Snus Market Size 2025-2029

The Snus market size is forecast to increase by USD 1.2 billion, at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the availability of flavored Snus and evolving consumption trends. The preference for discreet and convenient tobacco products has led to an increase in the popularity of Snus, particularly among younger consumers. Retailers, including tobacco stores, convenience stores, and online retailers, are capitalizing on this trend, expanding their offerings to include a wider range of Snus products. However, the negative health effects associated with Snus consumption remain a challenge for the market. The report provides a comprehensive analysis of these trends and growth factors, offering insights into the market dynamics and potential opportunities for businesses. The market is poised for steady growth, with key players focusing on product innovation and catering to changing consumer preferences. Understanding these trends and challenges is essential for businesses looking to capitalize on the growing demand for Snus in the global market.

What will be the Size of the Snus Market During the Forecast Period?

- The global market has gained significant traction as a potential healthier alternative to cigarettes. With the rising awareness of non-communicable diseases such as cancer, cardiovascular diseases, diabetes, and lung diseases, consumers are increasingly seeking tobacco options that minimize health risks. Snus, a form of smokeless tobacco, comes in various forms such as loose and portioned in pouches or as chewing tobacco. Menthol and licorice flavors are popular among young millennials, while fruit flavors have also gained popularity.

- Despite the potential health benefits, concerns regarding the presence of bacteria and mold in Snus products persist. Governments have responded by implementing taxes and regulations to curb consumption. The cigarette market, however, remains a significant competitor, with many smokers yet to make the switch. Shelf life and product innovation are crucial factors in the market. Manufacturers are investing in research and development to create longer-lasting and more appealing products. The use of pouches and pocket-friendly portion sizes has made Snus a convenient option for consumers on-the-go. In conclusion, the market is experiencing steady growth as consumers seek healthier alternatives to cigarettes.

How is this market segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Flavor

- Mint

- Fruit

- Whiskey

- Others

- Product

- Portion

- Loose

- Geography

- Europe

- Germany

- Spain

- Sweden

- Norway

- Denmark

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Flavor Insights

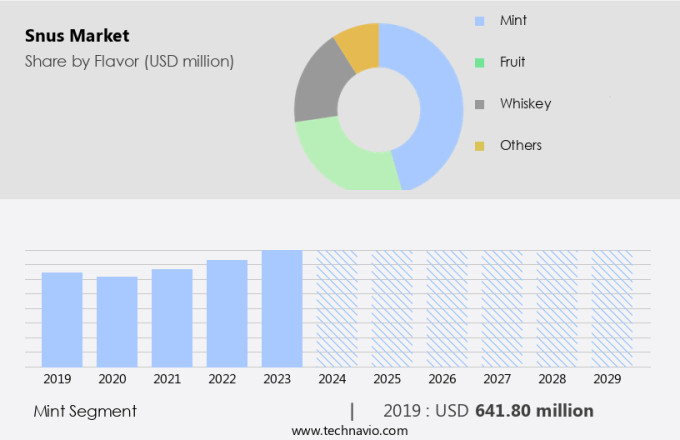

- The mint segment is estimated to witness significant growth during the forecast period.

Mint-flavored Snus represent a significant segment of the global smokeless tobacco market, particularly in countries like Sweden, Norway, and Denmark. This variant of Snus, which is available in pouches, offers a cool and refreshing taste, making it a popular choice among consumers. The demand for mint-flavored Snus has been growing due to increasing health consciousness and the desire for tobacco- and nicotine-free alternatives. The extended shelf life of Snus, compared to traditional cigarettes, is another factor contributing to its popularity.

However, proper storage and handling are essential to prevent bacterial growth and mold. Online retailers and e-commerce platforms have made it easier for consumers to purchase Snus, including mint-flavored varieties, from the comfort of their homes. Despite the taxes imposed on Snus in some regions, its appeal continues to expand.

Get a glance at the market report of share of various segments Request Free Sample

The mint segment was valued at USD 641.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

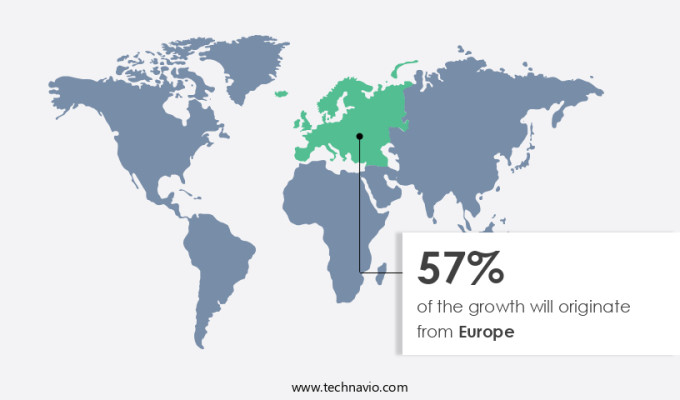

- Europe is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market dominates the global Snus industry, with Sweden, Norway, and Denmark being the leading producers and consumers. In Europe, key players such as Swedish Match AB and GN Tobacco Sweden AB manufacture a significant portion of Snus products. However, the European market is subject to stringent government regulations, with production and consumption banned in several countries. Noncommunicable diseases, including cancer, cardiovascular diseases, diabetes, and lung diseases, are health concerns associated with Snus use. Public awareness campaigns have been implemented to reduce the prevalence of Snus consumption. Some Snus variants contain flavors like menthol, licorice, and vanilla naturally. Despite regulations, the market continues to grow, driven by consumer preferences and the availability of various flavors.

Market Dynamics

Our Snus market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Snus Market?

The availability of flavored Snus is the key driver of the market.

- The market in the US has witnessed significant growth in the past few years, driven by the increasing awareness of noncommunicable diseases such as cancer, cardiovascular diseases, and diabetes. Smokeless tobacco products like Snus have emerged as a potentially healthier alternative to smoking cigarettes, which cause lung diseases, oral cancers, and respiratory illnesses. Swedish Match AB, a leading player in the market, offers a diverse range of Snus products to cater to various consumer preferences. Swedish Match's product lines, such as Kaliber and Kronan in Sweden and General G.3 in Norway, have gained popularity due to their quality and affordable pricing.

- The company has also introduced new functional properties and innovative flavors, including menthol, licorice, vanilla, fruits, eucalyptus, mint, whiskey, berries, citrus, cedar, bergamot, hay, smoky, dry fruit, and spices, to attract younger consumers. The market is not limited to Tobacco Stores and Convenience Stores; Online Retail Stores have also gained traction, particularly among younger consumers. The market dynamics are influenced by various factors, such as health concerns, taxes, and the shelf life of the products. However, the presence of bacteria and mold can pose challenges to the market's growth. Snus is used by various communities, including athletes, truck drivers, and soldiers, as a performance enhancer.

What are the market trends shaping the Snus Market?

Changing consumption trends in the global Snus market is the upcoming trend in the market.

- The market is experiencing a notable transition in consumer preferences, moving away from cigarettes due to increasing health concerns, smoking bans, and regulatory measures against cigarettes. Smokeless tobacco products, such as Snus, moist snuff, e-cigarettes, vapes, heat-not-burn tobacco products, and non-pharmaceutical nicotine-delivery systems, have gained traction among health-conscious consumers. These products contain nicotine but do not involve the burning of tobacco. In Sweden, the decline in cigarette consumption over the past five years has been significant, with the public increasingly turning to Snus products. Conversely, in Japan, e-cigarettes and vapes have gained immense popularity within the same timeframe.

- Snus comes in various forms, including portion Snus and loose Snus. Flavor varieties include menthol, licorice, vanilla, fruits, eucalyptus, mint, whiskey, berries, citrus, cedar, bergamot, hay, smoky, dry fruit, and spices. These flavors cater to diverse consumer preferences. Younger consumers, including young millennials, are increasingly drawn to these tobacco products due to their perceived health benefits and a wider range of flavor options. However, concerns regarding oral cancers, respiratory illnesses, and the presence of harmful chemicals in these products persist. Retailers, including Tobacco Stores, Convenience Stores, and Online Retail Stores, play a crucial role in the distribution and sales of these products. E-commerce platforms have also emerged as significant players in the market, offering a convenient and accessible shopping experience. However, concerns regarding health risks and regulatory measures remain significant challenges for the market.

What challenges does the Snus Market face during the growth?

The negative health effects of Snus consumption is a key challenge affecting the industry growth.

- The market for Snus and other smokeless tobacco products in the US has seen significant growth due to shifting consumer preferences towards less harmful alternatives to smoking. However, it is essential to acknowledge that these products are not entirely risk-free. The consumption of Snus and other smokeless tobacco products exposes users to various health risks, including noncommunicable diseases such as cancer, cardiovascular diseases, and diabetes. Cancer is a significant concern, with smokeless tobacco containing traces of carcinogens like tobacco-specific nitrosamines (TSNAs). Oral cancers, including tongue, cheek, and gum cancer, are common health risks associated with smokeless tobacco use. Additionally, pancreatic cancer and respiratory disorders, such as lung diseases and respiratory illnesses, have also been linked to smokeless tobacco consumption.

- Moreover, smokeless tobacco products can lead to lung diseases and respiratory problems due to the inhalation of fine particles. Harmful chemicals and toxic substances, such as heavy metals and volatile organic compounds, are also present in these products. Despite these health concerns, younger consumers, including teenagers, continue to explore various flavor varieties, such as menthol, licorice, vanilla, fruits, eucalyptus, mint, whiskey, berries, citrus, cedar, bergamot, hay, smoky, dry fruit, spices, tea, and more. These products are available at various retailers, including Tobacco Stores, Convenience Stores, and Online Retail Stores. The market in the US is driven by factors such as longer shelf life, taxes, and consumer preferences.

Exclusive Customer Landscape

The Snus market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

British American Tobacco Plc - The company offers Snus such as Camel Snus as part of their traditional oral product category.

The Snus market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altria Group Inc.

- Another Snus Factory Stockholm AB

- Dholakia Tobacco Pvt. Ltd.

- Empire of Snus

- GN Tobacco Sweden AB

- Harsh International

- Imperial Brands Plc

- Japan Tobacco Inc.

- Philip Morris International Inc.

- Swisher International Inc.

- TIGERSnus ORGANIC Snus TOBACCO

- Turning Point Brands Inc.

- Wilsons and Co. Sharrow Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by shifting consumer preferences towards smokeless tobacco products. This market research report provides an in-depth analysis of The market, focusing on key trends, consumer demographics, and flavor preferences. Market Overview Snus is a traditional Swedish smokeless tobacco product, typically consumed by placing a small pouch between the lip and gum. The market is experiencing steady growth due to increasing public awareness about the health risks associated with smoking and the perception of Snus as a healthier alternative.

Furthermore, consumer Preferences and Flavor Trends Younger consumers, particularly young millennials, are driving the demand for Snus products, with fruit flavors being a popular choice. Fruit flavors such as berries, citrus, and melon, offer a more palatable experience compared to traditional tobacco flavors. Other popular flavor varieties include menthol, licorice, vanilla, and various herbal and spice blends. Mint and menthol flavors continue to be a significant segment in the market, appealing to consumers seeking a cool, refreshing experience. Additionally, natural flavors such as eucalyptus, cedar, and bergamot are gaining popularity as consumers increasingly prefer products with cleaner, more natural taste profiles.

However, the market is increasingly attracting a more diverse consumer base, with young consumers and those concerned about their health opting for smokeless tobacco products as an alternative to cigarettes. Health Concerns and Regulations Despite the perceived health benefits of Snus compared to cigarettes, it still contains nicotine and other harmful chemicals. Oral cancers and respiratory illnesses are among the health concerns associated with Snus use. Regulations regarding the sale and advertising of Snus products vary by region, with some countries implementing stricter labeling and taxation policies.

|

Snus Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market Growth 2025-2029 |

USD 1.2 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

10.0 |

|

Key countries |

Sweden, US, Norway, Poland, Spain, Denmark, Canada, Germany, China, and Finland |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch