Stationary Lead-Acid (SLA) Battery Market Size 2024-2028

The stationary lead-acid (sla) battery market size is forecast to increase by USD 4.02 billion at a CAGR of 8.12% between 2023 and 2028.

- The market is experiencing significant growth, driven by increased investment in green telecommunications infrastructure and the development of advanced lead-acid batteries. These batteries offer several advantages, including their proven reliability, low cost, and long service life. However, the market faces challenges, including regulatory hurdles that impact adoption due to environmental concerns surrounding lead usage. Additionally, supply chain inconsistencies temper growth potential as demand for SLA batteries outpaces production capacity. To capitalize on market opportunities, companies must navigate these challenges by investing in sustainable lead sourcing and improving production efficiency.

- Strategic partnerships and collaborations with regulatory bodies can also help mitigate regulatory risks and ensure compliance. Overall, the SLA Battery Market presents a compelling opportunity for companies that can effectively address these challenges and deliver high-quality, sustainable battery solutions.

What will be the Size of the Stationary Lead-Acid (SLA) Battery Market during the forecast period?

- The market encompasses a range of applications, from voltage regulation and standby power to energy storage solutions and grid integration. These batteries, known for their high discharge rate and low maintenance, offer overcharge protection and temperature compensation, making them ideal for various industries. However, challenges such as battery degradation due to temperature extremes and corrosion resistance remain. Cost-effective solutions, including maintenance-free batteries and battery replacement, are essential for businesses seeking to minimize energy consumption and carbon footprint. Deep discharge applications require batteries with long service life and high reliability, while power management systems demand batteries with charging voltage regulation and load leveling capabilities.

- Lead-acid battery chemistry, including lead plates and terminal posts, is continually evolving to meet the demands of power distribution and power quality. Vibration resistance and series or parallel connection options cater to extreme weather conditions and peak shaving applications. Battery chargers and battery housing designs ensure efficient charging and protection from environmental factors. In the realm of green energy, SLA batteries play a crucial role in renewable power generation and grid integration, enabling demand response and providing stability during power outages. The market's future lies in advanced battery technologies that address battery failure risks and optimize energy consumption while maintaining high power quality and reliability.

How is this Stationary Lead-Acid (SLA) Battery Industry segmented?

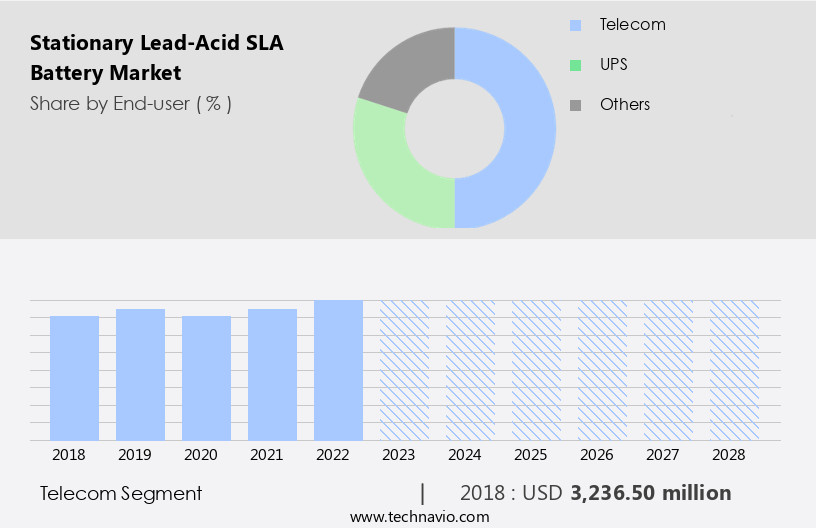

The stationary lead-acid (sla) battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Telecom

- UPS

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The telecom segment is estimated to witness significant growth during the forecast period.

Lead-acid batteries, a cost-effective energy storage solution, offer comparable energy potential to more advanced technologies like lithium-ion batteries when integrated into larger networks. These systems include cooling systems, interconnections, battery management systems, and safety equipment. In telecom applications, lead-acid batteries are preferred due to their reliability and performance in such complex setups. Sealed lead-acid batteries are widely used in uninterruptible power supply (UPS) systems and hybrid energy storage solutions, contributing to grid modernization and renewable energy integration. Life cycle testing and capacity testing ensure the longevity and efficiency of lead-acid batteries, which are crucial for emergency power and backup systems.

Remote monitoring and battery maintenance schedules optimize the battery's performance and extend its cycle life. Lead-acid batteries play a significant role in energy efficiency, energy management, and energy storage for various applications, including electric vehicles, deep cycle batteries, and float service. Safety standards and regulations govern the use of lead-acid batteries, ensuring their environmental impact is minimized during manufacturing, usage, and disposal. Innovations in lead-acid battery technology, such as performance testing and battery analytics, enhance the batteries' capabilities and contribute to the growth of the stationary batteries market. Lead-acid batteries are also integral to the smart grid, providing power reliability for distributed energy resources, off-grid power, and disaster preparedness.

The integration of lead-acid batteries in wind energy, solar energy, and material handling applications further expands their reach. Despite the competition from lithium-ion batteries, lead-acid batteries continue to offer cost optimization and a proven track record in various industries.

The Telecom segment was valued at USD 3.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 59% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing adoption of industrial lead-acid batteries in the renewable energy and industrial sectors. Countries like Japan, China, Australia, India, South Korea, Taiwan, and Singapore are major contributors to this market growth. Manufacturers from developed countries are relocating their bases to China to leverage the cost advantages of low labor and raw material costs, as well as timely delivery. In the telecom sector, the SLA battery market is projected to expand rapidly due to the growing demand for uninterruptible power supply (UPS) systems and hybrid energy storage solutions.

Grid modernization and energy efficiency are key drivers for the adoption of SLA batteries in the power sector. Renewable energy sources, such as wind and solar, are increasingly being integrated into the grid, necessitating energy storage solutions for power stability. Battery efficiency, cycle life, and safety standards are crucial factors influencing the market. Remote monitoring and battery maintenance have become essential for optimizing battery performance and reducing operating costs. Lead-acid battery recycling is a significant environmental concern, and regulations are being implemented to minimize the environmental impact of battery disposal. In the industrial sector, deep cycle batteries are widely used for material handling and distributed energy resources.

The market for backup power solutions, including emergency power and disaster preparedness, is also growing. UPS systems, battery testing, and performance testing are essential for ensuring power reliability and energy management. Battery analytics and battery management systems are becoming increasingly important for optimizing battery performance and extending battery life. The market for lithium-ion batteries is gaining popularity, but SLA batteries continue to dominate the market due to their cost-effectiveness and proven reliability. The SLA battery market is expected to continue growing due to the increasing demand for energy storage solutions in various applications, including electric vehicles, data centers, and off-grid power.

The market is also being driven by the need for power resilience and energy independence, particularly in the context of grid modernization and renewable energy integration.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Stationary Lead-Acid (SLA) Battery market drivers leading to the rise in the adoption of Industry?

- A significant investment surge in green telecom technology is the primary market catalyst. Green telecom, characterized by the utilization of renewable energy sources and energy-efficient technologies, is driving the industry forward.

- The market is experiencing significant growth due to increasing demand for reliable power supply in various sectors, including UPS systems, wind energy, and grid-scale storage. Regulations on lead-acid batteries continue to evolve, ensuring safety and environmental sustainability. Innovations in battery technology have led to improved performance testing and longer replacement cycles, making SLA batteries a cost-effective solution. Discharge rates have also increased, making them suitable for disaster preparedness applications. Lithium-ion batteries are gaining popularity, but SLA batteries still offer advantages in terms of operating costs and environmental impact. Battery monitoring systems ensure optimal performance and longevity, making SLA batteries a preferred choice for many applications.

- The market's growth is driven by the need for energy storage solutions in various industries, including telecommunications, healthcare, and transportation. As the world becomes more reliant on technology, the demand for reliable and efficient energy storage solutions will continue to grow, ensuring a strong future for the Stationary Lead-Acid Battery Market.

What are the Stationary Lead-Acid (SLA) Battery market trends shaping the Industry?

- Advanced lead-acid battery development is gaining significant traction in the market due to its potential for improved performance and efficiency. This trend reflects the growing demand for more sustainable and cost-effective energy storage solutions.

- Lead-acid batteries, specifically advanced stationary versions, offer cost advantages over other battery technologies for energy storage in various applications. These batteries, which include Enhanced Flooded Batteries (EFBs), Absorbed Glass Mat (AGM) batteries, and lead-carbon batteries, are preferred for their reliability and performance. Advanced lead-acid batteries address the issue of sulfation, a common problem in traditional lead-acid batteries, ensuring consistent energy output. These batteries play a crucial role in powering various sectors such as smart grids, data centers, and material handling. In the context of renewable energy, advanced lead-acid batteries are employed for solar energy storage and microgrids, contributing to energy independence and power reliability.

- Moreover, they are essential for Electric Vehicle (EV) charging infrastructure and distributed energy resources. Battery management systems and safety measures, including fire safety, are integral components of advanced lead-acid batteries, ensuring optimal performance and safe disposal. As the energy landscape evolves, lead-acid batteries continue to be a viable option for various applications, offering a cost-effective solution for energy storage.

How does Stationary Lead-Acid (SLA) Battery market faces challenges face during its growth?

- The lead-acid battery shortfalls pose a significant challenge to the growth of the industry, requiring continuous innovation and improvement to address these limitations and maintain competitiveness.

- Lead-acid batteries, known for their cost-effectiveness, are widely adopted in various applications despite their lower energy density and shorter cycle life compared to lithium-ion and nickel batteries. Sealed lead-acid batteries, in particular, are popular due to their maintenance-free design. However, their life cycle is influenced by factors such as charging frequency, charging voltage, and depth of discharge, with high temperatures reducing their lifespan. In the realm of renewable energy and hybrid energy storage, lead-acid batteries play a significant role in providing backup power and uninterruptible power supply (UPS). They are also crucial in grid modernization efforts and emergency power systems, ensuring power resilience.

- Capacity testing and life cycle testing are essential to optimize the cost of these batteries and ensure their efficient performance. Battery efficiency, remote monitoring, and battery maintenance are essential aspects of managing lead-acid batteries. The ability to accept a charge is lost when these batteries are discharged for extended periods due to sulfation. Despite these challenges, lead-acid batteries remain a viable solution for businesses seeking cost-effective, reliable energy storage solutions.

Exclusive Customer Landscape

The stationary lead-acid (sla) battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the stationary lead-acid (sla) battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, stationary lead-acid (sla) battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - Stationary lead-acid batteries from our company boast a distinctive feature: pocketed negative plates. This design safeguards the active mass, thereby preventing short circuits and enhancing overall reliability. By isolating each negative plate, this innovation minimizes the risk of electrical shorts, ensuring optimal battery performance and longevity. This cutting-edge technology sets our batteries apart from competitors, delivering unparalleled dependability and efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH

- Amara Raja Batteries Ltd.

- C and D Technologies Inc.

- CLARIOS LLC

- Crown Micro

- East Penn Manufacturing Co. Inc.

- EnerSys

- Exide Industries Ltd.

- GS Yuasa International Ltd.

- Hankook and Co. Ltd

- Hitachi Ltd.

- Leoch International Technology Ltd.

- MIDAC SpA

- Panasonic Holdings Corp.

- SEBANG GLOBAL BATTERY Co. Ltd.

- Shandong Sacred Sun Power Sources Co. Ltd.

- Surrette Battery Co. Ltd.

- Tianneng Group

- Zhejiang Narada Power Source Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Stationary Lead-Acid (SLA) Battery Market

- In February 2024, Tesla, a leading energy storage solutions provider, announced the expansion of its Megapack energy storage system's capacity to utilize only lithium-ion-free, large-format lead-acid batteries for utility-scale projects (Tesla Press Release, 2024). This development signifies a significant shift towards the adoption of Stationary Lead-Acid (SLA) batteries in large-scale energy storage applications, demonstrating their growing competitiveness with lithium-ion batteries.

- In May 2025, Clarios, a global battery manufacturer, and NGK Spark Plug Co., Ltd., a leading supplier of automotive and industrial batteries, formed a strategic partnership to jointly develop advanced lead-acid battery technologies for stationary energy storage applications (Clarios Press Release, 2025). This collaboration aims to strengthen their market position and enhance their product offerings, addressing the increasing demand for cost-effective and reliable stationary energy storage solutions.

- In October 2024, Exide Technologies, a leading SLA battery manufacturer, secured a strategic investment of USD100 million from BlackRock Real Assets to expand its production capacity for stationary batteries and meet the growing demand for energy storage solutions (Exide Technologies Press Release, 2024). This investment will enable Exide to increase its market share and cater to the needs of various industries, including renewable energy, telecommunications, and data centers.

- In January 2025, the European Union's Horizon Europe research and innovation program launched a â¬2.5 billion (USD2.8 billion) funding call for projects focusing on the development and deployment of advanced energy storage technologies, including SLA batteries (European Commission Press Release, 2025). This significant investment will accelerate the growth of the European SLA battery market and contribute to the European Green Deal's objectives of achieving carbon neutrality by 2050.

Research Analyst Overview

The stationary lead-acid battery market continues to evolve, driven by the growing demand for reliable and efficient energy storage solutions across various sectors. Sealed lead-acid batteries, a popular choice for uninterruptible power supply (UPS) systems and hybrid energy storage, undergo rigorous capacity testing and life cycle analysis to ensure optimal performance. In the context of grid modernization, lead-acid batteries contribute to power resilience and reliability, enabling the integration of renewable energy sources and reducing operating costs. Battery efficiency and energy management are key considerations in the evolving energy landscape. Lead-acid batteries, with their proven track record in backup power applications, are being adopted for emergency power, deep cycle, and float service in data centers and electric vehicles.

The market's dynamics are further shaped by the development of battery analytics, remote monitoring, and battery management systems, which facilitate cost optimization and performance testing. The stationary battery market is also influenced by regulations and safety standards, with lead-acid batteries undergoing regular testing and innovation to meet evolving requirements. The integration of smart grid technologies, such as flow batteries and grid-scale storage, enhances the overall energy efficiency and flexibility of the power supply. In the context of disaster preparedness, lead-acid batteries play a crucial role in off-grid power applications, ensuring energy independence and power reliability. Battery disposal and recycling are essential aspects of the stationary lead-acid battery market, with ongoing efforts to minimize the environmental impact and promote sustainable practices.

The market's continuous dynamism is further shaped by the emergence of alternative technologies, such as lithium-ion batteries, and the evolving discharge rate requirements in various applications. In summary, the stationary lead-acid battery market is characterized by its ongoing evolution and the seamless integration of various applications, from smart grid and renewable energy to material handling and emergency power. The market's continuous growth is driven by the need for reliable, efficient, and cost-effective energy storage solutions, with a focus on performance, safety, and sustainability.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Stationary Lead-Acid (SLA) Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.12% |

|

Market growth 2024-2028 |

USD 4016.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.51 |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Stationary Lead-Acid (SLA) Battery Market Research and Growth Report?

- CAGR of the Stationary Lead-Acid (SLA) Battery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the stationary lead-acid (sla) battery market growth of industry companies

We can help! Our analysts can customize this stationary lead-acid (sla) battery market research report to meet your requirements.