Smart Indoor Garden Systems Market Size 2025-2029

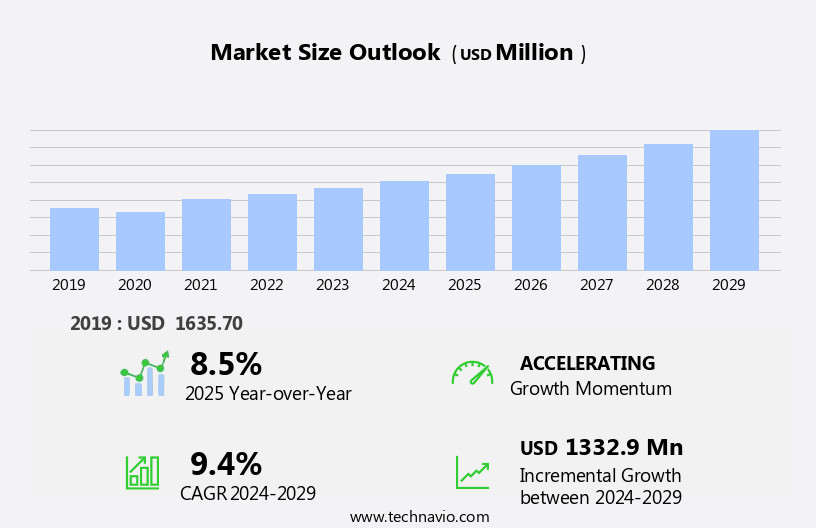

The smart indoor garden systems market size is forecast to increase by USD 1.33 billion at a CAGR of 9.4% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. One of the primary drivers is the increasing demand for wireless connectivity and IoT-enabled technologies in home gardening. This includes the use of artificial intelligence and machine learning for optimizing lighting, nutrition, and insecticides for indoor plants. Vertical gardens, a popular trend in indoor farming and construction, are also fueling market growth. Technologies like LED and aeroponics are gaining traction in smart indoor garden systems, offering benefits such as energy efficiency and water conservation. The integration of smart home technology is another trend, enabling users to remotely monitor and control their indoor gardens. Overall, the market for smart indoor garden systems is expected to continue its growth trajectory, offering numerous opportunities for stakeholders.

What will be the Size of the Smart Indoor Garden Systems Market During the Forecast Period?

- The smart indoor gardens market encompasses innovative systems that integrate digital technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), into vertical farming, urban farming, hydroponics, and controlled environment agriculture. These advanced solutions optimize plant growth by automating processes like fertilization, watering, lighting, temperature control, and insect management. Sensors and automated devices monitor and adjust these factors in real-time, ensuring optimal growing conditions. Self-sufficient systems, including self-watering mechanisms and intelligent nutrition systems, are gaining popularity in urban areas, particularly in apartments and cities, where arable land is limited. Smart greenhouses, with their sleek interior design and eco-friendly credentials, are increasingly adopted for growing fresh fruits, herbs, and vegetables without the need for insecticides or excessive water usage. These digital advancements in agriculture contribute to the overall growth and sustainability of the market.

How is this Smart Indoor Garden Systems Industry segmented and which is the largest segment?

The smart indoor garden systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Floor garden

- Wall garden

- Product

- LED grow lights

- Automated watering systems

- Nutrient delivery systems

- Environmental monitoring

- Product Type

- Hydroponics

- Soil-based

- Aquaponics

- Aeroponics

- End-user

- Residential

- Commercial

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Type Insights

- The floor garden segment is estimated to witness significant growth during the forecast period. The floor garden segment in the market is projected to experience notable revenue growth compared to the wall segment, driven by the rising emphasis on mental and emotional health in urban areas. Floor gardens, which are commonly found in apartments and cities, enable the cultivation of herbs, fruits, and flowers using advanced technologies. These systems incorporate self-watering mechanisms, pest management, and intelligent soil to optimize water, oxygen, and nutrient intake for plants. Despite the need for occasional maintenance, such as fertilizer application and pest control, floor gardening offers several benefits, including better yields and improved interior design. Digital technologies, including sensors, LED grow lights, machine learning algorithms, cameras, and vision systems, are integral to these systems. Additionally, the integration of IoT, artificial intelligence, and digital monitoring systems enhances the overall efficiency and productivity of smart indoor garden systems.

Get a glance at the market report of share of various segments Request Free Sample

The Floor garden segment was valued at USD 1.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

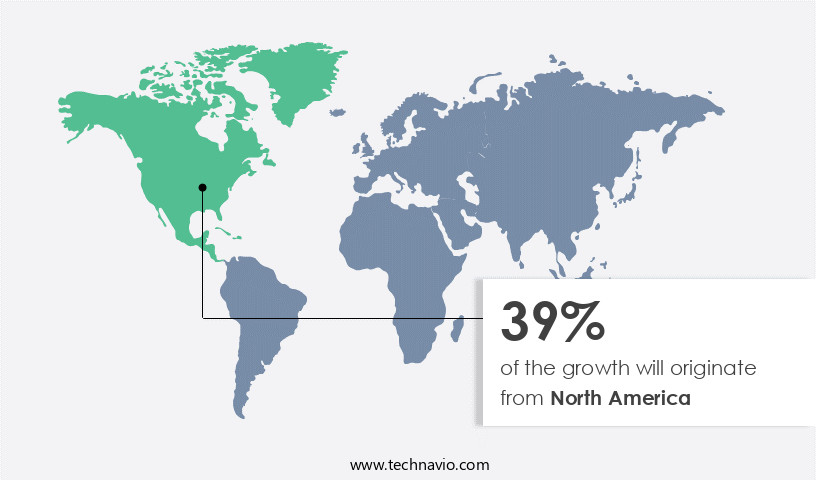

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market held the largest share in The market in 2024, driven by the increasing adoption of IoT-based home gardening solutions and the growing trend of urban farming. The US, Canada, and Mexico are the primary contributors to the market's revenue growth in this region. The need for space-saving solutions and appealing aesthetics is fueling the demand for smart indoor garden systems. Additionally, rising investments in construction and infrastructure projects are further propelling the market's expansion in North America. Digital technologies, including sensors, LED grow lights, machine learning algorithms, cameras, and vision systems, are integral components of these systems.

They enable automated devices for fertilizer application, watering, temperature control, and pest management. Smart soil, nutrition systems, and self-watering mechanisms are other essential features. Urban areas, apartments, cities, and commercial segments, including outdoor restaurants, cafes, hotels, entertainment parks, corporate offices, and lawn & garden consumables, are the primary end-users. The market's growth is also attributed to the increasing popularity of organic foods and the integration of modern and innovative technologies such as artificial intelligence and digital monitoring systems. The market's future potential lies in wireless connectivity, sensor-based monitoring systems, and home gardens.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Indoor Garden Systems Industry?

- Rising demand for IoT-based smart home garden watering systems is the key driver of the market. The market witnessed notable expansion in 2024, fueled by the increasing preference for Internet of Things (IoT)-enabled home garden watering systems. These advanced systems cater to consumers' demand for convenient and efficient gardening solutions. IoT integration facilitates real-time monitoring and control of watering schedules, promoting optimal plant health and minimizing water wastage. This trend is particularly prominent in urban environments, where space constraints and busy lifestyles necessitate innovative gardening approaches. Furthermore, the growing awareness of sustainable living and the benefits of indoor gardening, including improved air quality and mental well-being, are driving market growth. Digital technologies, such as artificial intelligence, machine learning algorithms, cameras, and vision systems, are integrated into these systems to optimize lighting, temperature, and nutrient delivery.

- Smart hydroponic systems, LED lights, and self-watering mechanisms are essential components of these systems, catering to the commercial and residential segments. Urban areas, apartments, cities, outdoor restaurants, cafes, hotels, entertainment parks, corporate offices, and lawn & garden consumables are primary markets for these modern and innovative technologies. Smart indoor garden systems offer intelligent soil, nutrition systems, pest management, and self-watering mechanisms, ensuring better yields and reducing the need for fertilizers, pesticides, and insecticides.

What are the market trends shaping the Smart Indoor Garden Systems Industry?

- Growing popularity of vertical gardens is the upcoming market trend. Smart indoor gardens, driven by vertical farming and urban farming techniques, are gaining popularity due to the scarcity of arable land in urban areas. Hydroponics, controlled environment agriculture, and other modern and innovative technologies are being employed to grow fresh fruits, herbs, and flowers in limited spaces. The Internet of Things (IoT), artificial intelligence, digital technologies, sensors, LED grow lights, machine learning algorithms, cameras, and vision systems are integral components of these advanced gardening systems. Automated devices for fertilizer application, watering, lighting, temperature control, and pest management ensure optimal plant growth. Insecticides and self-watering mechanisms are also utilized for insect control and intelligent soil nutrition.

- Vertical gardens in apartments, cities, and commercial buildings offer numerous benefits, including improved air quality, energy efficiency, and mental and emotional health. Exports and imports of these gardening techniques are increasing, with many countries adopting these farming methods for better yields. Organizations in various parts of the world are investing in smart greenhouses, interior design, and green technology to expand their vertical garden spaces. AI-based home appliances and digital monitoring systems with wireless connectivity and sensor-based monitoring systems are being used to automate plant maintenance and watering. Home gardens, vertical gardens, and lawn & garden consumables are becoming essential for modern living, making these technologies a significant trend in the market.

What challenges does the Smart Indoor Garden Systems Industry face during its growth?

- Rising demand for artificial grass is a key challenge affecting the industry growth. Smart indoor gardens, driven by technologies such as vertical farming, urban farming, hydroponics, and controlled environment agriculture, are revolutionizing the way we grow organic foods. The Internet of Things (IoT), artificial intelligence (AI), digital technologies, sensors, LED grow lights, machine learning algorithms, cameras, and vision systems are transforming traditional farming techniques. These advanced technologies enable automated devices for fertilizer application, watering, lighting, temperature control, and pest management. In urban areas, apartments, cities, and commercial segments, smart indoor gardens are gaining popularity due to their ability to provide fresh fruits, herbs, and flowers. Modern and innovative technologies like self-watering systems, intelligent soil, nutrition systems, and AI-based home appliances offer better yields and digital monitoring systems with wireless connectivity and sensor-based monitoring systems.

- Smart indoor gardens are essential for mental and emotional health, and their integration with interior designing enhances the aesthetic appeal of modern homes, offices, restaurants, cafes, hotels, entertainment parks, and corporate offices. The export and import of these advanced gardening systems are on the rise, making them accessible to a global audience. In summary, smart indoor gardens represent a significant shift in farming techniques, offering numerous benefits, including convenience, sustainability, and improved yields. These systems integrate various digital technologies, making them an essential component of modern living.

Exclusive Customer Landscape

The smart indoor garden systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart indoor garden systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart indoor garden systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AeroFarms LLC - The company offers a smart indoor garden system, such as fully connected indoor vertical farms with fully controlled environment, optimized plant biology and precision aeroponics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroFarms LLC

- Agrilution Systems GmbH

- AVA Technologies Inc.

- Bowery Farming Inc.

- CityCrop Automated Indoor Farming P.C

- Click and Grow LLC

- EDN Inc.

- Gardyn Inc.

- iFarm

- ingarden Inc.

- JOICOM Corp.

- Metropolis Farms Canada

- Moistenland LLC

- Natufia Labs

- Plantui Oy

- Rise Gardens LLC

- Robert Bosch GmbH

- The Leaf Land Scape

- Tower Garden

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for smart indoor gardens is experiencing significant growth as the demand for locally grown, fresh produce and sustainable farming practices continues to rise. This market encompasses various advanced technologies such as vertical farming, hydroponics, and controlled environment agriculture, all of which are integral components of urban and indoor farming. The integration of digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), is revolutionizing the way these farming systems operate. Sensors, LED grow lights, and machine learning algorithms are being employed to optimize plant growth and maintain ideal environmental conditions. Cameras and vision systems are used for real-time monitoring and analysis, while robots automate various tasks such as fertilization, watering, and temperature control.

The use of smart indoor gardens is not limited to commercial farming operations. Residential applications, including apartments and urban areas, are also adopting these modern and innovative technologies. The integration of smart indoor gardens in homes not only provides access to fresh fruits, herbs, and flowers but also offers mental and emotional health benefits. The commercial segment of the smart indoor gardens market is witnessing substantial growth due to the demand for better yields and increased efficiency. Automated devices and self-watering systems are becoming increasingly popular in commercial farming operations, reducing the need for manual labor and minimizing the use of fertilizers and pesticides.

Smart indoor gardens are also gaining popularity in various industries such as hospitality, including outdoor restaurants, cafes, hotels, and entertainment parks. Corporate offices are also incorporating these systems to create a healthier work environment and promote sustainability. The integration of smart indoor gardens in interior designing is another emerging trend. These systems can be used to create stunning vertical gardens and home gardens, adding aesthetic value to both residential and commercial spaces. The market for smart indoor gardens is expected to grow significantly due to the increasing demand for organic foods and the need for sustainable farming practices.

The use of digital technologies in these systems offers numerous benefits, including improved yields, reduced water usage, and the ability to grow produce year-round. The market for smart indoor gardens is also witnessing the development of AI-based home appliances and digital monitoring systems, enabling wireless connectivity and sensor-based monitoring systems. These advancements are expected to further drive the growth of the market. The global market for smart indoor gardens is experiencing significant growth due to the increasing demand for locally grown, fresh produce and sustainable farming practices. The integration of digital technologies, including the Internet of Things and artificial intelligence, is revolutionizing the way these systems operate, offering numerous benefits such as improved yields, reduced water usage, and the ability to grow produce year-round. The market is expected to continue growing due to the increasing demand for organic foods and the need for sustainable farming practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2025-2029 |

USD 1.33 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.5 |

|

Key countries |

US, Canada, China, UK, Japan, Germany, India, France, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Indoor Garden Systems Market Research and Growth Report?

- CAGR of the Smart Indoor Garden Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart indoor garden systems market growth of industry companies

We can help! Our analysts can customize this smart indoor garden systems market research report to meet your requirements.