Smart Waste Management Market Size 2025-2029

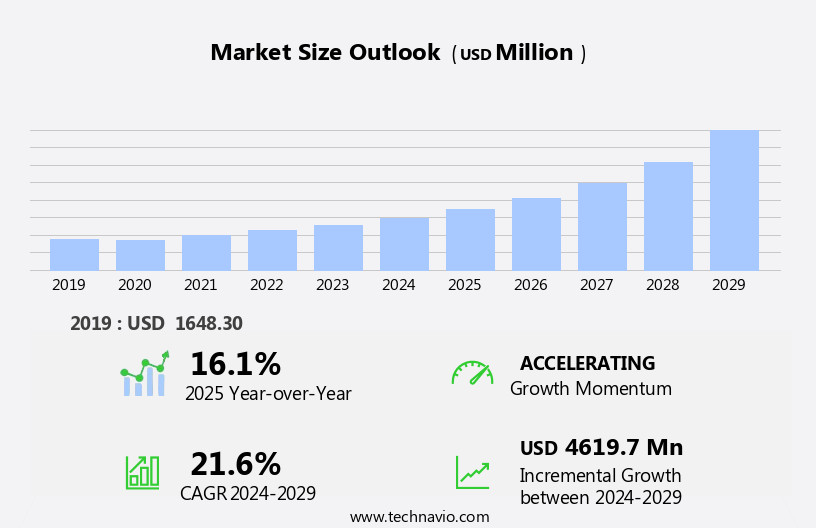

The smart waste management market size is forecast to increase by USD 4.62 billion at a CAGR of 21.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing urbanization and subsequent rise in urban waste generation. This trend is driving the demand for advanced solutions that can effectively address the challenges of managing waste in densely populated areas. Additionally, the number of strategic partnerships between key players In the industry is on the rise, as companies seek to collaborate and innovate to provide more efficient and sustainable solutions. Sensor technologies, such as cameras, mobile computers, RFID, GPS, and IoT sensors, enable remote monitoring and route optimization. However, the effective deployment of these technologies faces challenges, including high implementation costs and the need for robust infrastructure and technology integration. Despite these hurdles, the market is expected to continue growing, as the benefits, such as reduced waste disposal costs, improved environmental sustainability, and enhanced public health and safety, become increasingly apparent.

What will be the Size of the Smart Waste Management Market During the Forecast Period?

- The market encompasses innovative solutions for managing solid municipal waste in residential buildings, commercial spaces, and public places. These systems leverage sensor-based containers, vacuum systems, disposal tags, and IoT-based waste bins to optimize waste collection and facilitate intelligent monitoring.

- By integrating sensor-based services into waste management, the industry aims to reduce inefficiencies, minimize trash production, and improve waste processing. Smart city initiatives further drive the adoption of these solutions, promoting waste segregation and the efficient handling of solid municipal waste. Overall, the market is experiencing significant growth due to the increasing demand for sustainable practices and the integration of IoT technologies into various industries.

How is this Smart Waste Management Industry segmented and which is the largest segment?

The smart waste management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Collection

- Landfill

- Recovery and recycling

- Processing

- Type

- Solid waste

- Special waste

- E-waste

- Component

- Hardware

- Solution

- Waste Source

- Industrial

- Residential

- Commercial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

- The collection segment is estimated to witness significant growth during the forecast period.

Smart systems play a crucial role in addressing the challenges of inefficient waste collection and disposal, particularly in urban areas with high waste production. Traditional methods have resulted in issues such as pollution and health hazards due to uneven waste management, including domestic, industrial, and environmental wastes. To mitigate these problems, smart solutions have emerged, offering automated systems that minimize human interaction. These systems optimize waste collection and disposal processes, contributing to environmental sustainability and public health. Key market drivers include government initiatives, industrialization, and the increasing focus on environmental regulations and sustainability.

Additionally, the market is characterized by advance technologies, innovative strategies, and the integration of the Internet of Things (IoT) and data analytics. Companies are investing in smart solutions, including sensor-based containers, disposal tags, and fleet trucks. The market encompasses various segments, including solid municipal waste,e-waste management, and smart collection and disposal systems, serving residential buildings, commercial spaces, and public places. The integration of IoT-based systems, real-time tracking, and route optimization are essential components of smart waste management, reducing operational costs and carbon emissions.

Get a glance at the Smart Waste Management Industry report of share of various segments Request Free Sample

The collection segment was valued at USD 1.03 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

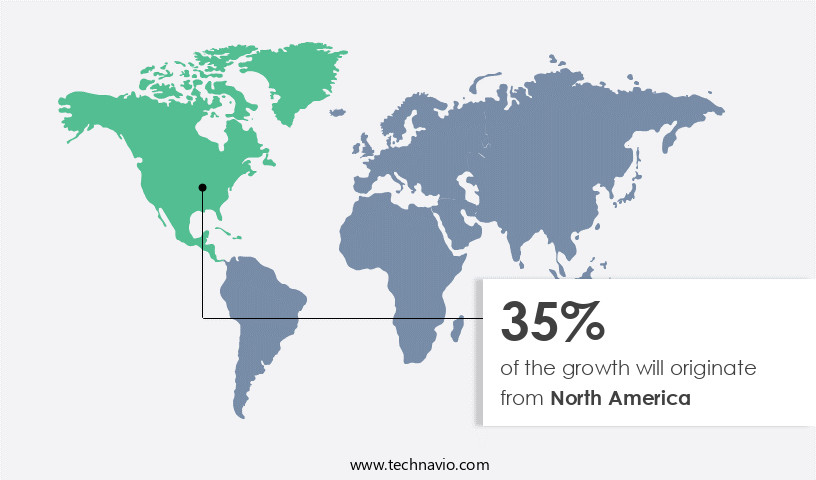

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is propelled by advanced network communication infrastructure and a well-established connected device ecosystem. This facilitates the implementation of IoT, machine learning, predictive analytics, and AI technologies, enabling effective solutions. The region's industries, including the US and Canada, are significant contributors to hazardous waste generation. In response, concerned authorities have enacted regulations to manage hazardous waste. Operational costs are a concern, but the adoption of sensors, route optimization, and real-time monitoring enhances efficiency and reduces fuel prices.

Additionally, smart solutions also encompass waste recycling, disposal and environmental sustainability. Key market players innovative strategies, like sensor-based containers, disposal tags, and vacuum truck containers, contribute to the market's growth.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart waste management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acorecycling.com - The company provides smart waste management solutions, including micro-sensor chips and a central server. These micro-sensor chips are installed in bins to track key data such as trash levels, movement, and peak disposal times. The central server collects and stores this information, enabling automated actions for more efficient waste management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aco Recycling

- Big Belly Solar, LLC.

- Bine sp. z o. o.

- BRE Group

- Covanta Holding Corp.

- Ecube Labs

- Enevo Inc.

- Evreka Yazilim Donanim Danismanlik Egitim Sanayi ve Ticaret A.S.

- Kantor Waste4Change

- Mr. Fill B.V.

- Nordsense

- Pepperl and Fuchs SE

- Republic Services Inc.

- RTS Holding Inc.

- SENSONEO j. s. a.

- SUEZ SA

- Veolia

- Waste Harmonics LLC

- Waste Management Inc.

- Wellness TechGroup

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Dynamics

Our smart waste management market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Smart Waste Management Industry?

Increasing urbanization leading to urban waste generation is the key driver of the market.

- The market has gained significant traction due to the increasing urbanization and the subsequent rise in waste generation. With more than half of the global population residing in urban areas and this number projected to reach two-thirds by 2050, the demand for efficient solutions has become crucial. Traditional waste collection methods have become insufficient to handle the increasing volume of waste, leading to the adoption of advanced technologies and innovative strategies. Operational costs are a major concern for concerned authorities. Smart systems, such as sensor-based containers, vacuum containers, and disposal tags, offer significant cost savings by optimizing waste collection routes, schedules, and fuel consumption. These systems use real-time data analytics and IoT-based systems to monitor fill patterns and trigger collection only when necessary, reducing the number of collection trips and fuel consumption. Environmental sustainability is another key driver for the market. Strict environmental regulations and growing environmental awareness have led to the adoption of sustainable practices.

- Additionally, companies are investing in capital-intensive technologies, such as renewable energy resources, carbon emissions reduction, and recycling of plastic and e-waste. The sector is undergoing a digital transformation, with the integration of sensors, cameras, mobile computers, RFID, GPS, and IoT sensors for intelligent monitoring and route optimization. The use of sensors in waste collection services enables the monitoring of trash production and the optimization of collection routes based on fill patterns and historical data. This not only reduces operational costs but also ensures efficiency and compliance with environmental regulations. The market is expected to face market restraints due to the higher operational costs associated with the implementation of advanced technologies. However, the benefits of environmental sustainability, public health, and operational efficiency far outweigh the initial investment.

- In summary, the market is witnessing significant growth due to the increasing urbanization, the need for sustainable practices, and the adoption of advanced technologies. The market is expected to continue its growth trajectory, driven by the interest of cmpanies in renewable benefits, recycling of plastic and e-waste, and the implementation of cloud-based technologies for data analytics and real-time tracking.

What are the market trends shaping the Smart Waste Management Industry?

A rise in the number of strategic partnerships for smart waste management solutions is the upcoming market trend.

- The market is witnessing significant growth due to the increasing urbanization and smart city initiatives worldwide. Concerned authorities are focusing on sustainable solutions to address the rising operational costs associated with waste collection, processing, and disposal. Recycling and environmental sustainability are key market drivers, with innovative strategies such as e-waste management and reprocessing waste gaining popularity. Advanced technology, including sensors, IoT-based systems, and data analytics, is transforming the sector by enabling real-time monitoring, route optimization, and fuel cost savings. Environmental regulations and public health concerns are also pushing the market forward. Key market participants, including Veolia Environmental Services, Suez Environmental Services, and Covanta Holding Corporation, are forming strategic partnerships to expand their market presence and offer smart solutions compatible with advanced technologies. These solutions provide real-time information on waste collection, helping end-users make data-driven decisions and optimize their operations. The market is expected to grow significantly during the forecast period due to these factors.

- Additionally, the integration of clean energy solutions, such as renewable energy resources and carbon emissions reduction, is further driving the market's growth. The market's restraint is the higher operational costs associated with implementing smart solutions. However, the long-term benefits, including environmental sustainability and cost savings, are expected to outweigh these costs. The market's historical data shows a steady growth trend, with the solid municipal waste segment leading the market, followed by the commercial segment and the residential segment. The market is segmented into Smart Collection, Smart Disposal, and Solid Waste segments. The European Commission has also shown interest In the market, with strict environmental regulations driving the market's growth in Europe. The market is expected to continue growing due to the increasing demand for sustainable solutions and the integration of advanced technologies in operations.

What challenges does the Smart Waste Management Industry face during its growth?

Challenges associated with the effective deployment of smart waste management solutions is a key challenge affecting the industry growth.

- Smart waste management is a critical aspect of urbanization and environmental sustainability, with key market drivers being the increasing concern for public health and strict environmental regulations. The waste management sector incorporates advanced technology and innovative strategies to improve efficiency in waste collection, processing, and disposal. Trash collectors utilize sensors integrated into sensor-based containers, vacuum containers, and disposal tags to optimize collection routes and schedules, reducing operational costs and fuel prices. Historical data from sensors, such as fill patterns and driver routes, enable real-time monitoring, route optimization, and remote monitoring. Sensors in IoT-based waste bins and wide-area IoT devices provide intelligent monitoring of the volume of waste, ensuring timely collection and reducing the need for manual inspections. Recycling plays a significant role in smart waste management, with companies like Suez Environmental Services, Veolia Environmental Services, and Pennsylvania's Harvest Power focusing on reprocessing waste into valuable resources.

- The European Commission's focus on solid waste management and the interest of companies in renewable benefits, such as clean energy solutions and CO2 gas reduction, further fuel the growth of the market. IoT-based systems, cameras, mobile computers, RFID, GPS, and IoT sensors are integral components of smart waste management, enabling waste segregation, waste management, and fleet management. In summary, smart waste management is a critical component of sustainable waste management, with a focus on reducing carbon emissions, improving efficiency, and ensuring environmental sustainability. The market is driven by various factors, including government initiatives, environmental regulations, and the interest of companies in renewable benefits. However, higher operational costs remain a challenge, necessitating continuous innovation and collaboration between concerned authorities and industry players.

Exclusive Customer Landscape

The smart waste management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart waste management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Research Analyst Overview

The market is experiencing significant growth due to the increasing focus on environmental sustainability and the implementation of innovative strategies in both the government and industrial sectors. The advancement of technology is playing a crucial role in this development, as sensors and data analytics are being utilized to improve waste collection, processing, and disposal efficiency. The urbanization process and the subsequent increase in waste production are key market drivers. Smart city initiatives are leading the way in implementing sensor-based systems, which enable real-time monitoring, route optimization, and remote monitoring of waste collection services. These systems help reduce operational costs by optimizing collection routes based on fill patterns and historical data. The sector is undergoing a transformation as traditional methods are being replaced with smart, sensor-based solutions. IoT-based waste bins and vacuum containers are becoming increasingly popular as they enable intelligent monitoring and provide disposal tags for efficiency. The use of sensors in waste collection vehicles allows for real-time tracking and fuel cost optimization. The environmental regulations imposed by concerned authorities are also driving the market, as companies are investing in sustainable solutions to reduce their carbon emissions and comply with strict regulations.

Furthermore, the European Commission, for instance, has set ambitious targets for reducing greenhouse gas emissions and increasing the recycling of plastic and e-waste. The market is segmented into solid municipal waste, e-waste, and smart collection, disposal, and processing segments. The solid municipal waste segment is the largest, accounting for the majority of the market share. The commercial segment is also growing rapidly, as businesses seek to reduce their environmental footprint and improve their operational efficiency. The industrial sector is also adopting smart waste management solutions, particularly In the chemical manufacturing industry, where the generation of hazardous waste is a significant concern. Tri Chemical Waste and other companies are investing in advanced technologies, such as cameras, mobile computers, and RFID, to optimize their waste management processes and reduce their carbon emissions.

Thus, the market is expected to face some restraints, however, as the higher operational costs associated with implementing these advanced technologies may be a barrier for some organizations. The use of sensors in waste collection services, for instance, requires significant capital investments. The market is also witnessing the adoption of IoT-based systems, which enable the collection and analysis of data in real-time. This data can be used to optimize waste collection routes, reduce fuel consumption, and improve overall operational efficiency. Short-range IoT devices and wide-area IoT devices are being used to achieve these goals. In summary, the market is experiencing significant growth due to the increasing focus on environmental sustainability and the implementation of innovative strategies in both the government and industrial sectors. The advancement of technology, particularly sensors and data analytics, is enabling the optimization of waste collection, processing, and disposal efficiency. The market is expected to continue growing, as organizations seek to reduce their environmental footprint and comply with strict regulations.

|

Smart Waste Management Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.6% |

|

Market growth 2025-2029 |

USD 4.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.1 |

|

Key countries |

US, Germany, China, France, Canada, UK, Japan, India, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Waste Management Market Research and Growth Report?

- CAGR of the Smart Waste Management industry during the forecast period

- Detailed information on factors that will drive the Smart Waste Management growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart waste management market growth of industry companies

We can help! Our analysts can customize this smart waste management market research report to meet your requirements.