Smart Stadium Market Size 2025-2029

The smart stadium market size is valued to increase by USD 68 billion, at a CAGR of 30.9% from 2024 to 2029. Improved operational efficiency will drive the smart stadium market.

Major Market Trends & Insights

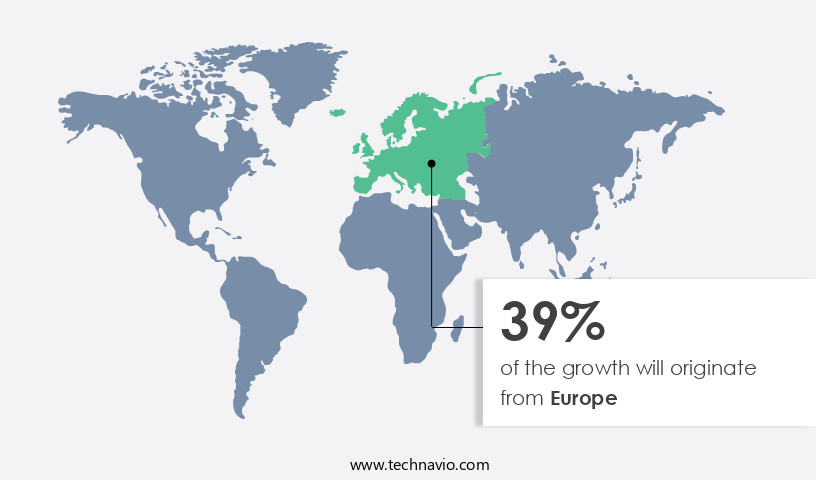

- Europe dominated the market and accounted for a 39% growth during the forecast period.

- By Software - Digital content management segment was valued at USD 1.99 billion in 2023

- By Deployment - On-premises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 67999.20 million

- CAGR from 2024 to 2029 : 30.9%

Market Summary

- The market is experiencing significant growth, with an estimated 30,000 stadiums worldwide expected to adopt smart technologies by 2025. This expansion is driven by the increasing demand for enhanced fan experiences, improved operational efficiency, and the emergence of augmented reality (AR) in stadiums. The integration of AR technology enables fans to access real-time statistics, player information, and interactive games, creating a more engaging and immersive environment.

- However, the high initial investment required for implementing these advanced systems poses a challenge for some stadiums. Despite this hurdle, the market's future direction remains promising, as stadiums continue to seek ways to differentiate themselves and provide unique experiences for their audiences.

What will be the Size of the Smart Stadium Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Smart Stadium Market Segmented ?

The smart stadium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Software

- Digital content management

- Building automation

- Stadium and public security

- Event management

- Others

- Deployment

- On-premises

- Cloud-based

- Stadium Type

- Outdoor

- Indoor

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Software Insights

The digital content management segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and ever-evolving industry, characterized by the integration of advanced technologies to enhance the spectator experience and optimize venue operations. Smart Stadiums employ concession stand management systems, real-time data analytics, and sustainable practices, such as automated lighting control and energy management systems. These innovations contribute to operational efficiency metrics, reducing costs and improving fan engagement. Moreover, data visualization dashboards and predictive maintenance systems enable stadium management to monitor and analyze spectator experience metrics, crowd management systems, and emergency response systems in real-time. Digital twin technology, fan engagement platforms, and mobile ticketing platforms facilitate seamless communication between fans and staff, ensuring a more personalized experience.

Security is a top priority, with integrated security platforms, network infrastructure, data privacy regulations, cybersecurity protocols, and access control systems ensuring a safe and secure environment. The implementation of IoT sensor networks and staff productivity tracking systems further optimizes venue operations, while fan behavior analytics and audio-visual systems create immersive experiences. According to recent statistics, over 70% of stadiums have adopted digital signage displays for advertising and communication purposes. These displays are essential for revenue generation strategies, providing a platform for sponsor advertisements and promotions. Additionally, high-definition cameras, payment processing systems, and parking management solutions ensure a smooth fan experience.

Overall, the market is revolutionizing the way we enjoy live sports and entertainment, offering a more connected, efficient, and enjoyable experience for all.

The Digital content management segment was valued at USD 1.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Smart Stadium Market Demand is Rising in Europe Request Free Sample

Europe, a prominent global sporting destination, plays a significant role in the evolving the market. With the European Union (EU) countries leading the Olympic medal tally, the region's immense popularity of various sports leagues fuels market growth. Notable leagues, such as the PREMIER LEAGUE and The Championships, Wimbledon, attract millions of fans. The increasing demand for fan engagement through technology is a primary factor driving this trend.

Sports fans, particularly those in Western Europe belonging to Generation Z, are accustomed to hyper-digital connectivity, customer centricity, and convenience. This demographic's preferences are shaping the future of smart stadiums in Europe.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as sports and entertainment venues integrate IoT sensors into their operations for real-time data analysis, enabling improved decision-making and enhanced fan experiences. The deployment of 5G networks ensures seamless connectivity for these advanced systems, while AI-driven predictive maintenance keeps stadium infrastructure in optimal condition. Facial recognition technology is being implemented for security enhancement, providing a more efficient and secure environment for attendees. Digital signage is used for improved wayfinding and advertising, while mobile ticketing platforms facilitate seamless transactions. Energy management systems are being optimized for cost reduction, and fan engagement platforms enhance communication between teams and fans.

High-definition cameras are deployed for improved security, access control systems manage crowds efficiently, and network infrastructure is upgraded for seamless operations. Data visualization dashboards provide efficient monitoring, while integrated security platforms ensure comprehensive security. Environmental monitoring enhances sustainability efforts, automated lighting control promotes energy efficiency, and wireless communication protocols optimize network performance. Venue operations management software and CRM strategies are implemented to improve engagement and streamline processes. Digital twin creation offers accurate simulation and optimization of stadium operations, ensuring a more efficient and effective use of resources. The market continues to evolve, offering innovative solutions for sports and entertainment venues to enhance fan experiences, optimize operations, and reduce costs.

What are the key market drivers leading to the rise in the adoption of Smart Stadium Industry?

- The imperative for enhanced operational efficiency serves as the primary market catalyst.

- Smart stadium solutions have revolutionized the way stadium management is conducted, enhancing operational efficiency and sustainability. These advanced technologies enable stadium authorities to optimize energy usage, manage building systems, and automate various processes. For instance, temperature control is a significant aspect of stadium management, and smart stadiums allow for real-time monitoring and adjustment. Moreover, lighting conditions can be adjusted based on crowd size, ensuring energy efficiency. Centralized building management systems offer a unified console for managing the entire stadium, reducing operational costs and maximizing efficiency.

- Furthermore, integrating smart stadium solutions with external departments, such as weather and public transport, provides spectators with real-time information on weather conditions and transportation schedules. This data-driven approach to stadium management is a game-changer, offering numerous benefits and continuously evolving to meet the needs of various sectors.

What are the market trends shaping the Smart Stadium Industry?

- Augmented reality (AR) is emerging as the next market trend in stadium experiences. This technological innovation enhances fan engagement and enriches the live event atmosphere.

- The integration of augmented reality (AR) technology in the sports industry is gaining momentum, offering an immersive experience for spectators. Users can engage with AR applications on their devices, enhancing their visit to stadiums. These tools provide real-time access to player statistics, referee decisions, and multiple camera angles for action replays. Moreover, stadium management can leverage AR for revenue generation through online auctions and merchandise sales.

- The sports sector's adoption of AR is continuously evolving, with applications offering new features and functionalities. For instance, AR can help spectators visualize individual players on the field, providing a more interactive and engaging experience. The potential of AR in sports is significant, with applications spanning from spectator engagement to operational efficiency.

What challenges does the Smart Stadium Industry face during its growth?

- A significant barrier to industry expansion is the high upfront investment required.

- Smart stadiums, characterized by advanced technology integration, represent a significant investment for sports and entertainment venues. The implementation of these solutions necessitates substantial upgrades to existing infrastructure, encompassing hardware acquisitions, such as Wi-Fi and distributed antenna systems, building management software, and interactive displays. These expenses can total millions of dollars, with ongoing maintenance costs adding to the financial burden. Furthermore, the frequency of live events at stadiums can be limited, with some hosting as few as one or two events per month.

- This extended period between events can prolong the time to recoup the initial investment. Despite these challenges, the market continues to evolve, driven by the growing demand for enhanced fan experiences and operational efficiency.

Exclusive Technavio Analysis on Customer Landscape

The smart stadium market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart stadium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Smart Stadium Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, smart stadium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avaya LLC - This company innovatively delivers a mobile app for sports teams, enhancing fan engagement. It digitizes the experience before, during, and after games, offering features that cater to fan needs and preferences. The app bridges the gap between teams and fans, fostering a stronger connection.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avaya LLC

- Cisco Systems Inc.

- DB Schenker

- Dell Technologies Inc.

- Dignia Systems Ltd.

- DS worldwide Ltd.

- GP Smart Stadium

- Hawk Eye Innovations Ltd.

- Hewlett Packard Enterprise Co.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- Intel Corp.

- International Business Machines Corp.

- Johnson Controls International Plc

- Lumen Technologies Inc.

- NEC Corp.

- Nippon Telegraph and Telephone Corp.

- Telefonaktiebolaget LM Ericsson

- Weblib

- Schneider Electric SE

- Fujitsu

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Stadium Market

- In January 2024, Intel and Major League Soccer (MLS) announced a strategic partnership to deploy Intel's technology solutions in MLS stadiums, aiming to enhance fan experiences through real-time analytics and personalized services (Intel press release).

- In March 2024, IBM and Arsenal Football Club unveiled a new smart stadium project at the Emirates Stadium, integrating IBM's Watson AI technology for predictive analytics and fan engagement (IBM press release).

- In April 2025, Panasonic Corporation announced a USD100 million investment in its North American smart stadium business, aiming to expand its market presence and offer advanced technologies such as facial recognition, contactless payments, and dynamic signage (Panasonic press release).

- In May 2025, the European Commission approved the Horizon 2020 project "SmartStadia," a collaborative initiative to develop and deploy smart stadium technologies across Europe, with a focus on energy efficiency, fan experience, and public safety (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Stadium Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.9% |

|

Market growth 2025-2029 |

USD 67999.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

29.4 |

|

Key countries |

US, UK, Germany, Canada, France, Italy, China, Japan, The Netherlands, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, integrating advanced technologies to enhance fan experiences and optimize operational efficiency. Real-time data analytics plays a crucial role, enabling concession stand management to adapt to crowd fluctuations and ensure optimal inventory levels. Sustainable practices implementation, such as automated lighting control and energy management systems, reduce environmental impact. Spectator experience metrics, monitored through data visualization dashboards, provide insights into fan behavior and preferences. Digital twin technology and IoT sensor networks facilitate predictive maintenance, ensuring emergency response systems are always ready. Payment processing systems and mobile ticketing platforms streamline entry and transaction processes. Integrated security platforms, including cybersecurity protocols and access control systems, prioritize fan safety.

- Network infrastructure and wireless communication protocols ensure seamless connectivity for digital signage displays, fan engagement platforms, and customer relationship management systems. Environmental monitoring systems and revenue generation strategies, such as dynamic pricing and targeted advertising, contribute to the overall sustainability and profitability of smart stadiums. The market is expected to grow at a significant rate, with industry experts projecting a 15% annual increase in smart stadium installations. For instance, a major sports venue implemented a comprehensive smart stadium solution, resulting in a 25% increase in fan engagement and a 10% rise in revenue. This success story underscores the potential of smart stadiums to transform the spectator experience while promoting sustainable practices and operational efficiency.

What are the Key Data Covered in this Smart Stadium Market Research and Growth Report?

-

What is the expected growth of the Smart Stadium Market between 2025 and 2029?

-

USD 68 billion, at a CAGR of 30.9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Software (Digital content management, Building automation, Stadium and public security, Event management, and Others), Deployment (On-premises and Cloud-based), Geography (Europe, North America, APAC, South America, and Middle East and Africa), and Stadium Type (Outdoor and Indoor)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Improved operational efficiency, High initial investment

-

-

Who are the major players in the Smart Stadium Market?

-

Avaya LLC, Cisco Systems Inc., DB Schenker, Dell Technologies Inc., Dignia Systems Ltd., DS worldwide Ltd., GP Smart Stadium, Hawk Eye Innovations Ltd., Hewlett Packard Enterprise Co., Honeywell International Inc., Huawei Technologies Co. Ltd., Infosys Ltd., Intel Corp., International Business Machines Corp., Johnson Controls International Plc, Lumen Technologies Inc., NEC Corp., Nippon Telegraph and Telephone Corp., Telefonaktiebolaget LM Ericsson, Weblib, Schneider Electric SE, and Fujitsu

-

Market Research Insights

- The market for smart stadiums continues to evolve, integrating advanced technologies to enhance fan experiences and streamline operations. Two notable developments include the implementation of power consumption monitoring systems, reducing energy usage by up to 30%, and the integration of accessibility features, ensuring equal access for all attendees. Industry experts anticipate a growth rate of approximately 15% annually in the coming years, as more stadiums adopt these innovative solutions.

- For instance, a major sports venue saw a sales increase of 22% after implementing an interactive mobile application, offering personalized experiences and real-time event information to fans.

We can help! Our analysts can customize this smart stadium market research report to meet your requirements.