Spasticity Treatment Market Size 2025-2029

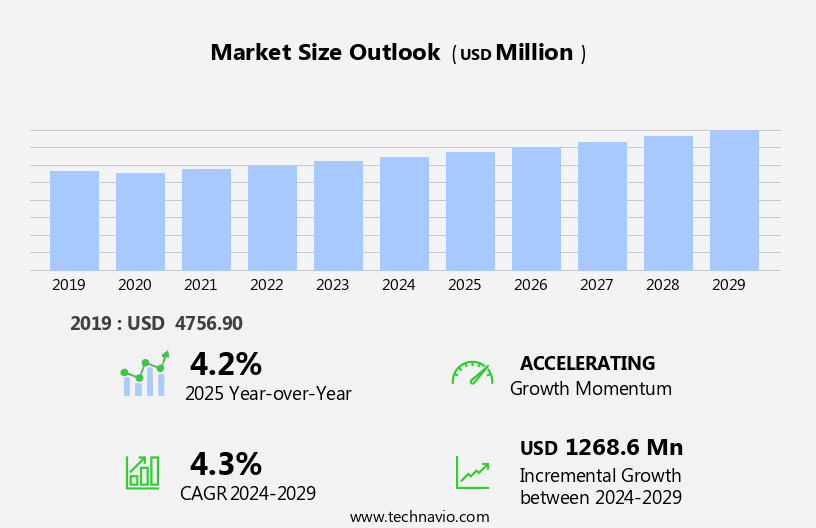

The spasticity treatment market size is forecast to increase by USD 1.27 billion at a CAGR of 4.3% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing incidence of chronic diseases and health conditions that result in spasticity. This condition, characterized by involuntary muscle contractions, affects a large population, particularly the elderly and individuals with neurological disorders. A key trend driving market growth is the advent of neurostimulation devices, which provide effective relief from spasticity symptoms. However, the high cost associated with these treatments remains a significant challenge, limiting access for many patients. Overall, the market is expected to continue expanding as new technologies and treatment options emerge to address the unmet needs of this patient population.

What will be the Size of the Spasticity Treatment Market During the Forecast Period?

- The market encompasses a range of advanced technologies and therapies aimed at managing abnormal posture, overactive reflexes, and involuntary muscle spasms resulting from various neurological conditions. These conditions, including brain injury, cerebral palsy, and chronic neuro-musculoskeletal illnesses, can lead to increased muscle tone, stiffness, clonus, and other symptoms. Despite the availability of physiotherapy, stimulatory devices, drugs, and physiotherapy centers, the market faces challenges such as inadequate reimbursement, lack of awareness, and limited access to skilled professionals. New developments In the product pipeline analysis, including novel therapeutics and healthcare expenditure, offer potential revenue pockets for market participants. Rehabilitation nurses, recreational therapists, and healthcare facilities, including hospital pharmacies, play crucial roles in the delivery of spasticity treatment.

- The growing population of children with neurological disorders and the prevalence of accidents, assaults, and other causes of spasticity further expand the market's reach. Adverse effects and product approval processes pose regulatory hurdles, while the need for continuous care and the complex nature of spasticity management present ongoing challenges.

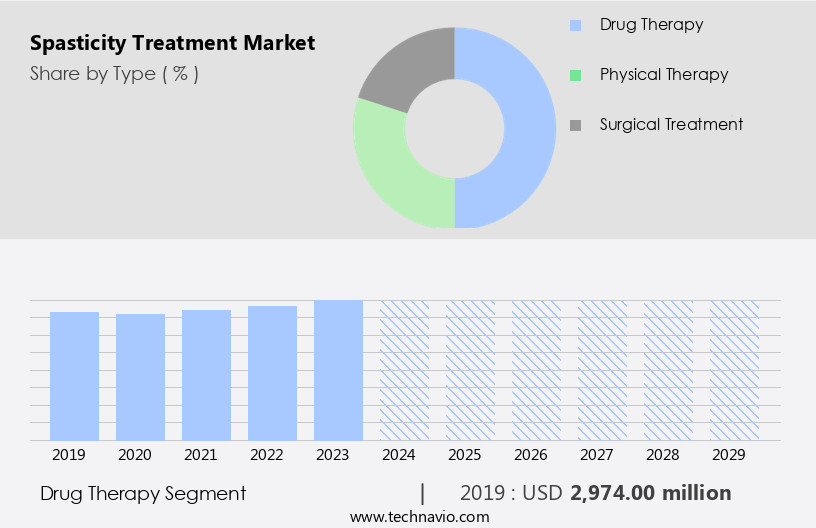

How is this Spasticity Treatment Industry segmented and which is the largest segment?

The spasticity treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Drug therapy

- Physical therapy

- Surgical treatment

- End-user

- Hospitals

- Ambulatory surgical centers

- Home care settings

- Specialty clinics

- Diagnostic centers

- Indication

- Cerebral palsy

- Multiple sclerosis

- Traumatic brain injury

- Others

- Route Of Administration

- Oral

- Parenteral

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

- The drug therapy segment is estimated to witness significant growth during the forecast period.

Spasticity, a muscle control disorder characterized by muscle stiffness, tightness, and increased tone, affects millions of patients with neurological conditions such as spinal cord injury, stroke, and cerebral palsy. Treatment options include pharmaceutical interventions like antispasmodic agents such as baclofen and muscle relaxants, as well as non-invasive therapies such as physical therapy exercises, speech therapy, and assistive devices. Movement disorders specialists, neurologists, orthopedic interventions, and rehabilitation centers provide diagnosis and treatment. Clinical trials are ongoing to explore new innovations, including botulinum toxin injections and reimbursement policies. Insurance coverage and patient advocacy play crucial roles in ensuring equitable access to care.

Get a glance at the market report of share of various segments Request Free Sample

The drug therapy segment was valued at USD 2.97 billion in 2019 and showed a gradual increase during the forecast period.

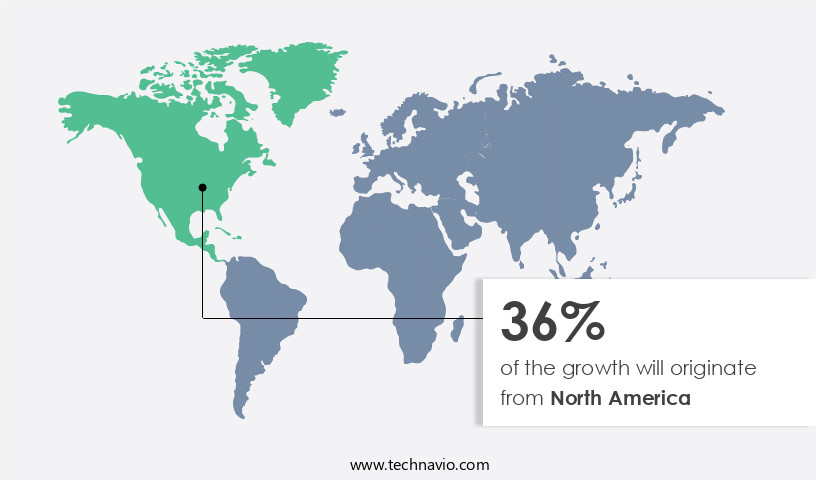

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American region dominates The market due to the high prevalence of neurological disorders, such as multiple sclerosis, which is a leading cause of spasticity. According to the National Center for Complementary and Integrative Health, multiple sclerosis affects approximately 400,000 Americans, making it a significant contributor to the market. Furthermore, healthcare reforms In the US are driving market growth by increasing access to treatments for spasticity, including muscle relaxants, injections, and medical devices. Patients with spasticity often experience muscle spasms, stiffness, and mobility limitations, which can significantly impact their quality of life. Treatment options include physical therapy exercises, assistive devices, and botulinum toxin injections.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Spasticity Treatment Industry?

Growing incidence of chronic diseases and health conditions is the key driver of the market.

- Spasticity is a common condition arising from damage to the central nervous system (CNS), primarily affecting patients with chronic neuro-musculoskeletal disorders such as multiple sclerosis, cerebral palsy, spinal cord injury, and traumatic brain injury. These conditions disrupt the communication between the brain and muscles, leading to muscle stiffness, spasms, and limited mobility. According to the Multiple Sclerosis Trust, approximately 2.5 million people worldwide live with multiple sclerosis, contributing to the rising incidence of spasticity. Healthcare providers employ various interventions to manage spasticity, including patient education, medication (muscle relaxants, botulinum toxin), clinical trials, and non-invasive therapies (physical therapy exercises, assistive devices).

- Orthopedic interventions, such as injections and surgery, are also utilized in severe cases. Neurological rehabilitation, speech therapy, and home healthcare services are essential components of spasticity management. Insurance coverage and funding are crucial factors In the adoption and development of spasticity treatments. Advocacy and awareness campaigns play a significant role in increasing spasticity diagnosis accuracy and promoting options for patients. The domestic market for spasticity treatment is experiencing significant research and development, with innovations in reimbursement policies, drugs, and legislation. Quality of care, patient outcomes, and equity are primary concerns In the spasticity treatment landscape. Inpatient services, specialist consultations, and accessibility to care are essential aspects of delivering effective and accessible spasticity management.

What are the market trends shaping the Spasticity Treatment Industry?

Advent of neurostimulation devices for spasticity treatment is the upcoming market trend.

- The prevalence of chronic conditions leading to spasticity is on the rise, fueling market growth beyond traditional drug and physical therapy treatments. However, managing spasticity presents unique challenges due to unmet market needs, as current treatments offer only short-term relief and may come with unpleasant side effects. In response, companies are innovating by developing neurostimulation devices to complement medication. Patient education, advocacy, and awareness campaigns are also crucial for accurate diagnosis and increasing adoption of these treatments. Insurance coverage, equity, and quality are key considerations In the domestic market, with clinical trials and research and development playing a significant role in advancing treatment options.

- Reimbursement, legislation, and policy are also essential factors influencing market dynamics. Neurological disorders, such as stroke and spinal cord injury, are significant contributors to spasticity, making mobility limitations and functional functional limitations a major concern. Non-invasive therapies, including botulinum toxin injections and physical therapy exercises, are also important treatment methods. Home healthcare, speech therapy, and assistive devices are additional areas of focus for improving patient outcomes. The future of spasticity treatment lies in continued research, collaboration between healthcare providers, and a commitment to addressing the unique needs of patients with spasticity disorders.

What challenges does the Spasticity Treatment Industry face during its growth?

High cost associated with spasticity treatment is a key challenge affecting the industry growth.

- Spasticity, a muscle control disorder characterized by muscle stiffness, spasms, and tightness, significantly impacts individuals with movement disorders such as spinal cord injury, stroke, and neuromuscular disorders. Healthcare providers employ various treatments to manage spasticity, including pharmaceutical interventions like muscle relaxants and botulinum toxin injections, clinical trials of new drugs, and orthopedic interventions. Non-invasive therapies, such as home healthcare, speech therapy, and physical therapy exercises, also play a crucial role in managing spasticity.

- Patient education, advocacy, and insurance coverage are essential to increase awareness and equity in spasticity treatment. Research and development In the domain of medical devices, assistive technologies, and neuromuscular innovations offer promising solutions to improve patient outcomes and accessibility. Policy, funding, and legislation are critical factors influencing the adoption and development of spasticity treatment options. Despite these challenges, ongoing awareness campaigns and advancements in diagnosis accuracy and reimbursement models offer hope for improved care and quality in spasticity management.

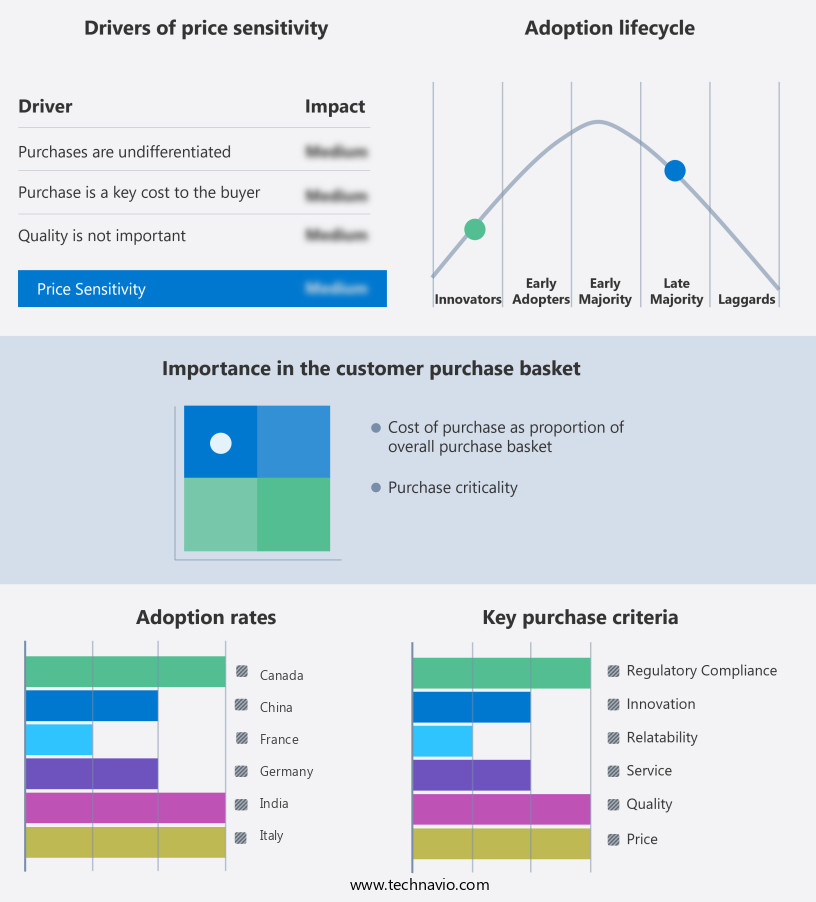

Exclusive Customer Landscape

The spasticity treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spasticity treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spasticity treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The company offers spasticity treatment such as Proclaim DRG Neurostimulation System, and Infinity Deep Brain Stimulation system.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axonics Inc.

- BioWave Ltd.

- Boston Scientific Corp.

- BrainsWay Ltd.

- electroCore Inc.

- LivaNova PLC

- Mayo Foundation for Medical Education and Research

- Medtronic Plc

- NEURONETICS Inc.

- Nevro Corp.

- OMRON Corp.

- PathMaker Neurosystems Inc.

- Rady Children's HospitalâSan Diego

- Saebo

- Saluda Medical Pty Ltd.

- ShiraTronics

- The Johns Hopkins Health System Corp.

- Theranica Bio Electronics Ltd.

- Thync Global Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of interventions aimed at managing muscle control issues arising from various movement disorders. These conditions, including spinal cord injuries and strokes, can result in mobility limitations, muscle stiffness, and spasms. Healthcare providers play a crucial role in addressing these challenges through a multidisciplinary approach that may involve pharmaceutical interventions, medical devices, and rehabilitation therapies. Patient education is a vital component of effective spasticity treatment. Neurological rehabilitation, including speech therapy and physical therapy exercises, can help improve functional limitations and enhance overall quality of life. Orthopedic interventions, such as injections and assistive devices, can also be employed to address muscle spasms and stiffness.

In addition, research and development efforts In the market continue to yield innovations. Clinical trials explore the efficacy of various treatments, including muscle relaxants and botulinum toxin injections. Non-invasive therapies, like electrical stimulation and heat or cold applications, are also under investigation for their potential benefits. The domestic market for spasticity treatments is driven by several factors. Awareness campaigns and advocacy initiatives aim to increase public understanding of spasticity disorders and their management. Improvements in diagnosis accuracy and the availability of options, including over-the-counter medications and prescription drugs, contribute to the market's growth. Policy and legislation play a significant role in shaping the spasticity treatment landscape.

Furthermore, insurance coverage for various interventions, such as inpatient services and home healthcare, can impact patient access to care. Funding for research and development and initiatives to improve accessibility are also essential considerations. As the field advances, specialists continue to refine their approaches to managing spasticity disorders. The future of spasticity treatment may involve a more personalized, patient-centered approach, with a focus on improving outcomes and enhancing overall quality of life.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 1.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Germany, Canada, China, UK, Japan, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spasticity Treatment Market Research and Growth Report?

- CAGR of the Spasticity Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spasticity treatment market growth of industry companies

We can help! Our analysts can customize this spasticity treatment market research report to meet your requirements.