Sepsis Diagnostics Market Size 2024-2028

The sepsis diagnostics market size is forecast to increase by USD 510 million at a CAGR of 8.9% between 2023 and 2028.

- The market is witnessing significant growth due to the rising number of sepsis cases worldwide. According to the Global Sepsis Alliance, sepsis affects over 1.5 million people in the United States each year. Early and accurate diagnosis of sepsis is crucial to improve patient outcomes and reduce healthcare costs. The market is driven by advancements in technology, such as Point-of-Care (POC) testing, which enables quick and efficient diagnosis at the patient's bedside. Partnerships and collaborations between industry players and research institutions are also contributing to the market's growth. However, high costs associated with sepsis diagnostics, including reagents and consumables for laboratory tests and instruments like immunoassays and automated systems, remain a challenge.

- Additionally, the market is expected to continue its growth trajectory due to the increasing demand for cost-effective and accurate diagnostic solutions. The use of advanced technologies like artificial intelligence and machine learning is also expected to revolutionize sepsis diagnostics, making them more accurate and efficient. In conclusion, the market is poised for growth due to the increasing number of sepsis cases, advancements in technology, and partnerships and collaborations. However, high diagnostic costs remain a significant challenge that needs to be addressed to make sepsis diagnostics more accessible to patients.

What will be the Size of the Market During the Forecast Period?

- Sepsis, a life-threatening condition caused by the body's response to infection, remains a significant challenge in healthcare. According to the Centers for Disease Control and Prevention (CDC), an estimated 1.7 million adults in the U.S. Develop sepsis each year, leading to approximately 270,000 deaths. Hospital-acquired infections (HAIs), including sepsis, contribute to substantial morbidity and mortality, particularly in Intensive Care Unit (ICU) patients. To improve sepsis diagnosis and reduce associated morbidity and mortality, advancements in diagnostic technologies have gained momentum. Traditional methods, such as microbiology, culture, and immunoassay, have been the cornerstone of sepsis diagnostics.

- However, these techniques present limitations, including delayed results and inability to differentiate between bacterial, viral, and fungal infections. Next-generation sequencing (NGS) and molecular diagnostics have emerged as promising alternatives. NGS enables the identification of pathogens and their antimicrobial resistance patterns with high accuracy and speed. Molecular diagnostics, including polymerase chain reaction (PCR) and real-time PCR, can detect sepsis-causing pathogens within hours, providing early and accurate diagnosis. Value-based care and digitalization have fueled the adoption of rapid diagnostic techniques, such as point-of-care (POC) tests. POC diagnostics offer several advantages, including quick results, reduced turnaround time, and improved patient outcomes.

- Additionally, POC diagnostic methods, including lateral flow assays and rapid test kits, are increasingly being used for sepsis diagnostics. Biomarker-based diagnostics, particularly lactate and procalcitonin, have gained popularity in sepsis diagnosis. These biomarkers can help distinguish sepsis from other conditions and guide antimicrobial therapy. Early detection of sepsis using these biomarkers can lead to improved patient outcomes and reduced ICU mortality. Automation and digitalization are transforming sepsis diagnostics, with instruments and reagents and consumables playing a crucial role. Automated systems can process large volumes of samples, ensuring accuracy and reducing the workload on healthcare professionals. Additionally, digitalization enables seamless data sharing and analysis, improving diagnostic accuracy and patient care.

- In conclusion, the market is witnessing significant advancements, driven by the need for rapid, accurate, and cost-effective diagnostic solutions. The integration of molecular technologies, POC diagnostics, and biomarker-based diagnostics is transforming sepsis diagnosis, enabling early detection and improved patient outcomes. The adoption of automation and digitalization is further enhancing the efficiency and accuracy of sepsis diagnostics.

How is this market segmented and which is the largest segment?

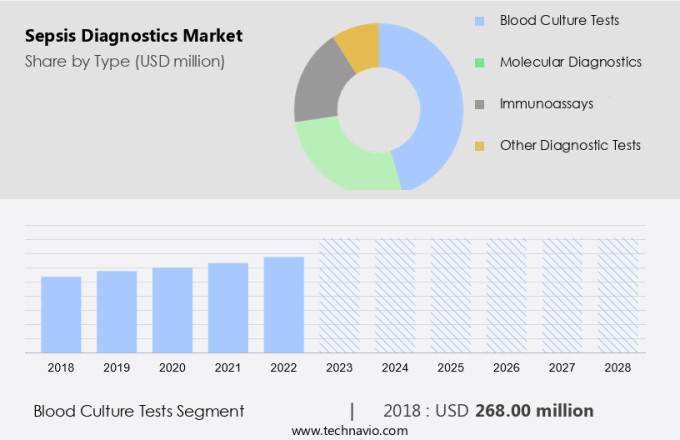

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Blood culture tests

- Molecular diagnostics

- Immunoassays

- Other diagnostic tests

- Method

- Conventional diagnostics

- Laboratory-based testing

- Point-of-care testing (POCT)

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Asia

- Rest of World (ROW)

- North America

By Type Insights

- The blood culture tests segment is estimated to witness significant growth during the forecast period.

Sepsis, a life-threatening condition caused by the body's response to infection, necessitates early and accurate diagnosis for optimal patient outcomes. Value-based care initiatives prioritize early detection and treatment, making sepsis diagnostics a significant focus in healthcare. Biomarker-based diagnostics, such as procalcitonin and C-reactive protein tests, are gaining popularity due to their ability to identify sepsis in its early stages, even before symptoms appear. Point-of-care diagnostic methods, including rapid tests and handheld devices, enable quick results, reducing the risk of hospital-acquired infections (HAIs) and chronic infections. Digitalization and automation are transforming sepsis diagnostics, with automated blood culture systems improving efficiency and reliability.

Additionally, these systems reduce manual handling and contamination risks, ensuring accurate results. Major market players are innovating, introducing advanced blood culture technologies with faster detection times and greater sensitivity. Early sepsis diagnosis and treatment are crucial, as every minute saved can significantly impact patient outcomes. The market is expected to grow as the healthcare industry continues to prioritize value-based care and early detection.

Get a glance at the market report of share of various segments Request Free Sample

The blood culture tests segment was valued at USD 268.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

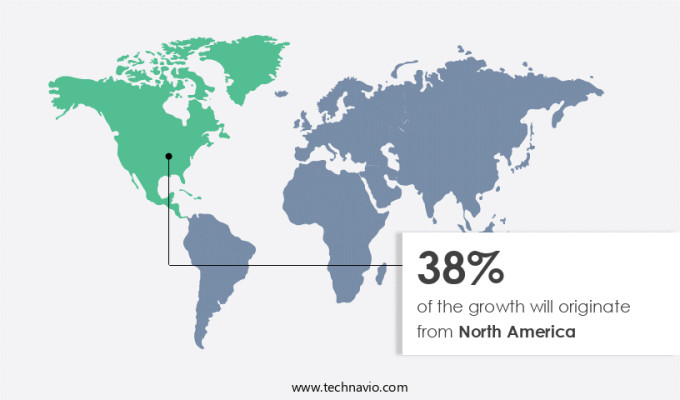

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing notable growth due to the region's advanced healthcare infrastructure, substantial healthcare expenditure, and the presence of key industry players. The region's sophisticated healthcare system encourages the implementation of innovative diagnostic technologies, leading to market expansion. Notably, in April 2024, Roche announced a strategic partnership to distribute Prenosis' newly authorized artificial intelligence (AI)-based sepsis detection tool in the US. This tool will be integrated into Roche Navify Algorithm Suite, a collection of validated algorithms developed by a multidisciplinary team at Roche. This collaboration underscores the region's dedication to utilizing advanced technologies to improve sepsis diagnosis and management.

Similarly, sepsis, a life-threatening condition caused by the body's response to infection, can lead to hospital-acquired infections (HAIs) and complications such as septic shock. Early and accurate diagnosis is crucial for effective treatment and reducing morbidity and mortality. Traditional methods for sepsis diagnosis include microbiology, molecular biology, and immunological tests like immunoassays. However, the emergence of advanced diagnostic technologies, such as AI and machine learning, is revolutionizing sepsis diagnostics. The sepsis prevalence in North America is significant due to the high number of HAIs, making infection prevention a priority. According to the Centers for Disease Control and Prevention (CDC), one in 25 hospital patients in the US contracts at least one HAI during their stay.

In addition, infection prevention strategies, such as the implementation of diagnostic tests, are essential to minimize the risk of HAIs and improve patient outcomes. The integration of AI-based tools into sepsis diagnostics is expected to streamline the diagnostic process, reduce false positives, and enhance overall patient care. In conclusion, the North American the market is thriving due to the region's strong healthcare infrastructure, substantial healthcare expenditure, and the presence of major industry players. The adoption of advanced diagnostic technologies, such as AI and machine learning, is revolutionizing sepsis diagnostics, enabling early and accurate diagnosis, and improving patient outcomes. The recent strategic partnership between Roche and Prenosis is a testament to the region's commitment to utilizing advanced technologies to enhance sepsis diagnosis and management.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Sepsis Diagnostics Market?

Increasing number of sepsis cases is the key driver of the market.

- Sepsis, an extreme response to infection, is a major cause of concern in the healthcare industry, accounting for one in every five deaths worldwide. In the United States, sepsis ranks as the third leading cause of mortality in hospitals. Annually, around 1.7 million Americans are diagnosed with sepsis, with the Centers for Disease Control and Prevention (CDC) reporting that approximately 350,000 of these cases prove fatal. The high mortality rate underscores the necessity for advanced diagnostic tools to combat this condition.

- Additionally, diagnostic technologies, including next-generation sequencing (NGS), assays, and reagents, molecular diagnostics, and microbiological testing, play a crucial role in identifying sepsis early and improving patient outcomes. Diagnostic kits are essential healthcare solutions that facilitate rapid and accurate diagnosis, reducing the risk of ICU mortality. The increasing incidence of sepsis and the associated high mortality rate necessitate the continuous development and implementation of advanced diagnostic tools to improve patient care and reduce the burden on healthcare systems.

What are the market trends shaping the Sepsis Diagnostics Market?

Partnerships and collaborations are the upcoming trends in the market.

- The market is experiencing a notable trend towards collaborations and partnerships, which are fostering innovation and broadening market scope. In April 2023, Prenosis, Inc., a precision medicine company specializing in AI technology, announced a partnership with Roche for the commercial distribution of the Sepsis ImmunoScore. This advanced software utilizes AI and machine learning to expedite sepsis diagnosis and forecast adverse patient outcomes. The collaboration signifies the increasing significance of incorporating AI technologies into sepsis diagnostics to boost accuracy and efficiency. In another development, the University of Oxford entered into a partnership with Danaher Corporation in November 2022 to develop a novel sepsis test, focusing on precision medicine.

- Furthermore, these collaborations underscore the importance of integrating AI technologies in sepsis diagnostics to enhance patient care. Point-of-care (POC) solutions, including instruments, reagents, and consumables, are essential components of sepsis diagnostics. Immunoassays and automated systems are commonly used laboratory tests for sepsis diagnosis. The Global Sepsis Alliance advocates for early sepsis detection and improved patient outcomes. Diagnostic costs are a significant concern, driving the need for cost-effective and efficient solutions. As the market evolves, companies such as Prenosis, Roche, and the University of Oxford are collaborating to develop advanced AI-driven diagnostics to address these challenges.

What challenges does Sepsis Diagnostics Market face during the growth?

High costs associated with sepsis diagnostics is a key challenge affecting the market growth.

- The market poses a substantial challenge due to the elevated costs linked to advanced diagnostic techniques for sepsis. These methods, comprising molecular testing, biomarker analysis, and blood culture systems, necessitate substantial capital investment for both initial procurement and ongoing upkeep. The financial strain is intensified by the exorbitant per-test costs, which are a result of the requirement for costly reagents, specialized materials, and proficient laboratory personnel.

- However, this financial burden is notably felt in developing regions and resource-limited settings, where the occurrence of sepsis is frequently prevalent. In these healthcare facilities, the inability to afford essential diagnostic tools hampers their capacity to accurately diagnose and manage sepsis cases, particularly those involving bacterial, viral, or fungal infections that can progress to severe sepsis or septic shock.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ad Astra Diagnostics Inc. - The company provides advanced sepsis diagnostics solutions, including the QScout CBC system, which delivers expedited complete blood count (CBC) test results.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ad Astra Diagnostics Inc.

- ALIFAX Srl

- Becton Dickinson and Co.

- Biocartis NV

- BioMerieux SA

- Bruker Corp.

- Cytovale Inc

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Loop Diagnostics

- OCEAN Dx

- QuantaMatrix Inc

- QuidelOrtho Corp.

- Siemens Healthineers AG

- T2 Biosystems Inc.

- Thermo Fisher Scientific Inc.

- Trinity Biotech Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sepsis, a life-threatening condition caused by the body's response to infection, requires early and accurate diagnosis to improve patient outcomes and reduce healthcare costs. The market is witnessing significant growth due to the increasing prevalence of hospital-acquired infections (HAIs), including bacterial, viral, and fungal infections. Diagnostic tests play a crucial role in identifying sepsis, with microbiology and molecular biology techniques, such as immunoassays, next-generation sequencing (NGS), and automated systems, being commonly used. HAI incidences lead to severe sepsis and septic shock, resulting in high ICU mortality rates. Early detection through rapid diagnostic techniques, including point-of-care (POC) tests, is essential for effective infection prevention and value-based care.

In summary, biomarker-based diagnostics and digitalization are driving the market, with automated diagnostic devices and real-time data management through electronic health records (EHRs) becoming increasingly popular. Molecular diagnostic tests, such as blood culture and flow cytometry, and microfluidics, are essential for identifying the causative organisms. Skilled healthcare professionals utilize a range of diagnostic kits, instruments, and reagents to ensure accurate and timely diagnosis. The Global Sepsis Alliance advocates for improved sepsis awareness and diagnostic tools to reduce sepsis-related deaths and healthcare costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2024-2028 |

USD 510 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.5 |

|

Key countries |

US, Germany, UK, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch