Satellite Transponder Market Size 2024-2028

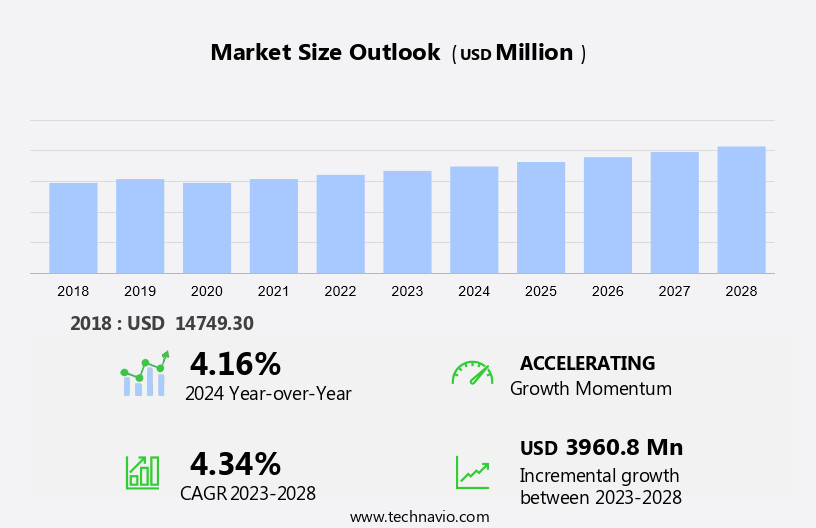

The satellite transponder market size is forecast to increase by USD 3.96 billion at a CAGR of 4.34% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market growth is the increasing adoption of High Throughput Satellite (HTS) technology. The market is expanding as fleet management companies increasingly rely on satellite transponders for real-time tracking and communication, while support services ensure seamless connectivity and reliable operations across various industries. HTS enables higher data rates, improved spectral efficiency, and broader coverage, making it an ideal solution for various applications, including broadband connectivity, video broadcasting, and telecommunications. Another trend influencing market growth is the rising demand for High Definition TVs (HDTVs) and video broadcasting. As consumers seek higher quality entertainment experiences, the demand for reliable and efficient satellite transponders to deliver HD content is on the rise. However, environmental interference, such as rain and snow, can negatively impact satellite performance, posing a challenge for market growth. Despite these challenges, the market is expected to continue expanding due to the increasing demand for reliable and high-speed connectivity solutions.

What will be the Size of the Satellite Transponder Market During the Forecast Period?

- The market encompasses a diverse range of applications, including commercial communications, government communications, navigation, and remote sensing. This market is experiencing significant growth, driven by the increasing demand for satellite-based applications in various sectors. Key trends include the expansion of broadband internet access through Ku-band and Ka-band transponders, the Internet of Things (IoT) and M2M communication, and the integration of satellite technology into consumer broadband, corporate enterprise networks, and telecommunications services. Additionally, the market is witnessing increased adoption of satellite communication infrastructure in broadcasting solutions, maritime communication, aviation services, disaster recovery, and other industries. The market size is substantial and continues to grow, with C-band, Ku-band, Ka-band, and K-band transponders in high demand for leasing and maintenance & support services. Overall, the market is poised for continued expansion, offering numerous opportunities for innovation and growth in the satellite communication technology landscape.

How is this Satellite Transponder Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Communication

- EO

- Technology development

- Navigation

- Space science

- Geography

- North America

- US

- Europe

- France

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

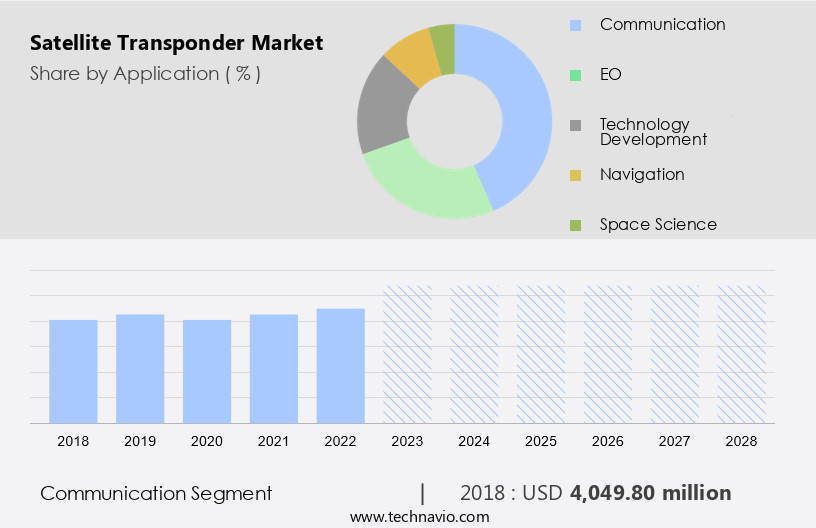

- The communication segment is estimated to witness significant growth during the forecast period.

The market caters to various communication applications, including commercial and government communications, navigation, remote sensing, maintenance and support, and broadcasting solutions. Transponders facilitate data transfer, voice, and text services through satellite networks, addressing the connectivity needs of regions not covered by terrestrial networks. With the increasing demand for broadband internet access and telecommunications services, the market for satellite transponders is experiencing growth. The advent of cost-effective launch vehicles enabling the deployment of nanosatellites further boosts market expansion. Applications encompassing Ku-band, Ka-band, and C-band segments include consumer broadband, corporate enterprise networks, disaster recovery, maritime communication, aviation services, and IoT applications. Additionally, satellite transponders support 5G backhaul, aircraft tracking, weather monitoring, in-flight networking, and cockpit communications.

Market participants include satellite operators, telecommunications companies, and broadcasting industries. Satellite capacity provisioning, satellite fleet management, and ground segment services are essential components of the satellite communication infrastructure. Customer support and emergency communication services are also integral to the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Communication segment was valued at USD 4.05 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

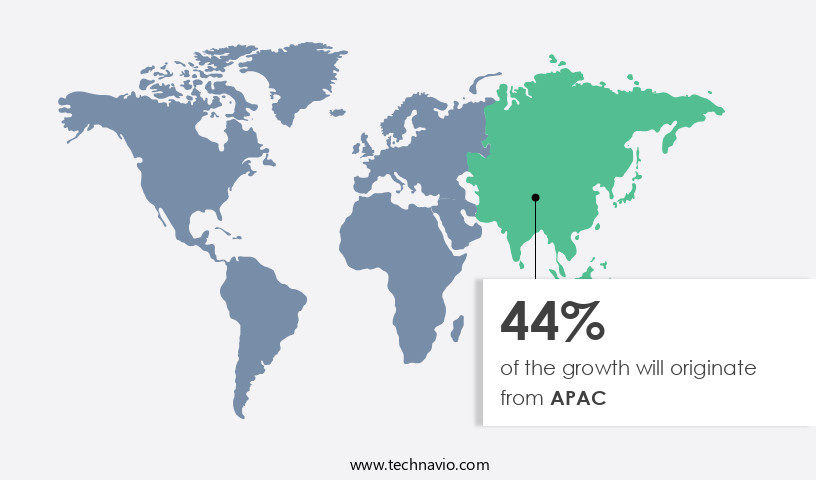

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds significant importance in the global satellite transponder industry, driven by technological innovations and a strong infrastructure. Key players in the satellite sector, including manufacturers, launchers, and operators, are based in this region. Telecommunications is a major contributor to the demand for satellite transponders, driven by the increasing requirement for high-speed internet and dependable communication services in remote areas. The expansion of Over-the-Top (OTT) media services and high-definition broadcasting further boosts market growth. Additionally, the defense sector heavily relies on satellite transponders for secure and resilient communication networks. In the telecommunications sector, satellite transponders facilitate broadband internet access, telecommunications services, and broadcasting solutions for various satellite-based applications.

These include maritime communication, aviation services, disaster recovery, and IoT applications. The satellite communication technology and systems enable services such as air traffic control, aircraft tracking, weather monitoring, in-flight networking, and cockpit communications. The C-band segment of the satellite communication infrastructure is a significant contributor to the market, providing satellite capacity for commercial communication, backhaul connectivity, and emergency communication services. The broadcasting industries, including television and radio, utilize satellite capacity for multimedia content distribution and video content streaming. Satellite-based internet services and satellite broadcasting services cater to the needs of telecommunications companies, aerospace, and disaster response.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Satellite Transponder Industry?

Rising adoption of HTS technology is the key driver of the market.

- The market is experiencing significant growth, particularly in the application areas of Commercial Communications and Government Communications. High-throughput satellites (HTS) utilizing Ku-band and Ka-band transponders have gained popularity due to their ability to provide broadband internet access and telecommunication services to consumers and corporate enterprise networks. The demand for HTS services is projected to reach 2 terabytes per second (TBps) by 2024, driven by the increasing need for bandwidth-intensive applications in various industries. companies, such as SES, are responding to this demand by deploying new HTS to cater to the expanding market. The Internet of Things (IoT), emergency services, homeland security, and wireless communications devices are among the key sectors fueling the adoption of satellite transponders for data transmission.

- Additionally, satellite communication technology is being integrated into aviation services, maritime communication, disaster recovery, and broadcasting solutions. The satellite communication infrastructure is also being utilized for 5G backhaul, aircraft tracking, weather monitoring, in-flight networking, and cockpit communications. Satellite capacity provisioning, satellite fleet management, and ground segment services are essential components of the satellite communication ecosystem, ensuring customer support and backhaul connectivity for various applications.

What are the market trends shaping the Satellite Transponder Industry?

Increasing demand for HDTVs and video broadcasting is the upcoming market trend.

- The market encompasses various applications, including Commercial Communications and Government Communications. In the Commercial Communications segment, the demand for satellite capacity is significant in sectors such as Navigation, Remote Sensing, Maintenance & Support, and the Internet of Things (IoT). Commercial communication applications include telecommunication services, video distribution, Direct-to-Home (DTH) television, legacy telephone, carrier services, commercial mobility services, and enterprise data services. Satellite operators invest in launching satellites with increased capacity to cater to the growing demand for broadband internet access and broadcasting solutions. The Ku-band, Ka-band, and K-band segments are crucial in providing the required bandwidth for these applications.

- The satellite communication infrastructure consists of satellite transponders, ground stations, satellite networks, and satellite capacity provisioning. Government Communications applications include emergency services, homeland security, wireless communications devices, and radio signals. The frequency spectrum plays a vital role in satellite communication technology, and satellite communication systems enable effective communication on Earth and in space. The satellite communication technology landscape is evolving, with advancements in satellite capacity, launch services, satellite services, and ground segment services. The satellite capacity is essential for various applications, including maritime communication, aviation services, disaster recovery, and 5G backhaul. The satellite communication systems facilitate airplane tracking, weather monitoring, in-flight networking, and cockpit communications.

What challenges does the Satellite Transponder Industry face during its growth?

Environmental interference is a key challenge affecting the industry growth.

- Satellite transponders play a crucial role in delivering commercial and government communications, including navigation, remote sensing, and broadcasting solutions. However, rain fade, an interference caused by unfavorable atmospheric conditions, can disrupt transmissions, particularly in Ku-band and Ka-band frequencies. This phenomenon occurs due to rain, sleet, or snow absorbing microwave signals, leading to path loss or signal interference. It can also affect signals transmitted at lower frequencies. In severe cases, satellite operations may be suspended during adverse weather conditions, resulting in communication disruptions for applications such as consumer broadband, corporate enterprise networks, and emergency services. Satellite communication technology continues to evolve, with advancements in satellite capacity provisioning, satellite fleet management, and ground segment services.

- Additionally, satellite-based applications are expanding to include maritime communication, aviation services, disaster recovery, and IoT, among others. Rain fade mitigation technologies and the integration of 5G backhaul are also addressing this challenge, ensuring uninterrupted satellite communication services.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Arabsat

- ArianeGroup

- Eutelsat S.A.

- Hispasat SA

- Inmarsat Global Ltd.

- Intelsat US LLC

- SES SA

- Singapore Telecommunications Ltd.

- SKY Perfect JSAT Holdings Inc.

- Telesat Corp.

- Thaicom Public Co. Ltd.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, each with unique requirements and demands. Two primary sectors driving the growth of this market are commercial communications and government communications. Commercial communications applications include telecommunication services, broadcasting solutions, and satellite-based applications. Telecommunication services utilize satellite transponders for broadband internet access, enterprise data services, and carrier services. Broadcasting solutions rely on satellite transponders for video distribution, Direct-to-Home (DTH) television, and legacy telephone services. Satellite-based applications extend to maritime communication, aviation services, disaster recovery, and in-flight networking. Satellite operators provide essential infrastructure for satellite communication, with satellite transponders being a critical component.

Moreover, these transponders enable the transmission and reception of radio signals in various frequency bands, including C-band, Ku-band, Ka-band, and K-band. The choice of frequency band depends on the specific application requirements, such as bandwidth needs, geographical coverage, and interference considerations. The Internet of Things (IoT) is another significant market for satellite transponders, particularly for applications requiring global connectivity, such as aircraft tracking, weather monitoring, and emergency services. Satellite communication technology plays a crucial role in providing backhaul connectivity for 5G networks, ensuring seamless and reliable communication for various industries, including homeland security, emergency services, and wireless communications devices. Government communications applications include defense, public safety, and intelligence agencies.

Furthermore, these organizations rely on satellite transponders for secure and reliable communication, often in remote or challenging environments. Satellite capacity provisioning, satellite fleet management, ground segment services, and customer support are essential for ensuring the efficient and effective use of satellite resources in government applications. Satellite communication systems enable global connectivity, providing essential services to various industries and sectors. Ground stations and satellite networks facilitate the transmission and reception of signals, while satellite capacity and launch services ensure the availability of resources for various applications. Satellite technology continues to evolve, with advancements in spectrum utilization, satellite capacity, and satellite communication systems driving growth In the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.34% |

|

Market growth 2024-2028 |

USD 3.96 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.16 |

|

Key countries |

US, China, Russia, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Satellite Transponder Market Research and Growth Report?

- CAGR of the Satellite Transponder industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the satellite transponder market growth of industry companies

We can help! Our analysts can customize this satellite transponder market research report to meet your requirements.