubber bond material allows for excellent bonding to the abrasive grain, ensuring minimal grain loss during use. Furthermore, the application of lubricants and diverse treatment processes, such as honing and lapping, can be employed to optimize the performance of rubber bonded abrasives for specific applications. The importance of selecting the right abrasive tool features cannot be overstated, as it is a prerequisite for smooth operation and meeting the requirements of various industrial grinding applications. Rubber bonded abrasives, with their adaptability and high performance, have proven to be a valuable asset in the realm of surface finishing.

Exclusive Customer Landscape

The rubber bonded abrasive market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rubber bonded abrasive market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rubber bonded abrasive market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a diverse range of rubber bonded abrasives, ideal for various applications and materials.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Abrasives Manhattan SA

- ARTIFEX Dr. Lohmann GmbH and Co. KG

- atto Abrasives Ltd.

- Carborundum Universal Ltd.

- Compagnie de Saint Gobain

- CRATEX Manufacturing Co.

- Illinois Tool Works Inc.

- Lowton Abrasive Ltd.

- Marrose Abrasives

- MISUMI Group Inc.

- PACER Industries Inc.

- PFERD Inc.

- SAK ABRASIVES Ltd.

- Schwarzhaupt GmbH and Co. KG

- Super Abrasives

- Tyrolit Schleifmittelwerke Swarovski KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rubber Bonded Abrasive Market

- In February 2024, 3M, a leading industrial company, announced the launch of its new line of rubber bonded abrasives, the Scotch-Brite⢠Abrasive Discs, engineered for enhanced durability and improved cutting performance (3M Press Release, 2024). This expansion underscores 3M's commitment to innovation and market leadership in the abrasives sector.

- In July 2025, Saint-Gobain Abrasives, a global abrasive solutions provider, entered into a strategic partnership with Sandvik, a Swedish engineering group, to jointly develop and commercialize advanced rubber bonded abrasive products (Saint-Gobain Abrasives Press Release, 2025). This collaboration is expected to accelerate product innovation and expand their market reach in the metalworking industry.

- In October 2024, Pfeiffer Vacuum, a leading vacuum technology provider, acquired the rubber bonded abrasive business of Ermetco GmbH, a German abrasive manufacturer, to strengthen its position in the abrasives market and expand its product portfolio (Pfeiffer Vacuum Press Release, 2024). This acquisition marks a significant strategic move to capitalize on the growing demand for advanced abrasive solutions.

- In March 2025, the European Union passed the new REACH regulation, which set stricter safety and environmental standards for rubber bonded abrasives and other industrial products (European Chemicals Agency, 2025). This regulatory development emphasizes the importance of sustainable manufacturing practices and increased transparency in the industry. Companies are now required to comply with these new regulations, which may impact their production costs and market competitiveness.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and diverse applications across various sectors. Ceramic bond abrasives, known for their high strength and durability, are increasingly being adopted for surface finishing in the manufacturing industry. Abrasive efficiency and durability are paramount in this context, with aluminum oxide and other abrasive grains playing crucial roles. Rubber bond abrasive paper and stones are widely used for stock removal and material finishing, respectively. Abrasive engineering and optimization techniques are essential in ensuring optimal abrasive performance and extending abrasive life. Coated abrasives and abrasive cloths offer enhanced flexibility and adaptability, while abrasive pastes and belts cater to specific grinding applications.

Abrasive efficiency and abrasive durability are key factors influencing market dynamics. The ongoing quest for improved abrasive performance and cost-effectiveness is driving innovation in abrasive technology. Silicon carbide and other abrasive grains are being explored for their unique properties, while abrasive discs and flaps are gaining popularity in metal bond applications. The manufacturing industry's ever-evolving requirements continue to shape the abrasive market. Abrasive tools and brushes, electroplated bond abrasives, and abrasive rolls are all essential components in various manufacturing processes. Grinding wheels and abrasive process adaptations are essential for maintaining production efficiency and ensuring consistent quality.

In summary, the market is characterized by continuous innovation and evolution, with a focus on enhancing abrasive efficiency, durability, and adaptability to meet the diverse needs of various industries. Abrasive grains, bond types, and application-specific products are all crucial elements in this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rubber Bonded Abrasive Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 534.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rubber Bonded Abrasive Market Research and Growth Report?

- CAGR of the Rubber Bonded Abrasive industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rubber bonded abrasive market growth of industry companies

We can help! Our analysts can customize this rubber bonded abrasive market research report to meet your requirements.