Thermal Printing Market Size 2025-2029

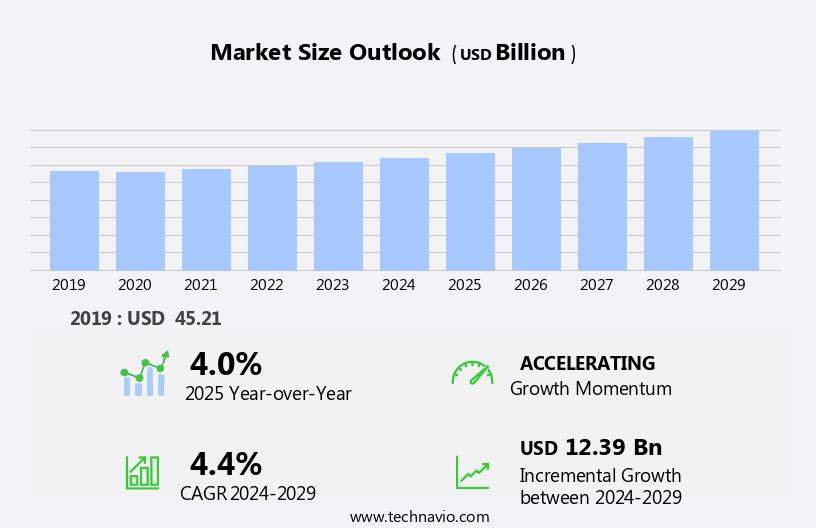

The thermal printing market size is forecast to increase by USD 12.39 billion, at a CAGR of 4.4% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. The increasing e-commerce industry is driving the demand for thermal printing technology as it is widely used in shipping and logistics for labeling and tracking purposes. Product innovations, such as the development of thermal printers with higher print resolution and faster print speeds, are also contributing to market growth. Furthermore, the availability of viable alternatives, such as inkjet and laser printing, is pushing thermal printing manufacturers to improve their offerings and offer competitive pricing. These trends are expected to continue shaping the market in the coming years. However, challenges such as the high initial investment cost and the need for regular maintenance and replacement of thermal print heads may hinder market growth.

What will be the Size of the Market During the Forecast Period?

- The market in the healthcare sector is witnessing significant growth due to the increasing demand for patient flow optimization and improved healthcare data management. Thermal printer software solutions are increasingly being adopted for their ability to provide cost-effective, on-demand label printing for various applications, including patient identification systems, medicine allergy labels, and RFID tag printing. Wireless printing solutions are gaining popularity in healthcare settings due to their convenience and mobility. These solutions enable remote data capture and integration with mobile Point of Sale (POS) systems, healthcare data management software, and mobile workforce solutions. Healthcare asset tracking is another area where thermal printing plays a crucial role, with RFID label printers being used to create high-resolution graphics labels for asset tracking and management.

- RFID label design is an essential aspect of thermal printing in healthcare, as these labels are used to capture and manage critical data related to patient identification, medicine allergies, and product tracking. Barcode printing solutions are also widely used in healthcare for data capture and patient data management. The use of barcode technology enables quick and accurate data entry and reduces the risk of errors, making it an essential component of healthcare data management. Mobile printing and mobile device management are becoming increasingly important in healthcare, with mobile devices being used extensively for data collection and patient tracking. Mobile device accessories, such as barcode scanners and mobile pos systems, are being integrated with thermal printer software to provide mobile workforce solutions that enable healthcare professionals to access critical information on the go.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Industrial format

- Desktop format

- Mobile format

- Technology

- Direct thermal (DT)

- Thermal transfer (TT)

- Dye diffusion thermal transfer (D2T2)

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

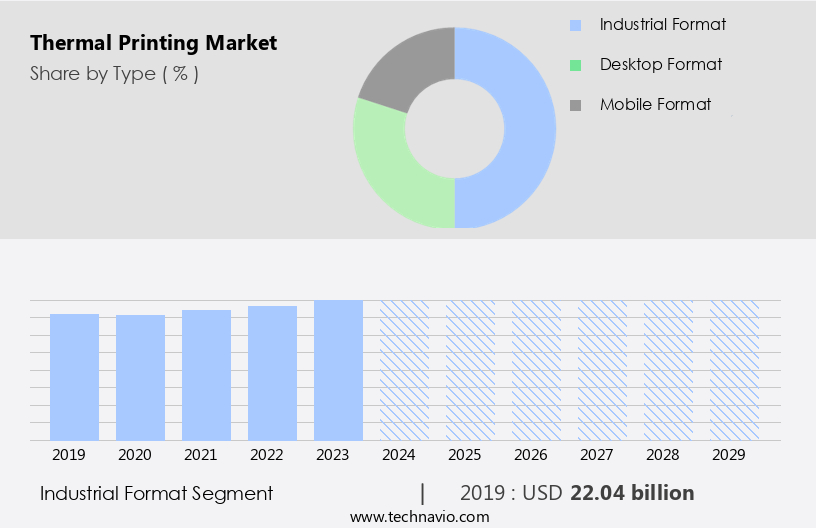

- The industrial format segment is estimated to witness significant growth during the forecast period.

The market is witnessing notable growth due to technological advancements and strategic partnerships. An illustrative collaboration occurred in January 2023 between Brother Mobile Solutions and TEKLYNX. Brother Mobile Solutions, a prominent supplier of mobile, desktop, and industrial printing solutions, joined forces with TEKLYNX, a global leader in barcode label software. This partnership significantly enhances Brother Mobile Solutions' range of commercial and industrial thermal barcode label printers, making them fully compatible with TEKLYNX software solutions. This development enables enterprises to design and print barcode labels that adhere to industry standards, thereby expanding Brother Mobile Solutions' product offerings and catering to the increasing demand for advanced digital packaging and labeling solutions. The partnership underscores the industry's ongoing evolution, driven by technological innovations and strategic alliances.

Get a glance at the market report of share of various segments Request Free Sample

The industrial format segment was valued at USD 22.04 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

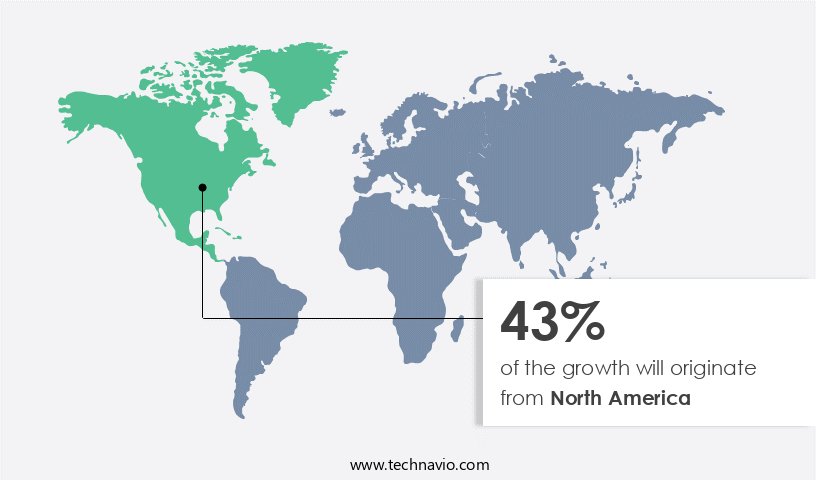

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is a substantial segment of the global thermal printing industry, fueled by technological innovations and the requirement for productive printing solutions across numerous industries. In June 2024, Epson unveiled the TM-m30III Thermal Receipt Printer in the US, marking a significant milestone in the regional market. Designed for the Retail and Food and Beverage sectors, this advanced POS printer from Epson is engineered to optimize business operations and enhance customer experience. Its features include versatility, efficiency, and ease of use, making it an indispensable tool for companies aiming to streamline their service delivery and workflows. The introduction of RFID-printed labels and RFID technology in the TM-m30III further boosts its appeal, offering cost-effective solutions for businesses seeking to automate their processes and reduce manual labor.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

Increasing e-commerce growth is the key driver of the market.

- The market is experiencing significant growth due to the increasing reliance on e-commerce. In 2023, e-commerce sales reached an all-time high of USD 1.119 trillion, accounting for 22.0% of total retail sales. This trend is driven by the convenience and accessibility of online shopping, which has become increasingly important during nationwide lockdowns. Thermal printing solutions play a crucial role in this market, providing efficient and reliable labeling, packaging, and shipping solutions. In the healthcare sector, RFID-printed labels and tags are gaining popularity for their functionality and data capture capabilities. Impact printers are commonly used in healthcare applications for printing patient labels, invoices, and receipts.

- These printers offer cost-effectiveness and inexpensive supplies, making them an attractive option for production centers and retail stores. Moreover, the adoption of wireless technologies such as Bluetooth and Wi-Fi, as well as mobile printers and handheld terminals, has facilitated on-demand printing and automatic identification in various industries. The use of RFID and barcode technology has further enhanced the efficacy of data capture and asset allocation. Value-added products such as personal digital assistants and intelligent printing systems have also gained traction in the market. These innovations offer user-friendly interfaces and improved functionality, making thermal printing solutions more appealing to businesses and consumers alike.

What are the market trends shaping the market?

Product innovations are the upcoming trend in the market.

- The market is experiencing notable progress, with a focus on creating cost-effective solutions for various industries. One significant innovation was introduced by Domino Printing Sciences in June 2024, combining thermal inkjet (TIJ) technology with thermal transfer overprinting (TTO) systems. This new technology, part of the Domino Gx-Series range, is designed for use in flexible packaging lines, including those in the food sector. By integrating TIJ into TTO, Domino offers a more efficient alternative to traditional TTO, providing clear and reliable printing of 1, 2, or 4 lines of text and small 2D codes up to 10 square millimeters. This advancement addresses the increasing need for high-quality, traceable printing solutions in flexible packaging, improving operational efficiency and enhancing product security.

- Additionally, the adoption of RFID-printed labels, on-demand printing, and automatic identification technologies is transforming industries such as healthcare, retail, and transportation distribution networks. These innovations enable value-added products like RFID tags and mobile printers, allowing for real-time data capture and wireless communication through technologies like Bluetooth and Wi-Fi. Furthermore, the integration of RFID, barcode, and wireless technologies into point-of-sale (POS) systems, handheld terminals, and mobile information devices has streamlined commerce, enhancing the user experience and ensuring cost-effectiveness. In healthcare applications, thermal printing is crucial for patient flow management, labeling, and invoicing, with impact printers and portable printers being essential tools for medical facilities.

What challenges does the market face during the growth?

The availability of viable alternatives is a key challenge affecting the market growth.

- The market is experiencing competition from alternative label printing technologies, such as digital and laser printing. Digital printing, in particular, is gaining popularity due to its advantages, including faster turnaround times, lower setup costs, and the ability to print small to medium batches with intricate designs and variable data. This technology utilizes digital printing processes, making it a versatile and dynamic alternative to traditional thermal printing. Another contender is laser printing technology, which offers benefits like higher print resolution, longer label life, and the ability to print on various substrates. Both digital and laser printing technologies are impacting the market, leading to commoditization and price pressure.

- In the retail sector, RFID-printed labels are gaining traction due to their ability to enhance data capture and automate inventory management. RFID tags can be printed on-demand using mobile or portable printers, allowing for real-time inventory tracking and improved supply chain efficiency. POS systems, including impact printers, handheld terminals, and Android or Windows-based devices, are also driving the market for thermal printing. These systems offer cost-effectiveness, functionality, and user experience, making them essential for retail stores and production centers. Furthermore, wireless technologies like Bluetooth and Wi-Fi are enabling the integration of mobile information devices, such as iPads and personal digital assistants, with thermal printers.

- This integration is enhancing the user experience and improving the efficiency of data capture in various industries, including healthcare and transportation distribution networks. Healthcare applications, such as patient flow and asset allocation, are also driving the demand for thermal printing. Thermal printers offer efficacy, product security, and data capture capabilities, making them essential for healthcare facilities. In conclusion, the market is facing challenges from alternative label printing technologies, digital and laser printing, which offer faster turnaround times, reduced setup costs, and higher print resolution. However, thermal printing continues to be a crucial technology for various industries due to its cost-effectiveness, functionality, and data capture capabilities.

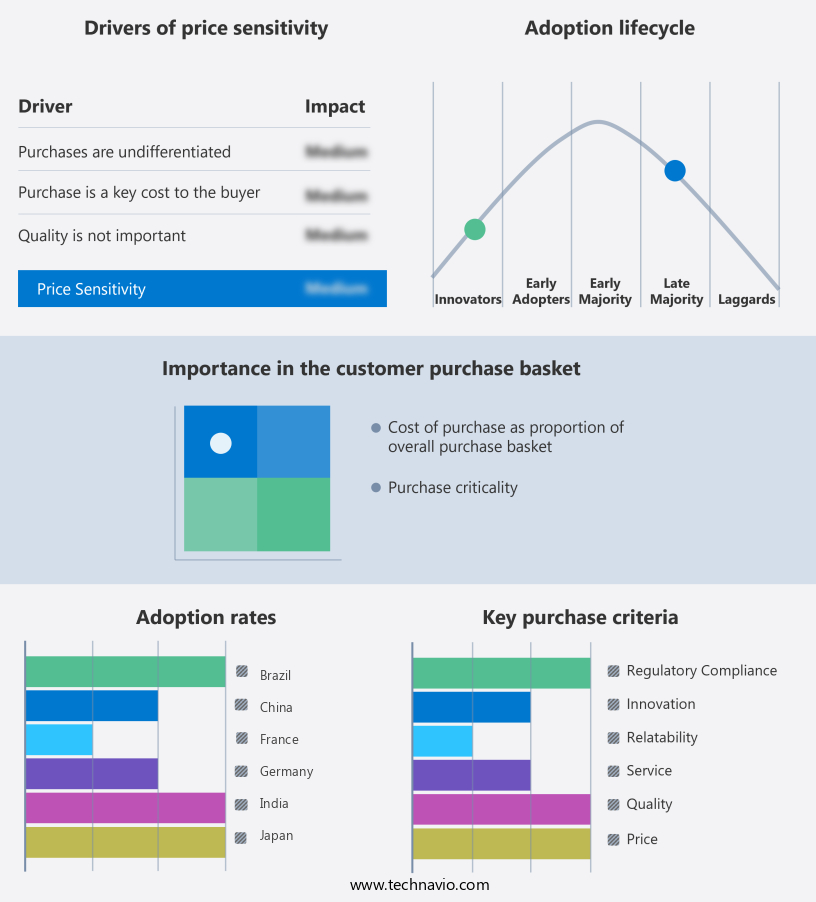

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Avery Dennison Corp. - This company offers thermal printing solutions including direct thermal and thermal transfer label materials.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axiohm

- BIXOLON CO. LTD.

- Brother Industries Ltd.

- Datalogic SpA

- Fujitsu Ltd.

- Honeywell International Inc.

- HP Inc.

- Konica Minolta Inc.

- Motorola Solutions Inc.

- Printronix

- Rongta Technology (Xiamen) Group Co. Ltd.

- SATO Holdings Corp.

- Seiko Epson Corp.

- Star Micronics Co. Ltd.

- Toshiba Tec Corp.

- TSC Auto ID Technology Co. Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for cost-effective and efficient printing solutions. This market caters to various industries, including healthcare, retail, and logistics, among others, by providing on-demand printing capabilities for various applications. One of the key drivers fueling the market is the commoditization of supplies. Inexpensive thermal printing supplies have become readily available, making it an attractive option for businesses seeking to minimize their printing costs. This trend is particularly noticeable in industries such as retail, where the use of RFID-printed labels for inventory management and POS systems is becoming increasingly common.

Further, another trend shaping the market is the integration of data capture innovations. The use of RFID technology in thermal printing has gained popularity due to its ability to capture and transmit data wirelessly. This technology is particularly useful in healthcare applications, where patient flow and asset allocation are critical. RFID-enabled thermal printers can print labels with unique identifiers, enabling automatic identification and tracking of patients and assets. Moreover, the adoption of wireless technologies such as Bluetooth and Wi-Fi in thermal printers is on the rise. This trend is driven by the growing need for mobility and flexibility in various industries, including retail and healthcare.

Moreover, mobile printers and handheld terminals equipped with these technologies enable users to print labels and receipts on-the-go, improving user experience and increasing efficiency. The infrastructure requirements for thermal printing are also evolving. The use of Android and Windows operating systems in thermal printers is becoming more common, providing users with greater flexibility and compatibility with various devices and applications. Additionally, the development of ultra-slim and portable printers is catering to the needs of businesses that require printing capabilities on the go. The cost-effectiveness of thermal printing is another factor contributing to its popularity. Thermal printing eliminates the need for ink cartridges, making it a more cost-effective option compared to other printing technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 12.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, South Korea, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch