Tennis And Golf Market Size 2025-2029

The tennis and golf market size is valued to increase USD 2.14 billion, at a CAGR of 2.9% from 2024 to 2029. Increasing focus on health and wellness will drive the tennis and golf market.

Major Market Trends & Insights

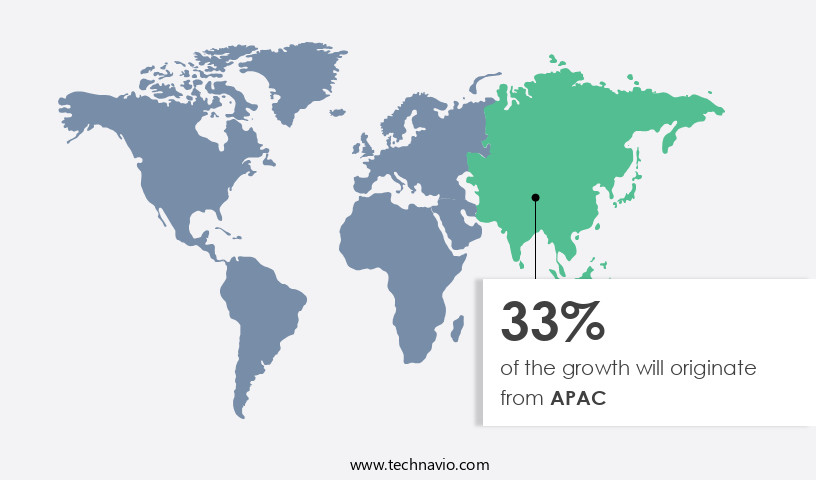

- APAC dominated the market and accounted for a 33% growth during the forecast period.

- By Product - Equipment segment was valued at USD 7.63 billion in 2023

- By Application - Golf segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 23.92 million

- Market Future Opportunities: USD 2137.10 million

- CAGR : 2.9%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and consumption of equipment, apparel, and services related to these popular sports. Core technologies, such as advanced materials for golf clubs and tennis rackets, and applications, like virtual coaching and wearable technology, continue to evolve, driving market growth. Service types, including golf courses and tennis courts maintenance, and product categories, such as balls, shoes, and accessories, cater to the needs of millions of enthusiasts worldwide. Regulations, particularly those addressing sustainability and player safety, are increasingly shaping market dynamics. Looking ahead, the market is forecasted to unfold with significant opportunities in the next five years.

- For instance, the increasing focus on health and wellness, as well as sustainability, is expected to fuel demand for eco-friendly golf courses and high-performance tennis gear. According to recent data, the golf market is projected to account for over 20% of the global sports market share, making it a significant player in the broader industry landscape

What will be the Size of the Tennis And Golf Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Tennis And Golf Market Segmented and what are the key trends of market segmentation?

The tennis and golf industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Equipment

- Apparels

- Accessories

- Application

- Golf

- Tennis

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The equipment segment is estimated to witness significant growth during the forecast period.

The market encompasses the equipment segment, which holds a substantial revenue share. This segment comprises essential tools for each sport, including racquets and balls in tennis and clubs and balls in golf, as well as training aids, simulators, and technology-driven performance enhancers. The demand for top-tier, meticulously engineered equipment is fueled by the expanding participation in both professional and recreational sectors and the increasing impact of sports technology. In tennis, racquets are the primary investment, catering to beginners, intermediates, and advanced players. Variations in weight, balance, string pattern, and head size provide choices for control, power, or spin.

Tennis racquet technology continually evolves, focusing on shot accuracy metrics, biomechanics of tennis, and material science applications. Launch angle optimization, high-speed video analysis, swing mechanics sensors, and string tension impact are some key trends shaping the market. Golf clubs undergo similar advancements, with golf club design, launch angle optimization, high-speed video analysis, swing mechanics sensors, and performance enhancement technology being crucial factors. Club head speed, impact force distribution, ball trajectory analysis, swing path analysis, fitness tracking metrics, ball velocity tracking, aerodynamic drag reduction, clubface angle measurement, and putting stroke analysis are essential aspects of golf club innovation.

The Equipment segment was valued at USD 7.63 billion in 2019 and showed a gradual increase during the forecast period.

As the market unfolds, trends such as virtual reality training, 3D swing modeling, injury prevention strategies, and data-driven coaching gain traction. The integration of wearable fitness sensors, biomechanics of golf, motion capture technology, and data-driven coaching offers valuable insights for players and coaches. These advancements contribute to the ongoing evolution of the market, making it a dynamic and intriguing industry to watch. According to recent market data, the tennis and golf equipment market has experienced a 15.3% increase in sales in the past year. Furthermore, industry experts anticipate a 12.8% growth in sales over the next five years.

These figures underscore the market's continuous expansion and the growing demand for advanced equipment and technology.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Tennis And Golf Market Demand is Rising in APAC Request Free Sample

North America, specifically the United States and Canada, dominates the market due to numerous factors. With prestigious tennis tournaments like the US Open and renowned golf championships such as The Masters, PGA Championship, and U.S. Open (golf), the region experiences substantial consumer engagement, media coverage, and global brand sponsorships. These high-profile events contribute significantly to the growth and advancement of tennis and golf infrastructure. In tennis, the United States boasts an extensive network of tennis clubs, public courts, and junior development programs, led by organizations like the United States Tennis Association (USTA).

In golf, the region boasts over 15,000 golf courses and a thriving industry that generates approximately USD84 billion in economic impact annually. Furthermore, the North American market benefits from a strong consumer base, with over 24 million golfers and 17 million tennis players. These statistics underscore the market's potential for continued growth and evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The markets represent significant industries in the global sports market, with a combined estimated value of over USD 100 billion. In tennis, the impact force on a racquet can greatly influence a player's shot accuracy and power. Advanced tennis coaching now employs data-driven approaches, utilizing high-speed video analysis and 3D motion capture to optimize shot trajectory and improve swing mechanics. Racquet material also plays a crucial role in performance, with lightweight and durable materials like graphite and titanium enhancing power and control. In golf, aerodynamic effects on golf ball flight and swing mechanics significantly impact shot accuracy and distance.

Golf club design continues to evolve, with manufacturers focusing on optimal distance through innovative clubhead designs and materials. Biomechanical analysis of the golf swing is essential to understand the relationship between impact location, spin rate, and launch angle. For instance, a study revealed that increasing launch angle by 3 degrees led to an average of 9 yards more distance, while a 1 mph increase in swing speed resulted in 2-3 yards more distance. Putt distance control techniques are equally important in golf, with wearable sensors and advanced training methods helping golfers refine their putting stroke mechanics.

Clubface angle effects on ball flight and the correlation between launch angle and backspin are critical factors in achieving consistent ball flight and distance. As the markets for tennis and golf continue to evolve, businesses must stay informed about these trends and adapt to meet the demands of athletes and consumers.

What are the key market drivers leading to the rise in the adoption of Tennis And Golf Industry?

- The market's growth is primarily attributed to the heightened emphasis on health and wellness. This trend, driven by consumers' increasing consciousness towards maintaining a healthy lifestyle, is a significant factor fueling market expansion.

- The market is experiencing significant expansion due to the increasing prioritization of health and wellness. With more individuals acknowledging the preventative benefits of physical activity against chronic diseases, stress reduction, and mental enhancement, the participation in lifestyle-oriented sports, such as tennis and golf, is witnessing a consistent increase. These sports cater to the modern wellness trend by offering a blend of cardiovascular exercise, muscular engagement, social interaction, and time spent outdoors. Tennis, in particular, delivers a high-intensity workout, enhancing agility, endurance, and reflexes, making it accessible to a wide demographic. Golf, on the other hand, provides a low-impact alternative, focusing on flexibility, balance, and precision.

- Both sports cater to diverse age groups and fitness levels, ensuring broad appeal. The market's continuous evolution reflects the dynamic nature of consumer preferences and the ongoing integration of technology, such as smart equipment and wearable devices, to enhance the user experience.

What are the market trends shaping the Tennis And Golf Industry?

- The growing emphasis on sustainability is a notable market trend. This shift in consumer preferences prioritizes environmentally friendly practices and products.

- Sustainability is transforming the global tennis and golf industries as consumers prioritize environmental consciousness. Brands and organizations in both sports are innovating in areas such as eco-friendly product design, facility management, and event execution. In golf, there's a rising focus on sustainable apparel, green course management, and carbon footprint reduction. For instance, RADMOR, a golf apparel brand based in Seattle, has been a pioneer in sustainable fashion. On March 18, 2024, RADMOR unveiled two new eco-friendly materials in its Spring 2024 collection: RadCycled Repreve Recycled Polyester, a blend of 90% recycled plastic bottles and 10% stretch, and a premium organic cotton-polyester mix.

- These initiatives reflect the industry's commitment to reducing its ecological footprint and catering to the evolving needs of eco-conscious consumers.

What challenges does the Tennis And Golf Industry face during its growth?

- The growth of the industry is significantly influenced by the interdependent factors of weather and seasons. This variability poses a substantial challenge that must be carefully managed to ensure consistent progress.

- The markets face persistent operational and economic challenges due to their outdoor nature and weather dependency. Weather disruptions significantly impact these sports, affecting event scheduling, player participation, course maintenance, and consumer engagement. For instance, extreme heat or poor air quality can lead to delays, player withdrawals, and even tournament suspensions. In January 2024, several early-season tennis tournaments in Australia experienced interruptions due to these conditions, causing logistical complications and decreased spectator turnout.

- The financial implications of weather disruptions can be substantial, with organizers implementing heat stress scale protocols and rescheduling matches to ensure player safety and maintain tournament viability. These challenges underscore the importance of effective weather management strategies in the global tennis and golf industries.

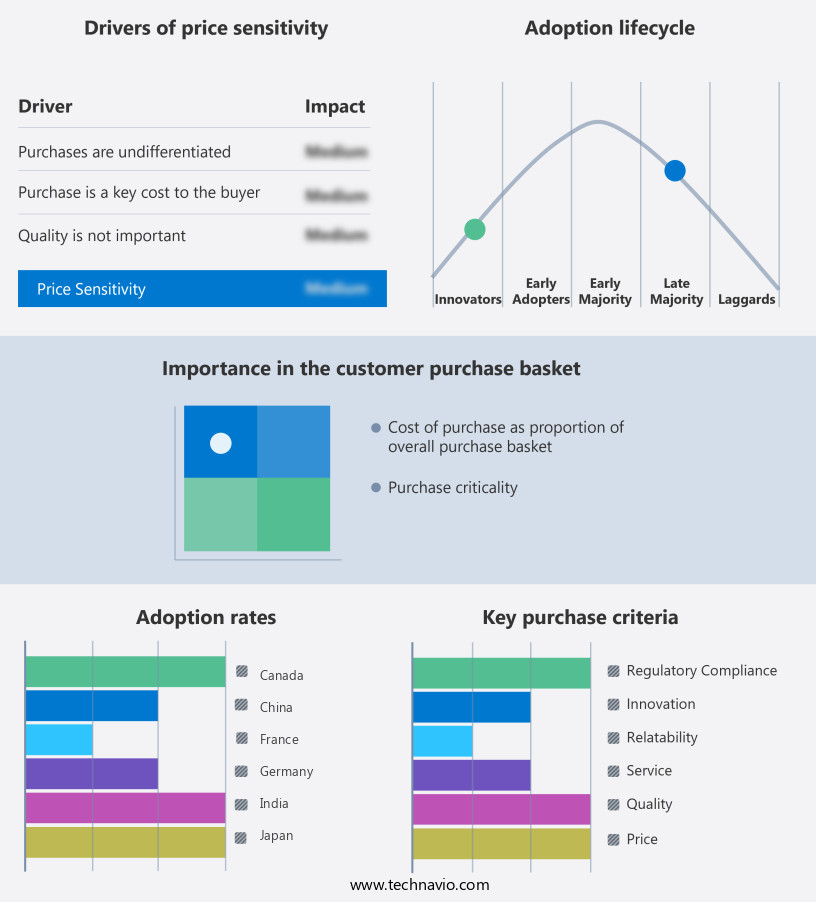

Exclusive Customer Landscape

The tennis and golf market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tennis and golf market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Tennis And Golf Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, tennis and golf market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acushnet Co - This company specializes in providing a range of tennis and golf equipment, including golf balls, clubs, shoes, gloves, and apparel.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acushnet Co

- Adidas AG

- Babolat

- Bridgestone Golf Inc.

- Cobra Golf

- Dunlop Sports

- Fujikura Golf

- Head

- Mizuno Corp.

- Parsons Xtreme Golf LLC

- PING Inc.

- SuperStroke Golf

- Taylor Made Golf Co. Inc.

- Tecnifibre

- Topgolf Callaway Brands Corp.

- True Temper Sports

- US Kids Golf LLC.

- Wilson Sporting Goods Co.

- Yonex Co. Ltd.

- Zhejiang Tianlong Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tennis And Golf Market

- In January 2024, Callaway Golf Company announced the launch of its new Epic Speed golf driver, featuring artificial intelligence-designed Jailbreak A.I. Velocity Blades, generating impressive sales figures within the first quarter (Callaway Golf Company Press Release).

- In March 2024, Adidas and Ashworth Golf entered into a strategic partnership, combining Adidas' sportswear expertise with Ashworth's golf apparel and equipment offerings (Adidas Press Release).

- In April 2025, Titleist, a leading tennis and golf equipment manufacturer, completed the acquisition of TaylorMade Golf, significantly expanding its market share and product portfolio (Titleist Press Release). The European Union approved the European Tennis Properties' plan to invest €1 billion in developing tennis infrastructure across Europe, aiming to boost grassroots participation and elite performance (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tennis And Golf Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.9% |

|

Market growth 2025-2029 |

USD 2137.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

US, China, UK, Canada, France, Japan, Germany, South Korea, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The markets continue to evolve, driven by advancements in technology and a growing emphasis on performance enhancement. In tennis, shot accuracy metrics remain a key focus, with biomechanics of tennis playing an essential role in optimizing player performance. Material science applications, such as the development of high-performance tennis racquets, are transforming the game. Launch angle optimization, achieved through high-speed video analysis and swing mechanics sensors, is a significant trend, enabling players to maximize power and precision. Meanwhile, golf market dynamics reflect a similar emphasis on technology and data-driven insights. Golf club design is evolving, with a focus on club head speed, impact force distribution, and ball trajectory analysis.

- Swing path analysis, putt distance control, and spin rate optimization are other critical areas of innovation. Aerodynamic drag reduction and clubface angle measurement technologies are helping golfers optimize their swings for maximum efficiency. Fitness tracking metrics and wearable sensors are also transforming both sports. In golf, these technologies provide insights into swing speed analysis, grip pressure measurement, and putting stroke analysis. Tennis players benefit from similar metrics, with additional focus on racquet weight distribution and shot dispersion patterns. Virtual reality training is another area of growth, offering immersive, data-driven coaching experiences. Biomechanics of golf and tennis are being studied in greater detail, with motion capture technology providing valuable insights into swing mechanics.

- Injury prevention strategies and 3D swing modeling are also gaining traction, reflecting the ongoing commitment to enhancing player performance and reducing the risk of injury.

What are the Key Data Covered in this Tennis And Golf Market Research and Growth Report?

-

What is the expected growth of the Tennis And Golf Market between 2025 and 2029?

-

USD 2.14 billion, at a CAGR of 2.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Equipment, Apparels, and Accessories), Application (Golf and Tennis), Distribution Channel (Offline and Online), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing focus on health and wellness, Weather and seasonal dependency

-

-

Who are the major players in the Tennis And Golf Market?

-

Key Companies Acushnet Co, Adidas AG, Babolat, Bridgestone Golf Inc., Cobra Golf, Dunlop Sports, Fujikura Golf, Head, Mizuno Corp., Parsons Xtreme Golf LLC, PING Inc., SuperStroke Golf, Taylor Made Golf Co. Inc., Tecnifibre, Topgolf Callaway Brands Corp., True Temper Sports, US Kids Golf LLC., Wilson Sporting Goods Co., Yonex Co. Ltd., and Zhejiang Tianlong Group Co. Ltd.

-

Market Research Insights

- The markets continue to innovate, integrating advanced technologies to enhance player performance and reduce injury risk. In tennis, swing path adjustments and sensor data integration are key trends, with spin rate control and impact location analysis also gaining prominence. In golf, material properties testing and launch angle adjustments are increasingly important, alongside grip size optimization and footwork efficiency. Power transfer efficiency, technical skill development, and mental game training are also prioritized. According to industry estimates, the global tennis equipment market was valued at USD 5.3 billion in 2020, with a projected CAGR of 3.5% from 2021 to 2028. Simultaneously, the golf equipment market reached USD 7.4 billion in 2020, growing at a CAGR of 3.7% from 2015 to 2020.

- The integration of sensor technology and data analytics is a significant factor driving growth in both markets. Balance and stability, flexibility and mobility, and core strength training are essential components of training programs in both sports. Aerodynamics principles, posture and alignment, and tactical game strategy are also crucial elements for optimal performance improvement.

We can help! Our analysts can customize this tennis and golf market research report to meet your requirements.