Smart Elevator Market Size 2024-2028

The smart elevator market size is forecast to increase by USD 4.92 million at a CAGR of 6.78% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for energy-efficient solutions in freight carriage and elevator systems. With the rise of green buildings, there is a heightened focus on reducing energy consumption, making energy-efficient elevators a priority. Cloud predictive maintenance is also gaining traction, enabling real-time monitoring and predictive analysis, thereby enhancing system performance and reducing downtime. Intense competition among market players is driving innovation and the integration of advanced technologies such as IoT, AI, and machine learning to offer more efficient and cost-effective solutions. Key hardware components, including sensors, controllers, and actuators, are becoming more sophisticated, enabling seamless integration and improved system functionality. These trends are shaping the future of the market, offering numerous opportunities for growth.

The market is experiencing significant growth in the building sector, particularly in high-rise buildings, as urbanization and the development of smart cities continue to gain momentum. This trend is driven by the need for energy efficiency, advanced control systems, and the integration of various technologies such as artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). Energy consumption is a major concern in buildings, and smart elevators are playing a crucial role in reducing energy waste. These systems use destination-oriented technology, which optimizes elevator routes based on passenger demand, thereby reducing the number of stops and the amount of energy consumed.

Moreover, the integration of AI and cloud predictive maintenance enables real-time monitoring and analysis of elevator performance, allowing for proactive maintenance and further energy savings. Smart technology, including AI, sensors, and infotainment systems, is also being integrated into passenger and freight elevator systems. These features enhance the user experience, provide real-time information, and enable remote monitoring and management. Green buildings, which prioritize energy efficiency and sustainability, are particularly adopting smart elevator systems to meet their sustainability goals. The construction industry is also embracing smart elevators as part of the building process. Elevator manufacturers are developing hardware and software solutions to streamline the installation and integration of these systems into new buildings.

Further, virtual reality diagnostics are being used to simulate elevator performance and optimize design, reducing the need for physical testing and minimizing construction time. The integration of smart technology in elevators is not limited to high-rise buildings. Low and mid-rise buildings are also adopting these systems to improve energy efficiency and enhance the user experience. The use of cloud computing and AI enables remote monitoring and management of these systems, reducing maintenance costs and increasing reliability.

In conclusion, the market is a key component of the building sector, particularly in the context of urbanization and the development of smart cities. The integration of advanced technologies such as AI, cloud computing, and the IoT is driving innovation and improving energy efficiency in both passenger and freight elevator systems. The construction industry is also embracing these systems to streamline the building process and enhance the user experience. Smart elevators are an essential element of green buildings and are expected to continue gaining popularity in the building sector.

Market Segmentation

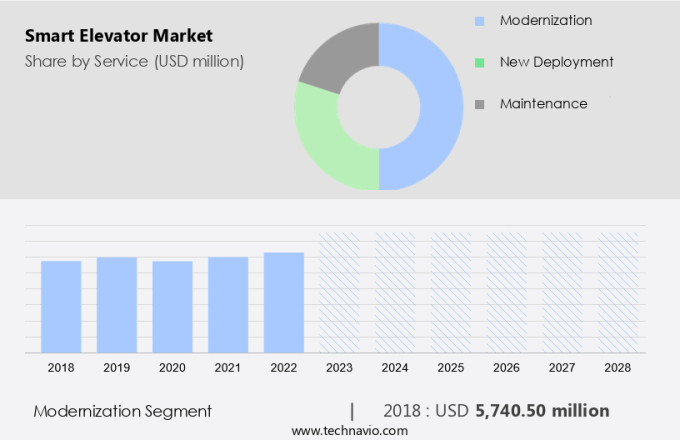

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- Modernization

- New deployment

- Maintenance

- Application

- Commercial

- Residential

- Industrial

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Service Insights

The modernization segment is estimated to witness significant growth during the forecast period. In the realm of modern building infrastructure, elevators play a pivotal role, particularly in high-rise structures. With a typical service life spanning three to four decades, these systems require consistent maintenance to ensure optimal performance. However, as elevators age, sourcing essential components and spare parts for older models becomes increasingly challenging. Consequently, the demand for upgrading to smart elevators arises. Modernization, the process of upgrading elevator systems, is gaining traction as technology advances. This transformation involves integrating Internet of Things (IoT) capabilities and infotainment systems to enhance efficiency and user experience. In the context of energy conservation, deploying smart elevators is a crucial step towards increased building efficiency.

Also, as the construction industry shifts towards more sustainable and technologically advanced designs, the adoption of energy-efficient elevator systems becomes a priority. By upgrading to smart elevators, buildings can benefit from improved performance, reduced energy consumption, and a more seamless user experience. The integration of IoT and infotainment systems enables real-time monitoring, predictive maintenance, and personalized services for occupants. In conclusion, the need for modernization and upgrading to smart elevators is a response to the challenges posed by aging infrastructure and the demand for more efficient and technologically advanced building systems. The integration of IoT and infotainment systems in elevators is a significant step towards enhancing the overall performance and user experience in both high-rise and low/mid-rise buildings.

Get a glance at the market share of various segments Request Free Sample

The modernization segment was valued at USD 5.74 billion in 2018 and showed a gradual increase during the forecast period.

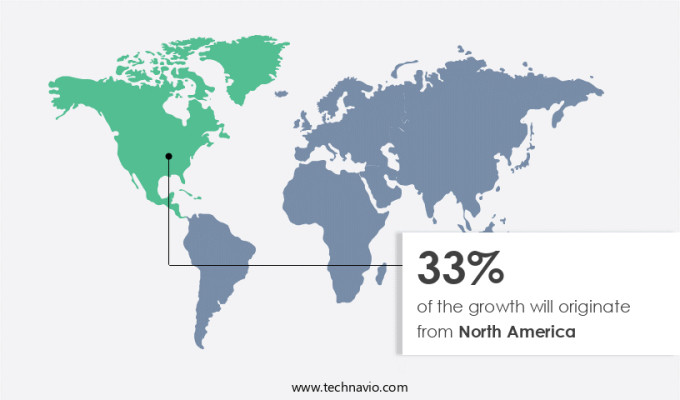

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is primarily driven by the United States due to the prevalence of numerous high-rise buildings in the country. The aging fleet of elevators in the US and Canada has led to an increased demand for modernizing existing elevators. Furthermore, the construction of new high-rise projects will fuel the need for advanced smart elevators.

For instance, in Canada, Frank Gehry's plans to construct two towering buildings, measuring 298 meters and 262 meters high, in Toronto, are expected to be completed during the forecast period. Urbanization and the subsequent increase in high-rise structures are key factors contributing to the growth of the market in North America. Virtual reality diagnostics and spatial technologies are also gaining popularity in the elevator industry, providing maintenance teams with real-time data to enhance elevator performance and prevent potential breakdowns. These advancements are expected to further boost the market growth in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing number of construction activities is the key driver of the market. In the realm of building construction, Artificial Intelligence (AI) is increasingly being integrated to enhance efficiency and productivity. Developed countries like the US and Canada, along with the European Union (EU), are focusing on upgrading their existing infrastructure, creating a significant demand for smart solutions in the construction industry.

The residential sector has experienced a notable uptick in spending, fueled by the economic recovery in the US since the 2008 recession. This optimism among homebuyers has led to an increased demand for new single- and multi-family homes. In this context, AI-driven technologies, such as cloud computing and advanced cameras, are playing a pivotal role in streamlining construction processes, reducing costs, and improving overall project outcomes. These innovations are expected to revolutionize the construction sector in the US and beyond.

Market Trends

Cloud predictive maintenance is the upcoming trend in the market. In the modern era of energy-conscious construction, the significance of energy-efficient freight elevator systems in green buildings has escalated. IoT-enabled smart elevators play a pivotal role in minimizing energy consumption and ensuring optimal performance.

Moreover, these systems collect data on elevator operations and analyze it against historical data to predict potential component failures. By alerting service engineers in advance, these elevators reduce downtime and save costs on repairs.

Market Challenge

The intense competition is a key challenge affecting the market growth. The market in the United States is witnessing significant growth, driven by the adoption of advanced technologies such as cloud predictive maintenance and destination-oriented technology. New entrants, such as Hitachi Elevators, are also entering the market due to its expansion. The increasing competition has led to price wars among companies, resulting in reduced profit margins.

However, elevator control technology is a crucial aspect of this market, with companies focusing on developing innovative solutions to meet the evolving needs of commercial applications. The companies must stay competitive by offering cost-effective solutions while maintaining high-quality control systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Hyundai Elevator Co. Ltd. - The company offers smart elevators such as i-XEL and THE EL. They manufacture, install, sell, and service elevators, escalators, moving walkways, automated parking systems, and material handling systems.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Express Lifts Ltd.

- Fujitec Co. Ltd.

- Halma Plc

- Hitachi Ltd.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Johnson Lifts Pvt. Ltd.

- KONE Corp.

- Mitsubishi Electric Corp.

- Nidec Corp.

- Otis Worldwide Corp.

- Robert Bosch GmbH

- Robustel

- Schindler Holding Ltd.

- Sigma Elevator Co.

- thyssenkrupp AG

- TK Elevator GmbH

- Toshiba Corp.

- Vantage Elevation LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the integration of artificial intelligence (AI) and IoT technologies in elevator control systems. These advanced technologies enable destination-oriented technology, cloud predictive maintenance, and energy efficiency features, making elevators an essential component of green buildings and smart cities. In the building construction sector, both high-rise and low & mid-rise structures are adopting smart elevator systems for commercial applications. These systems offer infotainment systems, virtual reality diagnostics, and regenerative drive features, enhancing the user experience and reducing energy consumption. Manufacturers provide new installation services, modernization, and renovation services to cater to the increasing demand for smart elevator systems.

In conclusion, control systems in these elevators use sensors and cameras for safety and security purposes. The integration of AI and spatial technologies enables virtual diagnostics and real-time maintenance, reducing downtime and improving overall efficiency. Freight elevator systems also benefit from smart technology, offering energy-efficient solutions for urbanization and the logistics sector. Overall, the market is poised for growth, with cloud computing and software solutions playing a crucial role in optimizing elevator performance and reducing energy consumption.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 4.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Express Lifts Ltd., Fujitec Co. Ltd., Halma Plc, Hitachi Ltd., Honeywell International Inc., Huawei Technologies Co. Ltd., Hyundai Elevator Co. Ltd., Johnson Lifts Pvt. Ltd., KONE Corp., Mitsubishi Electric Corp., Nidec Corp., Otis Worldwide Corp., Robert Bosch GmbH, Robustel, Schindler Holding Ltd., Sigma Elevator Co., thyssenkrupp AG, TK Elevator GmbH, Toshiba Corp., and Vantage Elevation LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch