Stem Cell Manufacturing Market Size 2024-2028

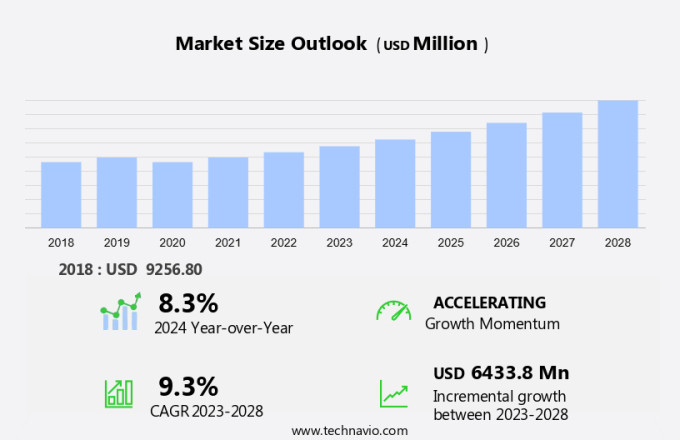

The stem cell manufacturing market size is forecast to increase by USD 6.43 billion at a CAGR of9.3% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing investment in scientific discoveries and advancements in therapies and treatments. The demand for cell culture systems that can maintain optimal environmental factors, such as temperature and oxygen levels, is increasing as researchers develop new consumables and instruments to support the production of stem cells. Geographical regions with strong research infrastructure are seeing a rise in funding and investment, particularly in precision medicine, including blood-related therapies and diagnostics. However, challenges remain, including the lack of trained professionals and the need for standardization in manufacturing processes. As the market evolves, stakeholders must stay informed of the latest trends and developments to remain competitive.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant advancements due to the increasing demand for regenerative therapies and treatments for various diseases and injuries. Stem cells, which are the body's natural repair cells, hold immense potential in healthcare, particularly in the context of neurodegenerative disorders, heart disease, organ failure, and cancer. Scientific discoveries and investment in stem cell research continue to fuel the market's growth. Neurodegenerative disorders, such as Alzheimer's disease and Parkinson's disease, are among the primary focus areas for stem cell-based therapies. Similarly, stem cells are being explored for the treatment of spinal cord injuries, amyotrophic lateral sclerosis, and stroke.

- In the realm of oncology, stem cells are being used for cancer treatment, including bone marrow transplants and immunotherapies. Operational costs, sterility, and a skilled workforce are crucial factors influencing the market. The need for stringent regulatory policies and maintaining aseptic conditions during manufacturing is essential to ensure the safety and efficacy of stem cell-based therapies. Environmental factors, such as temperature, also play a vital role in the production process. Corneal diseases represent another area where stem cell-based therapies are gaining traction. Stem cells can be used to regenerate damaged corneal tissue, offering hope to millions of people suffering from corneal blindness.

How is this market segmented and which is the largest segment?

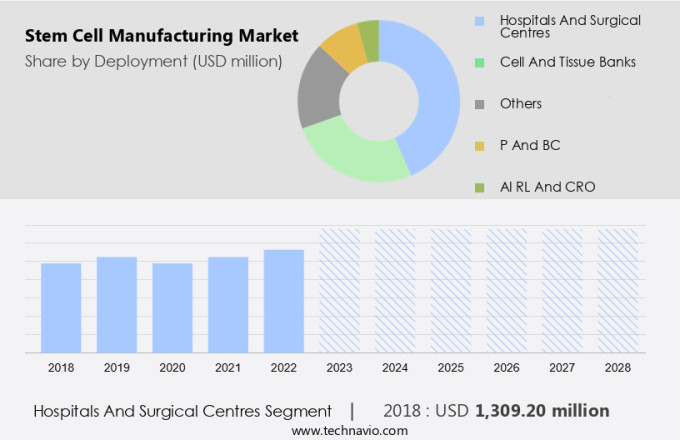

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Hospitals and surgical centres

- Cell and tissue banks

- Others

- P and BC

- AI RL and CRO

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Deployment Insights

- The hospitals and surgical centres segment is estimated to witness significant growth during the forecast period.

Stem cells, with their capacity to differentiate into various cell types, hold significant potential for therapies and treatments in the healthcare industry. The advancements in stem cell manufacturing involve scientific discoveries and the utilization of sophisticated cell culture systems. These systems consider environmental factors such as temperature and oxygen levels to optimize cell growth and differentiation. Investments in stem cell research continue to increase as researchers seek to develop new therapies and treatments. The market for stem cell manufacturing encompasses the demand for consumables, instruments, and research infrastructure. Geographical regions, including North America, Europe, and Asia Pacific, are investing in this field due to the potential of precision medicine.

Furthermore, funding and investment in stem cell research are crucial for driving innovation. For instance, researchers are developing methods to simplify the process of transforming stem cells into bone using polymer sheets. These sheets can act as dynamic scaffolds, expanding and contracting according to temperature changes, and mimic the function of artificial muscles. Stem cells are seeded on the underside of the sheet and exposed to temperature fluctuations between 10-degree C and 37-degree C, promoting bone production. This innovative approach represents the ongoing advancements in stem cell manufacturing and its potential impact on healthcare.

Get a glance at the market report of share of various segments Request Free Sample

The hospitals and surgical centres segment was valued at USD 1.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing significant growth due to advanced technological support and the presence of leading companies. These companies offer stem cell storage and processing services, utilizing stem cells to develop treatments for various diseases, such as cancer. The US and Canada are the largest contributors to the biotechnology sector's revenue in North America. Factors such as well-established healthcare systems and the facilitation of biotechnology companies' establishment contribute to this growth. Stem cell therapy is a promising area for disease management, particularly in treating conditions like osteoarthritis and Parkinson's disease. Customized medicine and genetic testing are also driving the demand for stem cells and tissues. Chemical effects on damaged cells are a focus for developing drugs to treat illnesses. Stem cell manufacturing is essential for providing the necessary cells and tissues for these therapeutic applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Stem Cell Manufacturing Market?

Rising prevalence of several chronic disorders is the key driver of the market.

- Chronic diseases, including cardiovascular disease, cancer, chronic obstructive pulmonary disease, and type 2 diabetes, account for a significant portion of global morbidity and mortality. These conditions are often linked to lifestyle factors such as unhealthy diets, physical inactivity, tobacco use, and obesity. By 2022, it is projected that chronic diseases will be responsible for 72.94% of all deaths and 59.96% of the global disease burden. This trend is particularly prevalent in developing countries, where 78.92% of deaths related to these diseases occur. The therapeutic potential of stem cells holds great promise for the treatment of various chronic diseases, including orphan illnesses and rare disorders such as thalassemia, phenylketonuria, and cystic fibrosis.

- The geriatric population, with its increased incidences of cancer and other chronic diseases, also stands to benefit from advancements in stem cell manufacturing. Urbanization and the increasing prevalence of chronic diseases necessitate the scaling up of stem cell manufacturing to meet the growing demand for therapeutic applications. However, technological challenges persist, requiring regulatory frameworks that ensure the safety and efficacy of these advanced therapies. In summary, the need for effective treatments for chronic diseases, particularly those affecting the geriatric population and those with rare disorders, is pressing. The use of stem cells offers a promising solution, but the manufacturing process must be scaled up and regulated to meet the growing demand while ensuring safety and efficacy.

What are the market trends shaping the Stem Cell Manufacturing Market?

Growing demand for personalized medicines is the upcoming trend in the market.

- Stem cell manufacturing is a significant area of research in personalized medicine due to the potential of mesenchymal stem cells (MSCs) to offer treatments tailored to patients' needs. MSCs, found in the bone marrow, have several advantages over other types of stem cells. They carry a low risk of immune rejection, do not necessitate the use of embryonic stem cells, and require minimal anti-rejection drugs. Moreover, the risk of graft rejection is low, and the chances of developing graft-versus-host disease (GvHD) are fewer. Regulatory policies play a crucial role in the market. These policies ensure the safety and efficacy of treatments derived from MSCs.

- Further, MSCs have applications in treating various diseases and injuries, including neurodegenerative disorders and heart disease. In the case of organ failure, MSCs can be used to regenerate damaged tissue. However, the operational costs associated with manufacturing these cells can be high. Sterility and a skilled workforce are essential to ensure the safety and efficacy of MSC-based therapies. In summary, the market is a dynamic and evolving field. Regulatory policies, the need for a skilled workforce, and operational costs are crucial factors influencing its growth. MSCs, with their numerous benefits, are at the forefront of personalized medicine, offering hope to patients suffering from various diseases and injuries.

What challenges does Stem Cell Manufacturing Market face during the growth?

Lack of trained professionals is a key challenge affecting the market growth.

- Stem cell manufacturing involves intricate processes that necessitate meticulous attention to detail, ensuring consistent and reliable outcomes. The global market for stem cell manufacturing is influenced by various factors, including operational expenditures, technical limitations, and the availability of skilled professionals. Socioethical concerns surrounding the use of stem cells in pharmaceutical medications and vaccine development add complexity to the market landscape. Logistical planning plays a significant role in stem cell manufacturing, with proper healthcare expenditure allocation and regulatory scenarios being essential considerations. For instance, the production of hydroxychloroquine, a drug used to treat malaria and arthritis, involves stem cell technology.

- However, staff disruptions due to a shortage of technical experts can hinder market growth. In affluent countries, healthcare systems prioritize the use of genomic technologies, enabling advancements in medicine. However, differences in education and training systems among nations result in inconsistent understanding and application of genomic data. Companies offering genomic health tests provide consumers with valuable insights into their physiologies. However, the lack of genetic experts to interpret test results can leave patients feeling uncertain and frustrated. In summary, the market faces challenges related to operational expenditures, technical limitations, and the availability of skilled professionals.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American CryoStem Corp.

- Becton Dickinson and Co.

- Bio Techne Corp.

- Catalent Inc.

- Corning Inc.

- Danaher Corp.

- FUJIFILM Holdings Corporation

- General Electric Co.

- HiMedia Laboratories Pvt. Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Miltenyi Biotec B.V. and Co. KG

- Perkin Elmer Inc.

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies Inc.

- Takara Bio Inc.

- Terumo BCT Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the therapeutic potential of these cells in treating various diseases and injuries. Regulatory policies play a crucial role in driving the market, ensuring the safety and efficacy of stem cell-based therapies and treatments. Investors are increasingly recognizing the potential of regenerative medicine in healthcare, leading to increased funding and investment. Neurodegenerative disorders, heart disease, organ failure, and cancer are some of the key areas where stem cell therapy is making a significant impact. Operational costs, sterility, and a skilled workforce are some of the key challenges in stem cell manufacturing. Scientific discoveries and advancements in cell culture systems, precision medicine, and research infrastructure are helping to address these challenges.

Furthermore, environmental factors such as temperature and oxygen levels, as well as the use of consumables and instruments, are essential considerations in the manufacturing process. Geographical regions with a high incidence of diseases and a large geriatric population are expected to drive the demand for stem cell therapies. However, regulatory frameworks and technical limitations pose significant challenges to the market's growth. The adoption of stem cell therapies for diseases such as leukemia, spinal cord injuries, and Alzheimer's disease is increasing, as is the use of stem cells for customized medicine, genetic testing, and orphan illnesses. The manufacturing scale-up of stem cells and the development of advanced technologies are key areas of focus for stakeholders in the market. Pharmaceutical medications and drugs with chemical effects on stem cells are also under investigation, as are the ethical concerns surrounding their use. Logistics planning and vaccine development are other areas of interest, as is the impact of staff disruptions and healthcare expenditure on the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market Growth 2024-2028 |

USD 6.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.3 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch