Server Operating System Market Size 2024-2028

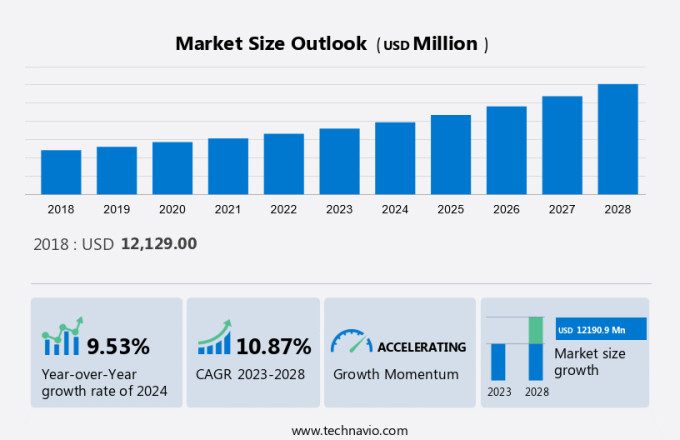

The server operating system market size is estimated to increase by USD 12.19 billion and grow at a CAGR of 10.87% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. Firstly, the increasing investments in the construction of hyper-scale data centers are fueling the demand for advanced server operating systems that can efficiently manage large-scale infrastructure. Secondly, technological advancements in server operating systems, such as containerization and virtualization, are enabling organizations to optimize their IT resources, data center, and improve application performance. However, the market is also facing challenges, including the rising number of security issues, which require server operating systems to provide robust security features to protect against cyber threats. Additionally, the growing complexity of IT environments is necessitating the need for server operating systems that can seamlessly integrate with various applications and tools. Overall, the server operating system market is expected to continue its growth trajectory, driven by these market trends and challenges.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Segmentation

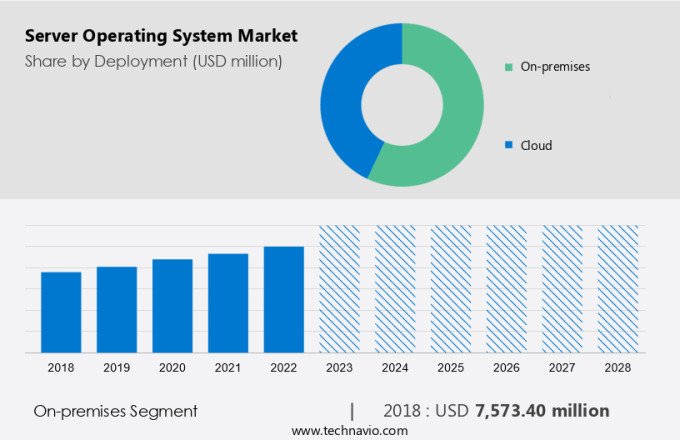

By Deployment

The market share growth by the on-premises segment will be significant during the forecast period. On-premises solutions in the global market are popular among companies looking to manage their IT infrastructure. On-premises solutions give companies complete control over the hardware and software, allowing them to adapt the system to their individual needs. One of the main benefits of on-premises solutions is increased security and privacy. Businesses can keep data and applications behind firewalls and other security measures, reducing the risk of cyberattacks and data breaches. This is especially important for software companies that handle sensitive data such as financial or medical information.

Get a glance at the market contribution of various segments View the PDF Sample

The on-premises segment was valued at USD 7.57 billion in 2018. On-premises solutions allow companies to choose their hardware and software companies, design their systems to meet their specific needs and make changes and upgrades as needed. This gives software companies more control over their IT infrastructure, helping them achieve the best possible performance. On-premises solutions also offer improved performance and reliability compared to cloud-based solutions. However, on-premises solutions can be expensive up-front, as software companies must invest in the hardware, software, and staff required to maintain and manage the operating system.

By Region

For more insights on the market share of various regions Download PDF Sample now!

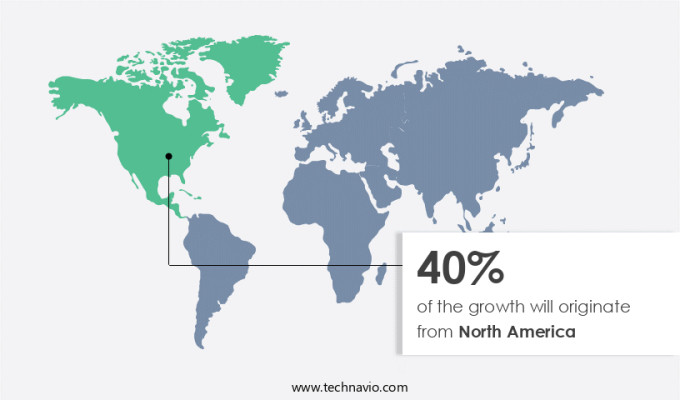

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavioâs analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. One of the reasons why North America has a strong position in the market is the high acceptance of cloud-based services by enterprises. These cloud-based services require advanced systems for optimal performance and security. North America is home to major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Another factor contributing to the growth of the North American market is the increasing demand for data centers.

The North American region is home to some of the world's largest data centers. Companies such as Microsoft Corp (Microsoft), IBM Corp (IBM), and Oracle Corp (Oracle) have a strong presence in North America and invest heavily in research and development (R&D) to innovate and gain a competitive advantage over other companies. For example, Google LLC (Google) announced its USD 750 million new data center in Nebraska to meet its goal of spending USD 9.5 billion on new Google data centers and offices in 2022. Such expansion plans drive the growth of the market in North America during the forecast period.

Market Dynamics and Customer Landscape

The market is a significant segment of the IT industry, focusing on software that manages and operates servers in data centers and cloud platforms. Server OS includes various types such as Application Servers, File Servers, Database Servers, Mail Servers, Web Servers, and others. These operating systems are essential for Client Server Infrastructure and Client Machinery to function effectively in Network environments. Cloud computing has been a major driver in the growth of the Server OS market, with hybrid cloud environments and 5G networking technologies playing a pivotal role. Server OS software is integral to enterprise migration and digital transformation, as businesses invest in IT infrastructure to enhance internet services and enterprise computing. Linux segment holds a substantial share in the Server OS market due to its open-source nature and flexibility. Virtual Machine Segment is also gaining traction with the increasing adoption of virtual machine software. Trained IT personnel are essential for implementing and managing Server OS, making it a vital area of focus for businesses and developers alike.

Key Market Driver

The market is experiencing significant growth, propelled by growing investments in the construction of hyper-scale data centers worldwide. Data center operators are expanding operations to meet the escalating demand for cloud computing services. For instance, AWS, a leading cloud service provider, has substantially increased annual spending on data centers, reaching USD 16.1 billion in Q3 2021.

Moreover, the Northern Virginia region, hosting over 50 data centers, benefits from extensive IT infrastructure and strategic positioning. Such investments contribute to increased demand for server operating systems, catering to the needs of businesses across various industries, driving market growth during the forecast period.

Significant Market Trends

Technological advancements are the major trend shaping the market. companies in the global market are focused on developing technologically advanced computer server solutions. These companies focus on deploying servers with customized configurations that meet the needs of end-user industries. The government is also supporting the development of new servers in developing countries such as India. For example, the Indian government's Ministry of Electronics and Information Technology (MeitY) launched India's first native server, Rudra, in December 2021. The Advanced Computing Development Center (C-DAC) developed the server as part of the National Supercomputing Mission (NSM). A newly introduced server design can be used to create a standalone commercial server. It also serves as a building block for large supercomputer systems. Similarly, in December 2021, Dell Technologies announced the launch of its new Dell EMC PowerEdge building block rack servers and small footprint tower servers in India. The company claims that its newly launched servers are tailored to the technical needs of small businesses.

Further, the small footprint of these servers helps alleviate SMB space constraints. These servers can also be used in offices, hospitality, and retail environments. Such servers support advanced technologies such as artificial intelligence (AI) and accelerators for enterprise-class workloads such as inference, medical imaging, data analytics, virtualization, and software-defined storage. Therefore, the increasing number of products offered by market companies, technological advancements in the market, and the availability of inexpensive physical servers specifically designed for SMEs all contribute to the growth of the focused market. These factors are likely to propel the growth of the global market during the forecast period.

Major Market Challenge

The rising number of security issues may impede the growth of the market. Data breaches and cyberattacks are an ongoing threat to businesses, especially small businesses, discouraging investment in physical servers. As a result, security issues have become one of the most important considerations when choosing a computer service provider. According to IBM's 2022 security report, the global average impact of a data breach on an organization is USD 3.86 million, with the highest average cost in the United States at an average of USD 7.9 million. The geographic location of data centers and security systems such as physical security, biometrics, and compliance provides assurance against potentially costly threats.

Additionally, organizations should implement various virtual security measures such as log inspection, strong data encryption, and access based on clearance levels to protect against internal and external attacks and data breaches. Data centers should monitor activity anomalies and report attempts to compromise communications. End-user trust is extremely important to companies operating in the global market. Market providers aim to convince end-users that their or their customers' sensitive data has not been compromised and is safely stored. A data breach doesn't just have an economic impact on your business. This can lead to a lack of trust in the company and provider, and damage the image, integrity, and credibility of the provider. Therefore, these security challenges faced by market companies may adversely affect the growth of the global market during the forecast period.

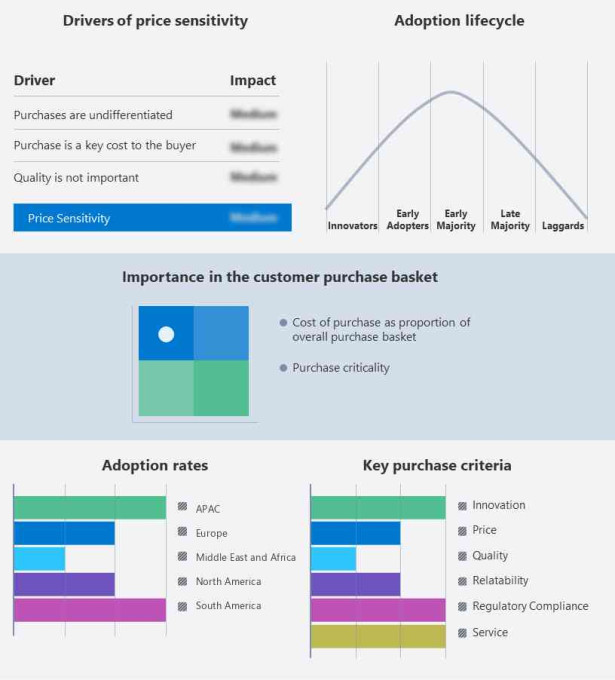

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovatorâs stage to the laggardâs stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Alphabet Inc.: The company offers server operating systems such as COS 101 LTS, Fedora CoreOS stable, and RHEL 9 under the brand Google LLC.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Canonical Ltd.

- Cisco Systems Inc.

- Debian

- Dell Technologies Inc.

- FreeBSD

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- NEC Corp.

- Open Text Corp.

- Oracle Corp.

- PC OpenSystems LLC

- SMART Global Holdings Inc.

- Suse Group

- Unisys Corp.

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment Outlook

- On-premises

- Cloud

- End-user Outlook

- Large enterprises

- Small and medium-sized enterprises

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

Market Analyst Overview

Unleashing the Power of Server Operating Systems in the Digital Age Server Operating Systems (OS) play a pivotal role in the digital transformation of businesses, powering various IT infrastructure including Cloud platforms, Data center infrastructure, Client server infrastructure, and Network. Operating Systems are the backbone of Computers, be it Windows Server or MacOS X Server, and enable the functioning of Application servers, File servers, Database servers, Mail servers, Web servers, and more. In today's Hybrid cloud environment, IT teams manage both Physical and Virtualized infrastructure, utilizing Virtual machines and Cloud based solutions. Server OS, a crucial component of IT technology, is available in both Subscription model, with Paid subscription and Non-paid subscription options, catering to the needs of Large enterprises and individual clients.

Further, advancements in IoT, AI technology, Government investments, and Digital technology have led to the adoption of 5G networking technologies and Colocation data centres, further fueling the growth of server operating systems. The integration of Server OS with hybrid cloud environments and the use of trained IT personnel ensure minimal Server downtime, making businesses more efficient and competitive. In conclusion, Server Operating Systems continue to be a significant player in the IT landscape, providing essential functionality and flexibility to businesses in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 12.19 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 40% |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alphabet Inc., Amazon.com Inc., Canonical Ltd., Cisco Systems Inc., Debian, Dell Technologies Inc., FreeBSD, Fujitsu Ltd., Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., International Business Machines Corp., Microsoft Corp., NEC Corp., Open Text Corporation, Oracle Corp., PC OpenSystems LLC, SMART Global Holdings Inc., Suse Group, Unisys Corp., and VMware Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecasting Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the marketâs competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.