Surface Treatment Chemicals Market Size 2025-2029

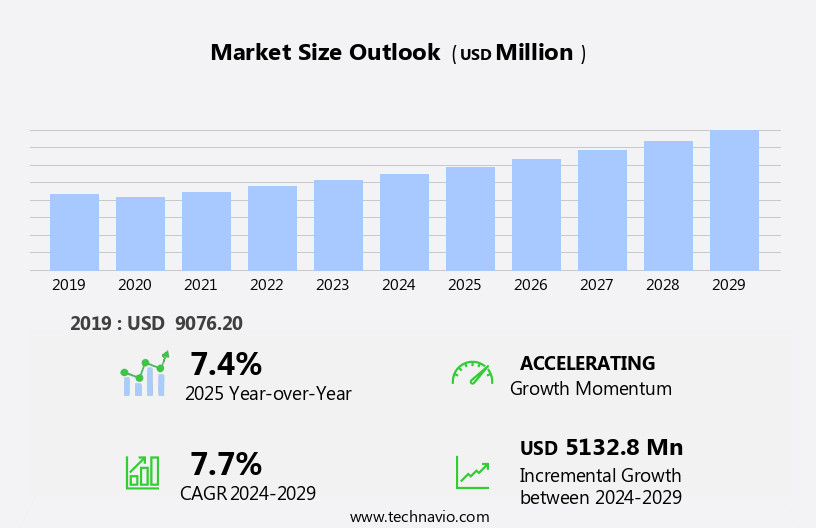

The surface treatment chemicals market size is forecast to increase by USD 5.13 billion at a CAGR of 7.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for corrosion protection in various industries such as automotive, construction, and oil and gas. This trend is particularly evident in regions with harsh environmental conditions, where the need for effective surface treatment solutions is paramount. Additionally, there is a growing shift towards eco-friendly and sustainable alternatives, as companies seek to reduce their carbon footprint and comply with increasingly stringent regulations. However, the market is not without challenges. The volatility in raw material prices, particularly for key inputs such as titanium dioxide and chromium, can significantly impact the profitability of surface treatment chemical manufacturers.

- Advanced coatings, such as self-cleaning coatings, fire retardant coatings, hydrophilic coatings, Hydrophobic Coatings, and low VOC coatings, cater to various industries' unique requirements. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must stay abreast of price trends and explore alternative raw material sources or production methods. Furthermore, investing in research and development to create innovative, sustainable, and cost-effective solutions will be key to staying competitive in this dynamic market.

What will be the Size of the Surface Treatment Chemicals Market during the forecast period?

- The market encompasses a range of innovative technologies, including superhydrophilic and superhydrophobic coatings, corrosion monitoring solutions, friction reduction coatings, smart coatings, and various deposition techniques such as chemical vapor deposition and atomic layer deposition. These advancements cater to diverse industries, addressing challenges like wear and tear, biofouling, and thermal management. Moreover, the market is driven by the increasing demand for sustainable development and green manufacturing. Sustainable coatings, like self-healing and bio-mimetic options, are gaining traction due to their eco-friendly properties and longer lifespan. Barrier coatings, anti-icing coatings, and optical coatings are essential in various applications, from protecting infrastructure against harsh environments to enhancing visual clarity in electronics.

- Decorative Coatings, including paint additives and eco-friendly coatings, are used to improve the visual appeal of products. Additionally, the integration of advanced technologies like laser surface treatment and ion implantation further expands the market's potential. Circular economy principles are also influencing the surface treatment chemicals industry, as companies focus on reducing waste and improving the overall sustainability of their processes. Coating inspection and failure analysis techniques ensure the longevity and performance of these advanced coatings, further fueling market growth.

How is this Surface Treatment Chemicals Industry segmented?

The surface treatment chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Cleaners

- Plating chemicals

- Conversion coatings

- Others

- End-user

- Transportation

- Construction

- Industrial machinery

- Electronics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

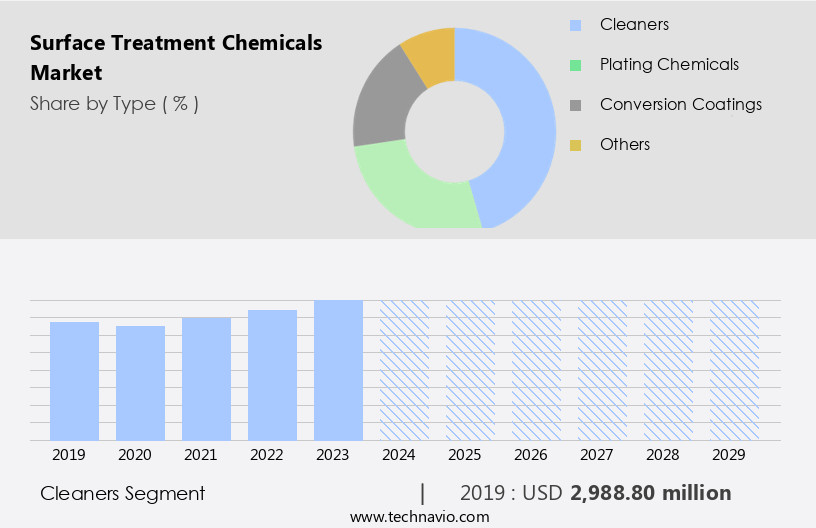

The cleaners segment is estimated to witness significant growth during the forecast period. The market encompasses various segments, with cleaners holding a significant role in preparing surfaces for subsequent processes such as coating, painting, or plating. These cleaners are formulated to eliminate contaminants like oils, greases, dirt, dust, and oxides that can obstruct adhesion or lead to surface imperfections. Effective cleaning is pivotal in ensuring surface uniformity, enhancing product aesthetics, and prolonging the service life of treated components. In industries where precision and performance are paramount, such as automotive, aerospace, electronics, and metalworking, advanced cleaners assume increased importance. Cleaners can be categorized based on their application and substrate compatibility, including alkaline, acidic, solvent-based, and aqueous.

Functional coatings, such as dip coating, plasma coatings, and sol-gel coatings, are applied to enhance surface properties like chemical resistance, corrosion resistance, and wear resistance. Coatings can be further classified based on their application methods, including spray coating, electrostatic spraying, roll coating, and airless spraying. Surface modification techniques like surface engineering and surface characterization play a crucial role in enhancing the performance of coatings. Regulatory compliance and safety standards are essential considerations in the development and application of coatings. Coating performance is influenced by factors like coating thickness, adhesion promoters, and substrate compatibility.

Sustainable coatings, including bio-based coatings and Waterborne Coatings, are gaining popularity due to environmental regulations and the growing demand for eco-friendly solutions. Surface analysis techniques, such as surface tension measurement and coating performance evaluation, help ensure the quality and consistency of coatings. Surface treatment processes, including surface preparation and surface cleaning, are essential steps in the application of coatings. Degreasing agents, release agents, and surface cleaning agents are commonly used in these processes. Electronics coatings, including anti-static coatings and UV curable coatings, are applied to protect sensitive electronic components.

Coating uniformity is crucial for optimal performance and aesthetics. Coatings are used in various industries, including automotive, industrial, construction, and aerospace, to provide protective layers, enhance surface properties, and improve product durability. In summary, the market is diverse and dynamic, with cleaners, functional coatings, decorative coatings, and advanced coatings catering to various industries' unique requirements. Effective surface preparation and treatment are essential for ensuring the optimal performance and longevity of treated components. Regulatory compliance, sustainability, and performance are key considerations in the development and application of surface treatment chemicals.

Get a glance at the market report of share of various segments Request Free Sample

The Cleaners segment was valued at USD 2.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

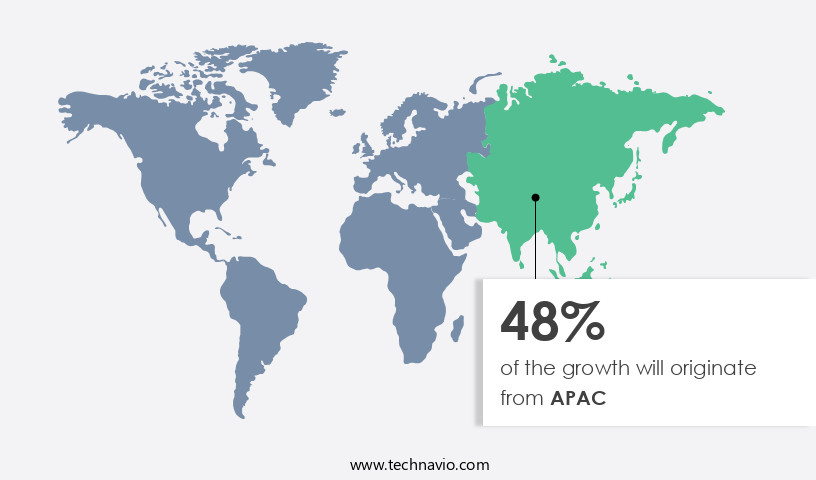

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia-Pacific (APAC) region is experiencing significant growth due to the region's thriving industrial sector and economic expansion. The automotive industry is a key driver of this market, with China, Japan, and South Korea leading the way. In 2024, China produced around 21 million units, representing a 2 percent increase from the previous year. Japan's car production grew by 17 percent in 2023, reaching 7.5 million units, while South Korea saw a 13.5 percent increase, producing approximately 4 million units. This growth in automotive production necessitates the use of surface treatment chemicals for enhancing corrosion resistance, improving paint adhesion, and ensuring the durability of automotive parts.

Beyond the automotive sector, other industries such as construction, electronics, and aerospace are also contributing to the market's expansion. For instance, the increasing demand for eco-friendly and sustainable coatings, driven by environmental regulations and safety standards, is fueling the growth of the market. Functional coatings, including self-cleaning, fire retardant, and anti-microbial coatings, are also gaining popularity due to their unique properties and benefits. Surface characterization and analysis techniques, such as surface tension measurement and coating thickness evaluation, are essential in ensuring the performance and quality of surface treatment chemicals. The use of advanced technologies like plasma coatings, sol-gel coatings, and nanotechnology in surface engineering is also transforming the market.

The increasing adoption of application methods like airless spraying, electrostatic spraying, and roll coating is enabling more efficient and cost-effective production processes. Regulatory compliance and substrate compatibility are critical factors influencing the market's dynamics. Corrosion Inhibitors, adhesion promoters, and release agents are some of the essential chemicals used in surface treatment processes to ensure optimal coating performance and uniformity. The market is also witnessing the emergence of innovative coatings, such as hydrophilic and hydrophobic coatings, which offer enhanced properties and improved service life. The market in the APAC region is experiencing strong growth, driven by the automotive industry and expanding industrial activities. The increasing demand for functional coatings, eco-friendly solutions, and advanced surface engineering techniques is further fueling the market's expansion. Regulatory compliance, substrate compatibility, and coating performance are key considerations shaping the market's dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surface Treatment Chemicals Industry?

- Increasing focus on corrosion protection is the key driver of the market. The demand for surface treatment chemicals is driven by the critical need for corrosion protection across various industries. Corrosion not only compromises the structural integrity and aesthetic value of materials, particularly metals, but also results in significant economic losses due to equipment failure, maintenance, and replacement costs. As industries such as automotive, aerospace, marine, construction, and oil and gas increasingly rely on metal components, the importance of protecting these materials from rust and environmental degradation is paramount. Surface treatment chemicals play a crucial role in forming protective barriers on substrates, enhancing their resistance to moisture, salt, chemicals, and other corrosive elements.

- These chemicals provide a protective coating that shields the underlying material from the harsh effects of the environment, thereby extending the life of the component and reducing maintenance and replacement costs. The use of surface treatment chemicals is essential in various applications, including painting, electroplating, anodizing, and powder coating. These treatments not only improve the appearance of the material but also provide additional benefits such as increased durability, improved resistance to wear and tear, and enhanced electrical conductivity. The need for corrosion protection is a critical concern for industries that rely heavily on metal components.

What are the market trends shaping the Surface Treatment Chemicals Industry?

- A shift toward eco-friendly and sustainable solutions is the upcoming market trend. The market is experiencing a notable shift towards eco-friendly and sustainable solutions. Stricter environmental regulations and the growing priority on sustainability are driving this trend. There is a strong push to replace hazardous chemicals, such as those containing volatile organic compounds (VOCs), heavy metals, and chromates, with non-toxic, water-based, and biodegradable alternatives. This shift is fueled by increasing environmental and worker safety concerns, as well as the need to reduce carbon footprints and promote circular economy principles. Manufacturers are responding by developing innovative surface treatment formulations that maintain or even improve performance standards while adhering to these eco-friendly guidelines.

- Examples include chromate-free corrosion inhibitors, phosphate-free metal pretreatments, and VOC-free coatings. This transition not only benefits the environment but also positions companies as industry leaders in sustainability.

What challenges does the Surface Treatment Chemicals Industry face during its growth?

- Volatility in raw material prices is a key challenge affecting the industry growth. The market faces volatility in raw material prices as a significant challenge, affecting both manufacturing costs and supply chain stability. These chemicals utilize raw materials such as metals (zinc, nickel, chromium), solvents, acids, and specialty additives. Price instability in these materials can significantly impact the cost structure of manufacturers, particularly when margins are already slim due to intense competition. In 2024, several essential raw materials experienced considerable price volatility. For instance, nickel prices saw substantial fluctuations due to geopolitical tensions and disruptions in production from major suppliers like Russia and Indonesia.

- As of Q1 2024, nickel prices ranged between USD 17,000 and USD 19,000 per metric ton, down from over USD 29,000 in early 2022 but still unstable due to persistent supply-demand imbalances. This price instability underscores the importance of effective raw material sourcing strategies and supply chain management for market participants.

Exclusive Customer Landscape

The surface treatment chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surface treatment chemicals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surface treatment chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aalberts NV - The company offers surface treatment chemicals such as anodizing, zinc-flake coating, and electroless nickel plating.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aalberts NV

- ALANOD GmbH and Co. KG

- Atotech

- Bulk Chemicals Inc.

- Chemetall GmbH

- ChemTech Surface Finishing Pvt. Ltd.

- Element Solutions Inc.

- Henkel AG and Co. KGaA

- JCU CORP

- McGean-Rohco Inc.

- Nihon Parkerizing Co., Ltd.

- Nippon Paint Holdings Co. Ltd.

- NOF CORP.

- OC Oerlikon Corp. AG

- PPG Industries Inc.

- Solvay SA

- The Sherwin Williams Co.

- Trion Coatings LLC

- YUKEN INDUSTRY CO LTD

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products and processes used to modify the properties of surfaces for various applications. One significant trend in this market is the shift towards green chemistry, which involves the use of environmentally friendly chemicals and processes in surface treatment. Dip coating and functional coatings are two common methods used to apply surface treatment chemicals. Dip coating involves immersing a substrate in a bath of the coating material, while functional coatings are designed to provide specific properties such as chemical resistance or self-cleaning capabilities. Surface characterization plays a crucial role in the development and optimization of surface treatment chemicals.

Techniques such as surface analysis and coating performance testing are used to evaluate the properties of coated surfaces and ensure they meet the desired specifications. Paint additives are another important category of surface treatment chemicals. These additives can enhance the performance of paints and coatings, improving properties such as corrosion resistance, durability, and application uniformity. Regulatory compliance and safety standards are major considerations in the market. Environmental regulations and safety requirements can impact the choice of chemicals and processes used in surface treatment, as well as the certification and labeling of finished products. Decorative coatings, such as automotive and Architectural Coatings, are a significant application area for surface treatment chemicals.

These coatings are designed to enhance the appearance of surfaces and provide protection against environmental factors. Functional coatings also find extensive use in various industries, including electronics, aerospace, and construction. For instance, electronics coatings provide protection against moisture, corrosion, and other environmental factors, while aerospace coatings offer protection against extreme temperatures and UV radiation. Surface modification techniques, such as plasma coatings and sol-gel coatings, are used to alter the surface properties of materials. These techniques can improve the adhesion of coatings, enhance surface roughness, and provide other desirable properties. Coating thickness and application methods, such as spray coating and roll coating, are critical factors in the surface treatment process.

Proper application techniques ensure even coating distribution and optimal performance. Sustainable coatings and eco-friendly alternatives are gaining popularity in the market due to increasing environmental concerns. Bio-based coatings and waterborne coatings are some examples of sustainable alternatives that offer reduced environmental impact. Corrosion inhibitors and Protective Coatings are essential in industries where equipment and infrastructure are exposed to harsh environments. These coatings provide protection against corrosion, abrasion, and other forms of damage. Release agents and degreasing agents are used in various manufacturing processes to facilitate the separation of parts or components from surfaces. These chemicals ensure proper surface preparation for subsequent coating applications.

Surface cleaning is an essential step in the surface treatment process, as it ensures the removal of contaminants and impurities that can affect the adhesion and performance of coatings. Proper surface cleaning can also extend the service life of coatings and reduce maintenance costs. The market is a diverse and dynamic industry that caters to various applications and industries. The market is driven by trends such as green chemistry, regulatory compliance, and the development of functional coatings with enhanced properties. Proper surface preparation, application techniques, and testing methods are crucial in ensuring the optimal performance of surface treatment chemicals.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 5.13 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, China, India, Japan, Germany, South Korea, UK, Canada, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surface Treatment Chemicals Market Research and Growth Report?

- CAGR of the Surface Treatment Chemicals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surface treatment chemicals market growth and forecasting

We can help! Our analysts can customize this surface treatment chemicals market research report to meet your requirements.