Thoracic Catheters Market Size 2025-2029

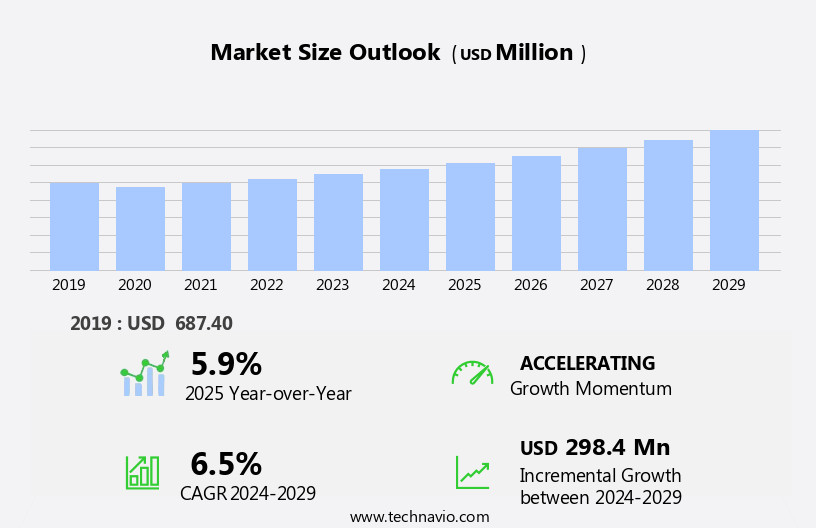

The thoracic catheters market size is forecast to increase by USD 298.4 million at a CAGR of 6.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prevalence of pneumothorax and pleural effusion diseases. These conditions necessitate the use of thoracic catheters for diagnosis and treatment, fueling market expansion. Additionally, the adoption of single-use catheters and self-catheterization techniques is on the rise, offering increased patient safety and convenience. However, the lack of skilled professionals to perform catheter insertion procedures poses a challenge, potentially hindering market growth. Regulatory hurdles and supply chain inconsistencies further temper the market's potential. The market's growth is influenced by several factors, including the escalating incidence of pneumothorax and pleural effusion diseases, a growing inclination among patients towards minimally invasive surgical procedures, insurance, and favorable health reimbursement policies.

- Companies in this space must address these challenges by investing in training programs for healthcare professionals and implementing robust supply chain management strategies. By capitalizing on these opportunities and navigating these challenges effectively, market participants can position themselves for success in the dynamic and evolving market. One such innovation is the utilization of Fractional Flow Reserve (FFR) devices in thoracic surgery.

What will be the Size of the Thoracic Catheters Market during the forecast period?

- The market encompasses a range of medical devices used in the diagnosis and treatment of various cardiovascular and respiratory conditions. Thoracic catheters play a crucial role in managing diseases such as pulmonary stenosis, thoracic outlet syndrome, and cardiac valve disease, including mitral valve repair and pulmonary valve interventions. Additionally, they are employed in the management of thoracic aortic conditions like dissection and aneurysms, as well as in the treatment of pulmonary hypertension, venous thromboembolism (VTE), and pulmonary embolism. Advancements in technology have led to the increasing use of radial and transradial access for catheter-based procedures, such as cardiac output assessment, pulmonary artery interventions, and endovascular stenting. Thoracic drainage systems come in various materials, such as Polyvinyl Chloride and Silicone, and include Single-Use Catheters and Self-Catheterization options.

- Furthermore, the development of biomarker-guided therapies, including cardiovascular risk factor assessment, has expanded the application of thoracic catheters in cardiac rehabilitation and the prevention of complications like inferior vena cava filters and superior vena cava obstruction. Conditions like congenital heart defects and thoracic aorta disorders continue to drive market growth, as innovative solutions are developed to address the unique challenges associated with these complex conditions. Overall, the market is characterized by continuous advancements and a growing demand for minimally invasive, patient-centric solutions. Despite their benefits, the use of thoracic catheters carries an Infection Risk, necessitating stringent sterilization protocols.

How is this Thoracic Catheters Industry segmented?

The thoracic catheters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Pleural effusion

- Pneumothorax

- Others

- Product

- Accessories

- Catheters

- End-user

- Hospitals

- ASCs

- Specialty clinics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

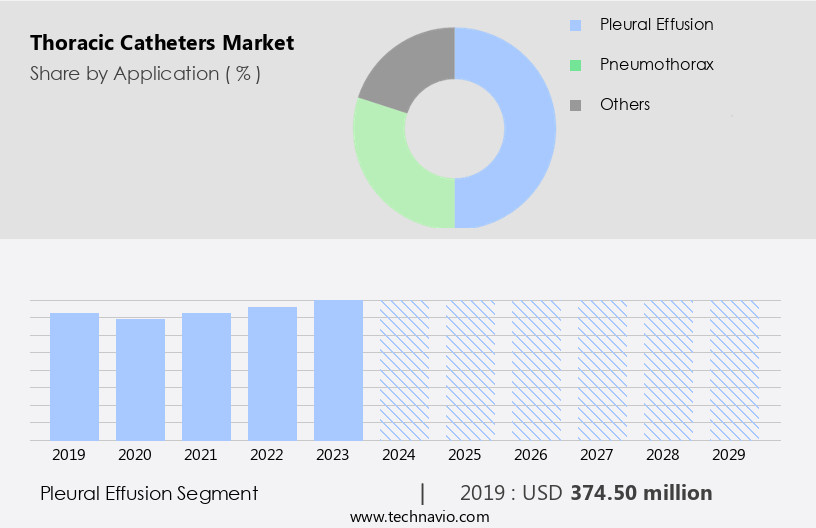

By Application Insights

The pleural effusion segment is estimated to witness significant growth during the forecast period. The catheter market is witnessing significant growth due to the increasing prevalence of cardiovascular diseases, such as heart failure, and the rising number of endovascular procedures. According to market research, image-guided interventions, 3D imaging, and radiofrequency ablation are key trends in the catheter industry. Catheter development is focused on improving catheter design, including the catheter shaft and tip, for enhanced catheter manipulation and safety. Balloon catheters and drug-eluting stents are commonly used in interventional cardiology for procedures like cardiac ablation, catheter inflation, and catheter retrieval. Computed tomography (CT) and catheter training are essential in ensuring accurate catheter insertion and minimizing catheter complications. Major players are focusing on minimally invasive operations and the use of plastic tubes and silicone catheters to reduce morbidity rates and infection risks.

Catheter design and catheter tip technology are critical to ensuring successful catheterization procedures. The catheter market is witnessing continuous growth due to the increasing prevalence of cardiovascular diseases and the rising number of endovascular procedures. Innovations in catheter design, materials, and delivery systems are driving the market forward, while ensuring safety and minimizing complications remains a priority.

The Pleural effusion segment was valued at USD 374.50 million in 2019 and showed a gradual increase during the forecast period. Product innovation and portfolio expansion are key strategies being employed, with the development of catheter valves, stabilization devices, fixing clamps, and adapters. Catheter certification and adherence to safety standards are crucial to prevent catheter-related infections. Aortic aneurysm repair and heart valve repair are other applications of catheter-based therapies. Minimally invasive surgery and peripheral vascular disease treatment are also driving the demand for catheters. Catheter innovation includes the use of bioabsorbable materials and the development of new catheter delivery systems. Catheter malfunction, despite advancements, remains a challenge, and ongoing research focuses on improving catheter sheath design and catheter inflation techniques. In the field of cardiac rhythm management, ablation catheters and cardiac catheters play a vital role. The catheter industry is continuously evolving, with a focus on catheterization lab infrastructure, catheter lumen size, and catheter lumen pressure.

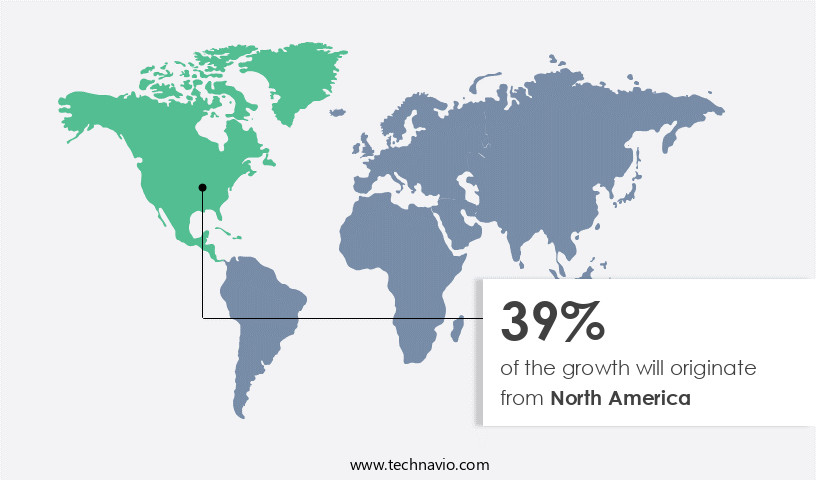

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, particularly in the US, is experiencing significant growth due to several factors. Extensive healthcare insurance coverage, increasing research and development expenditure of companies, and the high adoption of technologically advanced catheters are key drivers. The presence of a well-defined regulatory framework and the growing aging population also contribute to the market's expansion. Additionally, the rising incidence of conditions such as pneumothorax and pleural effusion, as well as the increasing popularity of minimally invasive surgeries, further fuel market growth. In the realm of thoracic catheter development, image-guided interventions, radiofrequency ablation, and 3D imaging technologies are gaining prominence.

Balloon catheters, drug-eluting stents, and catheter sheaths continue to dominate the market, while catheter malfunctions remain a significant concern. Interventional cardiology, cardiac ablation, catheter inflation, retrieval, and delivery systems are essential components of the catheter industry. Computed tomography (CT) and catheter training are crucial in ensuring catheter safety and effectiveness. Aortic aneurysm repair, catheter certification, catheter-related infections, and catheter innovation are ongoing areas of focus. Peripheral vascular disease, coronary artery disease, heart valve repair, and ablation catheters are among the catheter-based therapies gaining traction. Catheter manufacturing, using bioabsorbable materials, is an emerging trend in the industry. Minimally invasive surgery and catheter manipulation are essential aspects of catheterization lab procedures.

Catheter safety remains a top priority, with ongoing efforts to minimize complications and improve catheter design.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Thoracic Catheters market drivers leading to the rise in the adoption of Industry?

- The rising incidence of pneumothorax and pleural effusion diseases serves as the primary market driver, significantly contributing to market growth. Thoracic catheters are essential medical devices used in the diagnosis and treatment of various thoracic disorders, including pneumothorax and pleural effusion. Pneumothorax is a condition characterized by the collapse of a lung due to air accumulation in the pleural cavity. Causes include smoking, lung diseases such as asthma, tuberculosis, and emphysema, chest injuries, and conditions like cystic fibrosis and bacterial pneumonia. Spontaneous pneumothorax, which occurs without apparent cause, accounts for approximately 10-15% of all cases. Pleural effusion, another thoracic condition, is characterized by the accumulation of excess fluids between the pleura layers outside the lungs.

- Causes include heart failure, cirrhosis, pulmonary embolism, lung and breast cancer, kidney disease, bleeding, tuberculosis, and autoimmune diseases. Endovascular procedures, such as catheter insertion, image-guided interventions, and radiofrequency ablation, play a crucial role in managing these conditions. Catheter market research indicates a growing trend towards the development of advanced catheter technologies, including 3D imaging and drug-eluting stents, to enhance diagnostic accuracy and treatment efficacy. Balloon catheters, for instance, are commonly used in interventional procedures to treat pleural effusions by draining excess fluid. Catheter market trends reflect the increasing demand for minimally invasive procedures and the growing prevalence of cardiovascular diseases, such as heart failure, which contribute to thoracic disorders. Despite these advancements, challenges persist, including the risk of complications, such as infection and bleeding, and the need for continuous advancements to address the evolving needs of patients and healthcare providers.

What are the Thoracic Catheters market trends shaping the Industry?

- The use of single-use catheters and self-catheterization is gaining increasing popularity in the healthcare industry, representing a significant market trend. This shift towards disposable catheters and patient-administered catheterizations is driven by factors such as improved infection control, enhanced patient convenience, and cost savings. Thoracic catheters, a crucial component in interventional cardiology procedures such as catheter inflation for balloon dilation and catheter delivery systems for cardiac ablation, are experiencing increased demand due to the trend toward single-use catheters and self-catheterization. Single-use catheters, which are disposable and made of materials like polyvinyl chloride (PVC) or silicone, are favored in hospital settings for their infection prevention benefits. For instance, Argyle PVC Thoracic Catheters by Cardinal Health are single-use catheters utilized for removing fluid and air from the pleural sac. Self-catheterization enables patients to manage their symptoms, such as recurrent pleural effusions and malignant ascites, through intermittent drainages in a homecare setting, using disposable thoracic catheters to minimize infection risks.

- However, catheter malfunctions, such as catheter complications during catheter retrieval or CT imaging, remain challenges in the field. Catheter design advancements, like improved catheter sheath materials and catheter inflation systems, are ongoing efforts to mitigate these issues.

How does Thoracic Catheters market faces challenges face during its growth?

- The scarcity of adequately trained specialists poses a significant obstacle to the expansion of the industry, particularly in the performance of catheter insertion procedures. The market faces a significant challenge due to the shortage of skilled professionals capable of performing catheter insertion procedures. This issue increases the risk of catheter-related complications, including infections and non-infectious complications such as pain, hemorrhage, and bleeding. The aging workforce and the migration of trained specialists to developed countries are contributing factors to this shortage. Furthermore, the complexity of catheter procedures necessitates the involvement of experienced and dexterous professionals to ensure successful outcomes. Innovations in catheter technology, such as the use of bioabsorbable materials and catheter embolization, offer promising solutions to mitigate the risks associated with catheter-based therapies.

- Catheter certification programs and ongoing training initiatives can also help address the skills gap and improve patient safety. The market is driven by the increasing prevalence of coronary artery disease and the growing demand for minimally invasive diagnostic and interventional procedures.

Exclusive Customer Landscape

The thoracic catheters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the thoracic catheters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, thoracic catheters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ANGIPLAST Pvt. Ltd. - This company specializes in advanced thoracic catheters, featuring integrated chest drainage systems. Our innovative design enhances patient comfort and promotes efficient drainage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANGIPLAST Pvt. Ltd.

- Argon Medical Devices Inc.

- ATMOS MedizinTechnik GmbH and Co. KG

- Becton Dickinson and Co.

- Cardinal Health Inc.

- Cook Group Inc.

- Diversatek Inc.

- Getinge AB

- Intra special catheters GmbH

- ICU Medical Inc.

- LivaNova PLC

- Medela

- Merit Medical Systems Inc.

- PASCO Inc.

- Redax S.p.A.

- Rocket Medical Plc

- Sterimed Medical Devices Pvt. Ltd.

- Teleflex Inc.

- Vygon SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Thoracic Catheters Market

- In January 2024, Medtronic, a leading medical technology company, announced the launch of their new EnSite Precision⢠Thoracic Mapping System. This innovative catheter system is designed to improve the accuracy and efficiency of arrhythmia ablation procedures in the thoracic region. According to Medtronic's press release, the system has already received CE Mark and is under FDA review (Medtronic, 2024).

- In March 2025, Edwards Lifesciences, a global leader in patient care technologies, entered into a strategic partnership with Merit Medical to expand its product portfolio in the thoracic catheter market. The collaboration aims to combine Edwards' expertise in hemodynamic monitoring and Merit's in interventional devices, creating synergies and enhancing their offerings (Edwards Lifesciences, 2025).

- In May 2024, Boston Scientific Corporation completed the acquisition of Intuitive Surgical's thoracic business, including its portfolio of thoracic catheters and related products. This acquisition significantly strengthened Boston Scientific's presence in the thoracic catheter market and expanded its offerings for interventional pulmonology procedures (Boston Scientific, 2024).

- In October 2025, Abbott Laboratories received FDA approval for its new QuickSet⢠Introducer Sheath with the PrecisionGlide⢠Thrombectomy Catheter. This approval marks a significant technological advancement in the thoracic catheter market, as the new product combines the benefits of a quick-set introducer sheath with the precision and effectiveness of a thrombectomy catheter (Abbott Laboratories, 2025).

Research Analyst Overview

The thoracic catheter market continues to evolve, driven by advancements in endovascular procedures and the growing prevalence of cardiovascular disease. These catheters play a crucial role in interventional cardiology, particularly in cardiac ablation and catheter-based therapies for heart failure. The catheter market trends reflect the ongoing development of catheter technology, with innovations in catheter design, material science, and imaging techniques. Catheter sheaths and delivery systems are essential components of these procedures, enabling precise catheter insertion and manipulation. However, catheter malfunctions can occur, leading to complications such as catheter inflation issues, retrieval difficulties, and catheter tip damage. To mitigate these risks, there is a growing focus on catheter certification, training, and safety standards. The market is expected to grow further due to the increasing number of MI procedures and the expansion of medical tourism.

Image-guided interventions, including computed tomography (CT) and 3D imaging, are transforming catheter procedures, allowing for more accurate catheter placement and minimally invasive surgery. In turn, this is driving demand for catheters in various sectors, including aortic aneurysm repair, heart valve repair, and peripheral vascular disease treatment. The catheter industry is also witnessing the emergence of new technologies, such as bioabsorbable materials, drug-eluting stents, and catheter-embolization therapies. These advancements are set to redefine the landscape of catheter-based therapies, offering improved patient outcomes and reduced complications. Despite these advancements, challenges remain, including catheter-related infections and the need for continued innovation to address the unique demands of different catheter applications. The catheter market is poised for continued growth, driven by the ongoing unfolding of market activities and evolving patterns in interventional cardiology and endovascular procedures. Health insurance coverage plays a crucial role in the growth of the market.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Thoracic Catheters Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 298.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Canada, Germany, UK, Japan, Brazil, India, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Thoracic Catheters Market Research and Growth Report?

- CAGR of the Thoracic Catheters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the thoracic catheters market growth of industry companies

We can help! Our analysts can customize this thoracic catheters market research report to meet your requirements.