Surgical Suction Instruments Market Size 2024-2028

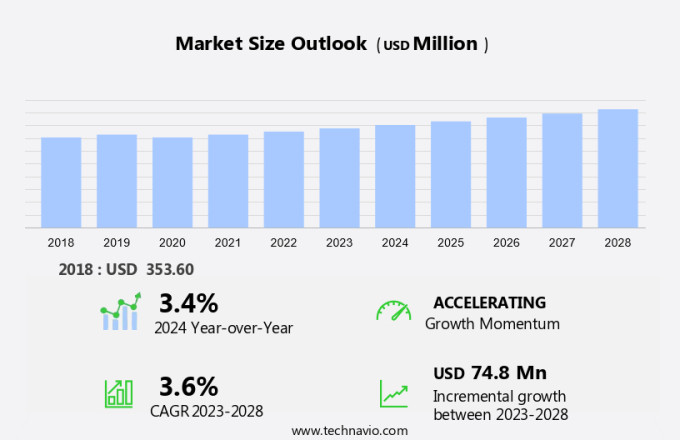

The surgical suction instruments market size is forecast to increase by USD 74.8 million at a CAGR of 3.6% between 2023 and 2028.

- The market is experiencing significant growth due to the rising volume of surgeries, particularly in areas such as general surgery, neurosurgery, orthopedic, cardiovascular, dental, and musculoskeletal conditions related to chronic diseases and an aging population. In emerging economies, this growth potential is particularly high. However, the market is also subject to stringent regulatory frameworks, which ensure surgical efficacy and patient safety. Manufacturers focus on innovations such as advanced tubes, tips, retractors, and cannulas to enhance surgical procedures and meet the evolving needs of healthcare professionals. This market analysis report provides an in-depth examination of these trends and the challenges they present for market participants.

What will be the Size of the Market During the Forecast Period?

- The market holds significant importance in the healthcare industry as these instruments play a crucial role in maintaining a clean operative field during various surgical interventions. The demand for surgical suction instruments is driven by the expansion of healthcare services, the increasing elderly population, and the rise in surgical procedures due to various health conditions. Surgical suction instruments are used extensively in orthopedic surgery, cardiovascular procedures, cancer treatments, and early diagnosis of diseases. These instruments help improve surgical efficiency by removing excess fluids, blood, and tissue debris from the operative site, ensuring optimal visibility for surgeons. Two primary categories of surgical suction instruments include disposable and reusable instruments. Disposable surgical suction instruments, also known as single-use devices, are widely used due to their convenience, ease of use, and reduced risk of cross-contamination. Reusable instruments, on the other hand, offer cost savings and are often used in hospitals with large surgical volumes. Healthcare expenditures related to surgical services, elective surgeries, and cataract surgeries have been on the rise, leading to increased demand for surgical suction instruments. Some common surgical procedures that utilize surgical suction instruments include hip replacement procedures, cesarean sections, and cardiovascular surgeries. The elderly population is a significant consumer group for surgical services, with a higher prevalence of health conditions requiring surgical intervention.

- Conditions such as orthopedic problems, cardiovascular diseases, and cancer necessitate surgical procedures, driving the demand for surgical suction instruments. Tissueflow, a leading manufacturer of surgical suction instruments, focuses on producing high-quality, efficient, and reliable instruments to cater to the evolving needs of the surgical industry. Their product portfolio includes a wide range of disposable and reusable suction devices designed to enhance surgical procedures and improve patient outcomes. In conclusion, the market is a vital segment of the surgical equipment market, playing a pivotal role in ensuring surgical efficiency and maintaining a clean operative field during various surgical procedures. The market is driven by factors such as healthcare expansion, the increasing elderly population, and the rise in surgical procedures due to various health conditions. Manufacturers like Tissueflow continue to innovate and produce high-quality surgical suction instruments to cater to the evolving needs of the healthcare industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Disposable

- Reusable

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

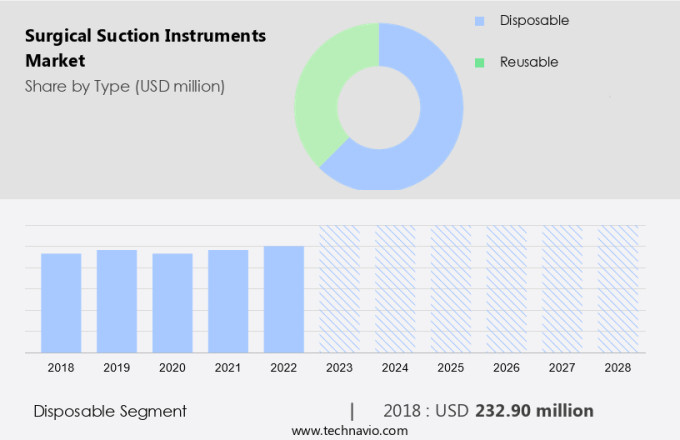

- The disposable segment is estimated to witness significant growth during the forecast period.

Hospitals are prioritizing infection control measures by increasing their use of disposable medical supplies, including surgical suction instruments. The affordability and convenience of disposable instruments, which do not require sterilization before use, are driving their adoption. Furthermore, hospitals' commitment to adhering to regulatory standards, such as those set by the Food and Drug Administration (FDA), the European Union Medical Device Directive (MDD), and the Occupational Safety and Health Administration (OSHA), is leading to a heightened demand for disposable surgical suction instruments. This trend is contributing to the expansion of the disposable segment.

In addition, manufacturers are also providing a range of single-use surgical suction instruments to minimize the risk of surgical site infections and contamination. By reducing infection rates and shortening hospital stays, these instruments are significantly improving patient outcomes and overall healthcare efficiency.

Get a glance at the market report of share of various segments Request Free Sample

The disposable segment was valued at USD 232.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

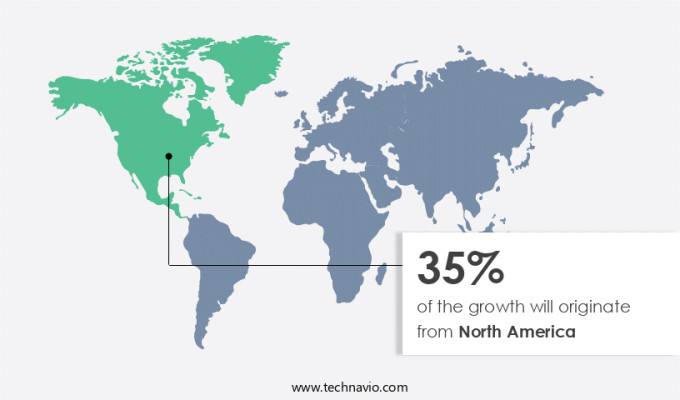

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing significant growth due to several key factors. With an aging population and rising prevalence of chronic conditions, such as cardiovascular diseases and chronic respiratory diseases, which affect approximately 80% of the population, the need for surgical interventions is increasing. Furthermore, the incidence of various types of surgeries, including cancer procedures, minimally invasive surgeries, and orthopedic surgeries for conditions like knee replacement and hip surgery, is on the rise. Advancements in technology, such as wireless technology and mobility solutions, are enhancing surgical efficiency and improving patient safety. For instance, wireless suction systems offer greater flexibility and ease of use, enabling surgeons to maintain a clear operative field during complex procedures.

Additionally, the tube segment of the market is expected to dominate due to its versatility and effectiveness in removing fluids and tissue debris. In conclusion, the healthcare industry in North America is witnessing a rise in demand for surgical suction instruments due to the increasing number of surgeries, an aging population, and the availability of advanced technologies. These factors are driving the growth of the market and are expected to continue doing so in the foreseeable future.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Surgical Suction Instruments Market?

An increase in the volume of surgeries coupled with chronic diseases and an older population is the key driver of the market.

- In managing various chronic health conditions, such as orthopedic, ENT, thoracic, and others, surgical care plays a crucial role. The rise in the number of surgeries performed in hospitals and clinics, including ambulatory surgery centers, is driven by the increasing prevalence of chronic diseases, obesity, and an aging population. Advanced surgical suction instruments are essential for intricate procedures like spinal, neuro, and cranial surgeries, which demand high precision and reliability.

- The market experiences growth due to the increasing volume of elective surgeries, such as cataract surgeries, hip replacement procedures, and cesarean sections, which are commonly performed to address chronic health issues. Healthcare expenditures continue to rise as the need for surgical services becomes more prominent. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Surgical Suction Instruments Market?

High growth potential in emerging economies is the upcoming trend in the market.

-

The healthcare industry's expansion, driven by an aging population and the increasing prevalence of chronic diseases, has led to a heightened demand for surgical interventions. Consequently, the use of suction devices during surgical procedures has become essential for effective tissue removal and maintaining a sterile environment. This trend is particularly notable in specialized fields such as orthopedic surgery and oncology, where cancer cases and emergency surgeries require precise and efficient suction techniques. Companies in the market are capitalizing on these trends by expanding their operations in emerging economies, such as China and India. Factors like increasing hospital facilities, growing awareness of infection control, and the availability of low-cost raw materials and labor are attracting both new entrants and established players to these markets.

The untapped potential in these countries is significant, making it an opportune time for businesses to establish a presence and capture a share of the growing demand. In summary, the market is poised for growth due to the increasing need for surgical interventions, particularly in emerging economies. Vendors are seizing this opportunity to expand their footprint and cater to the demands of healthcare providers and patients alike. The market's potential is vast, making it an attractive investment for businesses looking to capitalize on the expanding healthcare landscape. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Surgical Suction Instruments Market face during the growth?

A stringent regulatory framework is a key challenge affecting market growth.

-

Surgical suction instruments play a crucial role in various medical procedures, including cardiovascular disorders, hysterectomies, cholecystectomies, C-sections, and laparoscopic surgeries. These instruments are available in both disposable and reusable forms, with disposable, single-use devices gaining popularity due to their reduced risk of surgical site infections. Surgical suction devices and suction-irrigation devices are essential tools in these procedures, helping to maintain a clear surgical field and minimize blood loss. However, the development of new surgical suction instruments faces numerous challenges.

Regulatory approval is a rigorous process that can be unpredictable and subjective. Clinical trials are a significant hurdle, and failure to produce positive results in one region can lead to increased costs and uncertainty, potentially impacting other trials. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Healthcare Products Inc.

- Anand Medicaids Pvt. Ltd.

- Applied Medical Resources Corp.

- Arthrex Inc.

- Bionix LLC

- Cardinal Health Inc.

- Conmed Corp.

- HERSILL SL

- Laerdal Medical AS

- Medela AG

- Medline Industries LP

- Medtronic Plc

- Narang Medical Ltd.

- Olympus Corp.

- SP Industries Inc.

- SSCOR Inc.

- STERIS plc

- Stryker Corp.

- Wellell Inc.

- ZOLL Medical Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Surgical suction instruments play a crucial role in various surgical interventions, enhancing surgical efficacy and ensuring patient safety. With the expansion of healthcare and the increasing elderly population, the demand for surgical suction instruments is on the rise. These instruments are essential in managing surgical sites, improving patient outcomes, and maintaining surgical precision during procedures. Suction devices, including tubes, tips, retractors, and cannulas, are used in diverse surgical procedures such as orthopedic, neurosurgery, cardiovascular, dental, and general surgery. Chronic diseases like osteoporosis, hypertension, and cancer, as well as emergency surgeries, require the use of surgical suction instruments. Surgical suction instruments are available in disposable and reusable forms, catering to the varying needs of healthcare facilities.

Furthermore, minimally invasive surgeries and laparoscopic procedures increasingly rely on wireless technology and mobility, further driving the demand for advanced surgical suction devices. Early diagnosis and timely surgical interventions for health conditions like cardiovascular diseases, orthopedic problems, and cancer, are key factors contributing to the growth of the market. Surgical site management, patient safety, and surgical efficiency are primary concerns, making surgical suction instruments an indispensable part of the surgical equipment market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2024-2028 |

USD 74.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.4 |

|

Key countries |

US, Canada, China, Mexico, Germany, UK, Japan, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch