India Sanitary Pumps Market Size 2024-2028

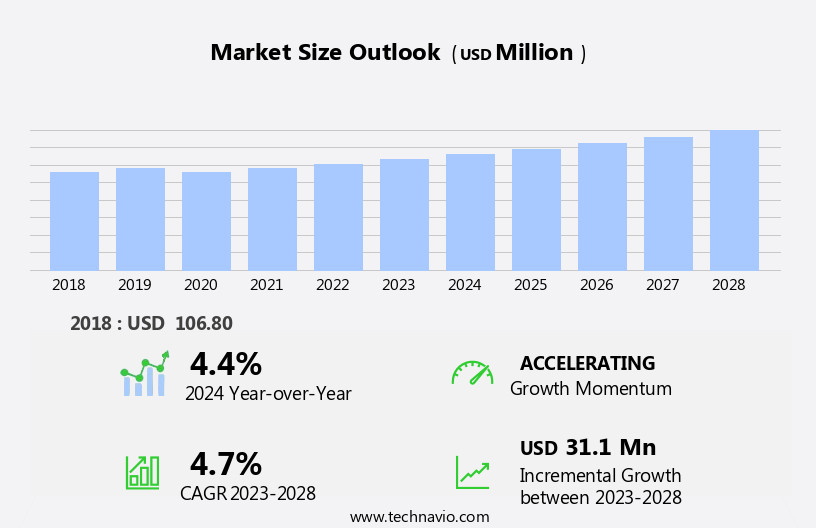

The india sanitary pumps market size is forecast to increase by USD 31.1 million at a CAGR of 4.7% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing demand from the food and beverage industry. This sector's expansion is primarily due to the rising awareness of food safety and hygiene regulations. In addition, the growing preference for twin-screw pumps, known for their superior performance and ability to handle viscous and high-shear applications, is fueling market growth. Moreover, the trend towards repair and remanufacture and rental model for pump procurement is gaining traction in India. This shift is driven by the need for cost savings and operational efficiency, especially among small and medium-sized enterprises. However, the market is not without challenges, including the high initial investment cost and the availability of counterfeit products in the market.

- To capitalize on the market opportunities and navigate these challenges effectively, companies need to focus on offering competitive pricing, ensuring product quality, and providing excellent after-sales service. By doing so, they can establish a strong market presence and build long-term customer relationships.

What will be the size of the India Sanitary Pumps Market during the forecast period?

- The sanitary pumps market is experiencing significant growth, driven by the increasing demand for hygiene and cleanliness in various industries, including pharmaceutical, cosmetic, and food processing. Machine learning algorithms and lean manufacturing practices are being integrated into smart pumps to enhance their performance and efficiency. Hygiene requirements in these industries necessitate the use of chemicals and air power sources, making energy-efficient pumps a priority. Fluid handling systems are becoming increasingly sophisticated, with sensors and IoT connectivity enabling predictive maintenance technology. Value-added services, such as self-diagnostic capabilities, are also gaining popularity. The market for sanitary pumps is expanding in sectors like biotechnology and biopharmaceutical, where stringent regulations and high standards for fluid handling are essential.

- Stainless steel sanitary pumps are a preferred choice due to their durability and resistance to corrosion. The market for fluid handling solutions is expected to grow, with automated pumps and single-use systems becoming more common in beverages and other industries. IIOT technology is transforming the industry by enabling real-time monitoring and optimization of pump performance.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PD sanitary pump

- Centrifugal sanitary pump

- End-user

- Food and beverage

- Pharmaceutical

- Others

- Geography

- North America

- Europe

- Middle East and Africa

- APAC

- India

- South America

- Rest of World (ROW)

- North America

By Product Insights

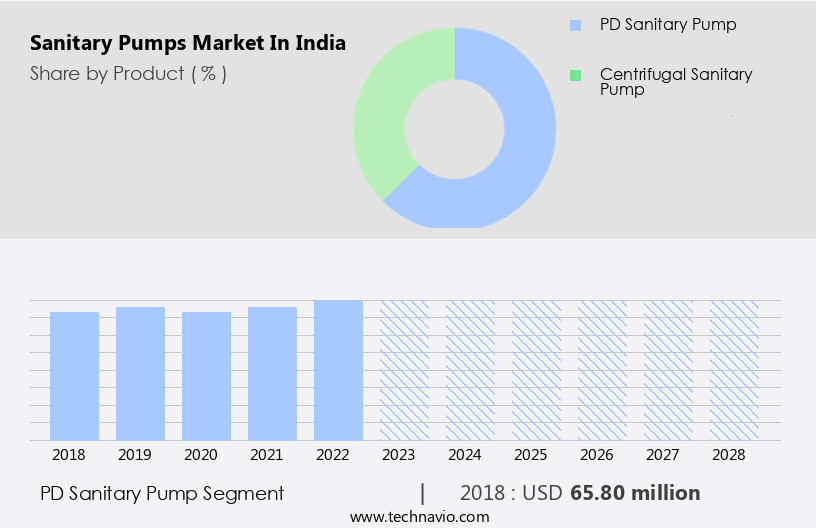

The pd sanitary pump segment is estimated to witness significant growth during the forecast period.

Sanitary pumps, specifically positive displacement (PD) pumps, play a significant role in various industries, including food and beverage and pharmaceutical sectors. PD pumps, which utilize rollers, gears, or impellers to transfer fluids into a fixed cavity, offer continuous flow regardless of pressure changes. This feature is essential in applications where maintaining consistent fluid flow is crucial. The PD sanitary pumps market experiences growth due to the introduction of advanced types, such as twin-screw pumps. These pumps cater to the increasing demand for hygienic and efficient fluid handling solutions in industries with stringent hygiene requirements, like food processing and pharmaceuticals. Stainless steel, a popular material for sanitary pumps, ensures durability and resistance to corrosion.

Lean manufacturing practices and the integration of Internet of Things (IoT) technologies, such as remote monitoring systems and predictive maintenance, further enhance the market's growth. Additionally, the demand for eco-friendly pumps and automated systems is on the rise, driven by the increasing focus on sustainability and the need for streamlined operations. The use of materials like Hastelloy, Titanium, and Ceramic in pump manufacturing caters to various industry-specific needs. Moreover, the biotechnology and biopharmaceutical industries rely on value-added services, such as cleaning-in-place (CIP) and sterilization-in-place (SIP), to ensure product purity and maintain regulatory compliance. Centrifugal pumps and peristaltic pumps are also widely used in these industries due to their unique advantages.

In the water treatment sector, the focus on water management systems and energy-efficient pumps has led to increased adoption, particularly in applications like wastewater treatment and desalination. The shale gas boom and hydraulic fracturing have also contributed to the growth of the sanitary pumps market in the energy sector. Overall, the sanitary pumps market is driven by the evolving needs of various industries and the ongoing advancements in pump technology. The integration of machine learning algorithms and IoT connectivity further enhances the market's potential for growth.

Get a glance at the market share of various segments Request Free Sample

The PD sanitary pump segment was valued at USD 65.80 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Sanitary Pumps Market?

- Increasing demand for sanitary pumps in food and beverage industry is the key driver of the market.

- In India, the food and beverage sector is a significant consumer of sanitary pumps due to the increasing emphasis on cleanliness and hygiene. The industry's transformation, driven by food technology and stringent food safety regulations, has led to a heightened focus on maintaining high standards in establishments such as restaurants. Commercial kitchens are also adopting automation to ensure food hygiene and efficient service.

- The food and beverage sector's evolution in India is a key market dynamic fueling the demand for sanitary pumps. This trend is expected to continue as the sector's growth accelerates and the need for advanced technologies to maintain hygiene becomes increasingly important.

What are the market trends shaping the India Sanitary Pumps Market?

- Increasing demand for twin-screw pumps is the upcoming trend in the market.

- Twin-screw pumps are a type of self-priming, double-ended PD pumps that utilize external timing gears and bearings. During operation, these pumps do not have metal-to-metal contact within the pump housing, leading to reduced maintenance costs on lubrication and corrosion. The rotation of the twin-screw pump creates intermeshing chambers between the screws and the pump housing, which fill with the pumped fluid and transfer it from the suction to the discharge side.

- This design allows for reverse flow by changing the shaft direction, making it possible to switch the suction and discharge without requiring any modifications to the pump. The efficient design and versatility of twin-screw pumps contribute to their popularity in various industries.

What challenges does India Sanitary Pumps Market face during the growth?

- Rising demand for repair and remanufacture and rental model for pump procurement is a key challenge affecting the market growth.

- The Indian sanitary pumps market is experiencing a shift towards equipment rental as companies discover the cost-efficiency of leasing over purchasing new equipment. This trend is particularly noticeable in the pumping sector. The uncertain economic climate in India and the increasing focus on reducing operational expenses are driving the popularity of equipment rental. In response, both pump manufacturers and distributors are strategically focusing on the rental market to cater to the demands of end-user industries.

- This dynamic has resulted in a decline in new pump sales. Despite this challenge, the market presents significant opportunities for growth as the rental sector continues to gain traction.

Exclusive India Sanitary Pumps Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Creative Engineers

- Das Engineering Works

- Dover Corp.

- FEC India Pvt. Ltd.

- FLOWTECH

- FRISTAM Pumpen KG GmbH and Co.

- GEA Group AG

- Hydro Prokav Pumps India Pvt Ltd.

- IDEX Corp.

- Infinity Pumps and Systems Pvt. Ltd.

- INOXPA INDIA Pvt. Ltd.

- KSB SE and Co. KGaA

- Minimax Pumps Pvt. Ltd.

- Sealtech Engineers

- SPX FLOW Inc.

- Sulzer Ltd.

- Taha Pumps and Valves

- Verder International BV

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for hygiene and sanitation solutions in various industries. These pumps play a crucial role in handling fluids that require stringent hygiene and sanitation standards, such as those used in the food, pharmaceutical, and biotechnology sectors. Stainless steel sanitary pumps are a popular choice in this market due to their durability and resistance to corrosion. Lean manufacturing practices are also driving the adoption of these pumps as they help in reducing downtime and improving overall efficiency. The integration of smart technologies, such as sensors and remote monitoring systems, is further enhancing the performance and reliability of sanitary pumps.

The use of eco-friendly pumps is another trend gaining traction in the market. These pumps are designed to minimize energy consumption and reduce environmental impact, making them an attractive option for industries looking to adopt sustainable practices. Automated pumps and IIoT connectivity are also becoming increasingly popular, enabling predictive maintenance and real-time monitoring of pump performance. The fluid handling market, which includes sanitary pumps, is expected to grow significantly due to the increasing demand for water treatment solutions. The water management sector is a major consumer of sanitary pumps, with applications ranging from industrial water treatment to wastewater management. The shale gas boom in India is also expected to drive the demand for sanitary pumps in the hydraulic fracturing process.

The use of non-self-priming pumps and sanitary valves is essential in ensuring the proper functioning of fluid handling systems. Peristaltic pumps are another type of sanitary pump that is gaining popularity due to their ability to handle viscous and corrosive fluids. The use of materials such as Hastelloy and titanium in the manufacturing of these pumps is also increasing due to their superior resistance to corrosion and high-temperature applications. The biopharmaceutical industry is a significant consumer of sanitary pumps due to the stringent hygiene requirements in the production of pharmaceuticals. The use of value-added services, such as cleaning-in-place (CIP) and sterilization-in-place (SIP), is also increasing to ensure the highest level of hygiene and sanitation.

The cosmetic and non-alcoholic beverage industries are also major consumers of sanitary pumps. Single-use systems and hygiene requirements are critical in these industries to ensure the production of high-quality products. Centrifugal pumps and positive displacement pumps are commonly used in these applications due to their ability to handle low to high flow rates and pressure requirements. In conclusion, the market is witnessing significant growth due to the increasing demand for hygiene and sanitation solutions in various industries. The integration of smart technologies, eco-friendly designs, and automation are driving the market's evolution. The fluid handling sector, including sanitary pumps, is expected to grow significantly due to the increasing demand for water treatment solutions.

The use of materials such as stainless steel, Hastelloy, and titanium, as well as the adoption of lean manufacturing practices, is also contributing to the market's growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2024-2028 |

USD 31.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch