Tampon Market Size 2024-2028

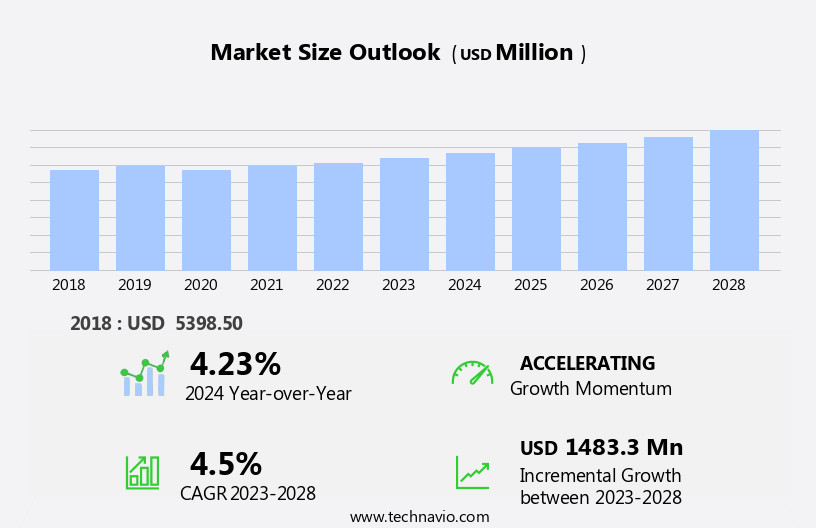

The tampon market size is forecast to increase by USD 1.48 billion at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Tampon Market During the Forecast Period?

How is this Tampon Industry segmented and which is the largest segment?

The tampon industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

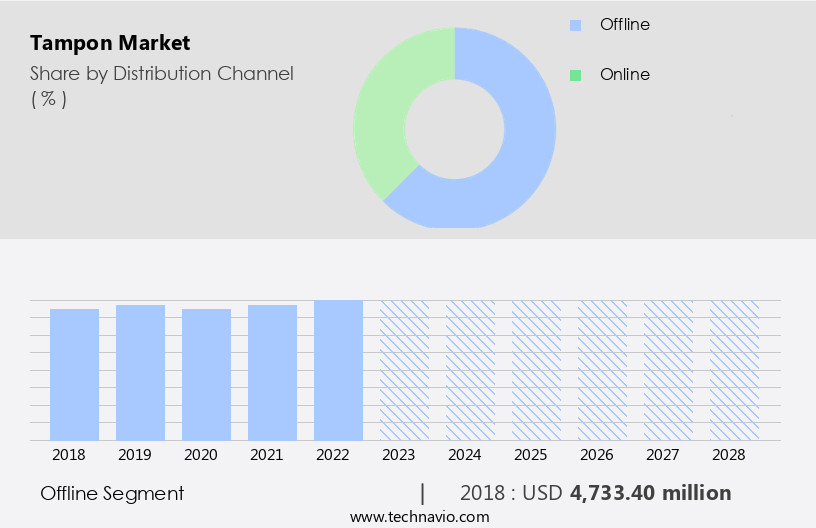

- The offline segment is estimated to witness significant growth during the forecast period.

The market caters to departmental stores, supermarkets, hypermarkets, pharmacies, and other retail channels. Major retailers, such as Walmart Inc., Walgreens Co., and CVS Pharmacy Inc., are capitalizing on the growing awareness of menstrual hygiene among modern women. This trend is driving demand for tampons in regional markets. companies are investing in physical stores to expand their reach, as increased traffic in retail spaces presents an opportunity for sales growth. The shift towards prioritizing personal hygiene is contributing to market expansion. Additionally, eCommerce channels and digital platforms are emerging as significant sales avenues, offering convenience and accessibility. Eco-friendly alternatives, such as those made from organic cotton, cardboard applicators, and biodegradable materials, are gaining traction due to environmental concerns and health-conscious consumer preferences.

Inclusion of tampons for people with disabilities, allergies, and sensitivities is also a developing trend. Subscription-based models and cultural factors, including traditions and regional differences, influence market dynamics. The holistic approach to self-care, emphasizing natural wellness and organic options, is shaping the competitive landscape. companies are innovating with product types, such as radially wound pledgets and rectangular/square pads, and material types, including rayon and plastic-free alternatives. The impact analysis reveals a growing demand for tampons, driven by changing societal norms, health considerations, and consumer preferences.

Get a glance at the Tampon Industry report of share of various segments Request Free Sample

The Offline segment was valued at USD 4.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

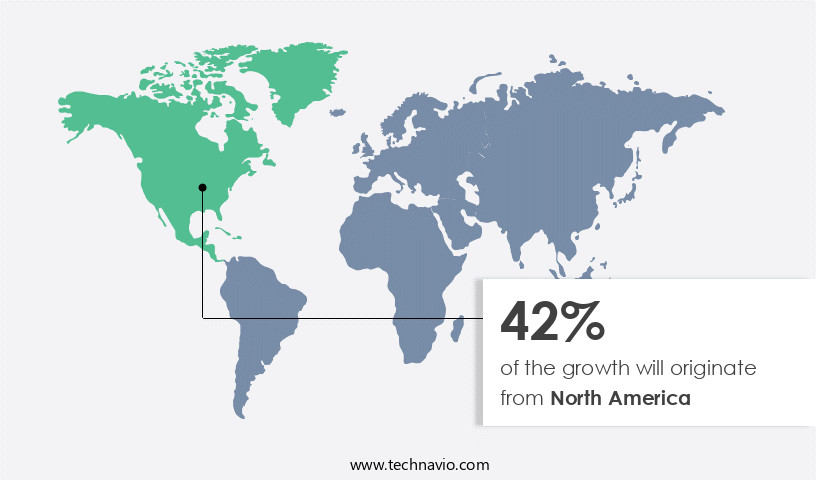

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing consistent growth due to the rising adoption and awareness of menstrual hygiene products among modern women. Canada and the United States are key markets, driven by their large populations of working women and travelers. Increased disposable income enables these women to prioritize their health and wellness through holistic self-care practices, including the use of tampons. Environmental concerns, such as plastic waste and degradation, have led to the demand for eco-friendly alternatives, including tampons made of organic cotton or biodegradable materials. Digital platforms and eCommerce channels have facilitated easy access to these products, further boosting market growth.

Cultural factors and traditions influence regional variations in tampon usage and product preferences. Brands offer inclusive tampon products catering to disabilities, allergies, sensitivities, and diverse menstrual cycles. Product innovations include applicator-free, fragrance-free, and blended tampons, as well as alternative menstrual solutions like sanitary pads. The market's development strategies focus on addressing societal taboos, expanding product lines, and catering to diverse consumer needs. Competitive scenarios and investment pockets include product type (applicator, cardboard, or plastic) and material type (cotton, rayon, or synthetic). The impact analysis considers environmental sustainability, health concerns, and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tampon Industry?

Rising cases of early puberty and awareness about hygiene products is the key driver of the market.

What are the market trends shaping the Tampon Industry?

Increasing popularity of organic feminine hygiene products is the upcoming market trend.

What challenges does the Tampon Industry face during its growth?

High availability of substitutes is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The tampon market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tampon market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tampon market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aunt Flow Corp. - The company caters to the market with a range of organic options, including regular applicator, super applicator, and non-applicator tampons. These eco-friendly alternatives cater to consumers seeking natural menstrual solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aunt Flow Corp.

- Bodywise Ltd.

- Calla Lily Personal Care Ltd.

- Corman SpA

- COTTON HIGH TECH SL

- DAME

- Daye Ltd.

- Edgewell Personal Care Co.

- First Quality Enterprises Inc.

- Johnson and Johnson Services Inc.

- Kimberly Clark Corp.

- Lil lets UK Ltd.

- LYV Life Inc.

- The Procter and Gamble Co.

- TOTM Ltd.

- TPC Inc.

- TZMO SA

- Unicharm Corp.

- W2W Partners LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The menstrual hygiene market encompasses a range of products designed to address the needs of modern women during their monthly cycles. This market is driven by various factors, including the growing awareness of environmental degradation and the desire for eco-friendly alternatives. Historically, tampons have been a popular choice among women due to their convenience and discreetness. However, concerns regarding plastic waste and environmental degradation have led to a shift towards more sustainable options. As a result, there has been a surge In the demand for tampons made from natural materials such as cotton and rayon, as well as those with applicators made from cardboard.

Moreover, the rise of digital platforms and ecommerce channels has made it easier for consumers to access these eco-friendly alternatives. Brands have responded to this trend by offering inclusive tampon products catering to the needs of women with disabilities, allergies, and sensitivities. Despite these advancements, societal taboos surrounding menstruation continue to persist in certain regions and communities. This has led to a growing emphasis on holistic self-care practices and natural wellness, with many women turning to organic tampon options as part of their overall health and wellness routines. Product innovations In the menstrual hygiene market include the use of biodegradable materials, such as radially wound pledgets and rectangular/square pads, which offer a more sustainable alternative to traditional tampons and sanitary pads.

Additionally, some brands have introduced blended product types and material types to cater to the diverse needs of consumers. The competitive scenario In the menstrual hygiene market is characterized by a high degree of product differentiation and innovation. Brands are focusing on development strategies that cater to the evolving needs and preferences of consumers, while also addressing concerns related to product safety and sustainability. Investment pockets In the menstrual hygiene market include companies that specialize In the production and distribution of eco-friendly tampons and sanitary pads, as well as those that offer subscription-based models to make it easier for consumers to access these products on a regular basis.

Despite the growing demand for eco-friendly alternatives, there are still challenges related to the adoption of these products. These include concerns regarding cost, availability, and cultural traditions that may influence women's choices. In conclusion, the menstrual hygiene market is undergoing significant changes as consumers become more conscious of the environmental impact of their choices and seek out more sustainable options. Brands are responding to these trends by offering a range of eco-friendly alternatives, while also addressing the diverse needs and preferences of consumers. The market is expected to continue to evolve as societal attitudes towards menstruation shift and new product innovations emerge.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1483.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, UK, Germany, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tampon Market Research and Growth Report?

- CAGR of the Tampon industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tampon market growth of industry companies

We can help! Our analysts can customize this tampon market research report to meet your requirements.