North America Syngas Market Size and Trends

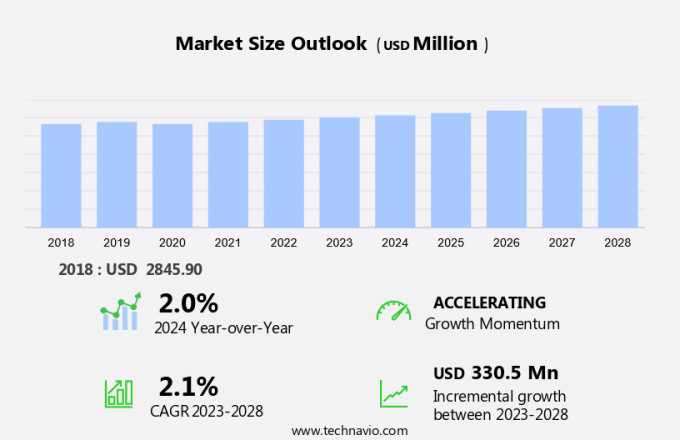

The North America syngas market size is forecast to increase by USD 330.5 million at a CAGR of 2.1% between 2023 and 2028. The market is experiencing significant growth due to the increasing application of syngas in various industries. One of the key drivers is the rising demand for bio-based feedstock, particularly in the production of bio-methanol and bio-hydrogen. Gasification technology, including methods such as steam reforming and partial oxidation, plays a crucial role in syngas production. However, challenges persist, including the need for effective tar removal during gasification and ensuring high hydrogen yields. Both biomass and petroleum coke are commonly used as feedstocks, with entrained bed gasifiers and fixed bed gasifiers being the most common types of gasifiers. In addition, Syngas is increasingly being used as a clean energy source for transportation, particularly in the form of green hydrogen. Meeting complex quality requirements for syngas is essential to ensure its successful utilization in various applications. In the market, the focus is on optimizing syngas production processes to improve efficiency and reduce costs while maintaining high-quality output.

The market is experiencing significant growth due to its increasing application in various sectors, including the production of chemicals, electricity, and transportation fuels. Syngas, or synthesis gas, is a mixture of hydrogen and carbon monoxide produced through various processes such as gasification of natural gas, biomass, and coal. The demand for Syngas is driven by its versatility as a feedstock for the production of chemicals like methanol, ammonia, and hydrogen. Syngas is also used as a fuel in gas engines and as a source of electricity through combined cycle power plants. The transportation of Syngas is facilitated through various modes, including rail, marine, and road transport. The choice of transportation mode depends on the distance and volume of the Syngas being transported. For instance, rail transport is commonly used for large-scale Syngas transportation, while road transport is suitable for smaller volumes. Marine transport is also an option for long-distance transportation, particularly for countries with extensive coastlines. The production of Syngas involves different gasification technologies, including steam reforming, fluidized bed gasification, and fixed bed gasifiers. Steam reforming is the most widely used process for Syngas production from natural gas, while biomass gasification is gaining popularity due to its potential to contribute to decarbonization efforts.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Feedstock

- Coal

- Natural gas

- Petroleum byproducts

- Biomass/waste

- Others

- Geography

- North America

- Canada

- Mexico

- US

- North America

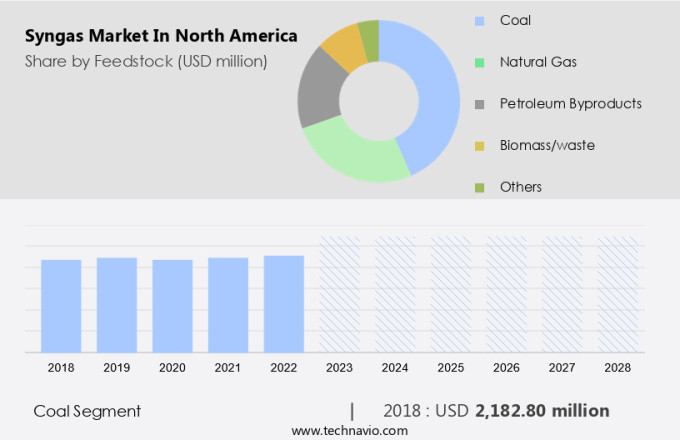

By Feedstock Insights

The coal segment is estimated to witness significant growth during the forecast period. Syngas, a gas mixture primarily composed of hydrogen, carbon monoxide, and carbon dioxide, is generated through coal gasification technology. This process is gaining traction in North America due to the increasing adoption of underground coal gasification (UCG), which is typically carried out below 1,000 feet.

Get a glance at the market share of various segment Download the PDF Sample

The coal segment was the largest segment and valued at USD 2.18 billion in 2018. Unlike conventional coal mining, UCG does not require the extraction of coal from the ground, making it a more environmentally-friendly alternative. Additionally, the disposal of ash, a byproduct of coal gasification, is eliminated, thereby reducing pollution. Furthermore, the low capital investment required for UCG, as there is no need to construct a dedicated gasification plant, is another significant factor driving market growth. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

North America Syngas Market Driver

Rising application of syngas is notably driving market growth. Syngas, a versatile energy carrier, plays a significant role in various industries, including chemicals, petrochemicals, refining, and fertilizers. Its primary use is in electricity generation due to its combustible properties, making it an alternative fuel for internal combustion engines.

Syngas can be transformed into chemical products via Syngas-to-chemicals technologies, such as the Fischer Tropsch process. This process produces hydrogen, which is a clean energy source and green fuel, essential for decarbonization in industries like plastics and methanol production. Additionally, syngas can be converted into synthetic natural gas (SNG), a future fuel, and an essential component in the energy transition. Thus, such factors are driving the growth of the market during the forecast period.

North America Syngas Market Trends

Rising demand for bio-based feedstock is the key trend in the market. Syngas, derived from bio-based feedstocks, is gaining significant traction in the chemical industry due to the increasing emphasis on sustainability. Renewable syngas production is experiencing rapid growth as a result of the escalating demand for eco-friendly alternatives to traditional fossil fuel sources.

Moreover, major market players are actively investing in this sector to create a more sustainable future. Bio-based feedstocks, such as wood, waste wood, cellulose, lignin, and other plant-based materials, are becoming increasingly economically viable options to replace conventional feedstocks. Thus, such trends will shape the growth of the market during the forecast period.

North America Syngas Market Challenge

Complex quality requirements for syngas is the major challenge that affects the growth of the market. Syngas, also referred to as synthesis gas or producer gas, is generated through the conversion of carbon-containing feedstocks, such as coal, biomass, plastics, municipal waste, and more, using gasification or pyrolysis processes. Gasification entails heating these materials under controlled oxygen levels and limited combustion to provide the necessary thermal energy.

Moreover, the resulting syngas composition varies based on the input feedstock. Syngas plays a crucial role in various industries, including the production of synthetic fuels, olefins for petrochemicals, and power generation. In power generation, syngas is utilized in combined-cycle power plants to generate electricity and heat. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Liquide: The company designs and engineers large-scale syngas production and purification units on-site at customer facilities.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Products and Chemicals Inc.

- Caloric Anlagenbau GmbH

- Chiyoda Corp.

- Dakota Gasification Co.

- EQTEC Plc

- Frontline BioEnergy LLC

- Honeywell International Inc.

- IHI Corp.

- Linde Plc

- McDermott International Ltd.

- Membrane Technology and Research Inc.

- Sierra Industrial Group

- SynGas Technology LLC

- Synthesis Energy Systems Inc.

- Topsoes AS

- W2 Energy Inc.

- Zachry Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is experiencing significant growth due to its increasing application in various sectors, including the production of chemicals, electricity, and transportation fuels. Syngas, or synthesis gas, is a mixture of hydrogen and carbon monoxide produced through various processes such as gasification of natural gas, biomass, and coal. The demand for Syngas is driven by its versatility as a feedstock for the production of chemicals like methanol, ammonia, and hydrogen. Syngas is also used as a fuel in gas engines and as a source of electricity through combined cycle power plants. In addition, Syngas is increasingly being used as a clean energy source for transportation, particularly in the form of green hydrogen. The transportation of Syngas is facilitated through various modes, including rail, marine, and road transport. The choice of transportation mode depends on the distance and volume of the Syngas being transported. For instance, rail transport is commonly used for large-scale Syngas transportation, while road transport is suitable for smaller volumes. Marine transport is also an option for long-distance transportation, particularly for countries with extensive coastlines. The production of Syngas involves different gasification technologies, including steam reforming, fluidized bed gasification, and fixed bed gasifiers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2024-2028 |

USD 330.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Liquide, Air Products and Chemicals Inc., Caloric Anlagenbau GmbH, Chiyoda Corp., Dakota Gasification Co., EQTEC Plc, Frontline BioEnergy LLC, Honeywell International Inc., IHI Corp., Linde Plc, McDermott International Ltd., Membrane Technology and Research Inc., Sierra Industrial Group, SynGas Technology LLC, Synthesis Energy Systems Inc., Topsoes AS, W2 Energy Inc., and Zachry Brands Inc. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch