Smart Home Security Market Size 2025-2029

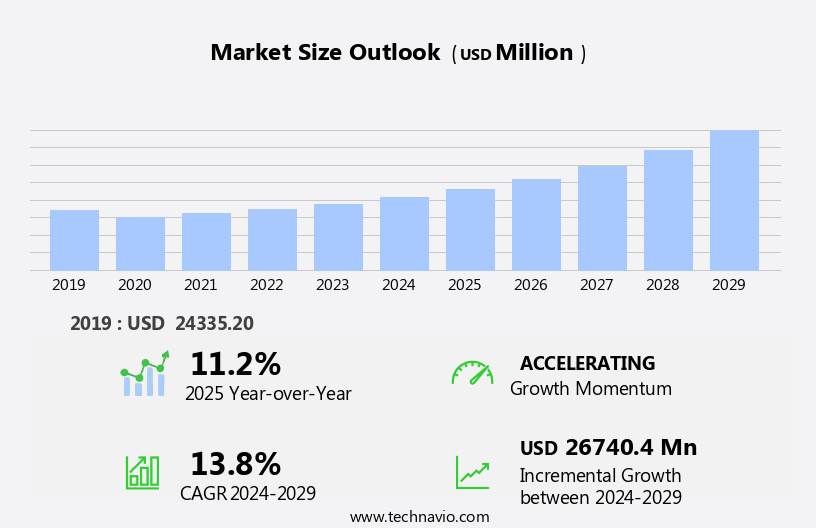

The smart home security market size is forecast to increase by USD 26.74 billion, at a CAGR of 13.8% between 2024 and 2029.

- The market is witnessing significant growth due to the escalating concerns over home security. With the increasing number of burglaries and break-ins, homeowners are investing in advanced security solutions to safeguard their properties. A notable trend in the market is the shift toward AI-powered security systems. These solutions offer enhanced features such as facial recognition, motion detection, and voice commands, making them more effective in deterring intruders and ensuring home safety. However, consumer privacy concerns associated with these advanced security systems pose a significant challenge to market growth. Homeowners are wary of the potential misuse of their personal data by security providers.

- Addressing these concerns through transparent data handling policies and robust security measures will be crucial for market players to gain consumer trust and loyalty. Effective communication and education about the benefits and security measures of AI-powered security solutions will also be essential in mitigating privacy concerns and driving market growth.

What will be the Size of the Smart Home Security Market during the forecast period?

The market continues to evolve, with innovative technologies and applications shaping its dynamics. Mobile apps enable users to control their security systems remotely, receiving notifications for potential threats in real-time. Data privacy remains a priority, with access control solutions employing facial recognition and two-factor authentication to ensure only authorized individuals gain entry. Wireless communication, such as Wi-Fi and Bluetooth connectivity, facilitate seamless integration of various devices, including security cameras and smart hubs. Energy management and maintenance plans are also becoming essential components of home security packages, offering professional monitoring and video surveillance for added peace of mind. Security systems are expanding beyond traditional intrusion detection, incorporating object detection, window sensors, and motion sensors.

IoT integration and smart home ecosystems enable users to manage their entire home through a single interface, enhancing user experience and convenience. Professional installation services and DIY options cater to various preferences, while smart locks and smart plugs add an extra layer of security. Real-time monitoring and cloud storage provide valuable data for vulnerability assessments and AI-powered security solutions. Network security, penetration testing, and malware protection are essential components, ensuring the system remains secure against potential threats. Smart lighting and home automation offer energy savings and added convenience, while smart thermostats and home monitoring systems provide users with valuable insights into their living environment.

The continuous unfolding of market activities and evolving patterns underscore the importance of staying informed and adapting to the ever-changing smart home security landscape.

How is this Smart Home Security Industry segmented?

The smart home security industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Wired

- Wireless

- Device

- Smart cameras

- Smart alarm

- Smart sensors and detectors

- Smart door locks

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

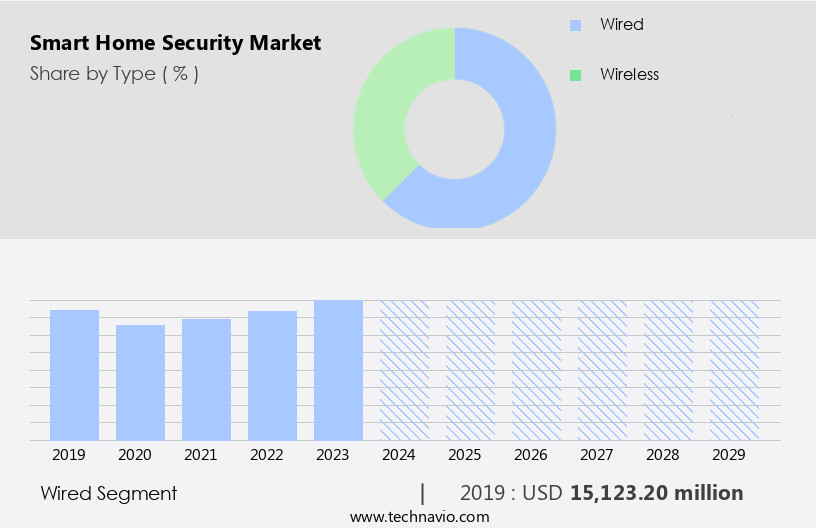

The wired segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable expansion, with wired security systems continuing to hold significant sway due to their dependable and robust features. Wired systems, which utilize physical cables for power, data transmission, and connectivity, offer unwavering reliability and minimal interference. This stability is particularly valued in environments where consistent performance is essential. Furthermore, wired systems provide enhanced security, as they are less susceptible to hacking compared to wireless alternatives. Mobile app control and real-time monitoring are integral components of the smart home security ecosystem, enabling users to manage their systems remotely and receive instant notifications. Data privacy and access control are also crucial concerns, with advanced encryption and user authentication methods ensuring secure information transfer and user-specific access.

Security cameras, window sensors, and motion sensors are key security devices, while wireless communication and IoT integration enable seamless connectivity and automation. Energy management, maintenance plans, and professional monitoring services add value to home security packages, ensuring optimal system performance and peace of mind. Smart home ecosystems, DIY installation, and smart assistants further enhance user experience, while professional installation and smart locks provide additional layers of security. Security consulting, network security, and penetration testing services ensure the protection of smart home systems against potential threats. Wired security systems adhere to smart home standards and offer integration with various smart home devices, including smart lighting, thermostats, and plugs.

Home automation and home monitoring provide users with comprehensive control and peace of mind, while push notifications keep them informed of system activity. In summary, the market is characterized by its integration of advanced technologies, including wired systems, mobile app control, real-time monitoring, and user-friendly interfaces, to provide reliable, secure, and convenient solutions for homeowners.

The Wired segment was valued at USD 15.12 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing significant growth, fueled by several key factors. With disposable personal income in the US reaching an estimated USD22,056.3 billion in 2023, consumers have the financial means to invest in advanced security systems. This trend is driving market expansion as homeowners seek to enhance their home security with sophisticated solutions. Crime statistics from the FBI indicate that while property crime rates have decreased, it remains a concern, with over 6.2 million incidents reported in 2023. This persistent issue underscores the importance of reliable security systems. Smart home security solutions offer numerous benefits, including mobile app control, real-time monitoring, and security notifications.

These features enable homeowners to stay informed and take action remotely, providing peace of mind and enhancing overall security. Security cameras with object detection and facial recognition, access control systems with biometric authentication, and smart locks with two-factor authentication offer added layers of protection. Wireless communication, IoT integration, and Wi-Fi connectivity enable seamless integration of various smart home devices, creating a harmonious ecosystem. Energy management and maintenance plans further add value, while professional monitoring services provide an extra layer of security. Home security packages cater to diverse needs, with DIY installation options available for those who prefer a more hands-on approach.

These systems offer numerous benefits, including mobile app control, real-time monitoring, energy management, and added layers of security through features like facial recognition, biometric authentication, and two-factor authentication.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Home Security Industry?

- The escalating importance of home security is the primary factor fueling market growth. (Maintaining a professional tone, ensuring grammatical correctness, and adhering to the 100-word limit.)

- The market is experiencing significant growth due to escalating concerns over home security. With increasing crime rates in various regions, homeowners are prioritizing advanced security solutions that provide real-time monitoring, intrusion detection, and remote access control. Traditional security measures, such as basic locks and alarms, are no longer sufficient. Instead, there is a growing preference for AI-powered surveillance cameras, smart alarms, and biometric door locks. In North America, particularly in the US, cities have seen a rise in home break-ins, with Chicago, Los Angeles, and Houston reporting an increase in such incidents in 2023. This trend is driving the demand for smart home security systems that offer IoT integration, wi-fi connectivity, Bluetooth connectivity, and user-friendly experiences.

- Security consulting services and cloud storage solutions are also becoming essential components of these systems. Smart assistants, such as Amazon Alexa and Google Home, are being integrated into these systems, allowing users to control their security systems using voice commands. Overall, the market is expected to continue growing as homeowners prioritize their safety and seek innovative solutions to protect their properties.

What are the market trends shaping the Smart Home Security Industry?

- The trend in the market is moving towards AI-powered security solutions. As a professional, it is essential to adopt this approach for enhanced security systems.

- The market is experiencing notable growth due to the integration of advanced technologies such as facial recognition, two-factor authentication, and biometric authentication. These innovations enhance security systems by providing more accurate identification and stronger access control. Additionally, wireless security protocols, network security, penetration testing, and malware protection ensure robust system defenses. Smart hubs serve as central control centers, allowing users to manage various security features through a user-friendly interface. Innovations in smart home security continue to emerge, with companies introducing new solutions. For instance, Alarm.Com's AI Deterrence (AID) service, unveiled at CES 2025, uses AI-driven audio warnings and personalized alerts to deter intruders in real-time.

- Furthermore, smart lighting integration enables energy savings and added security benefits. To maintain optimal security, it's essential to prioritize professional installation and regular system updates. By focusing on these market dynamics, businesses can make informed decisions and stay ahead of evolving security trends.

What challenges does the Smart Home Security Industry face during its growth?

- The growth of the industry is confronted by significant challenges due to consumer privacy concerns surrounding security solutions. It is essential to address these issues in a professional and informed manner to ensure both effective security implementation and the protection of individual privacy.

- The market is experiencing significant growth due to the increasing adoption of home automation technologies, including smart locks, motion sensors, and home monitoring systems. These devices offer enhanced security features, such as push notifications and AI-powered security, to provide peace of mind for homeowners. However, consumer privacy concerns represent a significant challenge for this market. The collection and management of personal data by smart security systems, including cameras, motion sensors, and smart plugs, increase the risk of privacy breaches. For instance, unauthorized access and data misuse are potential vulnerabilities that need to be addressed through robust data security measures and regular vulnerability assessments.

- The FTC's recent complaint against Ring, a home security camera company, highlights the importance of implementing essential security measures to protect consumers' privacy. Smart home standards, such as Z-Wave and Zigbee, can help ensure interoperability and improve security. In conclusion, the market offers numerous benefits, but it's crucial to prioritize data security and privacy to build consumer trust and confidence.

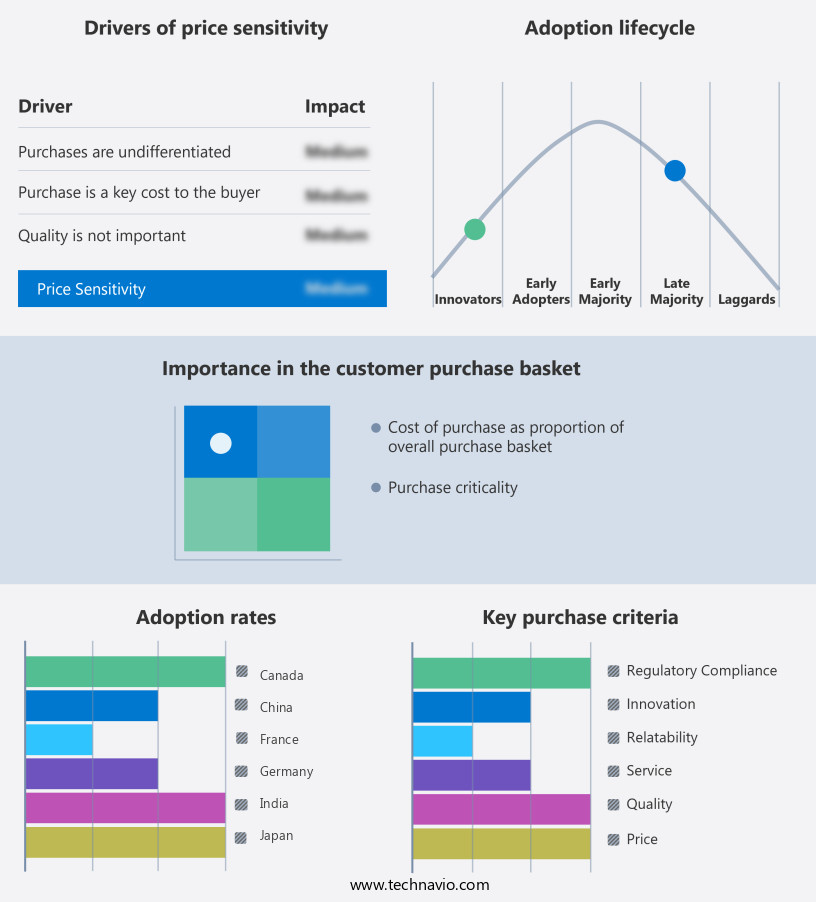

Exclusive Customer Landscape

The smart home security market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart home security market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart home security market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company delivers advanced smart home security, showcasing the ABB-Welcome IP system. This innovative IP-based door entry communication system ensures a secure and convenient building entry experience. Integrating seamlessly, it offers an intuitive solution for access control.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ADT Inc.

- Alarm.com Holdings Inc.

- Allegion Public Ltd. Co.

- Arlo Technologies Inc.

- Comcast Corp.

- Eufy

- Google LLC

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

- Legrand SA

- LG Corp.

- Panasonic Holdings Corp.

- Ring LLC

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Scout Security Ltd.

- Securitas AB

- Simplisafe Inc.

- Vivint Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Home Security Market

- In February 2023, Google announced the integration of its smart home security system, Google Nest, with Apple HomeKit, enabling users to control Nest devices using Siri voice commands and the Home app (Google Press Release, 2023). This strategic partnership expands Google Nest's compatibility, catering to Apple users and increasing its market reach.

- In June 2024, Amazon's Ring, a leading smart home security brand, unveiled its new solar-powered doorbell camera, Ring Doorbell 4 Solar. This innovative product launch addresses the need for wireless security solutions, reducing reliance on electrical outlets and contributing to the growing trend of eco-friendly smart home devices (Ring Press Release, 2024).

- In August 2024, ADT, a prominent security services provider, completed its acquisition of Vivint Smart Home, a major player in the market. This merger strengthened ADT's position in the industry by adding Vivint's advanced technology and customer base, further solidifying its presence in the competitive market (ADT Press Release, 2024).

- In June 2025, the European Union passed the Cybersecurity Act, mandating specific security requirements for smart home devices. This regulatory approval ensures the protection of consumers' privacy and security, driving the development of more secure smart home security solutions (European Parliament, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by the integration of advanced technologies such as big data, computer vision, machine learning, and deep learning. Home security software and open source platforms are enabling API integration with various smart home appliances, including smart washers, smart sprinklers, and smart doorbells. Security management platforms are leveraging voice control, gesture control, and video doorbells for enhanced user experience and threat intelligence. Smart refrigerators, ovens, and vacuums are incorporating security analytics and machine learning for predictive maintenance and energy efficiency. Smart lawn care and edge computing are optimizing irrigation and fertilization based on weather patterns and soil conditions.

- Home automation platforms are integrating with the smart grid for energy management and cost savings. Security is a top priority for homeowners, leading to the adoption of smart smoke detectors, which use machine learning algorithms to detect anomalies and alert homeowners of potential fires. Threat intelligence and data analytics are essential components of these systems, providing real-time monitoring and response to security threats. Overall, the market is transforming the way we secure and manage our homes, offering convenience, efficiency, and peace of mind.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Home Security Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.8% |

|

Market growth 2025-2029 |

USD 26740.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.2 |

|

Key countries |

US, China, UK, Germany, Canada, Japan, France, India, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Home Security Market Research and Growth Report?

- CAGR of the Smart Home Security industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart home security market growth of industry companies

We can help! Our analysts can customize this smart home security market research report to meet your requirements.