Shower Trays Market Size 2024-2028

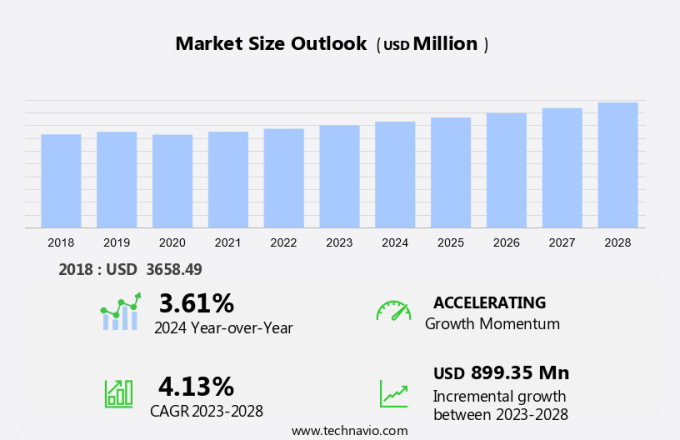

The shower trays market size is forecast to increase by USD 899.35 billion at a CAGR of 4.13% between 2023 and 2028. The market is witnessing significant growth due to the frequent launches of innovative shower tray designs by companies. Rectangular and square shapes continue to dominate the market, while cornered shower trays are gaining popularity for their space-saving benefits. A key trend in the market is the increasing demand for anti-slippery shower trays, ensuring safety and convenience for users. However, the installation complexity associated with shower trays, including the need for proper drainage ditch and water hole alignment, poses a challenge for both consumers and installers.

Overall, the market is expected to grow steadily, driven by these factors and the increasing preference for modern and functional bathroom designs. Key considerations for consumers include the material, size, and drainage system of the shower tray, while hardware such as drain covers and grates play a crucial role in ensuring proper functionality and aesthetics.

Market Analysis

The shower trays market is witnessing significant growth in the US, driven by the increasing demand for modern and functional bathroom designs. Shower trays come in various shapes and sizes, including rectangular and square, with cornered options offering a sleek and space-saving solution. Materials such as acrylic, steel, ceramic, resin, and exotic teak are commonly used in manufacturing shower trays. Acrylic and steel are popular choices due to their durability and easy maintenance, while ceramic and resin offer a more affordable alternative. Designs range from simple and minimalist to high-end, luxury options.

Moreover, shower trays with drainage ditches or water holes add a touch of sophistication, while sink-integrated models provide added convenience. The real estate sector, luxury hotels, spas, penthouse developments, designer modular homes, and tourism industries are major contributors to the market's growth. Brands focus on creating high-end products with anti-slip materials, anti-bacterial properties, and easy-to-clean surfaces to meet consumer demands. However, concerns over water leakage and improper installation can negatively impact the market. Proper maintenance and the use of sealant are essential to ensure the longevity and functionality of shower trays. In summary, the shower tray market in the US is thriving, with a focus on design, materials, and functionality driving growth.

Consumers seek durable, easy-to-clean, and stylish options, while manufacturers strive to meet these demands while addressing concerns over water leakage and improper installation.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Ceramics

- Acrylic

- Others

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Material Insights

The ceramics segment is estimated to witness significant growth during the forecast period. Shower trays are an essential component of modern bathroom designs, ensuring dryness and maintaining high levels of hygiene. Among the various materials used in manufacturing shower trays, ceramic is a popular choice due to its inherent waterproof properties. This feature effectively prevents water from permeating through the surface, safeguarding the bathroom floor and subfloor from potential water damage. Ceramic shower trays boast durability and resistance to wear and tear, making them a reliable investment for homeowners. Compared to other materials, ceramic trays are less prone to cracking, chipping, or fading over time. Moreover, they offer versatility in terms of design, with various colors, shapes, and styles available to suit diverse bathroom decors.

Moreover, the sleek, glossy finish of ceramic adds an air of sophistication and elegance to the bathroom space. Ceramic's waterproof nature, coupled with its durability and aesthetic appeal, makes it a preferred choice for those seeking long-lasting and visually appealing shower tray solutions.

Get a glance at the market share of various segments Request Free Sample

The ceramics segment was valued at USD 1.75 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Asia Pacific (APAC), the ongoing urbanization process has resulted in a significant increase in construction activities, particularly in the residential and commercial sectors. This trend is driven by the region's growing middle-class population, which now has increased disposable income and a higher standard of living. Consequently, there is a surging demand for modern bathroom fixtures, including shower trays. These functional and stylish products cater to the region's evolving lifestyle preferences, which prioritize health, wellness, and personal hygiene. Shower trays provide a practical and hygienic bathing solution, especially in urban environments where space is at a premium. The market for shower trays in APAC is witnessing substantial growth due to these factors, with materials like acrylic and steel being popular choices for their durability and ease of maintenance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Frequent launches of shower trays by companies is the key driver of the market. Shower trays continue to evolve with frequent product launches, providing consumers with an array of design choices, materials, sizes, and features. This differentiation not only broadens the customer base but also offers manufacturers a competitive advantage. Innovative shower trays, such as the latest release from Acquabella in January 2023, boast an extensive color palette, with over 2,000 options from RAL and NCS systems. By introducing unique features, enhanced functionality, or superior value, manufacturers secure market share and maintain growth. Other companies, like Square, Cornered, and Drainage Ditch, also introduce new shower trays with distinct attributes, contributing to the market's expansion.

Market Trends

Growing demand for anti-slippery shower trays is the upcoming trend in the market. Shower trays play a crucial role in ensuring safety and convenience in bathrooms. Anti-slip shower trays, in particular, are gaining popularity due to their ability to provide enhanced traction and stability. With an aging population and a growing focus on accessibility, the demand for anti-slip shower trays is on the rise. These trays help prevent slips and falls, thereby addressing a significant safety concern for consumers. Manufacturers are continually innovating to improve the effectiveness of anti-slip features, ensuring that shower trays meet and exceed customer expectations. Rectangular, square, and cornered shower trays, equipped with drainage ditches or water holes, serve as functional sinks, adding to the overall safety and functionality of the bathroom space.

Market Challenge

Installation complexity associated with shower trays is a key challenge affecting the market growth. Shower trays are essential components of modern bathroom designs, available in various shapes and sizes, including rectangular and square models, as well as cornered options. The installation process, however, can be time-consuming and intrusive, especially in existing bathrooms where extensive floor preparation or structural adjustments are necessary. Homeowners may postpone their purchase decisions due to the inconvenience of lengthy installation times and disruption to daily routines. Installing shower trays demands a certain degree of proficiency, particularly in areas of plumbing, carpentry, and waterproofing. Inaccurately installed shower trays can result in problems such as leaks, water damage, or uneven surfaces, which can impair the shower enclosure's functionality and appearance.

However, the complex installations may lead to increased product returns or exchanges, as customers may find it challenging to install the shower trays themselves or encounter complications with professional installations. The installation process for shower trays involves several steps, including preparing the floor, installing the drainage ditch or water hole, and securing the shower tray in place. Each step requires precision and attention to detail to ensure a successful installation. Incorrect installation can lead to costly repairs and replacements, making it crucial to consider the expertise of professionals or invest in thorough DIY preparation and research.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Duravit AG: The company offers stone resin shower trays with upstands in rectangular, square, and quadrant shapes. Additionally, the company offers upstand stone resin trays, which come in different sizes and shapes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Bath Group

- Ceramica Althea SPA

- Cersanit SA

- Coram Showers

- Cosentino Global S.L.U

- Drummonds

- Eczacibasi Holding AS

- Jaquar India

- LIXIL Corp.

- MX Group Ltd.

- Novellini Spa

- POLIMAT

- POLYSAN s.r.o

- Roca Sanitario SA

- RONAL GROUP

- SONAS

- Villeroy and Boch AG

- Wolseley UK

- acquabella

- AKW Medi Care Ltd.

- CCL Specialist Supplies Ltd.

- Kohler Co.

- Roman Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Shower trays, an essential bathroom fixture, come in various shapes and sizes including rectangular and square designs with cornered or flat edges. Materials range from acrylic, steel, ceramic, resin, and exotic teak. The drainage ditch or water hole is a crucial feature ensuring water flow and preventing leakage. Anti-slip materials and anti-bacterial properties add to the hygiene and safety aspects. In the real estate sector, high-end properties prefer large, luxurious shower trays in designer shapes and sizes. In contrast, budget homes may opt for cheap substitutes. Proper installation and maintenance are vital to prevent water leakage and damage to tiles.

Moreover, the sealant plays a significant role in ensuring a leak-proof fit. Lixil and other leading market players offer digital instruments like water sensors and leakage control systems for added convenience and water conservation. Shower trays are not just functional but also contribute to brand awareness and lifestyle in luxury hotels, spas, penthouses, and designer modular homes. Despite their importance, shower trays are often overlooked, leading to issues like improper installation, slippery surfaces, and water wastage. Regular maintenance and choosing the right materials and designs can ensure a long-lasting, functional, and aesthetically pleasing bathroom fixture.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.13% |

|

Market growth 2024-2028 |

USD 899.35 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.61 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Bath Group, Ceramica Althea SPA, Cersanit SA, Coram Showers, Cosentino Global S.L.U, Drummonds, Duravit AG, Eczacibasi Holding AS, Jaquar India, LIXIL Corp., MX Group Ltd., Novellini Spa, POLIMAT, POLYSAN s.r.o, Roca Sanitario SA, RONAL GROUP, SONAS, Villeroy and Boch AG, Wolseley UK, acquabella, AKW Medi Care Ltd., CCL Specialist Supplies Ltd., Kohler Co., and Roman Ltd |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch