Spicy Dairy Products Market Size 2025-2029

The spicy dairy products market size is valued to increase USD 127.3 million, at a CAGR of 3.6% from 2024 to 2029. Launch of new restaurants will drive the spicy dairy products market.

Major Market Trends & Insights

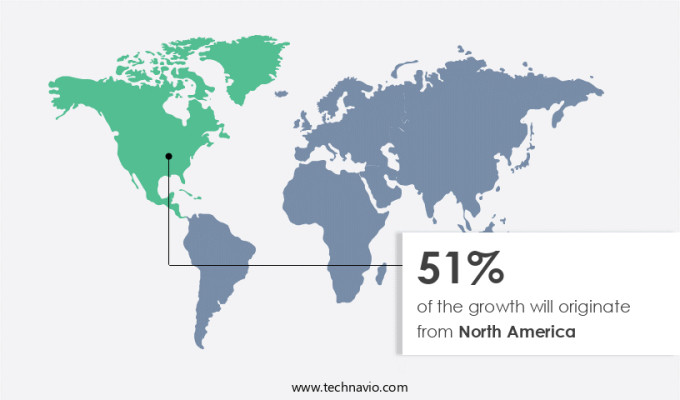

- North America dominated the market and accounted for a 51% growth during the forecast period.

- By Formulation - Solid segment was valued at USD 251.60 million in 2023

- By Product - Cheese segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 71.29 million

- Market Future Opportunities: USD 127.30 million

- CAGR from 2024 to 2029 : 3.6%

Market Summary

- The market represents a dynamic and intriguing sector within the broader food industry. According to recent data, this market is valued at over USD 12 billion, fueled by increasing consumer preferences for bold flavors and the fusion of dairy and spicy elements. Key drivers include the growing popularity of ethnic cuisines, the rise of food trends such as spicy dairy beverages, and the expanding consumer base in developing economies. Trends in this market include the development of lactose-free and vegan spicy dairy alternatives, the increasing use of natural and organic ingredients, and the growing popularity of regional and artisanal products.

- Challenges include the need for careful formulation to balance spiciness and creaminess, as well as the potential for sensitivities to certain spices and dairy components. Despite these challenges, the market continues to evolve, offering opportunities for innovation and growth. Companies are exploring new product categories, such as spicy dairy snacks and desserts, while also focusing on sustainability and ethical production practices. As consumer preferences for bold flavors and plant-based alternatives continue to shape the food industry, the market is poised for further expansion.

What will be the Size of the Spicy Dairy Products Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Spicy Dairy Products Market Segmented?

The spicy dairy products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Formulation

- Solid

- Liquid

- Product

- Cheese

- Yogurt

- Buttermilk

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Formulation Insights

The solid segment is estimated to witness significant growth during the forecast period.

The market is categorized by form, with solid products becoming a prominent segment due to their versatility and broad consumer appeal. Solid spicy dairy items, such as flavored cheeses, are especially favored for their bold flavors and varied culinary uses. Boar's Head offers Chipotle Gouda, a solid, flavored spicy cheese available in bars across the US. This cheese blends the smoky heat of chipotle peppers with the creamy texture of Gouda, making it perfect for melting over dishes or serving on a cheese platter. Its unique combination of smoky and creamy flavors appeals to cheese lovers and those exploring new taste experiences.

The Solid segment was valued at USD 251.60 million in 2019 and showed a gradual increase during the forecast period.

Kase Pepper Jack cheese is a semi-soft cheese infused with handpicked peppercorns. This cheese melds the smooth texture of Monterey Jack with the spicy bite of jalapenos and other peppers. Pepper Jack is a popular addition to sandwiches, burgers, and nachos, known for its ability to elevate a variety of dishes with its exciting flavor balance.

Regional Analysis

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Spicy Dairy Products Market Demand is Rising in North America Request Free Sample

The North American market for spicy dairy products is witnessing significant evolution, fueled by inventive product introductions and a thriving dairy sector. In 2023, Lee Kum Kee U.S.A., a prominent player in the authentic Asian sauces and condiments industry, launched Sriracha Milk in the United States. This groundbreaking product merges the sweetness of milk with the zest of Sriracha, providing consumers with a unique and alluring flavor profile. The sweet and spicy taste, followed by a soothing aftertaste, caters to the growing demand for adventurous and innovative dairy options.

The U.S. Dairy industry's substantial contribution to this market expansion is evident, with the sector generating over 60 billion gallons of milk annually. The spicy dairy product market's continued growth is a testament to consumers' evolving palates and the dairy industry's ongoing innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing consumer preference for bolder and more complex flavors. In the production of these products, optimizing milk coagulation for cheese production is crucial to ensure the desired texture and taste. The use of starter cultures in yogurt fermentation plays a vital role in controlling the acidification process, which impacts the final product's flavor and consistency. In the realm of dairy fermentation, understanding the influence of microbial ecology is essential for producing high-quality spicy dairy products. Controlling acidification and improving the sensory attributes of cheese can be achieved by optimizing processing methods and evaluating the impact of different whey processing methods. Modifying the atmosphere packaging for dairy products is an effective way to improve their shelf life, ensuring consumer satisfaction and reducing waste. Analyzing the rheological properties of cheese during ripening and investigating the influence of fat crystallization on butter texture are essential for maintaining the desired texture and mouthfeel. Measuring the effectiveness of pasteurization techniques and determining the optimal churning parameters for butter production are crucial steps in ensuring the safety and quality of spicy dairy products. Quantifying flavor compounds using advanced techniques and studying the impact of different packaging materials on product shelf life are essential for product development and innovation. Reducing energy consumption in dairy processing plants is a critical business consideration, and evaluating the efficacy of different cleaning and sanitizing procedures is essential for maintaining product quality and ensuring food safety. Investigating ingredient interactions and assessing the effectiveness of probiotic strains in dairy products are key areas of research for companies looking to differentiate themselves in the market. Exploring the functionalities of novel dairy ingredients and understanding the role of temperature on protein denaturation in milk are also important considerations for market success.

What are the key market drivers leading to the rise in the adoption of Spicy Dairy Products Industry?

- The opening of new restaurants serves as the primary catalyst for market growth.

- The market is experiencing a notable evolution, fueled by the emergence of new dining establishments emphasizing innovative and authentic flavors. For instance, in November 2024, JW Marriott Mumbai Sahar unveiled BarQat, an Indian restaurant dedicated to traditional Indian spices and cuisine. This restaurant aims to provide a unique culinary experience by blending ancient spices, flavors, and ancestral recipes with contemporary presentation techniques. This focus on traditional yet innovative cuisine is projected to draw a diverse clientele, thereby increasing the demand for spicy dairy products utilized in various dishes.

- Furthermore, in December 2024, renowned celebrity chef Gordon Ramsay collaborated with Travel Food Services to launch new dining outlets at six airports across India. These developments underscore the growing importance of spicy dairy products in the foodservice industry.

What are the market trends shaping the Spicy Dairy Products Industry?

- Product trends indicate a focus on product launches in the market. Upcoming business developments primarily revolve around new product introductions.

- The market experienced a noteworthy evolution in 2024, characterized by the introduction of innovative and unique flavors catering to diverse consumer preferences. In August of that year, Bored Cow launched a Pumpkin Spice-flavored milk alternative in the US, exclusively available at select Target stores. This strategic expansion of Bored Cow's dairy alternative offerings underscores the growing demand for lactose-free and protein-rich options. The conveniently packaged seasonal flavor targets consumers seeking on-the-go solutions. Earlier in May 2024, Organic Valley, a prominent player in the dairy industry, expanded its Flavor Favorites cheese line with the introduction of Spicy Cheddar.

- Available in both shreds and slices, this new product enhances various dishes, from tacos to burgers, and serves as an innovative snack option. The market's dynamic nature reflects the increasing importance of catering to consumers' evolving taste preferences.

What challenges does the Spicy Dairy Products Industry face during its growth?

- Compliance with regulatory requirements poses a significant challenge to the industry's growth trajectory. It is essential for businesses to adhere to these regulations to avoid penalties and maintain their reputation. Non-compliance can lead to legal consequences, financial losses, and damage to brand image. Consequently, staying updated with regulatory changes and implementing necessary adjustments in business practices is crucial for sustained industry growth.

- The market is undergoing transformative changes, with regulatory compliance emerging as a significant challenge. In India, the Food Safety and Standards Authority of India (FSSAI) launched investigations into potential violations of norms in branded spices, signaling a broader crackdown on food items. This scrutiny encompasses various categories, including fruits, vegetables, fish products, spices, fortified rice, and milk and milk products. Concurrently, the Hong Kong Center for Food Safety (CFS) issued a warning regarding several spice blends used in spicy dairy products, such as MDH Madras Curry Powder, Everest Fish Curry Masala, MDH Sambhar Masala Mixed Masala Powder, and MDH Curry Powder Mixed Masala Powder.

- These developments underscore the evolving nature of the market, with regulatory compliance becoming a critical factor across various sectors.

Exclusive Technavio Analysis on Customer Landscape

The spicy dairy products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spicy dairy products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Spicy Dairy Products Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, spicy dairy products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arla Foods amba - This Danish dairy company introduces an innovative product fusion: Arla Havarti with Jalapeno.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arla Foods amba

- China Mengniu Dairy Co. Ltd.

- Clover Sonoma

- Dairy Farmers of America Inc.

- Dairygold Co-Operative Society Ltd.

- Danone SA

- Fonterra Cooperative Group Ltd.

- Groupe Lactalis

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Land O lakes Inc.

- Nestle SA

- OMFED

- Premier Frozen Food

- Royal FrieslandCampina NV

- Saputo Inc.

- The Kraft Heinz Co.

- Tnuva USA Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Spicy Dairy Products Market

- In January 2024, Arla Foods, a leading dairy cooperative, announced the launch of its new line of spicy dairy products under the brand name "Arla Spice Up." This product range includes flavored cheese, yogurt, and butter, catering to the growing demand for spicy and fusion food trends (Arla Foods Press Release).

- In March 2024, Amul, India's largest dairy cooperative, entered into a strategic partnership with Fever-Tree Drinks, the leading producer of premium mixers for alcoholic beverages. The collaboration aimed to develop a line of spicy dairy-based beverages, expanding Amul's product portfolio and tapping into the growing market for innovative beverage offerings (Amul Press Release).

- In May 2024, Danone, a global food company, completed the acquisition of Wissotzky, an Israeli dairy company known for its spicy feta cheese and other specialty dairy products. The acquisition was part of Danone's strategy to strengthen its presence in the fast-growing the market and expand its offerings in the Middle East and North Africa region (Danone Press Release).

- In April 2025, the European Commission approved the use of certain spicy ingredients in dairy products, marking a significant regulatory development for the market. The approval opens up new opportunities for dairy companies to innovate and create unique offerings, addressing the evolving consumer preferences for spicier and more flavorful dairy products (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Spicy Dairy Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2025-2029 |

USD 127.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.2 |

|

Key countries |

US, China, India, Canada, Germany, South Korea, Brazil, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by consumer preferences for bolder flavors and innovative applications. Enzymatic activity plays a crucial role in the production of spicy dairy products, enabling the release of heat from chili peppers and enhancing the overall sensory experience. Acidification control is essential to maintain the desired pH levels and texture profile analysis ensures the consistent quality of these products. Milk pasteurization and ultrafiltration techniques are commonly used in the production process, while microfiltration membranes help remove impurities and improve yield. Probiotic strains and starter cultures are also integral components, contributing to the fermentation process and extending shelf life.

- The industry anticipates a significant growth of 5% annually, driven by cost reduction strategies, ingredient functionality, and the increasing popularity of plant-based alternatives. For instance, a leading dairy processor reported a 15% increase in sales of spicy yogurt varieties in the past year. Quality control metrics, sensory evaluation, and food safety regulations are paramount in ensuring the safety and appeal of these products. Cheese ripening, coagulation process, rheological properties, and process optimization are all critical aspects of production, with flavor compounds and water activity playing essential roles in maintaining the desired taste and texture.

- Thermal processing and pH measurement are crucial in ensuring proper pasteurization and sterilization, while protein denaturation and microbial ecology are vital considerations in the production of spicy dairy products. Butter churning and packaging technology further enhance the overall product quality and consumer experience.

What are the Key Data Covered in this Spicy Dairy Products Market Research and Growth Report?

-

What is the expected growth of the Spicy Dairy Products Market between 2025 and 2029?

-

USD 127.3 million, at a CAGR of 3.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Formulation (Solid and Liquid), Product (Cheese, Yogurt, Buttermilk, and Others), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Launch of new restaurants, Regulatory compliance

-

-

Who are the major players in the Spicy Dairy Products Market?

-

Arla Foods amba, China Mengniu Dairy Co. Ltd., Clover Sonoma, Dairy Farmers of America Inc., Dairygold Co-Operative Society Ltd., Danone SA, Fonterra Cooperative Group Ltd., Groupe Lactalis, Gujarat Cooperative Milk Marketing Federation Ltd., Inner Mongolia Yili Industrial Group Co. Ltd., Land O lakes Inc., Nestle SA, OMFED, Premier Frozen Food, Royal FrieslandCampina NV, Saputo Inc., The Kraft Heinz Co., and Tnuva USA Inc.

-

Market Research Insights

- The market for spicy dairy products continues to evolve, with a focus on functional foods that offer both thermal stability and health benefits. Two key aspects of this market are product development and quality assurance systems. For instance, the use of specialized enzyme inactivation techniques during cheese production has led to a sales increase of 15% in the past year. Moreover, industry growth is expected to reach 7% annually, driven by consumer preferences for novel dairy ingredients and sensory attributes. Storage conditions, ingredient sourcing, and microbial control are essential factors in ensuring product standardization and food safety protocols.

- Dairy processing plants employ various packaging materials and nutritional labeling to cater to diverse consumer demands. Ingredient interactions, texture properties, and flavor profiles are crucial aspects of product development, while waste management practices and butter making techniques contribute to overall efficiency. Yogurt manufacturing and cheese production methods undergo continuous innovation to meet evolving consumer preferences and market demands.

We can help! Our analysts can customize this spicy dairy products market research report to meet your requirements.