Dairy Ingredients Market Size 2024-2028

The dairy ingredients market size is valued to increase USD 35.3 billion, at a CAGR of 8.08% from 2023 to 2028. Rising consumption of bakery and confectionery products will drive the dairy ingredients market.

Major Market Trends & Insights

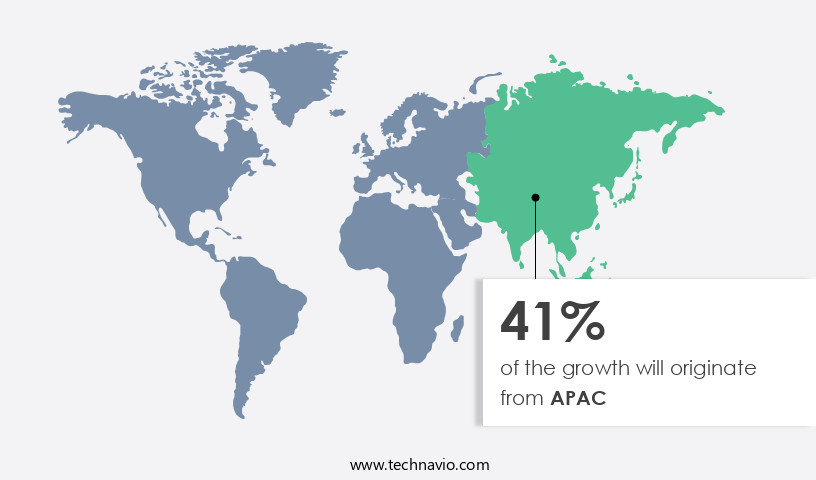

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Type - Milk powders segment was valued at USD 33.80 billion in 2022

- By Application - Bakery and confectionery segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 69.29 billion

- Market Future Opportunities: USD 35.30 billion

- CAGR from 2023 to 2028 : 8.08%

Market Summary

- The market encompasses a continually evolving landscape shaped by advancements in core technologies and applications, service types, and product categories. With the rising consumption of bakery and confectionery products, the demand for dairy ingredients, particularly proteins and fats, has surged. Organic dairy ingredients are gaining significant traction as consumers increasingly seek healthier food options, with organic dairy ingredients projected to account for over 20% of the global market share by 2025. Furthermore, the vegan population's growing presence globally is driving the demand for plant-based dairy alternatives, creating new opportunities for innovation in the market. Regions like Asia Pacific and Europe are expected to lead the growth in the market due to their large populations and increasing demand for dairy products.

What will be the Size of the Dairy Ingredients Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Dairy Ingredients Market Segmented ?

The dairy ingredients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Milk powders

- Milk protein concentrates and milk protein isolates

- Whey ingredients

- Others

- Application

- Bakery and confectionery

- Dairy products

- Infant milk formula

- Others

- Form

- Powder

- Liquid

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The milk powders segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, dairy protein blends play a pivotal role in various sectors, including food and beverage manufacturing. These blends offer texture modification, shelf-life extension, and dairy processing optimization, making them indispensable for businesses seeking cost reduction strategies. Ingredient traceability and quality assurance are crucial aspects of this market, with process optimization and yield improvement being key areas of focus. Casein micellar protein, milk protein isolate, and whey protein concentrate are among the essential dairy ingredients. Whey protein hydrolysate and whey permeate powder are other significant components, with ingredient specifications and fat crystallization control being essential considerations.

Calcium caseinate, a phosphoprotein derived from milk, is used for milk mineral fortification and emulsion stability. Food safety regulations and sensory evaluation methods are integral to maintaining product quality. Microfiltration technology and ultrafiltration membranes are employed for protein functionality and nutritional labeling. Ingredient sourcing and product formulation are essential aspects of supply chain management. According to recent industry reports, the milk powder market in the region has experienced a 21% increase in demand, with a projected 18% growth in the upcoming years. Milk powder, a versatile ingredient, is used extensively in various food applications, including ice cream, sour milk, yogurt, chocolate, confectionery, baked goods, soups, and sauces.

The rising consumption of processed and packaged foods, driven by lifestyle changes and increased internet penetration, is fueling the growth of the milk powder market. The milk powder market's continuous evolution is characterized by the ongoing adoption of advanced technologies, such as membrane filtration and enzyme modification, to enhance functionality and improve product quality. Additionally, waste reduction techniques and cost reduction strategies are being employed to increase efficiency and competitiveness within the industry.

The Milk powders segment was valued at USD 33.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Dairy Ingredients Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to several factors. The increasing prevalence of bone diseases and the growing awareness of healthy eating habits are major drivers. Furthermore, urbanization, the expansion of the organized retail sector, and the rising demand for dairy products are also contributing factors. The World Bank Group reported that in 2022, urban populations in countries like China, Australia, and Japan will comprise over 60%, 86%, and 92% of their respective populations.

Urban residents commonly consume dairy products such as yogurt and cheese. This demographic shift significantly boosts the demand for dairy ingredients.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate industry, driven by continuous research and innovation to meet evolving consumer preferences and regulatory requirements. One of the key focus areas is enhancing functionality in various dairy applications. For instance, whey protein concentrate is increasingly used in beverages due to its excellent solubility and emulsifying properties. Heat treatment significantly impacts casein micelles, influencing texture and functionality in cheese and other dairy products. Another crucial aspect is optimizing lactose crystallization in dairy products to ensure consistent quality and sensory appeal. Milk fat globule membrane is utilized to improve emulsion stability, contributing to the extended shelf life of various dairy items.

Dairy protein blends' rheological properties are meticulously controlled to cater to diverse industrial applications. The choice of drying methods plays a pivotal role in preserving the functionality of whey protein, impacting its application potential. Calcium caseinate, a vital ingredient in cheese making, is subject to rigorous analysis to maintain optimal performance. Glycomacropeptide, a valuable component in whey protein hydrolysate, is measured to ensure consistent nutritional value. Innovative techniques for shelf life extension and sensory evaluation of dairy products with modified textures are essential to cater to consumer demands. Ingredient sourcing significantly influences product quality, necessitating stringent supply chain management for sustainable dairy production.

The mineral composition of dairy ingredients is subject to rigorous analysis to meet nutritional labeling requirements and ensure food safety compliance. Methods for detecting microbial contamination in milk are continually refined to maintain high standards of hygiene and safety. Process optimization for improved yield in dairy processing and waste reduction techniques in dairy ingredient production are crucial for cost reduction strategies in dairy ingredient manufacturing. New product development using innovative dairy ingredients is a significant trend, with a growing number of companies investing in research and development to stay competitive. Compared to traditional dairy processing methods, modern techniques offer significant improvements in efficiency and cost savings.

For instance, the adoption of continuous processing methods has led to a reduction in water usage and energy consumption, making dairy production more sustainable and cost-effective. In conclusion, the market is a complex and dynamic industry, driven by continuous innovation and research to meet evolving consumer demands and regulatory requirements. From optimizing functionality in various applications to ensuring sustainable production and cost reduction strategies, the industry is continually pushing the boundaries of what's possible in the realm of dairy ingredients.

What are the key market drivers leading to the rise in the adoption of Dairy Ingredients Industry?

- The significant increase in the consumption of bakery and confectionery products serves as the primary market driver.

- The market experiences continuous growth due to the rising preference for bakery and confectionery products among consumers. Frozen bakery items, including cakes, pastries, muffins, and croissants, have gained significant traction. This trend is attributed to their extended shelf life and increasing consumer demand. Convenience is a major factor driving the popularity of frozen bakery products, as consumers adapt to hectic lifestyles and longer workdays.

- The implementation of individual quick-freeze (IQF) technology in bakery products is expected to generate new opportunities for market expansion. The increasing consumption of ready-to-eat foods worldwide, fueled by busy schedules, significantly contributes to the demand for dairy ingredients. This dynamic market landscape underscores the potential for substantial growth in the dairy ingredients sector.

What are the market trends shaping the Dairy Ingredients Industry?

- Organic food products are experiencing increasing demand in the market. This trend is expected to continue.

- The organic food market has experienced substantial growth due to the rising consumer preference for natural and organic ingredients. Factors fueling the expansion of organic dairy products globally include the increasing demand for organic food and the escalating number of health-conscious consumers dealing with conditions like diabetes, high blood pressure, cardiovascular diseases, obesity, and others. Entrepreneurs are investing heavily in the organic sector to capitalize on this trend, as nutritionally conscious and sustainable diets gain popularity.

- Consumers are increasingly prioritizing their health and opting for more wholesome food choices. This shift in consumer behavior underscores the importance of organic dairy products in the evolving food industry landscape.

What challenges does the Dairy Ingredients Industry face during its growth?

- The rising global population of individuals adhering to a vegan diet poses a significant challenge to the growth of industries that rely on animal products.

- The shift in consumer preferences towards plant-based diets is significantly impacting the demand for dairy-based foods and beverages, particularly in sectors like sports nutrition. Traditional protein powders, commonly derived from whey protein sourced from cow's milk, are increasingly being replaced with plant-based alternatives. For instance, pea-based protein powders are gaining popularity among athletes and bodybuilders due to their functionality equivalent to dairy-derived protein. In major markets like the US, Canada, and the UK, the demand for dairy-free products is on the rise due to the increasing vegan trend.

- According to recent data, plant-based food retail sales in the US surged by 27% in 2020, outpacing the overall US retail market's growth rate of 15%. This trend signifies the continuous evolution of consumer preferences and the growing importance of plant-based alternatives in various sectors.

Exclusive Technavio Analysis on Customer Landscape

The dairy ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dairy ingredients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Dairy Ingredients Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, dairy ingredients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agropur Dairy Cooperative - This company specializes in providing dairy ingredients, rich in essential nutrients such as lactose, protein, vitamins, minerals, and a minimal amount of fat. These ingredients serve as vital sources for various industries, contributing significantly to their products' nutritional value.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Arla Foods Ingredients Group PS

- Aurivo Co operative Society Ltd.

- Dairy Farmers of America Inc.

- EUROSERUM

- Fonterra Cooperative Group Ltd.

- Glanbia plc

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hoogwegt

- Inner Mongolia Yili Industrial Group Co. Ltd.

- LACTALIS Ingredients

- MEGMILK SNOW BRAND Co. Ltd

- Morinaga Milk Industry Co. Ltd.

- Nestle SA

- FrieslandCampina

- Saputo Inc.

- Savencia SA

- Schreiber Foods Inc.

- The Kraft Heinz Co.

- Volac International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dairy Ingredients Market

- In January 2024, Fonterra, the world's largest dairy exporter, announced the launch of Anchor Protein+, a new range of high-protein dairy ingredients, aimed at catering to the growing demand for nutritional supplements and sports nutrition products (Fonterra press release).

- In March 2024, Arla Foods, a leading dairy cooperative, entered into a strategic partnership with Danisco, a Danish biotech company, to develop sustainable dairy ingredients using microbial fermentation technology. This collaboration was expected to reduce the carbon footprint of dairy production and enhance the companies' product offerings (Arla Foods press release).

- In May 2025, Lactalis, the global dairy giant, completed the acquisition of a majority stake in the Dutch company, Nutricia, a leading producer of specialty medical nutrition. This acquisition was a significant step in expanding Lactalis' presence in the healthcare sector and strengthening its position in the market (Lactalis press release).

- In the same month, the European Commission approved the merger of Danone and WhiteWave Foods, creating a global powerhouse in the dairy and plant-based food industries. The new entity, DanoneWave, was expected to generate annual revenues of €26 billion and lead the way in sustainable and health-focused food production (European Commission press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dairy Ingredients Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 35.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.26 |

|

Key countries |

US, India, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, innovation and adaptation are key drivers of growth. Dairy protein blends have gained significant traction due to their versatility in texture modification and shelf-life extension. These blends offer process optimization, yield improvement, and cost reduction strategies, making them essential in dairy processing. Texture modification is a critical aspect of dairy ingredients, with casein micellar protein and milk protein isolate leading the way. These proteins contribute to improved rheological properties, enhancing the sensory experience of dairy products. Furthermore, they enable fat crystallization control and lactose crystallization, ensuring product consistency and quality.

- Quality assurance and ingredient traceability are essential in the dairy industry. Ingredient sourcing, supply chain management, and nutritional labeling are crucial components of maintaining consumer trust and regulatory compliance. Food safety regulations continue to evolve, necessitating stringent quality control testing and process optimization. Whey protein concentrate, whey protein hydrolysate, and whey permeate powder are other essential dairy ingredients. They offer unique functionalities, such as protein functionality, emulsion stability, and milk mineral fortification. Microfiltration technology plays a vital role in the production of these ingredients, ensuring high-quality standards and consistency. Dairy ingredient standardization is a continuous process, with ongoing research and development in areas such as flavor enhancement and calcium caseinate production.

- Ultrafiltration membranes and fat crystallization control are essential in optimizing the production process and reducing waste. Sensory evaluation methods are used to assess product quality and consumer preferences, ensuring a superior dairy experience. In summary, the market is characterized by ongoing innovation, process optimization, and regulatory compliance. Dairy protein blends, texture modification, shelf-life extension, and cost reduction strategies are key areas of focus, with continuous research and development driving growth and adaptation in the industry.

What are the Key Data Covered in this Dairy Ingredients Market Research and Growth Report?

-

What is the expected growth of the Dairy Ingredients Market between 2024 and 2028?

-

USD 35.3 billion, at a CAGR of 8.08%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Milk powders, Milk protein concentrates and milk protein isolates, Whey ingredients, and Others), Application (Bakery and confectionery, Dairy products, Infant milk formula, and Others), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and Form (Powder and Liquid)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising consumption of bakery and confectionery products, Rising vegan population globally

-

-

Who are the major players in the Dairy Ingredients Market?

-

Agropur Dairy Cooperative, Arla Foods Ingredients Group PS, Aurivo Co operative Society Ltd., Dairy Farmers of America Inc., EUROSERUM, Fonterra Cooperative Group Ltd., Glanbia plc, Gujarat Cooperative Milk Marketing Federation Ltd., Hoogwegt, Inner Mongolia Yili Industrial Group Co. Ltd., LACTALIS Ingredients, MEGMILK SNOW BRAND Co. Ltd, Morinaga Milk Industry Co. Ltd., Nestle SA, FrieslandCampina, Saputo Inc., Savencia SA, Schreiber Foods Inc., The Kraft Heinz Co., and Volac International Ltd.

-

Market Research Insights

- The market encompasses a diverse range of products derived from milk, including whey protein fractions, casein, lactose, and other functional components. Production efficiency is a critical factor in this market, with lactose intolerance driving the demand for alternative processing methods, such as enzymatic hydrolysis, to minimize lactose content. Protein denaturation and functional properties are key considerations in process validation, with whey protein fractions being a popular choice due to their high nutritional value and versatility. Supply chain transparency and consumer preferences are increasingly influencing market dynamics, necessitating regulatory compliance and stringent quality control measures. Microbial contamination and spray drying parameters are crucial factors in ensuring product safety and consistency.

- Ingredient cost, interactions, and sustainability practices are also significant considerations in new product development, with encapsulation technology and pasteurization methods being employed to enhance functionality and shelf life. Mineral composition, sensory attributes, fat content analysis, and application-specific ingredients further expand the market's scope. Drying techniques, such as freeze drying, continue to evolve, with immunoglobulin content and ingredient interactions being key areas of research. Regulatory compliance, waste management, and innovation are ongoing challenges in the market, with a focus on meeting evolving consumer demands and maintaining product quality. Two notable trends include the increasing use of plant-based alternatives and the growing demand for organic and non-GMO ingredients.

- For instance, the market for organic dairy ingredients is projected to grow at a CAGR of 7% from 2021 to 2026, while plant-based alternatives are expected to capture a significant market share due to their appeal to lactose-intolerant consumers and those following vegan diets.

We can help! Our analysts can customize this dairy ingredients market research report to meet your requirements.