Silver Nitrate Market Size 2025-2029

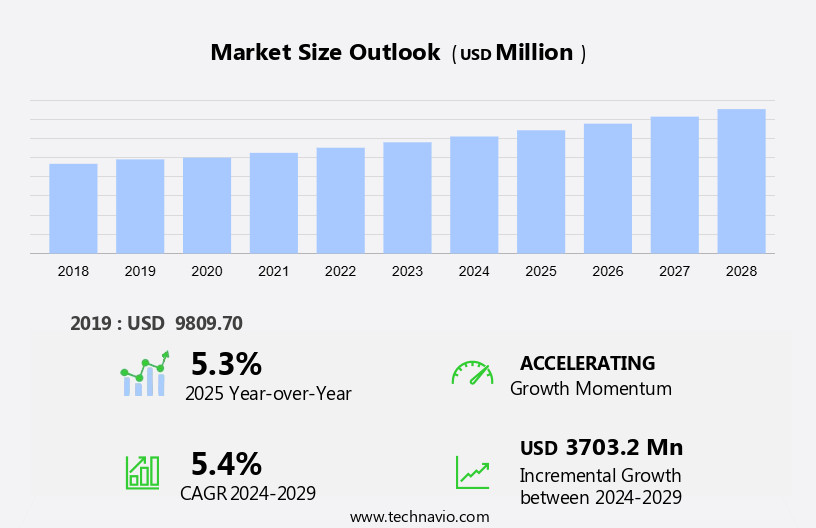

The silver nitrate market size is forecast to increase by USD 3.7 billion at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand from the healthcare sector. Silver nitrate's versatile properties make it an essential component in various medical applications, including wound care, antimicrobial therapy, and photographic industry. In the healthcare sector, silver nitrate's antimicrobial properties are gaining increasing recognition, leading to its widespread use in the treatment of various types of wounds, including diabetic ulcers and venous ulcers. However, the market growth is not without challenges. The availability of substitutes for silver nitrate, such as silver sulfadiazine and iodine-based antiseptics, poses a significant threat to market growth. These substitutes offer similar antimicrobial properties but may have lower costs and fewer side effects, making them attractive alternatives for healthcare providers. To capitalize on the market opportunities and navigate these challenges effectively, companies operating in the market must focus on developing innovative products that offer unique benefits and competitive advantages. Additionally, strategic collaborations, mergers and acquisitions, and investments in research and development can help companies stay ahead of the competition and maintain their market position.

What will be the Size of the Market during the forecast period?

- The market encompasses the global trade of this inorganic chemical compound, primarily used for various applications in industries such as silver plating, medicinal treatments, and laboratory investigations. A white crystalline substance, silver nitrate is produced by reacting silver with nitric acid. Its antibacterial characteristics make it a valuable agent in the medical sector, where it is used as a cauterizing and sclerosing agent, as well as an anti-microbial agent. In the industrial sector, silver nitrate is employed in the electroplating business as a silver plating material and in the production of coloring agents. Additionally, it finds application in the ceramic sector and in analytical chemistry.

- The market for silver nitrate is driven by the growing demand for silver plating in various industries, the increasing use of silver nitrate in medicinal treatments, and its role as a coloring agent and catalyst in various chemical processes. The market is expected to grow steadily due to the versatility and wide range of applications of silver nitrate. However, the potential hazards associated with the handling of silver nitrate, such as its toxicity and corrosive nature, may pose challenges to market growth.

How is this Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Grade Type

- Photographic grade

- Active pharmaceutical ingredient grade

- Analytical reagents grade

- Application

- Photography and jewelry

- Medical and healthcare

- Glass coating

- Others

- Type

- Crystal/powder

- Liquid solution

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- North America

By Grade Type Insights

The photographic grade segment is estimated to witness significant growth during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The photographic grade segment was valued at USD 3.82 billion in 2019 and showed a gradual increase during the forecast period.

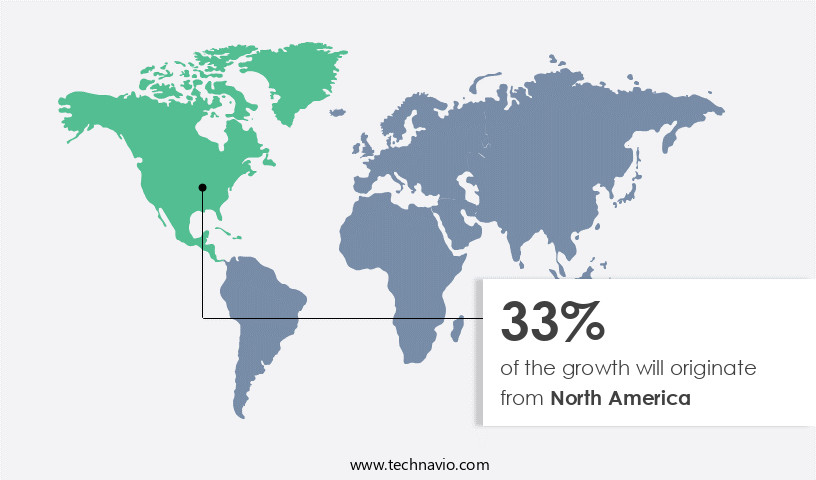

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for silver nitrate is projected to expand steadily over the forecast period, fueled by its applications in various industries such as electronics, healthcare, and photography. In healthcare, silver nitrate functions as a caustic and antiseptic agent, contributing to its extensive usage in dermatological treatments and wound care. The increasing emphasis on hygiene and advanced wound care solutions is driving the demand for silver nitrate in this sector. In the electronics industry, silver nitrate plays a crucial role in producing conductive coatings and materials for numerous electronic devices, including laptops, tablets, and mobile phones.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Silver Nitrate Industry?

- Growing demand for silver nitrate in healthcare sector is the key driver of the market. The market is experiencing significant growth due to its increasing utilization in the healthcare industry. Silver nitrate's antibacterial and caustic properties make it a popular choice for various applications within this sector.

- Wound treatment is a primary use for silver nitrate, as it aids in reducing scarring, expediting healing, and preventing infections in burns, ulcers, and other open wounds. The market is anticipated to expand further due to the rising prevalence of chronic wounds, such as diabetic ulcers and pressure ulcers. Additionally, silver nitrate finds applications in gynecology, contributing to the market's growth.

What are the market trends shaping the Silver Nitrate Industry?

- Rising medical applications of silver nitrate is the upcoming market trend. Silver nitrate is a crucial chemical compound with significant antiseptic and antibacterial properties, making it indispensable in various medical applications. In the healthcare sector, it is primarily used in wound care for removing hypergranulation tissue and calloused edges, as well as acting as an effective cauterizing agent to aid in blood clotting. Silver nitrate is also widely employed in dentistry for faster healing of mouth ulcers and in the cauterization of nasal blood vessels to prevent nosebleeds.

- Moreover, its disinfecting capabilities have led to an increase in its consumption for killing and disinfecting pathogens in drinking water. Silver nitrate's versatility and essential role in medical treatments make it a valuable commodity in the healthcare industry.

What challenges does the Silver Nitrate Industry face during its growth?

- Availability of substitutes for silver nitrate is a key challenge affecting the industry growth. The market faces competition from silver salts, particularly silver chloride, which can hinder its growth. Silver chloride is utilized in various applications, including water treatment for long-term preservation and the production of antimicrobial products. Its antiseptic properties make it a popular choice for wound healing and personal deodorants.

- In addition, silver chloride is used in photographic applications and as an antidote for mercury poisoning. Metallic salts like aluminum, copper, and gold serve as alternatives in electronic and electrical applications, photography, and jewelry. These substitutes offer advantages such as ease of application and manufacturability, as well as cost advantages, which may influence consumers' purchasing decisions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACS Chemicals - The company offers silver nitrate such as silver nitrate Lr power under brand ACS chemicals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Chemika

- Ames Goldsmith Corp.

- Celtic Chemicals Ltd.

- Central Drug House P. Ltd.

- East India Chemicals International

- Ennore India Chemical International

- Fine Chemicals and Scientific Co.

- Green Vision Technical Services Pvt Ltd

- INDIAN PLATINUM PVT LTD.

- Innova Corporate India

- Marine Chemicals

- Modison Metals Ltd.

- Otto Chemie Pvt. Ltd.

- Ralington Pharma LLP

- RXChemicals

- Sky Chem

- Texchem Industries

- Tung State

- Vizag Chemical International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Silver nitrate is an inorganic chemical compound with the formula AgNO3. This white crystalline substance is known for its antibacterial and antimicrobial characteristics, making it a valuable component in various industries. Silver nitrate plays a significant role in silver plating, a process used to coat metals with a thin layer of silver for decorative or protective purposes. Beyond silver plating, silver nitrate finds applications in medicinal treatments and laboratory investigations. Its antibacterial properties make it an effective agent in antimicrobial fabric finishing, particularly in the textile sector. Natural textiles, including raw cotton, can be treated with silver nitrate solutions to enhance their antimicrobial properties.

In addition, in the realm of digital printing methods, silver nitrate is used in dye sublimation printing, where it acts as a coloring agent and a sensitizer. Silver nanoparticles, derived from silver nitrate, are increasingly used in the production of antimicrobial coatings for consumer electronics devices and medical devices. Silver nitrate is also employed in the production of hydrogen peroxide, which is used as an oxidizing agent in various industries. In the glass coating industry, silver nitrate is used in the manufacturing of glass and ceramics. Its antimicrobial properties make it an ideal choice for creating antimicrobial coatings for these materials.

Moreover, the medical and healthcare sectors benefit from silver nitrate's antimicrobial properties as well. It is used as a cauterizing agent, a sclerosing agent, and an anti microbial agent in various medical procedures and treatments. In analytical chemistry, silver nitrate serves as an analytical reagent and a photographic grade material. Silver nitrate's antifungal and antiseptic characteristics make it an effective agent in wound care. In the field of printed electronics, silver nanoparticles derived from silver nitrate are used in the production of conductive inks. Nanotechnology advancements have led to the development of silver nanoparticles with enhanced antibacterial properties, making them valuable in various applications.

Furthermore, silver nitrate is an essential ingredient in the production of iodine cyanide, which is used as a coloring agent and an oxidizing agent in various industries. It is also used in the electroplating business as a silver plating material. In summary, silver nitrate is a versatile inorganic compound with a wide range of applications. Its antibacterial and antimicrobial properties make it an essential component in various industries, including textiles, digital printing, glass coating, medical and healthcare, and analytical chemistry. Silver nitrate's role in the production of silver oxides, silver halides, and silver nanoparticles further expands its applications in jewelry, photographic, and electronic industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 3.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Canada, Japan, India, Germany, South Korea, UK, Brazil, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Silver Nitrate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.