Time-Sensitive Networking Market Size 2024-2028

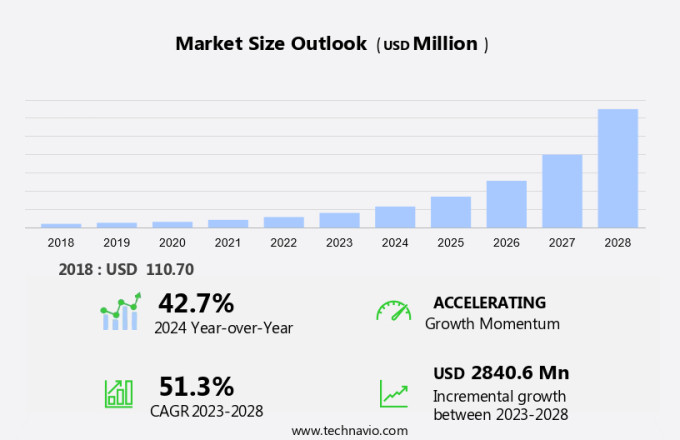

The time-sensitive networking market size is forecast to increase by USD 2.84 billion, at a CAGR of 51.3% between 2023 and 2028.

- The Time-Sensitive Networking (TSN) market is experiencing significant growth, driven by the rapid digitization of various industries. The increasing adoption of Industry 4.0 and the Internet of Things (IoT) is leading to an escalating demand for real-time data transfer and processing capabilities. This trend is further fueled by new product launches from companies, offering advanced features and functionalities that cater to the specific needs of time-critical applications. However, the market faces challenges that require careful consideration. Security concerns are a major obstacle, as the implementation of TSN networks exposes organizations to potential cyber threats. Ensuring robust security measures is essential to mitigate risks and maintain data integrity.

- Additionally, the complexity of TSN technology and the need for interoperability between different systems can pose implementation challenges for organizations. Addressing these challenges through strategic partnerships, collaborations, and continuous innovation will be crucial for market participants seeking to capitalize on the opportunities presented by the TSN market.

What will be the Size of the Time-Sensitive Networking Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

Time-sensitive networking (TSN) continues to gain momentum in various sectors, including medical devices, process control, and remote surgery, as the need for real-time, low latency communication becomes increasingly crucial. Wireless communication and autonomous vehicles also benefit from TSN's capabilities, enabling seamless integration of network deployment and network topologies. Network scheduling and network switches play a pivotal role in ensuring data reliability and integrity, while network monitoring and network topologies facilitate network management and optimization. TSN's deterministic networking properties are essential for data acquisition in applications such as smart grid and industrial automation. Network routers and network interfaces are crucial components in TSN architectures, ensuring standard compliance and efficient bandwidth allocation.

Real-time Ethernet and IEEE 802.1QBU protocols provide the foundation for high-speed data transmission, enabling real-time data processing and network performance enhancement. Network security remains a priority, with TSN's network protocols and traffic management features ensuring data transmission's integrity and preventing packet loss. IEEE 802.1AS and IEEE 802.1QBV standards further enhance TSN's capabilities, enabling edge computing and network configuration flexibility. Cloud computing and industrial ethernet are among the many applications of TSN, as the demand for low latency communication and deterministic networking grows across industries. The ongoing evolution of TSN continues to unfold, with new applications and innovations emerging in the realm of network management, data transmission, and network optimization.

How is this Time-Sensitive Networking Industry segmented?

The time-sensitive networking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Hardware

- Software

- Services

- End-user

- Industrial automation

- Automotive

- Digital communication

- Power and energy

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Rest of World (ROW)

- North America

.

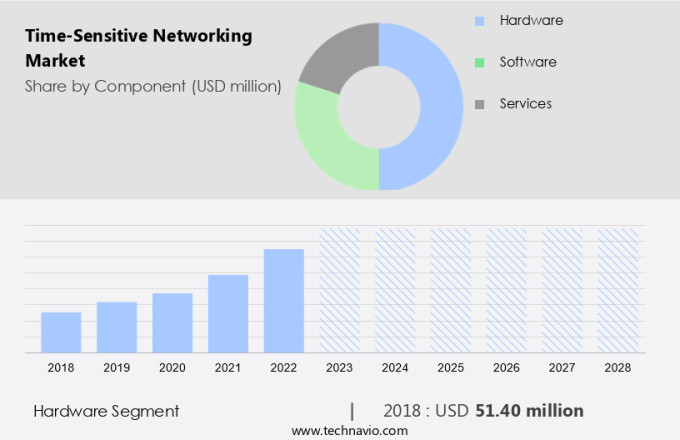

By Component Insights

The hardware segment is estimated to witness significant growth during the forecast period.

The time-sensitive networking (TSN) market is witnessing significant growth, driven by the increasing demand for synchronized, low-latency communication across various industries. The hardware segment plays a crucial role in this market, providing the necessary infrastructure through advanced Ethernet switches, routers, and other networking devices. These TSN-enabled hardware solutions are essential for applications in industrial automation, intelligent transportation, smart power grids, and more. Recent innovations in TSN hardware include Fiberroad's new TSN Industrial Ethernet Switch, which features TSN technology and IEEE 1588 Precision Time Protocol. This switch enhances real-time communication and network reliability, contributing to the growth and adoption of TSN technology in markets such as automotive, energy, and others.

TSN technology is also crucial in applications like medical devices, process control, remote surgery, wireless communication, autonomous vehicles, network scheduling, and network monitoring. It offers standard compliance, data integrity, time synchronization, and deterministic networking, ensuring high-speed data transmission with low latency and minimal packet loss. Moreover, TSN's integration with cloud computing, edge computing, and network optimization further expands its applications in various industries. The continuous development of TSN-enabled hardware and network protocols is expected to fuel the growth of this market, enhancing network performance, data acquisition, and network bandwidth allocation.

The Hardware segment was valued at USD 51.40 billion in 2018 and showed a gradual increase during the forecast period.

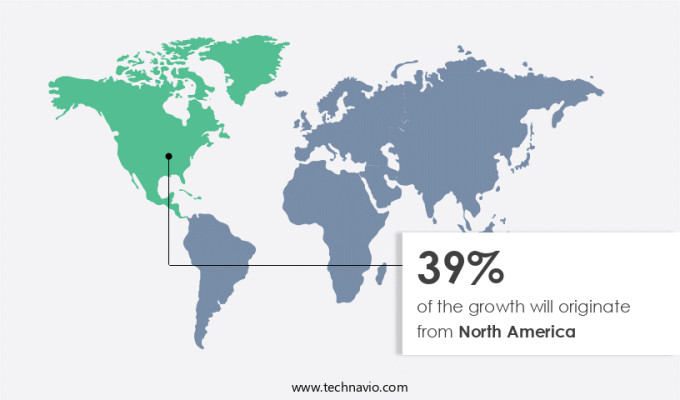

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The time-sensitive networking (TSN) market is experiencing significant growth, particularly in North America, where advanced sectors such as automotive, aerospace and defense, and industrial automation are driving adoption. North America's robust technological infrastructure and substantial investments in research and development position it as a global leader in TSN innovation. TSN technology is transforming industries by enhancing real-time communication, improving operational efficiency, and ensuring system reliability. In the automotive sector, for instance, TSN is enabling the integration of advanced driver assistance systems and autonomous vehicles. In process control, TSN is optimizing network performance and ensuring data integrity for high-speed data transmission.

In medical devices, TSN is facilitating time synchronization for remote surgery and real-time data acquisition. Furthermore, TSN is critical for network scheduling in smart grids and network optimization in cloud computing. Network switches, routers, and interfaces are being upgraded to support TSN standards such as IEEE 802.1qbu, 802.1as, and 802.1qbv. Network security and traffic management are also becoming essential considerations in TSN network architectures. Overall, TSN is revolutionizing industries by enabling low latency communication, deterministic networking, and standard compliance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Time-Sensitive Networking Industry?

- Rapid digitization serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing digitization of industries. Industrial Ethernet, a key technology enabler for time-sensitive communication, is gaining popularity as high-speed data transfer and low latency become essential for industrial automation and edge computing applications. IEEE 802.1Qbv, a network protocol designed for time-sensitive communication, is increasingly being adopted to ensure network security and packet loss reduction. The global investment in digital transformation is a major driver for this market, with an estimated USD4 trillion expected to be spent by 2027. Governments, international organizations, and corporations are leading this charge, aiming to optimize processes and eliminate economic barriers.

- The integration of digital technologies is not only improving operational efficiency but also contributing significantly to economic growth, with the World Economic Forum estimating that digitalization could add up to USD45 trillion to global GDP by 2025. Network optimization is a critical aspect of time-sensitive networking, as even minor delays can result in significant downtime and production losses. As such, there is a growing focus on improving network protocols and implementing advanced technologies to minimize latency and ensure reliable communication. Overall, the market is poised for continued growth as industries increasingly embrace digitalization and automation.

What are the market trends shaping the Time-Sensitive Networking Industry?

- The trend in the market involves frequent new product launches by companies. This professional and dynamic approach keeps consumers engaged and fosters innovation.

- The time-sensitive networking (TSN) market is experiencing significant growth due to the increasing demand for advanced networking solutions in various industries. New product launches, such as Microchip Technology's next-generation LAN969x Ethernet switches, are driving market expansion. These switches cater to industrial automation, offering scalable bandwidths from 46 Gbps to 102 Gbps and a powerful 1 GHz Arm Cortex-A53 CPU. The LAN969x switches prioritize deterministic communication, ensuring reliable network performance. They also support High-availability Seamless Redundancy (HSR) and Parallel Redundancy Protocol (PRP) for zero-loss redundancy, allowing multiple RedBox instances to operate in parallel or series.

- TSN technology's adoption is crucial in industries that require real-time communication, such as medical devices, process control, remote surgery, wireless communication, autonomous vehicles, and network scheduling. The market's growth is attributed to the technology's ability to provide immersive, harmonious, and synchronous communication, addressing the evolving needs of these industries.

What challenges does the Time-Sensitive Networking Industry face during its growth?

- Security concerns represent a significant challenge to the industry's growth. In today's business landscape, ensuring the protection of sensitive information and mitigating potential risks is crucial for companies to thrive and maintain their reputation.

- Time-sensitive networking (TSN) technology's growing adoption in industries like manufacturing, automotive, and healthcare necessitates addressing the associated cybersecurity risks. The integration of real-time networking systems in critical applications heightens vulnerabilities, making cybersecurity a priority. Any security breach in TSN networks can result in severe consequences. For instance, the Cybersecurity and Infrastructure Security Agency (CISA) issued an advisory (ICSA-24-158-03) in June 2024 regarding a vulnerability in the Mitsubishi Electric CC-Link IE TSN Industrial Managed Switch. Network management, data acquisition, and network interfaces in TSN are crucial elements requiring enhanced security measures. Real-time Ethernet and IEEE 802.1Qbu standards play a significant role in network architectures, ensuring data reliability and network bandwidth allocation.

- Cybersecurity threats, such as unauthorized access or data manipulation, can disrupt network operations and compromise data integrity. As TSN becomes more prevalent, it's essential to implement robust security measures, including encryption, access control, and intrusion detection systems. Network routers and other network devices must be updated regularly to address any vulnerabilities and maintain optimal performance.

Exclusive Customer Landscape

The time-sensitive networking market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the time-sensitive networking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, time-sensitive networking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc. - This company specializes in Time-Sensitive Networking (TSN), an advanced technology that builds upon standard Ethernet infrastructure.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Beckhoff Automation

- Belden Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Fiberroad Technology Co Ltd.

- Fujitsu Ltd.

- HMS Networks AB

- Huawei Technologies Co. Ltd.

- Intel Corp.

- Marvell Technology Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- Moxa Inc.

- NXP Semiconductors NV

- PLANET Technology Corp.

- Qualcomm Inc.

- Renesas Electronics Corp.

- Rockwell Automation Inc.

- Siemens AG

- Spirent Communications Plc

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Time-Sensitive Networking Market

- In February 2023, Cisco Systems, a leading networking technology company, announced the launch of its new Time-Sensitive Networking (TSN) solution, Cisco Catalyst 9300 Series Switches, designed to deliver deterministic, low-latency connectivity for industrial automation and other time-sensitive applications (Cisco Press Release). This development underscores Cisco's commitment to expanding its TSN offerings and catering to the growing demand for reliable, high-speed networking solutions in various industries.

- In May 2024, Intel and Bosch announced a strategic partnership to jointly develop and commercialize Time-Sensitive Networking (TSN) solutions for industrial automation and other time-critical applications. The collaboration aims to combine Intel's TSN technology expertise with Bosch's industry knowledge, creating innovative, high-performance networking solutions for the global market (Intel Newsroom). This partnership represents a significant step forward in the adoption of TSN technology, as it brings together two major players in the technology and automation industries.

- In January 2025, Siemens announced the acquisition of Sensicast Systems, a leading provider of Time-Sensitive Networking (TSN) solutions for industrial automation and control applications. The acquisition strengthens Siemens' portfolio in the TSN market and enables the company to offer a more comprehensive suite of networking solutions to its customers (Siemens Press Release). The financial terms of the deal were not disclosed.

- In March 2025, the International Electrotechnical Commission (IEC) published the IEC 60802-7 standard for Time-Sensitive Networking (TSN), which defines the requirements and recommendations for implementing TSN in industrial automation and control systems. The standard is expected to accelerate the adoption of TSN technology by providing a common framework for manufacturers and system integrators (IEC Website). This regulatory approval marks a significant milestone in the maturity and widespread acceptance of TSN technology in various industries.

Research Analyst Overview

- In the market, network monitoring tools play a crucial role in ensuring optimal performance of industrial control systems and cyber-physical systems. Network testing and network optimization algorithms are essential for identifying and resolving issues in real-time, enabling seamless communication between distributed control systems and embedded systems. Software-defined networking (SDN) and network virtualization facilitate network segmentation and time-triggered architectures, enhancing the reliability of time-sensitive applications. Network analysis and network modeling help in understanding the behavior of complex systems, while network simulation enables the testing of network security protocols and data encryption techniques. Event-triggered architectures and network firewalls provide an additional layer of security for these critical systems.

- Network certification ensures compliance with industry standards and regulations, while network management systems enable efficient administration and maintenance of these intricate networks. Network-on-chip (NoC) and system-on-chip (SoC) technologies optimize the communication between different components within these systems, further improving their overall performance. Time-sensitive networking continues to evolve, with ongoing research in distributed control systems, network optimization algorithms, and cyber-physical systems, among others, driving innovation and growth in this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Time-Sensitive Networking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 51.3% |

|

Market growth 2024-2028 |

USD 2840.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

42.7 |

|

Key countries |

US, Germany, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Time-Sensitive Networking Market Research and Growth Report?

- CAGR of the Time-Sensitive Networking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the time-sensitive networking market growth of industry companies

We can help! Our analysts can customize this time-sensitive networking market research report to meet your requirements.