North America Superabsorbent Polymers Market Size 2024-2028

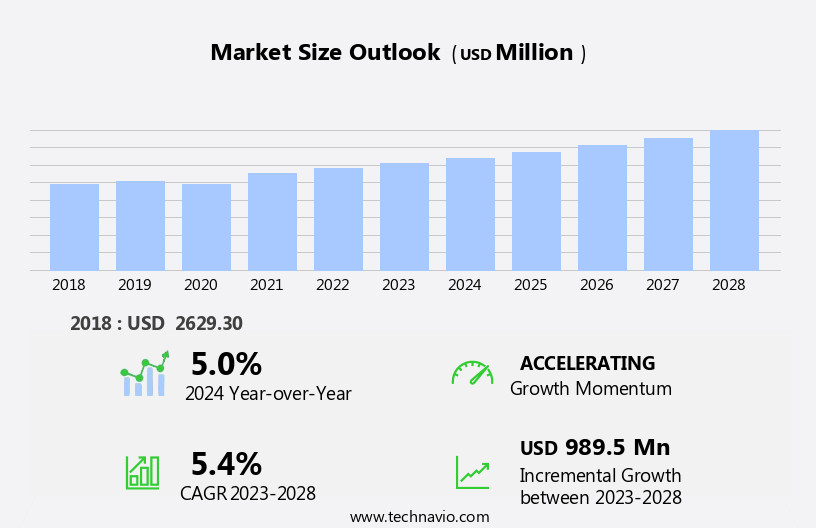

The north america superabsorbent polymers market size is forecast to increase by USD 989.5 million, at a CAGR of 5.4% between 2023 and 2028.

- The Superabsorbent Polymers (SAP) market in North America is experiencing significant growth, driven primarily by the burgeoning demand for baby diapers. This sector's expansion is fueled by increasing birth rates, rising disposable income, and the growing preference for convenient and hygienic diapering solutions. Additionally, the adoption of bio-based SAP is gaining traction due to environmental concerns and shifting consumer preferences towards eco-friendly alternatives. However, the market faces challenges as well. Environmental pollution arising from the production and disposal of SAP remains a pressing concern.

- Regulatory bodies are imposing stringent regulations to mitigate these issues, necessitating investments in sustainable production methods and waste management solutions. Companies must adapt to these changing regulatory landscapes and incorporate eco-friendly practices to maintain their competitive edge and ensure long-term growth.

What will be the size of the North America Superabsorbent Polymers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The North American superabsorbent polymers (SAPs) industry outlook remains robust, driven by innovation and technological advancement in SAPs. Sustainable manufacturing practices, such as the use of renewable resources and biocompatible coatings, are gaining traction in the market. Key players are focusing on new product development, particularly in the areas of bio-based superabsorbents and superabsorbent composites, to meet the demands of emerging applications. Crosslinking density and swelling behavior continue to be critical factors in the development of high-performance SAPs. Future market trends include a focus on reducing the environmental footprint of SAPs through life cycle assessment and circular economy principles.

- Technological advancements in polymeric networks and water uptake kinetics are expected to drive growth in the market. SAPs also find applications in drug delivery, release kinetics, and tissue engineering, further expanding their market potential. The regional market analysis indicates that the demand for SAPs is diverse, with significant growth expected in the healthcare and agriculture sectors.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Baby diapers

- Adult incontinence products

- Feminine hygiene

- Agriculture

- Others

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Type

- Synthetic

- Bio-Based

- End-User

- Consumer Goods

- Healthcare

- Agriculture

- Industrial

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The baby diapers segment is estimated to witness significant growth during the forecast period.

The Superabsorbent Polymers (SAP) market in North America is driven by the significant demand for disposable baby diapers, which is the largest segment in the market. SAP's high liquid retaining capacity makes it an essential material for absorbing liquids in these diapers. The convenience, performance, and affordability of disposable diapers have made them a popular choice for modern parents, particularly in households with two income streams and an increasing awareness of hygiene. SAPs are also used in various end-use industries, including incontinence products, meat packaging, and fluid management. Incontinence products, such as adult diapers and sanitary napkins, utilize SAPs for their water retention and leakage prevention properties.

In the food industry, SAPs are used for food preservation, thickening agents, and moisture control. In agriculture, they are used for soil conditioning, heavy metal removal, and seed germination. The manufacturing process of SAPs involves biopolymer synthesis, which includes the use of raw materials such as sodium polyacrylate, acrylamide monomer, and polyvinyl alcohol. The production process also involves crosslinking polymers to enhance their absorption capacity and swelling ratio. The use of biodegradable polymers and starch-based polymers has gained popularity due to their eco-friendly nature and drought tolerance. The SAP market is subject to price volatility due to fluctuations in raw material sourcing and testing standards.

Regulatory compliance and safety standards are crucial factors in the market, ensuring the quality control of SAPs used in various applications, including baby diapers, feminine hygiene products, and wound dressing. In the food packaging industry, SAPs are used as gelling agents and release agents to enhance the shelf life and freshness retention of perishable items, such as fruits and vegetables. In the environmental sector, SAPs are used for oil spill cleanup and water absorbency in wastewater treatment. The SAP market's future trends include the development of new applications, such as plant growth promotion and heavy metal removal, as well as the use of nanotechnology to improve the rheological properties and particle size distribution of SAPs.

The market's growth is expected to continue due to the increasing demand for convenient and eco-friendly products in various industries.

The Baby diapers segment was valued at USD 1717.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the North America Superabsorbent Polymers Market drivers leading to the rise in adoption of the Industry?

- The rapid adoption of baby diapers is the primary factor fueling market growth in this region.

- Superabsorbent polymers (SAPs) are essential components in various industries, including food packaging and moisture control. In North America, the market for SAPs is driven by several factors. The demand for SAPs in food packaging is increasing due to their ability to maintain the freshness and prolong the shelf life of perishable goods. These polymers absorb moisture and prevent the growth of microorganisms, ensuring food safety and quality. In the healthcare sector, SAPs are used as thickening agents in pharmaceuticals and as leakage prevention materials in sanitary napkins. The sanitary napkin market is growing due to rising awareness regarding women's health and hygiene.

- SAPs' ability to absorb fluids quickly and efficiently, with a high swelling ratio and excellent gel formation, makes them an ideal choice for this application. Moreover, SAPs have industrial applications, such as oil spill cleanup and seed germination. In oil spill cleanup, SAPs absorb oil and help prevent further environmental damage. In seed germination, they retain moisture and provide a suitable environment for seed growth. The production of SAPs involves the use of monomers like acrylic acid, which undergo polymerization to form the final product. The particle size distribution of SAPs is crucial for their effectiveness, and stringent quality control measures are in place to ensure consistency and regulatory compliance.

- In conclusion, the North American market for superabsorbent polymers is witnessing significant growth due to their diverse applications in various industries. Their ability to absorb moisture, maintain quality, and provide effective leakage prevention makes them indispensable in food packaging, healthcare, and industrial applications.

What are the North America Superabsorbent Polymers Market trends shaping the Industry?

- The adoption of bio-based superabsorbent polymers is an emerging market trend. These eco-friendly alternatives to traditional petroleum-based polymers are gaining popularity due to their sustainability and environmental benefits.

- Superabsorbent polymers (SAPs), a crucial component in various industries such as packaging films, incontinence products, and wastewater treatment, are primarily based on acrylate derivatives. Acrylate-based SAPs, including poly(acrylic acid)s, poly(acrylamide)s, and their salts, exhibit superior absorption capacity. However, their high molecular weight and carbon atom-based structure hinder biodegradability, posing environmental concerns. To mitigate these issues, the market is shifting towards bio-based and degradable SAPs. Biodegradable polymers, such as those derived from renewable resources, offer a viable solution. These polymers, including biopolymers synthesized from polysaccharides, proteins, and lipids, have gained traction due to their eco-friendly nature and equivalent performance to conventional petroleum-derived SAPs.

- Moreover, the use of biodegradable SAPs in packaging films and incontinence products contributes to reducing CO2 emissions throughout the product life cycle. In the manufacturing process, biodegradable SAPs can be synthesized using renewable resources, such as corn starch or sugarcane, instead of non-renewable resources. Additionally, the use of biodegradable SAPs in agriculture enhances drought tolerance, making them a promising solution for sustainable farming practices. Despite the benefits, price volatility and supply chain management challenges persist in the market. The production of biodegradable SAPs involves the use of acrylamide monomer, which is subject to price fluctuations due to its limited availability.

- Effective supply chain management is essential to ensure a consistent and reliable supply of these materials. In conclusion, the demand for bio-based and degradable SAPs is growing due to their eco-friendly properties and equivalent performance to conventional SAPs. The use of these polymers in various industries, including packaging films and incontinence products, offers a sustainable solution to environmental concerns while contributing to reducing CO2 emissions. However, challenges such as price volatility and supply chain management must be addressed to ensure the widespread adoption of these materials.

How does North America Superabsorbent Polymers Market faces challenges face during its growth?

- Environmental pollution poses a significant challenge to the expansion and growth of industries, necessitating the implementation of stringent regulations and sustainable practices to mitigate its adverse effects.

- Superabsorbent polymers, a non-biodegradable material, pose a significant environmental concern as they contribute significantly to landfill waste and take decades to degrade. Their high molecular weight makes them resistant to solubilization by most microorganisms, leading to a prolonged degradation cycle. The environmental impact of superabsorbent polymers is particularly notable in applications such as disposable diapers, which account for over 40% of non-biodegradable waste in the US. Despite these concerns, the superabsorbent polymers market continues to grow due to their unique properties, including high fluid absorption capacity and rheological properties. They find extensive applications in various end-use industries, including fluid management, soil conditioning, heavy metal removal, and food preservation.

- In food preservation, superabsorbent polymers function as gelling agents and release agents. In soil conditioning, they enhance water retention and improve soil structure. In heavy metal removal, they aid in the adsorption and immobilization of heavy metals. Safety standards and polymer characterization are crucial factors in the superabsorbent polymers market. The development of eco-friendly and biodegradable alternatives is also a growing trend, as consumers become increasingly conscious of the environmental impact of their purchases. Starch-based polymers are a promising alternative to traditional superabsorbent polymers, offering similar performance with reduced environmental impact. In conclusion, the superabsorbent polymers market is driven by their unique properties and diverse applications.

- However, the environmental concerns associated with their disposal remain a significant challenge. The development of eco-friendly alternatives and stricter safety standards will help mitigate these concerns and ensure the sustainable growth of the market. Recent research indicates that the market for superabsorbent polymers is expected to continue growing, driven by increasing demand from various end-use industries.

Exclusive North America Superabsorbent Polymers Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF

- Evonik Industries

- Nippon Shokubai

- LG Chem

- Sumitomo Seika

- Formosa Plastics

- Kao Corporation

- Sanyo Chemical

- Songwon Industrial

- Yixing Danson

- Archer Daniels Midland

- Acuro Organics

- Chemtex Speciality

- Gelok International

- Quanzhou Banglida

- SNF Floerger

- Zhejiang Satellite Petrochemical

- Chase Corporation

- High Smart Commodity

- Wanhua Chemical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Superabsorbent Polymers Market In North America

- In January 2024, BASF Corporation, a leading chemical producer, announced the expansion of its superabsorbent polymer (SAP) production capacity at its Geismar, Louisiana, site. This USD120 million investment aims to enhance the company's market position and meet the growing demand for SAPs in various applications, such as diapers, agriculture, and construction (BASF press release, 2024).

- In March 2025, Lonza Inc., a Swiss specialty ingredients supplier, entered into a strategic partnership with Avgol Industries Ltd., a leading producer of nonwoven fabrics for hygiene applications. The collaboration focuses on the development and commercialization of innovative SAP solutions for improved absorbency and sustainability in hygiene products (Lonza press release, 2025).

- In May 2024, Evonik Industries AG, a German specialty chemicals company, completed the acquisition of Perquimon S.A., a Brazilian producer of superabsorbent polymers. This acquisition strengthens Evonik's global presence in the SAP market and provides access to Perquimon's production facilities and customer base in Latin America (Evonik press release, 2024).

- In February 2025, the United States Environmental Protection Agency (EPA) announced the approval of a new type of superabsorbent polymer, which significantly reduces water usage in the production process. This development is expected to contribute to the growth of the North American SAP market by reducing the environmental footprint and increasing the competitiveness of SAP manufacturers (EPA press release, 2025).

Research Analyst Overview

Superabsorbent polymers (SAPs) are a dynamic and evolving market in North America, with various sectors continually integrating these innovative materials into their applications. SAPs, known for their high absorption capacity, find extensive use in diverse industries, including packaging films, absorption capacity enhancement in various end-use sectors, and biodegradable polymers for drought tolerance. Manufacturing processes for SAPs, such as biopolymer synthesis and sodium polyacrylate production, are under constant refinement to optimize efficiency and reduce environmental impact. Supply chain management plays a crucial role in ensuring the availability and reliability of raw materials, including acrylamide monomer and starch-based polymers, in the production of SAPs.

Applications of SAPs span across sectors, from baby wipes and incontinence products to fluid management in industries like meat packaging and food preservation. SAPs contribute to moisture control, freshness retention, and leakage prevention in various applications, such as disposable diapers, feminine hygiene products, and wound dressing. In the realm of environmental applications, SAPs play a significant role in wastewater treatment, soil conditioning, and heavy metal removal. The ongoing research and development in the field of SAPs result in the creation of compostable polymers, reducing the environmental impact of these materials. Price volatility, driven by raw material sourcing and testing standards, continues to be a critical factor in the SAP market.

The market's continuous evolution is further influenced by regulatory compliance and the development of new applications, such as oil spill cleanup and seed germination. In the ever-changing landscape of the SAP market, the role of rheological properties, safety standards, and polymer characterization becomes increasingly important for ensuring the quality and performance of these materials. The ongoing research and innovation in the field of SAPs ensure their continued relevance and application across various industries.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Superabsorbent Polymers Market in North America insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2024-2028 |

USD 989.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch