Thermoplastic Elastomers Market Size 2024-2028

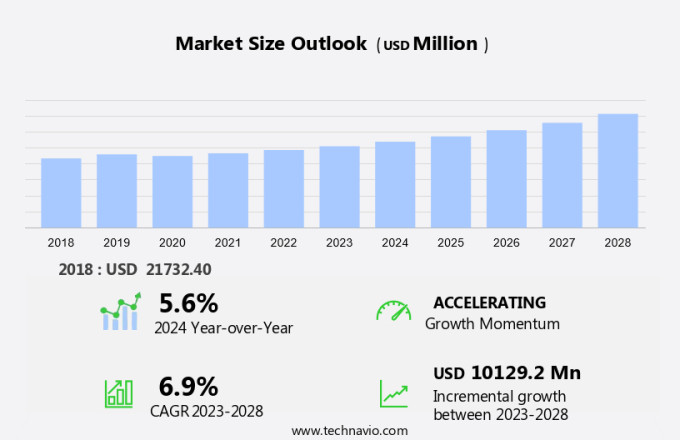

The thermoplastic elastomers market size is forecast to increase by USD 10.13 billion at a CAGR of 6.9% between 2023 and 2028.

- The thermoplastic elastomers (TPE) market is experiencing significant growth, driven by the increasing demand for lightweight materials in various industries. Mechanical performance and energy efficiency are key factors fueling this trend, particularly in the construction and automotive sectors. In the automotive industry, the shift towards hybrid and electric vehicles is driving the adoption of TPEs due to their reduced emissions and improved energy efficiency.

- Furthermore, the growing focus on emission reduction and sustainability is leading to an increased preference for recyclable materials in TPE production. TPEs are also widely used in gaskets, wire insulation, and interior applications due to their excellent mechanical properties and lightweight characteristics. The market is further driven by regulatory pressures, such as those associated with the European Union's REACH regulations, which have led to increased investment in TPE manufacturing plants. Overall, the TPE market is poised for continued growth as it addresses the evolving needs of industries for high-performance, sustainable, and cost-effective materials.

What will be the Size of the Market During the Forecast Period?

- Thermoplastic elastomers (TPEs), a class of polymers, offer the benefits of both thermoplastics and elastomers. These materials exhibit the processability of thermoplastics and the elastic properties of rubber, making them an attractive alternative to conventional materials in various industries. In the automotive sector, TPEs have gained significant traction due to their lightweight properties. The increasing demand for lightweight vehicles, particularly in the MUV/SUV models, has led automakers to explore materials that can help reduce vehicle weight without compromising safety and performance. TPEs, with their high strength-to-weight ratio, are an ideal choice for manufacturing automotive components such as bumpers, seals, and interior components.

- Furthermore, the automotive industry isn't the only sector benefiting from TPEs. In the electric vehicle (EV) market, these materials play a crucial role in improving energy efficiency and reducing carbon emissions and greenhouse gases (GHG). TPEs are used in the production of EV batteries, gaskets, wire insulation, and connectors, contributing to the overall performance and longevity of the vehicles. Consumer electronics, another thriving industry, also leverages TPEs for their aesthetic appeal and functionality. TPEs are extensively used in manufacturing mobile phone cases, cables, and connectors due to their flexibility, durability, and resistance to impact and abrasion. Food packaging is another significant application area for TPEs.

- Moreover, high-quality films made from TPEs offer excellent barrier properties, ensuring the freshness and shelf life of various food items. TPE films are increasingly being preferred over conventional materials due to their lightweight properties and lower carbon footprint. The healthcare sector is another industry that benefits from TPEs. These materials are used in the production of medical devices, gaskets, and seals due to their biocompatibility, flexibility, and resistance to chemicals and temperature variations. Compared to conventional materials like polyethylene and thermoplastic vulcanizates (TPVs), TPEs offer several advantages. TPEs have a lower density, making them lighter and easier to transport and process.

- In conclusion, they also have better energy efficiency and contribute to reduced emissions during manufacturing and use. In conclusion, TPEs are versatile materials that offer numerous benefits, including lightweight properties, flexibility, durability, and biocompatibility. They are increasingly being adopted across various industries, including automotive, consumer electronics, food packaging, and healthcare, to improve product performance, reduce carbon footprint, and enhance overall sustainability.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Poly styrenes

- Poly olefins

- Poly urethanes

- Poly esters

- Others

- End-user

- Automotive

- Electrical and electronics

- Construction

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Singapore

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Product Insights

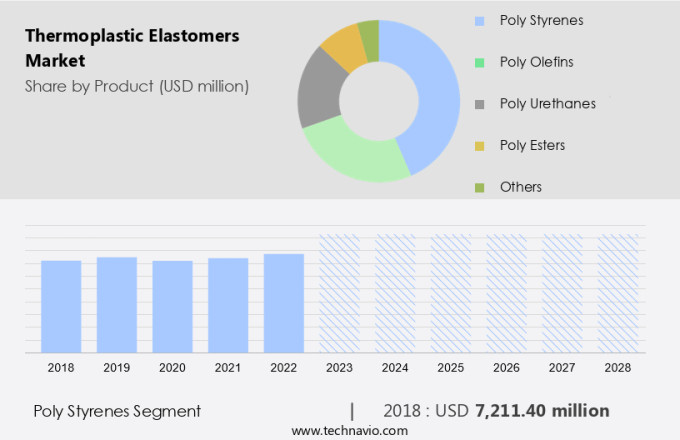

- The poly styrenes segment is estimated to witness significant growth during the forecast period.

The thermoplastic elastomers (TPE) market is experiencing notable progress and expansion, notably in the polystyrenes segment. Polystyrenes, recognized for their flexibility and adaptability, are increasingly being adopted for various applications, such as food contact packaging. This sector is thriving due to technological innovations in recycling and the emergence of eco-friendly alternatives. For instance, in July 2024, Versalis, the chemical division of Eni, an Italian energy corporation, launched a new line of recycled polystyrene tailored for food contact packaging within Italy. This announcement signifies the industry's transition towards sustainability and the escalating demand for environmentally-friendly materials. Versalis' recycled polystyrene offering is anticipated to cater to the burgeoning consumer preference for sustainable packaging solutions, thereby fueling market expansion.

In the realm of TPEs, conventional materials like polyethylene, polyvinyl chloride (PVC), rubbers, and polyurethane continue to dominate. However, there is a growing trend towards biobased TPEs derived from renewable resources. Biobased TPEs, such as those derived from biopolymers and corn starch, offer the benefits of biodegradability and reduced reliance on non-renewable resources. Leading industry players like Lubrizol are actively investing in research and development to expand their biobased TPE portfolios. These advancements are expected to shape the future of the TPE market, as sustainability becomes a key priority for consumers and businesses alike.

Get a glance at the market report of share of various segments Request Free Sample

The poly styrenes segment was valued at USD 7.21 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

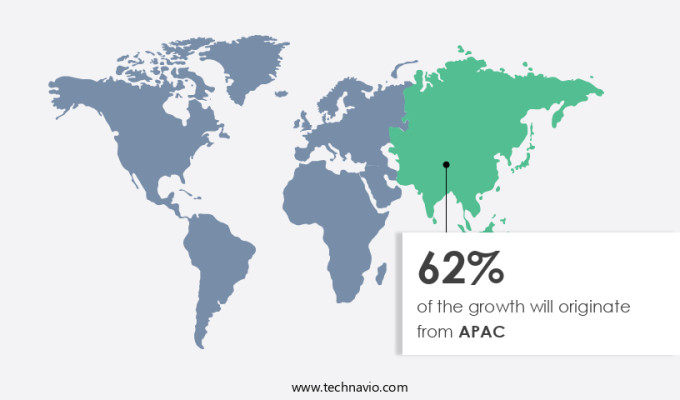

- APAC is estimated to contribute 62% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific market for thermoplastic elastomers (TPEs) is witnessing notable expansion due to escalating demand and substantial investments in this region. Key industries, including automotive and healthcare, are fueling this growth. In the automotive sector, TPEs are increasingly being utilized in lightweight vehicles, particularly in MUV/SUV models, due to their excellent properties, such as flexibility, durability, and lightweight nature. In the healthcare sector, TPEs find extensive use in surgical tools, drug delivery tubes, and other medical devices, owing to their biocompatibility and ability to be processed into various shapes and sizes. Furthermore, the shift towards bio-based materials and renewable resources is propelling the market's expansion, with TPEs derived from castor oil and other natural sources gaining popularity.

Additionally, recycling initiatives are driving the market's growth, as TPEs can be recycled and reused, making them an eco-friendly alternative to traditional materials. Covestro AG, a prominent chemical company, is expanding its footprint in the region by constructing a new thermoplastic polyurethanes (TPU) application development center in Guangzhou, South China, to cater to the increasing demand and provide tailored solutions for various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Thermoplastic Elastomers Market?

Opening of new manufacturing plants is the key driver of the market.

- The Thermoplastic Elastomers (TPEs) market is witnessing notable expansion due to the rising demand for lightweight and high-performance materials in various industries. TPEs, also known as thermoplastic rubber, are increasingly being used in automotive components such as bumpers, seals, and interior parts. In addition, the growing popularity of electric vehicles (EVs) is fueling the need for TPEs in battery casings and other EV components.

- Furthermore, the consumer electronics sector, including mobile phone cases and cables, is another significant application area for TPEs. To cater to this escalating demand, major players in the industry are expanding their production capacities. For instance, BASF, a leading chemical company, recently inaugurated a new thermoplastic polyurethane (TPU) plant in South China's Guangdong Province. This new facility will bolster BASF's production capabilities in the Asia-Pacific region and enable the company to meet the increasing demand for high-quality TPE materials in the automotive, electronics, and consumer goods sectors.

What are the market trends shaping the Thermoplastic Elastomers Market?

Increasing demand for lightweight materials is the upcoming trend in the market.

- The thermoplastic elastomers (TPE) market is experiencing notable growth due to the rising demand for materials that offer improved mechanical performance and lightweight properties. This trend is predominantly driven by the automotive sector, where TPEs are increasingly being used to enhance vehicle efficiency and reduce emissions. KRAIBURG TPE Americas, a leading TPE compound specialist, showcased its latest advancements in TPE technology at the TPO Global Automotive Conference 2024.

- Additionally, the event, held from September 30th to October 3rd, 2024, provided a platform for showcasing innovative solutions for the automotive industry. KRAIBURG TPE presented a newly renovated technology for lightweight materials, which is expected to gain significant traction in the market. The use of TPEs in construction, hybrid vehicles, electric vehicles, gaskets, wire insulation, and interior applications is on the rise due to their energy efficiency and emission reduction properties. The shift towards sustainable and recyclable materials is also driving the demand for TPEs in various industries.

What challenges does Thermoplastic Elastomers Market face during the growth?

Regulations associated with TPEs are key challenges affecting the market growth.

- The thermoplastic elastomers (TPE) market experiences notable challenges due to intricate regulatory requirements in sectors such as automotive, medical, and consumer goods. Regulations ensure safety, environmental sustainability, and adherence to industry standards. In medical and food contact applications, TPEs must conform to the U.S. Food and Drug Administration (FDA) regulations, including 21 CFR. These regulations necessitate comprehensive testing and certification to guarantee TPE safety for medical devices and food packaging.

- Additionally, FDA compliance is indispensable for manufacturers seeking to penetrate the US market, necessitating substantial investment in testing and documentation. Aesthetic appeal, thermal performance, and versatility make TPEs popular choices for connectors, medical devices like catheters and syringe components, and consumer goods. Bio-based TPEs, such as Poly styrenes, Poly-amide TPEs, and Nylon TPEs, offer sustainability advantages. Despite regulatory hurdles, the market for TPEs continues to grow, driven by their unique properties and expanding applications.

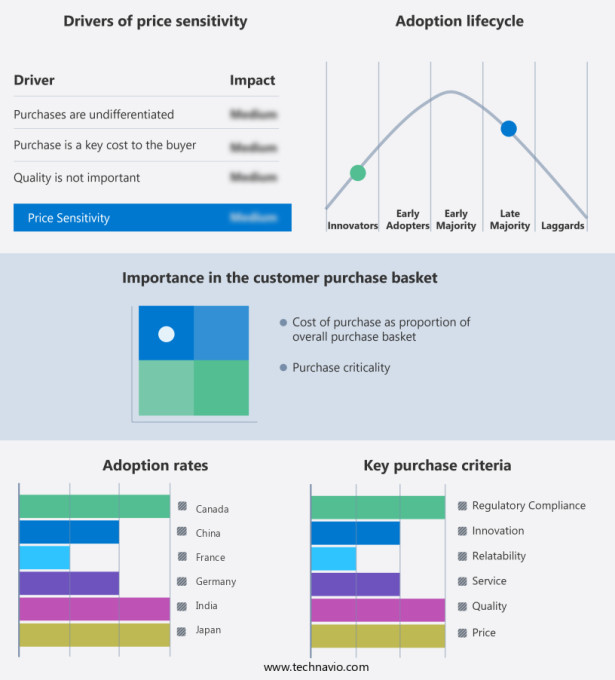

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apar Industries Ltd.

- Arkema SA

- Asahi Kasei Corp.

- Aurora Material Solutions

- Avient Corp.

- BASF

- Covestro AG

- Dow Inc.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Evonik Industries AG

- Exxon Mobil Corp.

- Huntsman Corp.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Group Corp.

- Mitsui and Co. Ltd.

- Ocean Thermoplastic Elastomer P Ltd

- Saudi Basic Industries Corp.

- Teknor Apex Co. Inc.

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermoplastic elastomers (TPEs) have gained significant traction in various industries due to their unique properties, which combine the processability of thermoplastics with the elasticity of rubber. Lightweight TPEs are increasingly being adopted in automotive components, including bumpers, seals, and interior components, to enhance fuel efficiency and reduce carbon emissions in electric vehicles (EVs) and hybrid vehicles. The automotive sector is not the only industry benefiting from TPEs; they are also used extensively in consumer electronics, such as mobile phone cases, cables, and connectors, for their aesthetic appeal and mechanical performance. Bio-based TPEs derived from renewable resources, such as corn starch, wheat starch, poly hydroxybutyrate (PHB), polylactide (PLA), castor oil, palm oil, and polyethylene furanoate (PEBA), are gaining popularity due to their eco-friendly nature.

Furthermore, these materials offer reduced emissions and energy efficiency, making them an attractive alternative to conventional materials like polyethylene, PVC, rubbers, and polyurethane. TPEs are also utilized in the construction industry for gaskets, wire insulation, and interior applications. Their recyclable nature and thermal performance make them an ideal choice for emission reduction initiatives. The healthcare sector is another significant market for TPEs, with applications in medical devices, medical tubing, catheters, and syringe components. In summary, the TPE market is expanding rapidly due to its versatility and sustainability. The lightweight properties of TPEs make them suitable for use in automotive components and EVs, while their bio-based counterparts offer a more sustainable alternative to traditional materials. The potential for recycling and emission reduction further strengthens the market's growth prospects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2024-2028 |

USD 10.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

China, US, Germany, Japan, India, South Korea, Singapore, Canada, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch