Smart Education Software Market Size 2024-2028

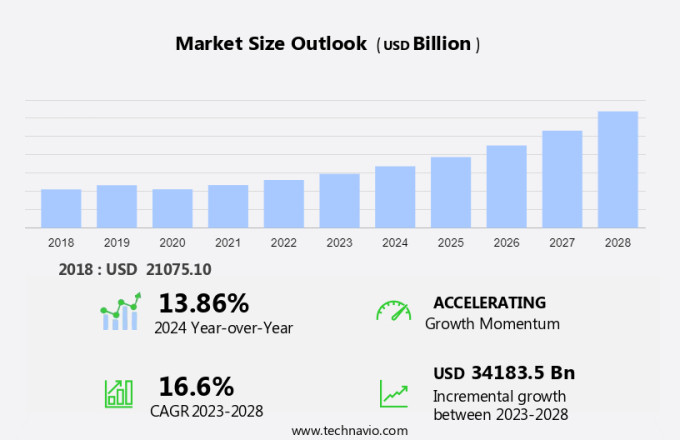

The smart education software market size is forecast to increase by USD 34,183.5 billion, at a CAGR of 16.6% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing adoption of e-learning is driving market growth, as students and educators seek flexible and convenient learning solutions. Another trend is the rising acceptance of cloud-based software, which offers cost savings and accessibility. However, the high implementation cost of smart infrastructure remains a challenge for market growth. The smart education market, a segment of educational technology (EdTech) and e-learning, is experiencing significant growth due to the increasing adoption of gamification and IoT-enabled smart devices in teaching and learning environments. Schools and universities must invest in modern technology to provide students with an effective and engaging learning experience. Despite this challenge, the benefits of smart education software, such as personalized learning and improved student engagement, make it a worthwhile investment for educational institutions.

What will be the Size of the Smart Education Software Market During the Forecast Period?

- Gamification, utilizing the Octalysis Framework, enhances student engagement and motivation by integrating game elements into educational content. Transnational education (TNE) institutions are leveraging digital infrastructure, including high-speed internet and interactive whiteboards, to deliver individualized instruction and adaptive evaluations. However, challenges persist with the rise of viruses, cyberattacks, and the need for VPNs to secure data. Technology advancements, such as artificial intelligence and machine learning, are revolutionizing the delivery of smart learning solutions for colleges and institutions. Hardware suppliers, software developers, and content providers collaborate to cater to the evolving needs of corporate professionals and educators.

How is this Smart Education Software Industry segmented and which is the largest segment?

The smart education software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Content

- Learning

- Assessment

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Product Insights

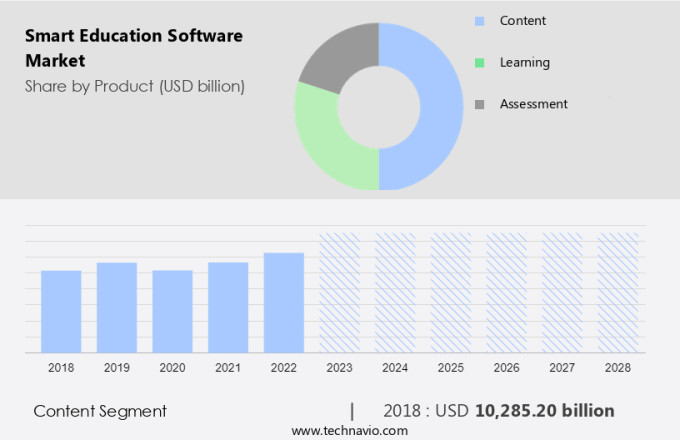

- The content segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the advantages it offers, such as content flexibility, increased accessibility, and interactive content like video-based learning. The proliferation of high-speed internet, smartphones, and tablets has further fueled market expansion. The market is divided into two primary content categories: packaged and customized. Packaged content, which consists of pre-determined and standardized material, dominates the market, particularly In the K-12 sector, where government-regulated course content is prevalent. Customized content, on the other hand, can be tailored to individual user requirements. The market's growth is driven by the increasing adoption of technology in educational institutions and the need for personalized learning experiences.

Get a glance at the Smart Education Software Industry report of share of various segments Request Free Sample

The content segment was valued at USD 10,285.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

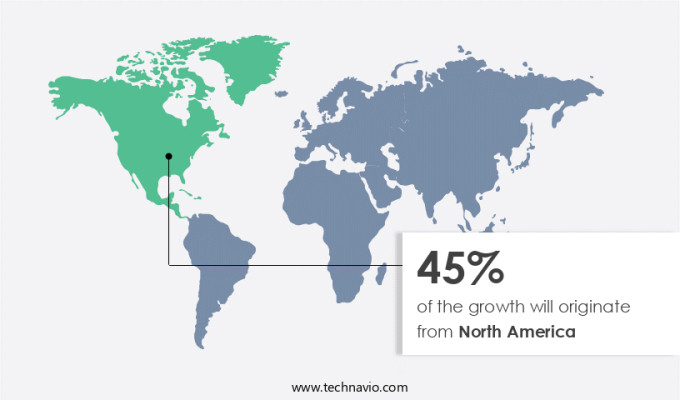

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region led The market in 2023 due to the early adoption of online education, driven by increased internet penetration and advanced EdTech technologies. The US and Canada are the primary contributors to this region, with a digitally savvy population and a strong focus on technology integration in education. Government initiatives, such as the National Education Technology Plan (NETP), further encourage the use of education software in schools and colleges. These factors contribute to the significant growth of the market in North America.

Market Dynamics

Our smart education software market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Smart Education Software Industry?

The growing adoption of E-learning is the key driver of the market.

- The smart learning market, a segment of Educational Technology (EdTech), is experiencing significant growth due to the integration of Gamification in education. The Octalysis Framework, a gamification system, enhances learner engagement and motivation. IoT-enabled smart devices, such as smart wearables and mobile phones, are increasingly used in K-12 and Higher Education for interactive learning. Cloud technologies and mobile technologies have transformed traditional classrooms into digital learning environments, with platforms like Google Classrooms and Blackboard Learn leading the way. The global e-learning market is driven by improved digital infrastructure, high-speed internet, and the increasing preference for individualised instruction and adaptive evaluations.

- Artificial intelligence and machine learning are revolutionising education by providing personalised learning experiences. Transnational education (TNE) and corporate professionals are also adopting e-learning for its flexibility and convenience. However, cybersecurity concerns, including viruses and cyberattacks, are a significant challenge for the e-learning industry. VPNs and secure educational platforms are essential to ensure data security. Policies and regulations are being implemented to address these concerns and ensure the protection of student data. Hardware suppliers, software developers, and content providers are collaborating to create comprehensive e-learning solutions. Interactive displays, virtual classrooms, and interactive whiteboards are becoming increasingly popular tools for delivering engaging educational content.

What are the market trends shaping the Smart Education Software Industry?

Increasing adoption of cloud based software is the upcoming market trend.

- The market is witnessing significant growth due to the integration of gamification techniques using frameworks like Octalysis. This trend is driving the demand for gamified learning solutions, including IoT-enabled smart devices, interactive displays, and mobile phones, in both K-12 and higher education. Cloud technologies and mobile technologies are essential components of this digital infrastructure, enabling individualized instruction, adaptive evaluations, and artificial intelligence. Transnational education (TNE) and corporate professionals are increasingly utilizing these smart learning solutions for flexible and convenient education. However, concerns around viruses and cyberattacks necessitate the use of Virtual Private Networks (VPNs) and secure educational content providers.

- Policies and regulations are being put in place to ensure the security and privacy of student data. Hardware suppliers, software developers, and content providers are collaborating to offer comprehensive smart learning solutions. Google Classrooms and Blackboard Learn are popular platforms for K-12 education, while colleges and institutions are adopting interactive whiteboards and VPNs for secure remote learning. The adoption of high-speed internet and e-learning infrastructure is also crucial for the effective implementation of these solutions.

What challenges does the Smart Education Software Industry face during its growth?

The high implementation cost of smart infrastructure is a key challenge affecting the industry growth.

- The market faces challenges, particularly in developing regions, due to the high costs associated with digital infrastructure and software development. The use of Gamification Octalysis Framework, IoT-enabled smart devices, and wearables in education is increasing, but the recurring costs of software upgrades can be a deterrent for adoption. Transnational education (TNE) and corporate professionals are embracing cloud technologies and mobile learning solutions, including Google Classrooms and Blackboard Learn, for individualised instruction and adaptive evaluations.

- High-speed internet and e-learning infrastructure are essential for effective implementation, but concerns over cyberattacks and viruses persist. Hardware suppliers, software developers, and content providers are collaborating to offer comprehensive solutions. Policymakers and institutions are investing in technology to enhance K-12 and higher education, while mobile phones and interactive displays are becoming common tools In the classroom. Despite these advancements, the market growth is hindered by the ongoing costs and infrastructure challenges.

Exclusive Customer Landscape

The smart education software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart education software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart education software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Anthology Inc.

- Apollo Asset Management Inc.

- Cisco Systems Inc.

- Cornerstone OnDemand Inc.

- D2L Inc.

- Educomp Solutions Ltd.

- Ellucian Co.

- Hon Hai Precision Industry Co. Ltd.

- John Wiley and Sons Inc.

- MPS Ltd.

- NetDragon Websoft Holdings Ltd

- NIIT Ltd.

- Oracle Corp.

- Pearson Plc

- Promethean World Ltd.

- SAP SE

- Scholastic Corp.

- Skillsoft Corp.

- Thoma Bravo LP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth as technology continues to revolutionize the education sector. This evolution is driven by several factors, including the increasing demand for personalized learning experiences, the proliferation of digital infrastructure, and the integration of advanced technologies such as artificial intelligence and machine learning. One of the key trends shaping the market is gamification. Gamification is the application of game design elements to non-game contexts, such as education. It has been shown to increase student engagement, motivation, and learning outcomes. The Octalysis Framework, a comprehensive gamification framework, identifies eight core drives that motivate human behavior, providing a solid foundation for designing effective gamified learning experiences.

Further, another significant trend is the integration of IoT-enabled smart devices and wearables into the education system. These devices offer numerous benefits, including real-time data collection, personalized learning, and improved accessibility. For instance, smart wearables can be used to monitor students' progress, provide instant feedback, and even detect health issues that may impact learning. The increasing adoption of cloud technologies and mobile technologies in education is another major trend. Cloud technologies enable the delivery of educational content and services over the Internet, making learning more accessible and flexible. Mobile technologies, on the other hand, offer the convenience of learning on-the-go, allowing students to access educational resources from anywhere, at any time.

Despite the numerous benefits of smart education software, there are challenges that need to be addressed. One of the most significant challenges is ensuring the security of digital infrastructure. With the increasing use of technology in education, there is a growing risk of cyberattacks and viruses. Institutions must invest in strong cybersecurity measures to protect their e-learning infrastructure and the sensitive data it contains. Another challenge is the need for high-speed internet access in educational institutions. While many schools and colleges have made significant progress in this area, there are still many that lack the necessary infrastructure to support effective e-learning.

|

Smart Education Software Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market Growth 2024-2028 |

USD 34,183.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.86 |

|

Key countries |

US, China, Canada, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Education Software Market Research and Growth Report?

- CAGR of the Smart Education Software industry during the forecast period

- Detailed information on factors that will drive the Smart Education Software Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart education software market growth of industry companies

We can help! Our analysts can customize this smart education software market research report to meet your requirements.