Europe Solar Thermal Market Size 2025-2029

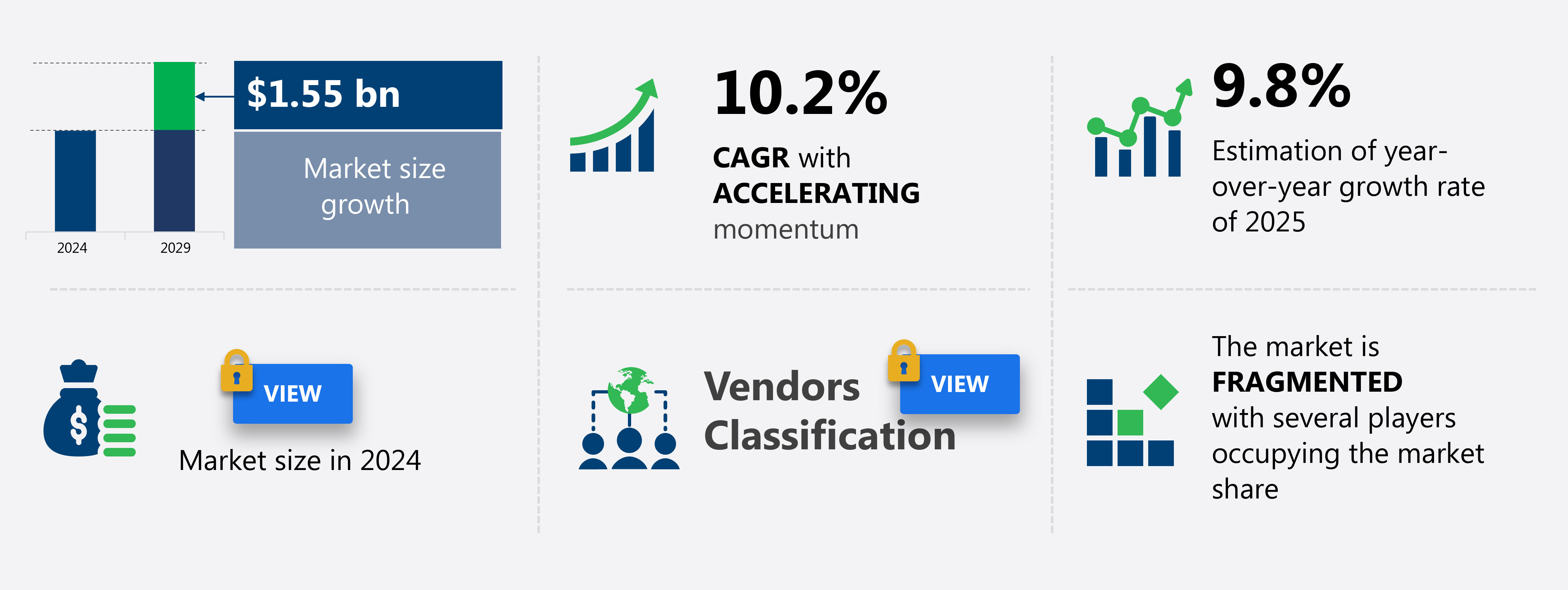

The Europe solar thermal market size is forecast to increase by USD 1.55 billion, at a CAGR of 10.2% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The increasing demand for concentrated solar power (CSP) systems is a major driving factor, as these systems provide consistent and reliable energy output even during peak sunlight hours and can store energy for use during off-peak hours. Additionally, the emergence of smart cities is leading to increased adoption of technology for heating and cooling applications. However, the intermittency of the solar resource remains a challenge for the market, requiring advancements in energy storage and grid integration solutions. Overall, the market is poised for growth as these challenges are addressed and the benefits of this clean and renewable energy source become more widely recognized.

What will be the Size of the market During the Forecast Period?

- The market encompasses the production of thermal energy through the use of solar power. These systems absorb electromagnetic radiation from the sun and convert it into heat, which can be utilized for various applications, including industrial processes such as direct heating, drying, and water desalination. The technology is distinct from photovoltaic energy, which generates electricity. These systems consist of glazed and unglazed collectors, with the former being more efficient at producing high-temperature heat.

- The industrial segment is a significant contributor to the market's growth, as businesses seek to reduce energy bills and decrease reliance on natural gas. These systems are also employed in district heating networks and residential applications, providing cost-effective and renewable alternatives to traditional heating sources. The market is expected to continue expanding, driven by advancements in technology and increasing global awareness of the importance of renewable energy sources.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- L and M temperature

- High temperature

- Application

- Heat generation

- Power generation

- Collector Type

- Evacuated Tube Collector

- Flat Plate Collector

- Unglazed Water Collector

- Air Collector

- Geography

- Europe

- Germany

- France

- Italy

- Spain

- Europe

By Technology Insights

- The I and M temperature segment is estimated to witness significant growth during the forecast period.

Solar thermal energy, derived from sun rays, is utilized for various applications, including industrial processes, direct heating, drying, water desalination, and power generation. Solar heating systems encompass hot water systems, solar combi systems, and solar air heating. Industrial sectors, such as power generation industries, employ the technology for steam turbines to generate electricity. Solar thermal systems are also integrated into desalination plants for fresh water resource production, particularly In the sea water desalination sector. In the residential and commercial segments, solar thermal technology is applied for water heating, space heating, and solar desalination. Solar water heating systems consist of solar collectors and storage tanks, which capture solar radiation and transfer thermal energy to heat transfer fluids, subsequently heating water in a heat exchanger. Common types of solar collectors include evacuated tube collectors, flat plate collectors, unglazed water collectors, and air collectors. The technology offers numerous advantages, including reducing greenhouse gas emissions, contributing to renewable energy targets, and mitigating climate change.

The technology is also utilized in agriculture, food processing, and the tourism industry for drying and heating applications. The power generation sector, particularly In the form of photothermal materials and infrared insulating materials, benefits from thermal technology. Solar thermal systems can be integrated with heat pumps, water heaters, boilers, furnaces, and solar chimneys. Additionally, the technology is employed in swimming pool facilities and for heating greenhouse structures. Solar thermal systems offer cost savings through reduced energy bills, as an alternative to fossil fuels and natural gas. Government incentives and regulatory plans further support the adoption of the technology. The solar industry continues to innovate, with advancements in energy storage, collector surface, and solar panels.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Europe Solar Thermal Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Europe Solar Thermal Market?

Increasing demand for CSP is the key driver of the market.

- Solar thermal energy, a subset of renewable energy, is gaining significant traction in various industries due to its ability to provide thermal energy for direct heating, drying, water desalination, and power generation. Solar heating systems, including evacuated tube collectors, flat plate collectors, unglazed water collectors, and air collectors, are widely used for hot water systems, solar combi systems, and space heating. In the power generation sector, the technology is utilized in steam turbines to generate electricity, particularly in desalination plants that convert seawater into fresh water resources. The industrial sector, agriculture, food processing, and the tourism industry are some of the major consumers of energy.

- These systems are increasingly being adopted for greenhouse gas emissions reduction and to meet renewable energy targets, as part of regulatory plans and green building codes. Thermosiphoning, heat pumps, water heaters, boilers, furnaces, solar chimneys, and swimming pool facilities are other applications of energy. Solar thermal energy storage, such as molten salt storage, is a crucial component of power plants, enabling the generation of electricity in adverse weather conditions and reducing the constraints of ramping and minimum generation levels. The cost of electricity generation using power plants has significantly decreased, making them a cost-effective alternative to fossil fuels and natural gas.

- The solar industry is witnessing an increase in new installations of power plants due to the reduced cost of electricity generation, the flexibility of solar plants, and the growing demand for clean energy resources. Solar thermal systems offer high-temperature heat, making them a suitable alternative to batteries for energy storage in power generation industries. Government incentives and renewable energy targets are further driving the growth of the market. Solar thermal technology is a promising solution for process heating, industrial catalysis, and artificial energy, reducing the consumption of fossil fuels and fossil-derived energy. Solar-heating catalysis and photothermal materials are areas of ongoing research and development In the field of technology.

What are the market trends shaping the Europe Solar Thermal Market?

The emergence of smart cities is the upcoming trend In the market.

- Solar thermal energy, a subset of renewable energy, is gaining significant traction in various industries due to its ability to convert sunrays into thermal energy. This thermal energy is used for direct heating, drying, water desalination, and power generation. Solar heating systems, including evacuated tube collectors, flat plate collectors, unglazed water collectors, and air collectors, are commonly used for hot water systems, solar combi systems, and solar desalination. The power generation sector is increasingly adopting solar thermal technology for electricity production through steam turbines. Solar thermal systems are also used In the industrial sector for process heating, industrial catalysis, and artificial energy, providing an alternative to fossil fuels.

- In the public and private sectors, technology is used in desalination plants to produce fresh water resources from seawater, which is crucial for agriculture, food processing, and the tourism industry. Green technologies, such as heat pumps, water heaters, boilers, furnaces, solar chimneys, and swimming pool facilities, are also utilizing solar thermal energy to reduce greenhouse gas emissions and energy bills. The residential segment, including homes, is also embracing systems for domestic water heating, space heating, and solar drying. Government incentives and renewable energy targets are driving the growth of the market, which is expected to reach gigawatts in capacity.

- The solar industry is also investing in energy storage solutions to ensure a consistent energy supply, especially during peak demand hours. The solar thermal market is a significant contributor to clean energy resources, reducing the reliance on fossil fuels and contributing to climate change mitigation efforts. The market is expected to continue growing, driven by advancements in solar devices, such as concentrating solar panels and photovoltaic panels, and the development of photothermal materials and infrared insulating materials.

What challenges does the Europe Solar Thermal Market face during the growth?

The intermittency of solar resource is a key challenge affecting the market growth.

- Solar thermal energy, derived from the sun's rays, is a vital component of the renewable energy sector. This form of thermal energy is harnessed using solar heating systems, including evacuated tube collectors, flat plate collectors, unglazed water collectors, and air collectors. Solar thermal energy is used for various applications, such as industrial processes, direct heating, drying, water desalination, and space heating. Power generation industries utilize solar thermal technology to generate electricity through steam turbines, while solar devices like photovoltaic generators are employed for photovoltaic power generation. Public and private companies are increasingly adopting solar thermal systems as part of their green technologies to reduce greenhouse gas emissions and meet renewable energy targets.

- The intermittent nature of solar energy, however, poses a challenge. Solar thermal and photovoltaic systems produce the most power during peak hours when the sun is shining brightly. This variability disrupts conventional electric grid operations, requiring grid operators to adjust real-time procedures to accommodate the power fluctuations. Solar thermal energy is used for various applications, including water heating, solar combi systems, solar drying, solar air heating, and solar desalination. Thermosiphoning, heat pumps, water heaters, boilers, furnaces, solar chimneys, swimming pool facilities, and the tourism industry are other sectors that benefit from solar thermal technology.

- Solar thermal systems come in various sizes, from residential to commercial and industrial applications. The solar industry is continually innovating, with advancements in solar panels, energy storage, and concentrating solar panels. The market is growing, driven by increasing energy costs, government incentives, and the need to reduce reliance on fossil fuels. Despite the challenges, solar thermal energy remains an attractive clean energy resource. Its potential to reduce energy bills, provide fresh water resources, and contribute to climate change mitigation make it an essential part of the renewable energy landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Aalborg CSP - The company offers solar thermal such as CSP parabolic troughs, Flat solar thermal panels, combination plants and heat storage accumulation tanks.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aalborg CSP

- Abengoa

- Acciona SA

- ACS Actividades de Construccion Y Servicios SA

- Baxi ( BDR Thermea Group BV)

- BrightSource Energy

- CGC SAMCA

- Cosmosolar Ltd

- DEL PASO SOLAR SL

- DIMAS SA

- Enel Green Power

- Frenell GmbH

- GREENoneTEC Solarindustrie GmbH

- Greenville Energy and Research Inc.

- Hewalex Sp. z o. o. Sp.k.

- PHOENIX SonnenWarme AG

- Robert Bosch GmbH

- SENER GRUPO DE INGENIERIA SA

- Vaillant Group

- Viessmann Climate Solutions SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

It is a subset of renewable energy, harnesses the sun's heat to generate thermal energy. This form of energy is gaining traction in various industries due to its potential to reduce greenhouse gas emissions and reliance on fossil fuels. Solar thermal energy is used for diverse applications, including industrial processes, direct heating, drying, water desalination, and solar heating systems. Industrial applications are prevalent in power generation industries, where steam turbines convert thermal energy into electricity. The technology is also employed in water desalination plants, providing a sustainable solution for fresh water resources. In agriculture and food processing, the energy is used for drying and cooking, reducing the reliance on traditional energy sources.

Further, systems come in various designs, including evacuated tube collectors, flat plate collectors, unglazed water collectors, and air collectors. These systems are used to generate hot water and heat for residential, commercial, and industrial applications. Solar combi systems provide both hot water and space heating, making them an attractive option for energy-efficient buildings. The market is driven by the growing demand for clean energy resources and government incentives. Renewable energy targets and regulatory plans are encouraging the adoption of systems in various sectors. The construction sector is also embracing green building codes, which mandate the use of renewable energy sources.

In addition, the energy is used in various industries, including power generation, desalination, agriculture, food processing, and tourism. In power generation, the energy is used to generate electricity, while in desalination, it is used to produce fresh water. In agriculture and food processing, the energy is used for drying and cooking, reducing the reliance on traditional energy sources. In the tourism industry, energy is used to provide hot water and space heating for facilities such as swimming pools and hotels. The energy is an essential component of the renewable energy landscape, providing a sustainable alternative to fossil fuels.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market Growth 2025-2029 |

USD 1.55 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.8 |

|

Key countries |

Germany, Spain, France, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.