Seaweed Snacks Market Size 2025-2029

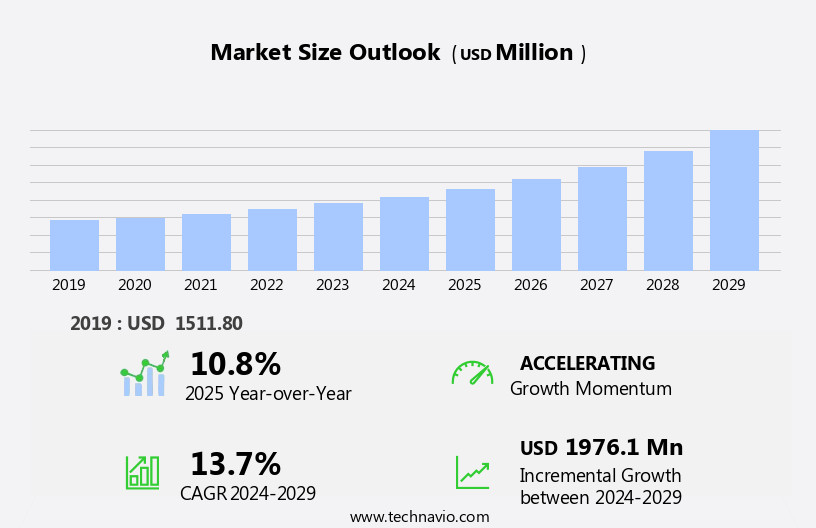

The seaweed snacks market size is forecast to increase by USD 1.98 billion at a CAGR of 13.7% between 2024 and 2029.

- The market is experiencing significant growth driven by the rising demand for healthy food options among consumers worldwide. This trend is particularly prominent in developed markets where consumers are increasingly conscious of their health and wellness. Additionally, the growing prominence of online shopping is providing a new sales channel for seaweed snack manufacturers, expanding their reach and making these products more accessible to a wider audience. However, challenges remain in the market, particularly in the area of distribution. Seaweed snacks are often sourced from remote locations and require specialized handling and storage, making logistics a complex issue.

- Companies seeking to capitalize on the market's opportunities must navigate these challenges effectively, investing in food supply chain solutions and building strong relationships with distributors and retailers to ensure timely delivery and optimal product freshness. By doing so, they can effectively meet the growing demand for healthy, convenient snack options and position themselves for long-term success in the market.

What will be the Size of the Seaweed Snacks Market during the forecast period?

- The market exhibits strong growth, driven by increasing consumer preference for natural, low-calorie, and nutrient-dense alternatives to traditional snack options. Seaweed snacks offer a unique flavor profile and varied textures, catering to diverse taste preferences. The market encompasses a wide range of seaweed species, each with distinct characteristics, such as color, flavor, and nutritional profiles. Innovation in production methods, packaging design, and branding continues to expand the market, addressing consumer demands for convenience, freshness, and sustainability. Quality control measures ensure consistent product standards, while the pipeline for new product launches maintains market momentum. Despite the natural variability in seaweed's calorie, fat, and sugar content, its overall nutritional benefits align with current food trends.

- The market faces challenges in logistics, as seaweed's delicate nature requires careful handling and storage, but advancements in processing techniques and preservatives mitigate these issues. Allergen considerations and labeling requirements are essential aspects of the market, ensuring transparency and safety for consumers.

How is this Seaweed Snacks Industry segmented?

The seaweed snacks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Red

- Brown

- Green

- Distribution Channel

- Offline

- Online

- Product

- Strips and chips

- Flakes

- Bars

- Others

- Type

- Original

- Salt

- Sweet

- Spicy

- Others

- Packaging

- Individual packs

- Multi-packs

- Bulk packs

- Others

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- APAC

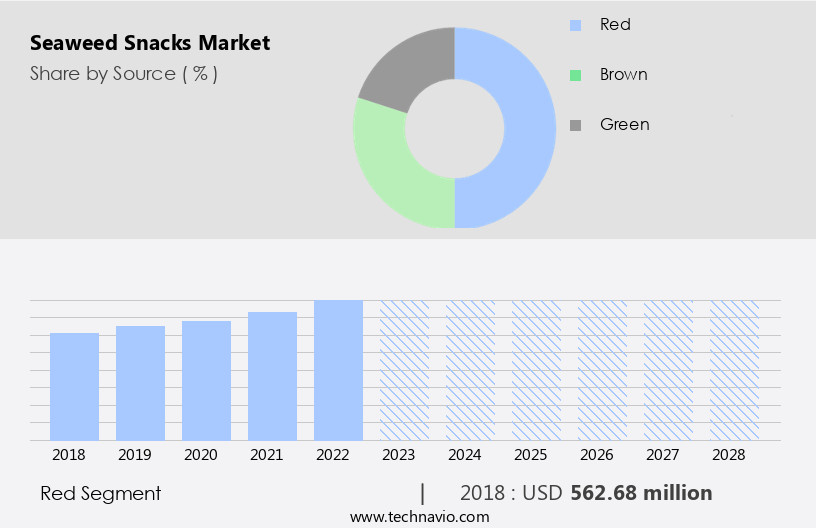

By Source Insights

The red segment is estimated to witness significant growth during the forecast period. Red seaweed snacks, derived from various edible seaweed species, have gained significant popularity in the global market due to their distinctive taste, nutritional benefits, and versatility. The mild, slightly sweet flavor of red seaweed sets it apart from other types, making it an appealing choice for consumers seeking unique and exotic snack options. Additionally, the vibrant red color adds to their allure. Red seaweed is a rich source of iodine, an essential nutrient for thyroid health. It also offers various vitamins, including A, B, and C. Seaweed snacks come in various forms, such as chips, crisps, crackers, noodles, and bites.

These include seaweed seasoning, flavoring, and supplements, catering to diverse consumer preferences. Seaweed processing involves harvesting, drying, and packaging. Harvesting methods include manual and mechanical methods. The drying process can be done through sun-drying or mechanical methods. Seaweed certification, such as organic and sustainable, is essential to meet consumer demands for healthier and eco-friendly options. Seaweed's nutritional value extends beyond iodine. It is a high-protein, low-calorie snack, providing essential minerals like magnesium, zinc, iron, calcium, potassium, and various vitamins. Seaweed's health benefits include antioxidant properties and fiber content, making it a popular choice for those following plant-based diets or seeking healthy snack alternatives.

The seaweed market is driven by increasing consumer awareness of health and wellness, veganism, and sustainability. Innovation in seaweed processing, such as roasted seaweed and seaweed extracts, and the development of new products, like seaweed oil and fiber, further fuel market growth. The seaweed industry's economic impact is significant, with potential for further expansion in retail, foodservice, and e-commerce sectors.

Get a glance at the market report of share of various segments Request Free Sample

The Red segment was valued at USD 599.30 billion in 2019 and showed a gradual increase during the forecast period.

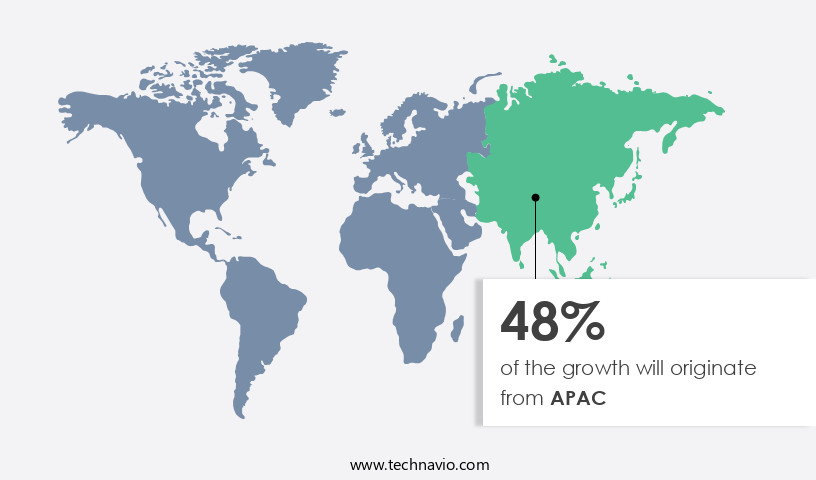

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific region significantly contributes to the market due to its cultural affinity and growing health consciousness. Consumers in countries like Japan, South Korea, and China have a long-standing tradition of incorporating seaweed into their diets. In Japan, for example, nori (edible seaweed) has been a staple in Japanese cuisine for centuries. As a result, the emergence of seaweed snacks, such as chips, crisps, and bites, caters to these preferences. Seaweed snacks offer numerous health benefits, including being high in protein, low in calories, and rich in minerals like magnesium, zinc, and iodine.

These snacks are also vegan, gluten-free, and free from artificial flavors and preservatives. Moreover, they are a sustainable and eco-friendly alternative to traditional snack options. The seaweed processing industry ensures the highest standards of certification, harvesting, and distribution to maintain the snacks' nutritional value and freshness. Innovations in seaweed snack production, such as roasted seaweed, seasoning, and flavoring, cater to diverse taste preferences. Seaweed's nutritional profile and health benefits have fueled its popularity as a healthy snack option. The market's growth is further driven by the increasing demand for plant-based and low-fat snacks, as well as the rising trend of sustainable and e-commerce businesses.

Seaweed snacks' versatility extends beyond traditional snacking, with applications in salads, noodles, and even supplements. The industry's focus on research and development ensures the continuous innovation and expansion of seaweed snack offerings. The Asia Pacific region's cultural preferences, increasing health consciousness, and rich history of seaweed consumption have led to a significant market for seaweed snacks. These snacks offer numerous health benefits, cater to diverse taste preferences, and contribute to a more sustainable and eco-friendly food industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Seaweed Snacks Industry?

- Rising demand for healthy food among global population is the key driver of the market. The use of synthetic chemical fertilizers and pesticides in agriculture has been a common practice for increasing crop yield. However, the build-up of these chemicals on the outer layer of fruits and vegetables cannot be entirely removed by rinsing with water. As a result, consumers unknowingly ingest harmful residues, leading to health concerns such as cancer, obesity, and birth defects. This issue has prompted a shift towards alternative farming methods, including organic and natural farming. Seaweed snacks, derived from seaweed, have gained popularity due to their natural growth and nutrient-rich properties. These snacks offer a healthier alternative to traditional processed snacks and do not contain any synthetic chemicals.

- The seaweed snack market is expected to grow due to increasing health awareness and consumer preference for natural and organic food products. Additionally, the market is driven by the rising demand for convenient and portable snack options. Overall, the seaweed snack market presents a significant opportunity for companies to cater to the growing demand for healthy and natural food products. Focus on seaweed brand loyalty, investment in seaweed innovation pipeline, and emerging seaweed food trends fuel growth. Efficient seaweed logistics, appealing seaweed packaging design, strategic seaweed branding, and clear seaweed labeling support market expansion. These elements create an exciting space for manufacturers and consumers alike.

What are the market trends shaping the Seaweed Snacks Industry?

- Growing prominence of online shopping is the upcoming market trend. The market has experienced substantial growth in recent years, with the online distribution channel playing a pivotal role in its expansion. E-commerce platforms enable consumers to access a wide range of packaged seaweed snack brands from around the world. The proliferation of smartphones and the subsequent rise in e-commerce companies have contributed significantly to the market's growth. Both brand-owned online formats and pure-play e-retailers offer packaged seaweed snacks, with major global retailers such as Amazon.Com and eBay leading the charge. The increasing popularity of online retailing, particularly in developing countries, is expected to further boost sales of seaweed snacks through this channel during the forecast period.

- The Seaweed Snacks Market is thriving with diverse seaweed variety and unique seaweed cultivar contributing to innovation. Attributes like seaweed color, seaweed flavor, seaweed salt content, seaweed sugar content, seaweed fat content, and seaweed carbohydrate content highlight nutritional profiles. Low seaweed calories and awareness about seaweed allergens drive demand. Enhanced seaweed additives and seaweed preservatives ensure longer shelf life. Advanced seaweed production methods and refined seaweed processing techniques uphold seaweed quality control standards.

What challenges does the Seaweed Snacks Industry face during its growth?

- Challenges related to distribution is a key challenge affecting the industry growth. Seaweed snacks have gained popularity in the retail sector, with supermarkets, hypermarkets, and large chains of discount or convenience stores serving as significant distribution channels for manufacturers. However, this arrangement poses challenges for seaweed snack producers. They face intense pressure to maintain competitive prices and margins due to retailers' lower profit margins. Retailers also prefer frequent and smaller product deliveries to minimize warehousing costs.

- Moreover, retailers aim to prevent revenue declines by sourcing from alternative suppliers when faced with insufficient supply from a particular manufacturer. Consequently, manufacturers must ensure consistent and adequate product availability to retain their retail partners and maintain a strong market presence. Seaweed can also be consumed as salads, seasonings, or supplements. The flavor profiles of seaweed snacks vary, with some offering a savory umami taste and others a more subtle, mild flavor. The production process for seaweed snacks involves harvesting, processing, and packaging. Harvesting methods include manual collection, using rakes or dredges, or using mechanical harvesters. Once harvested, seaweed is processed through various methods, such as drying, roasting, or extraction, to create the desired texture and flavor. Sustainability is a key consideration in the seaweed snack market. Seaweed farming is a sustainable and eco-friendly process that does not require arable land or freshwater.

Exclusive Customer Landscape

The seaweed snacks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the seaweed snacks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, seaweed snacks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Annie Chuns Inc. - The company offers seaweed snacks, including Nori Krinkles and Spicy Nori Strips, as innovative and health-conscious alternatives to traditional snack options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Annie Chuns Inc.

- Barnacle Foods

- Delice Global Inc.

- Eden Foods Inc.

- gimMe Health Foods Inc.

- Honest to Goodness

- Jayone Foods Inc.

- Kimnori USA Inc.

- Nora Seaweed Snacks

- Oceans Halo

- Roland Foods LLC

- Seaman Chips

- Seamore Holding BV

- SeaSnax

- SEMPIO FOODS CO.

- Taokaenoi Food and Marketing PCL

- Thai Korean Seaweed Co. Ltd.

- WRAWP FOODS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The seaweed snack market has experienced significant growth in recent years, driven by increasing consumer demand for healthy, plant-based, and sustainable snacking options. This trend is attributed to several factors, including the nutritional benefits and versatility of seaweed. Seaweed snacks offer a range of health advantages, making them an attractive alternative to traditional snack choices. They are rich in essential minerals, including iodine, magnesium, zinc, and iron, as well as vitamins and fiber. Additionally, seaweed snacks are typically low in calories, making them an ideal choice for those seeking to maintain a healthy weight. The market for seaweed snacks is diverse and includes various product formats, such as chips, crisps, bites, noodles, and crackers.

The Seaweed Snacks Market showcases growing demand for seaweed bites, seaweed noodles, and organic seaweed catering to trends like glutenfree seaweed, vegan seaweed, and healthy snacks. Emphasis on plantbased snacks and highprotein snacks highlights consumer preferences. Techniques like seaweed drying and seaweed flavoring enhance innovation in seaweed ingredients, seaweed supplements, and seaweed powder. Nutritional benefits from seaweed protein, seaweed fiber, seaweed minerals, seaweed vitamins, seaweed antioxidants, seaweed iodine, seaweed calcium, seaweed magnesium, seaweed potassium, seaweed iron, and seaweed zinc drive market expansion. Focus on seaweed shelf life, seaweed storage, and efficient seaweed distribution boosts growth. Channels like seaweed retail, seaweed ecommerce, and seaweed directtoconsumer contribute to convenience. Emerging seaweed foodservice, evolving seaweed food industry, and advancements through seaweed research and seaweed development mark exciting progress.

Additionally, seaweed absorbs carbon dioxide during growth, making it a carbon-neutral crop. Consumer preferences for seaweed snacks are influenced by various factors, including taste, texture, and health benefits. Some consumers prefer the savory umami taste of roasted seaweed, while others prefer the milder flavor of dried seaweed. Texture preferences also vary, with some consumers preferring crispy or crunchy seaweed snacks and others preferring softer, chewy options. The seaweed snack market is also influenced by food trends, such as the increasing popularity of plant-based and vegan diets. Seaweed snacks offer a convenient and tasty option for those following these dietary preferences.

The Seaweed Snacks Market is experiencing significant growth, driven by the increasing demand for healthy, plant-based, and sustainable snack options. Seaweed chips, nori snacks, seaweed crackers, and seaweed crisps are popular choices, offering a crunchy texture and savory taste. Organic, gluten-free, vegan, and high-protein variants are also available, catering to diverse dietary needs. Sustainable seaweed harvesting practices ensure a minimal environmental footprint. Seaweed salads provide additional nutritional benefits, making these low-calorie snacks an excellent alternative to traditional chips and crackers. The market is expected to continue thriving, as consumers seek out nutritious, plant-based, and ethically-sourced snack options.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

262 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.7% |

|

Market growth 2025-2029 |

USD 1976.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.8 |

|

Key countries |

US, China, Canada, Japan, India, UK, Germany, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Seaweed Snacks Market Research and Growth Report?

- CAGR of the Seaweed Snacks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the seaweed snacks market growth and forecasting

We can help! Our analysts can customize this seaweed snacks market research report to meet your requirements.