Smartphone Screen Protector Market Size 2025-2029

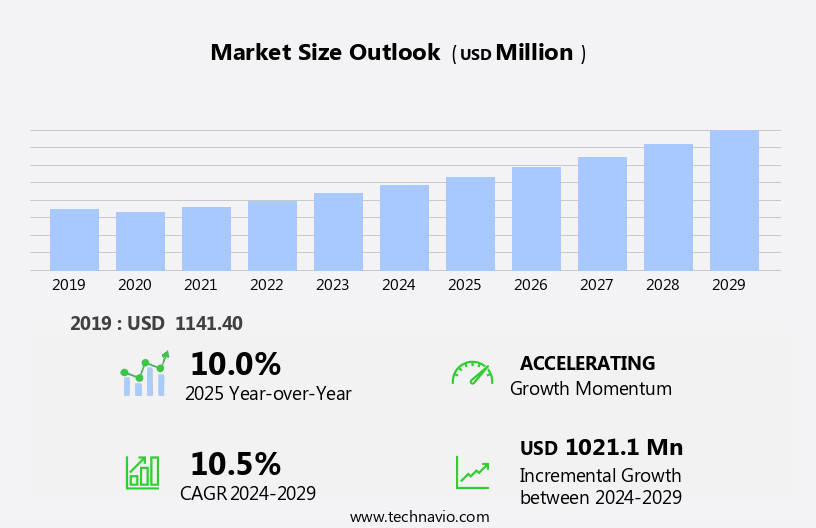

The smartphone screen protector market size is forecast to increase by USD 1.02 billion at a CAGR of 10.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of smartphones in emerging markets. According to recent statistics, the global smartphone user base is projected to reach 3.8 billion by 2021, presenting a vast opportunity for screen protector manufacturers. Additionally, the development of new screen protector technologies, such as tempered glass and liquid gel protectors, is fueling market growth. However, the market faces challenges, including the decreased demand for PET (Polyethylene Terephthalate) screen protectors due to their inferior protection capabilities compared to newer technologies.

- Companies seeking to capitalize on market opportunities should focus on innovation, offering advanced screen protector solutions that cater to the evolving needs of consumers in both established and emerging markets. Meanwhile, navigating the challenge of declining demand for PET screen protectors will require strategic positioning and effective marketing efforts to differentiate offerings from competitors.

What will be the Size of the Smartphone Screen Protector Market during the forecast period?

- The market continues to evolve, driven by consumer demand for enhanced device protection and improved digital experiences. Full coverage screen protectors, available in various materials such as hydrogel film and TPU film, offer scratch resistance and edge protection. Glass screen protectors provide HD clarity and oleophobic coating for smudge resistance. Retail sales thrive on competitive pricing and value proposition, with consumers comparing prices and brands. Technology adoption includes self-healing technology, surface treatment, and coating technology, ensuring device durability and screen damage prevention. Brands differentiate themselves through fingerprint resistance, UV protection, and privacy screens. Consumer electronics manufacturers integrate screen protectors into their product offerings, catering to mobile phone users' diverse needs.

- Screen protector films offer touch sensitivity, UV protection, and antimicrobial properties. After-sales service, including return policies and installation kits, plays a crucial role in customer satisfaction. Flexible screen protectors cater to curved screens and 3D curved displays. Market dynamics unfold as material science advances, with innovations in TPU, hydrogel, and tempered glass. Consumers prioritize edge protection, impact resistance, and ease of installation. Screen protectors extend the lifespan of devices, aligning with the digital lifestyle and consumer electronics sector's continuous growth.

How is this Smartphone Screen Protector Industry segmented?

The smartphone screen protector industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Glass

- Polyethylene terephthalate (PET)

- Thermoplastic polyurethane (TPU)

- Others

- Price Range

- Mid-range

- Premium

- Economy

- Product Type

- 2.5D

- 2D

- 3D

- 9H tempered glass

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

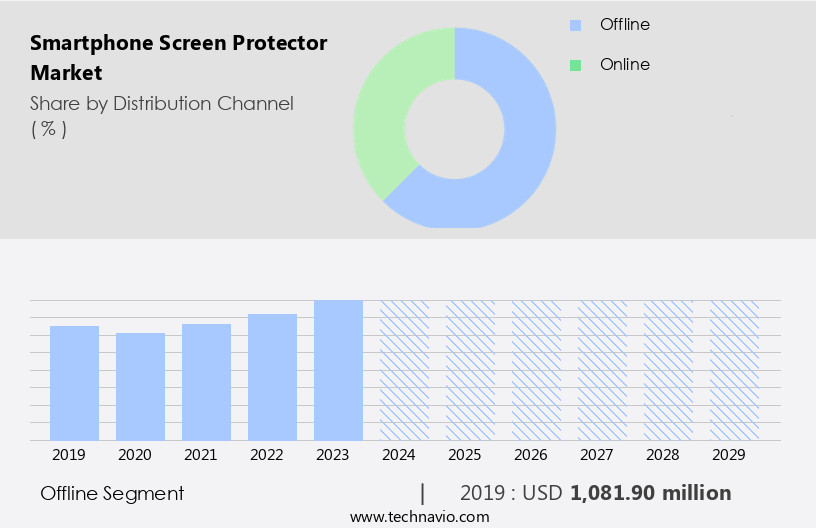

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including distribution channels, screen protector types, and end-users. Offline and online channels represent the distribution channels, with retail stores selling consumer electronics, including smartphones and their accessories, being a significant portion. In developing economies like India, Indonesia, Brazil, and Mexico, where the number of smartphone users is on the rise, offline sales dominate due to the novelty of e-commerce and online platforms. Self-healing technology, full coverage, and scratch resistance are essential features driving demand for screen protectors. The market's competitive landscape includes hydrogel film, TPU film, glass screen protectors, and more.

Consumer preferences lean towards protective films offering edge protection, impact resistance, and fingerprint resistance. Additionally, screen protectors with oleophobic coating, UV protection, and privacy screens cater to the evolving needs of mobile phone users. Material science advancements have led to the development of screen protectors with HD clarity, antimicrobial properties, and touch sensitivity. Retail sales remain a significant revenue source, while technology adoption and return policies contribute to market growth. Smartphone accessories, including screen protectors, benefit from competitive pricing and value propositions that cater to a digital lifestyle and consumer electronics market.

The Offline segment was valued at USD 1.08 billion in 2019 and showed a gradual increase during the forecast period.

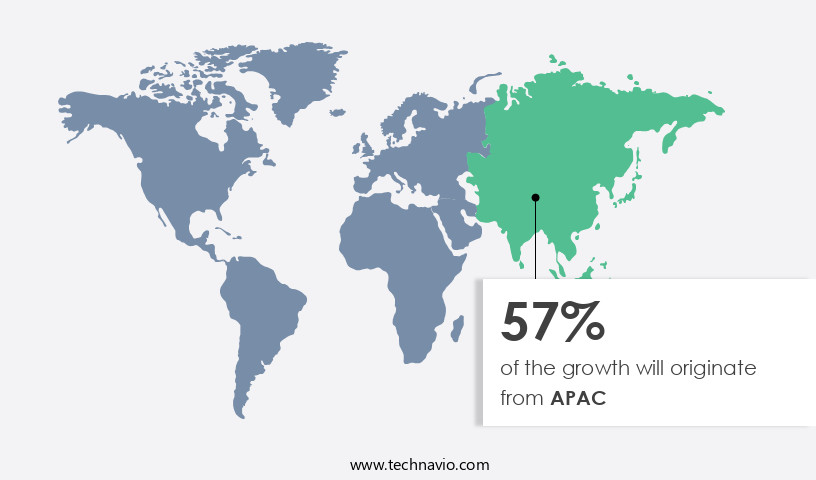

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing popularity of smartphones in the region. With high-end features and competitive pricing, smartphones have become a must-have device for many consumers in countries like India, Indonesia, Vietnam, China, Sri Lanka, and Pakistan. The expanding urban population and rising disposable income have fueled the demand for these devices, leading to a corresponding increase in the need for screen protectors. Full coverage, scratch resistance, and edge protection are key features that consumers look for in screen protectors. Technologies such as self-healing, oleophobic coating, and fingerprint resistance add value to the product.

Hydrogel film, TPU film, glass screen protectors, and protective films cater to various consumer preferences. Retail sales are a significant revenue source for screen protector brands, with competitive pricing and return policies being essential factors in consumer decision-making. Device durability is another critical consideration, with screen repair costs being a significant deterrent for many users. The market is witnessing the adoption of advanced technologies such as 3D curved screens, flexible screens, and antimicrobial properties. Smartphone accessories like privacy screens, screen protector films, and installation kits offer product differentiation and added value. Material science plays a crucial role in the development of screen protectors, with tempered glass and TPU film being popular choices.

HD clarity, touch sensitivity, and UV protection are essential features for consumers in the digital lifestyle market. Tablet screen protectors and privacy screens are other segments that are gaining traction, with the need for screen protection extending beyond mobile phones. The market is highly competitive, with numerous brands offering a range of products catering to diverse consumer needs and preferences. In conclusion, the market in APAC is poised for growth, driven by the increasing demand for smartphones and the need for screen protection. Brands that offer high-quality products with advanced features, competitive pricing, and excellent customer service are likely to succeed in this market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smartphone Screen Protector Industry?

- In emerging markets, the surge in smartphone adoption serves as the primary catalyst for market growth.

- The global market for smartphone screen protectors is experiencing substantial growth due to the widespread adoption of smartphones as an essential tool in daily life. With the increasing use of smartphones, there is a heightened demand for accessories such as screen protectors that ensure the preservation of their functionality and integrity. Emerging markets in the Asia Pacific region, including China, India, and the US, account for a significant portion of the global demand for smartphones. In 2024, China alone had approximately 1.4 billion smartphone users. Smartphone screen protectors offer various features to cater to diverse consumer needs.

- These include competitive pricing, blue light filters, surface treatments for enhanced touch sensitivity, case compatibility, and flexible designs for curved and tablet screens. Material science plays a crucial role in the development of advanced screen protectors, providing value-added features such as fingerprint resistance and 3D curved designs. In conclusion, the market is poised for continued growth as the demand for smartphones continues to surge. Consumers seek reliable and advanced screen protectors to safeguard their devices from everyday wear and tear, making it a lucrative market for businesses. The focus on innovation and advanced technology will drive the market forward, ensuring that screen protectors remain an essential accessory for smartphone users.

What are the market trends shaping the Smartphone Screen Protector Industry?

- The market trend increasingly favors the advancement of new screen protector technologies. Two key areas of growth include the development of more durable materials and the integration of advanced features such as touch sensitivity and antimicrobial properties.

- The smartphone market is witnessing significant advancements, with manufacturers continually releasing new models featuring innovative technologies and designs. In response to this trend, screen protector manufacturers are required to keep pace and introduce compatible and advanced screen protection solutions. In 2024, Belkin introduced new screen protector options for the latest iPhone models, such as the ScreenForce UltraGlass 2 Treated Screen Protector and the ScreenForce InvisiGlass Privacy Treated Screen Protector. These offerings provide edge protection, impact resistance, and HD clarity, ensuring the latest devices remain protected while maintaining their aesthetic appeal.

- Additionally, privacy screen protectors with antimicrobial properties have gained popularity, addressing the growing concern for screen hygiene. With the increasing demand for advanced screen protection solutions, screen protector manufacturers are focusing on product differentiation and innovation to meet the evolving needs of mobile phone users.

What challenges does the Smartphone Screen Protector Industry face during its growth?

- The decreased demand for PET screen protectors poses a significant challenge to the industry's growth trajectory. This trend, which is a key concern for industry professionals, may hinder the expansion and progress of the market for these protective coverings.

- Smartphone protection is a crucial aspect of the digital lifestyle for consumers of consumer electronics. PET, a type of plastic used in some screen protectors, offers affordable scratch resistance with a matte coating and silicone adhesive. However, its limitations include no impact protection and susceptibility to discoloration from sunlight and oil build-up. The market for screen protectors is dynamic, with manufacturers addressing these challenges through improvements in quality. Touch sensitivity and UV protection are essential features for many consumers. Price comparison and screen protector reviews significantly influence customer satisfaction. Top screen protector brands prioritize these factors while providing after-sales service and privacy screen options.

- In recent research, the demand for advanced screen protectors with better impact resistance and UV protection has increased. The market for screen protectors continues to evolve, offering consumers a range of options tailored to their digital needs. Regardless of the choice, ensuring a high-quality screen protector that maintains touch sensitivity and provides adequate protection is essential.

Exclusive Customer Landscape

The smartphone screen protector market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smartphone screen protector market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smartphone screen protector market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A Z Infolink Pvt. Ltd. - This company specializes in advanced smartphone screen protectors, featuring tempered glass with anti-glare, ultra-clear, high-definition, and scratch-resistant properties. Our shields enhance visual clarity and durability, safeguarding screens from scratches and glare. By integrating cutting-edge technology, we ensure optimal screen protection, allowing users to enjoy uninterrupted digital experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A Z Infolink Pvt. Ltd.

- AGC Inc.

- BBK Electronics Corp. Ltd.

- BGZ brands

- Carl Zeiss Stiftung

- Clarivue

- Corning Inc.

- FeYong Digital Technology Ltd.

- Hon Hai Precision Industry Co. Ltd.

- Mobile Phone Guard

- Mous Products Ltd.

- Nippon Electric Glass Co. Ltd.

- NuShield Inc.

- PanzerGlass AS

- Spigen Inc.

- Targus Inc.

- Urban Armor Gear LLC

- XtremeGuard

- ZAGG Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smartphone Screen Protector Market

- In February 2023, Corning, a leading glass manufacturer, introduced its new Gorilla Glass Victus, boasting improved durability and scratch resistance, surpassing its previous versions (Corning Inc. Press release). This advancement in smartphone screen protector technology is expected to enhance the overall user experience and provide greater peace of mind for consumers.

- In October 2024, ZEBRONICS, an Indian IT peripherals and mobile accessories brand, announced a strategic partnership with Samsung, enabling exclusive distribution of Samsung's screen protectors in India (ZEBRONICS press release). This collaboration is expected to strengthen ZEBRONICS' market position and provide Samsung with a wider reach in the Indian market.

- In March 2025, Belkin International, a leading consumer electronics company, raised USD100 million in a funding round to expand its mobile accessories business, including screen protectors (TechCrunch). This significant investment will enable Belkin to enhance its product offerings, improve its technology, and expand its market presence.

- In August 2025, JustMobile, a Finnish mobile accessories manufacturer, launched its new line of tempered glass screen protectors with antimicrobial properties, addressing the growing concern for hygiene in the post-pandemic era (JustMobile press release). This innovative product development is expected to differentiate JustMobile in the market and cater to the evolving consumer needs.

Research Analyst Overview

The screen protector market analysis reveals a significant focus on advanced features to enhance user experience and device protection. One notable trend is the integration of eye strain prevention, with matte finish screen protectors gaining popularity. However, removal and installation remain challenges for consumers, leading to a rise in professional installation services. Anti-static films, anti-dust, and anti-reflective coatings are also in demand, as are privacy protection and data security solutions. Innovations such as blue light reduction, hydrophobic and scratch-resistant coatings, and UV filtering extend the lifespan of screens and protect against damage. Gorilla Glass and Sapphire Glass are popular choices for their durability, while screen protector recycling and cleaning services address environmental concerns.

Smartphone screen repair, extended warranties, and device insurance offer cost-effective alternatives to screen replacement. Fingerprint-proof coatings and anti-reflective technology further enhance the user experience. The future of screen protectors lies in continued innovation and integration with device features, ensuring business readers stay informed of market trends.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smartphone Screen Protector Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2025-2029 |

USD 1021.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.0 |

|

Key countries |

US, China, Japan, India, South Korea, Australia, Germany, Canada, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smartphone Screen Protector Market Research and Growth Report?

- CAGR of the Smartphone Screen Protector industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smartphone screen protector market growth of industry companies

We can help! Our analysts can customize this smartphone screen protector market research report to meet your requirements.