Smart Air Purifier Market Size 2024-2028

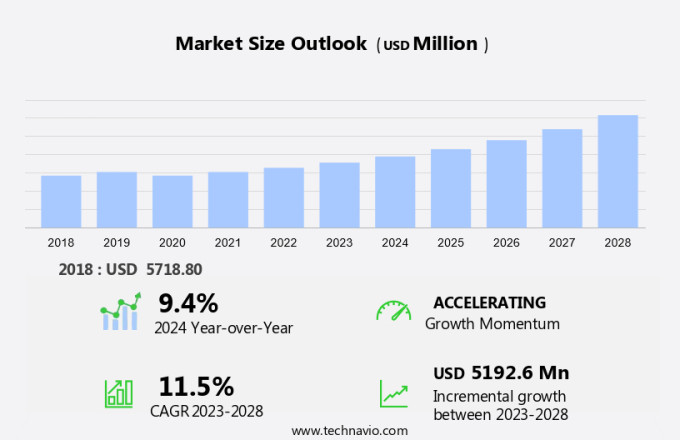

The smart air purifier market size is forecast to increase by USD 5.19 billion, at a CAGR of 11.5% between 2023 and 2028.

- The market witnesses significant growth, driven by the increasing trend towards home automation and the integration of air purifiers into this category. This development is fueled by consumers' desire for convenience and improved indoor air quality. Another key driver is the increasing adoption of smart air purifiers in healthcare facilities, where maintaining optimal air quality is essential for patient health and safety. However, the market faces challenges, including the availability of substitutes such as traditional air purifiers and HEPA filters.

- Companies in this market must differentiate themselves by offering advanced features, integrating with home automation systems, and providing effective marketing strategies to reach consumers and healthcare facilities. To capitalize on opportunities and navigate challenges, market participants should focus on innovation, competitive pricing, and strategic partnerships.

What will be the Size of the Smart Air Purifier Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in air quality technologies and consumer demand for improved indoor air quality. Air purifiers equipped with filter replacement indicators offer convenience and ensure optimal performance, while adherence to stringent air quality standards ensures effective filtration. Real-time monitoring and remote diagnostics enable proactive maintenance, enhancing user experience. VOC removal and hepa filtration technologies are at the forefront of air purification, addressing various pollutants and allergens. Consumer perception is shaped by factors such as room coverage, noise levels, and dust mite removal capabilities. Customer service and mobile app control add to the value proposition, offering ease of use and convenience.

Price competitiveness and energy management are key considerations for consumers, with energy-efficient models and data analysis tools gaining popularity. Ultraviolet (UV) lamps and UV-C sterilization offer additional benefits, addressing microorganisms and enhancing overall air quality. Marketing strategies focus on highlighting the health benefits of smart air purifiers, targeting various sectors including healthcare applications and smart home integration. Design aesthetics and brand reputation also play a role in consumer decision-making. Evolving air purification technologies include plasma technology, electrostatic precipitation, and activated carbon filters, each offering unique advantages. Environmental regulations continue to shape the market, driving innovation and ensuring compliance.

Data security and privacy concerns are addressed through secure data analysis and distribution channels, ensuring user confidence. Smart sensors and air quality monitoring offer real-time insights, enabling users to make informed decisions about their indoor environment. Ongoing advancements in air purification technologies and consumer preferences shape the dynamic the market, offering opportunities for innovation and growth.

How is this Smart Air Purifier Industry segmented?

The smart air purifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Dust collectors

- Fume and smoke collectors

- Technology

- HEPA

- Activated carbon

- Others

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

.

By Product Insights

The dust collectors segment is estimated to witness significant growth during the forecast period.

Smart air purifiers have gained significant traction in the market due to rising health concerns and increasing awareness about indoor air quality. These devices utilize various filtration technologies, including HEPA filters and activated carbon filters, to remove pollutants such as dust, allergens, pet dander, and volatile organic compounds (VOCs). Consumers prioritize features like real-time monitoring, remote diagnostics, and mobile app control for enhanced user experience. Air quality standards and environmental regulations drive the market's evolution, with a focus on energy efficiency, energy management, and noise levels. HEPA filtration, with its multi-stage filtration process, effectively removes particles as small as 0.3 microns.

Plasma technology and electrostatic precipitation are alternative air purification technologies that eliminate pollutants through ionization and electrostatic attraction. Brand reputation and customer service are crucial factors in consumer perception. Effective dust mite removal and mold spore elimination contribute to the overall health benefits of these devices. Smart sensors and data analysis enable remote monitoring and particle filtration efficiency, while UV-C sterilization and ozone generation provide additional disinfection capabilities. Marketing strategies emphasize design aesthetics, healthcare applications, and smart home integration. Price competitiveness and distribution channels are essential for reaching a broader audience. Data security and privacy concerns are addressed through secure data transmission and storage.

Air purifier lifespan and filter replacement are essential considerations, with some devices offering long-lasting filters and easy replacement options. UV-C sterilization and HEPA filtration contribute to the air purifier's effectiveness in removing various pollutants, ensuring cleaner and healthier indoor environments.

The Dust collectors segment was valued at USD 4.32 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing notable growth, surpassing other regions. This expansion is primarily driven by the influx of global brands and advanced air purifiers in the market. For example, Coway Co., Ltd., based in South Korea, launched smart home products, including Airmega air purifiers, in India in January 2022. Increasing consumer awareness regarding air quality and its health benefits, as well as the expansion of the commercial sector, are additional factors fueling market growth. Air quality standards and real-time monitoring are essential features in modern air purifiers, ensuring cleaner and healthier indoor environments.

Remote diagnostics and VOC removal are other advanced technologies gaining popularity. Hepa filters, with their high filtration efficiency, are a preferred choice for many consumers. Consumer perception, room coverage, noise levels, and dust mite removal are crucial factors influencing purchasing decisions. Customer service, mobile app control, and price competitiveness are also significant considerations. Energy management and ultraviolet lamps contribute to energy efficiency and improved air quality. Data analysis and air purification technologies, such as plasma technology and electrostatic precipitation, enhance the overall performance of air purifiers. Pet dander reduction, mold spore removal, and allergen removal are essential features for those suffering from allergies or asthma.

Marketing strategies and brand reputation play a vital role in the market. Activated carbon filters, remote monitoring, and particle filtration efficiency are essential components of air purification systems. Data security and distribution channels are essential for maintaining user trust and convenience. Ozone generation and smart sensors are other emerging trends, addressing privacy concerns and offering customized air purification solutions. The lifespan of air purifiers and UV-C sterilization are essential factors for long-term investment. Smart home integration and air quality monitoring are also gaining traction, enhancing user experience and convenience. Design aesthetics and healthcare applications are essential considerations for manufacturers, catering to diverse consumer preferences and needs.

Hepa filtration, filtration stages, air flow rate, and air circulation are essential factors affecting the performance and efficiency of air purifiers. Environmental regulations and energy efficiency are crucial aspects for sustainable and eco-friendly air purification solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Air Purifier Industry?

- The home automation market is propelled forward by the growing demand for such products, reflecting a significant trend in modern residential living.

- The market for smart air purification systems is experiencing significant growth due to the increasing preference for improved indoor air quality and home automation. These advanced air purifiers utilize technologies such as smart sensors, electrostatic precipitation, and activated carbon layers for allergen removal and mold spore reduction. Users can operate these systems via smartphones, tablets, or remotes, ensuring a seamless and immersive experience. Energy efficiency is another key benefit, as smart air purifiers can be integrated with HVAC systems to optimize energy consumption. However, privacy concerns regarding data security are emerging as potential challenges. Ozone generation, a feature found in some air purifiers, is a topic of debate due to potential health risks.

- Distributors play a crucial role in reaching consumers, and establishing robust distribution channels is essential for market success. In conclusion, the market is poised for continued growth, driven by consumer demand for healthier indoor environments and the convenience of home automation.

What are the market trends shaping the Smart Air Purifier Industry?

- The rising adoption of smart air purifiers is a notable trend in the healthcare sector. This technological advancement is increasingly being integrated into healthcare facilities to enhance indoor air quality and create healthier environments for patients and staff.

- Smart air purifiers play a crucial role in maintaining indoor air quality in healthcare facilities, where the elimination of contaminants is essential for patient health. These advanced devices utilize HEPA filters, VOC removal technology, and real-time monitoring to ensure adherence to air quality standards. Filter replacement and remote diagnostics ensure uninterrupted operation, while dust mite removal and noise levels are considerations for optimal patient comfort.

- Consumer perception and customer service are vital in the selection process, with mobile app control offering convenience and ease of use. Effective air filtration is essential for reducing the risk of airborne infectious diseases, making smart air purifiers an indispensable investment for healthcare providers.

What challenges does the Smart Air Purifier Industry face during its growth?

- The availability of substitutes poses a significant challenge to the industry's growth trajectory. In today's competitive business landscape, companies must continually innovate and differentiate themselves to maintain market share and outpace competitors. The emergence of viable alternatives can threaten a company's profitability and market position, necessitating a strategic response. Effective market analysis, product development, and customer engagement are essential to mitigating the impact of substitutes and sustaining industry growth.

- Smart air purifiers represent an advanced category of air filtration systems, incorporating features such as energy management, ultraviolet (UV) lamps, data analysis, and air quality monitoring. These technologies enhance the air purification process and offer additional benefits like pet dander reduction and UV-C sterilization. However, the market for smart air purifiers faces a significant threat of substitution from conventional air purifiers due to their higher price point. Energy efficiency and smart home integration are key selling points, but these features come at a premium.

- To appeal to a wider audience, marketing strategies focusing on the long-term cost savings and improved air quality may be effective. The smart air purifier's lifespan, a crucial consideration for consumers, is another factor influencing market dynamics. As the market evolves, continued innovation in air purification technologies and integration with smart home systems will be essential for maintaining competitiveness.

Exclusive Customer Landscape

The smart air purifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart air purifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart air purifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acer Inc. - The company introduces the Hot cool HP07 air purifier, featuring an advanced high efficiency particulate air filter enclosed with vacuum seals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- AllerAir Industries Inc.

- Blue Star Ltd.

- Coway Co. Ltd.

- Dyson Technology India Pvt. Ltd.

- Guardian Technologies LLC

- Honeywell International Inc.

- IQAir AG

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Rabbit Air

- Radic8 Pte Ltd.

- Samsung Electronics Co. Ltd.

- Shapoorji Pallonji And Co. Pvt. Ltd.

- Sharp Corp.

- Silicon Valley Air Expert Inc.

- Smart Air

- Unilever PLC

- Winix America Inc.

- Xiaomi Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Air Purifier Market

- In January 2023, Dyson, a leading technology company, announced the launch of its new Dyson Pure Cool Link Air Purifier, which integrates air purification with heating and cooling capabilities (Dyson, 2023). This innovative product expansion underscores Dyson's commitment to providing comprehensive home solutions.

- In March 2024, Philips and Google entered into a strategic partnership to integrate Google Assistant into Philips' air purifier line, enabling users to control their devices using voice commands (Google, 2024). This collaboration underscores the growing importance of smart home technology in the air purifier market.

- In May 2024, Blueair, a Swedish air purifier manufacturer, secured a strategic investment of USD50 million from EQT Ventures, a leading European venture capital firm (EQT Ventures, 2024). This funding round will support Blueair's continued growth and innovation in the air purifier market.

- In August 2025, the European Union passed new regulations mandating the inclusion of air quality sensors in all new residential buildings (European Commission, 2025). This policy change represents a significant shift towards proactive air quality management and is expected to drive demand for smart air purifiers in Europe.

Research Analyst Overview

- The market is experiencing significant growth as consumers prioritize indoor air quality for health and comfort. PM10 filtration and PM2.5 filtration technologies are crucial for removing airborne pollutants, including particulate matter and chemical fumes. Advanced features such as smoke removal, virus inactivation, and bacteria removal cater to concerns over airborne pathogens. Wi-Fi connectivity and cloud connectivity enable remote monitoring and control, while quiet operation ensures minimal disruption to daily activities.

- Energy-saving modes and gas sensors further enhance the air purifiers' efficiency and effectiveness. Bluetooth connectivity and sleep mode add to the user-friendly experience, making these devices indispensable tools for businesses seeking to maintain optimal indoor air quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Air Purifier Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2024-2028 |

USD 5192.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.4 |

|

Key countries |

China, US, Japan, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Air Purifier Market Research and Growth Report?

- CAGR of the Smart Air Purifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart air purifier market growth of industry companies

We can help! Our analysts can customize this smart air purifier market research report to meet your requirements.